JHVEPhoto/iStock Editorial via Getty Images

Yesterday, Air Liquide (OTCPK:AIQUF, OTCPK:AIQUY) released its pre-Q3 2022 sales update. This brief communication is a key takeaway not only for the French company but for the whole sector. Here at the Lab, we recently initiate the coverage of Linde plc (LIN) with a buy rating target at $330 per share, while we have a long-standing buy with Air Products and Chemicals (APD) supported by its new project developments.

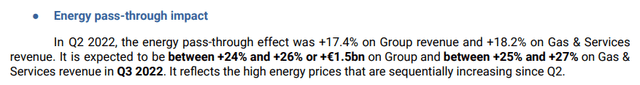

In June, we provided an update with five compelling pushbacks from Air Liquide investors and Mare Evidence Lab’s readers. In August, we analysed the company’s half-year performance, confirming our buy rating target (based on an unchanged 2022 guidance). Our internal team was supportive on Air Liquide ability to pass through raw material and higher energy costs. Indeed, this is exactly what happened in Q3.

Air Liquide ability to pass through

Cross-checking Wall Street consensus estimates, the energy increase was forecasted at 15% versus Air Liquide which achieved more than 18% growth, this was also supported by FX evolution, the company delivered a plus 7% versus estimates at 6.5%. In the press release, we can clearly see that in the gas & service division, the currency effect is “estimated to be close to +9.0% in Q3 2022“.

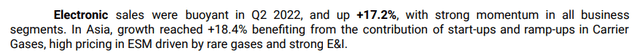

Looking at the details, despite a slowdown in Europe’s Large Industry division, we note that European volumes were pretty resilient supported by a strong economic activity from SME companies. Even if it was not communicated in the Air Liquide note, there was a volume decrease in steel of approximately 20%, chemicals were unchanged and refining volumes were holding up thanks to biofuel demand. Looking beyond the numbers, the US region was very supportive and this confirmed our buy rating on APD and also Mare Evidence Lab’s positive view on EU semiconductor companies (Technoprobe spa, STMicroelectronics (STM) and Infineon Technologies AG (OTCQX:IFNNY)).

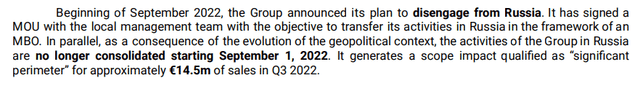

Another essential consideration is Air Liquide’s disinvestment from Russia. In early September, the French company communicated its plan to exit the country with a memorandum of understanding with the local management team. In numbers, the company used to employ more than 700 workers with a turnover of less than one percent of the total group’s top-line sales. Air Liquide also announced a €404 million provision as a one-off with no cash impact.

Conclusion

The company’s top-management was confident in benefiting from the price increase in the second part of the year. Price momentum will be strong in all Air Liquide areas, and the company is on track to reaching better profitability. Despite the positive outcome, Air Liquide is still trading at a lower multiple compared to Linde and APD, so we do not add anything more. Mare Evidence Lab’s buy target is confirmed.

Be the first to comment