Petmal

Things are always better in the morning.”― Harper Lee, To Kill a Mockingbird

Today, we take a deeper look at a manufacturer that has faced myriad challenges recently. The stock has become beyond cheap on a price-to-sales basis and has seen some encouraging insider buying on the pullback as well. An analysis follows below.

Company Overview:

Unifi, Inc. (NYSE:UFI) is a Greensboro, North Carolina headquartered manufacturer of synthetic and recycled polyester and nylon performance fibers. The company is best known for its REPREVE brand, which is the output of more than 30 billion recycled plastic bottles (to date) and is found in apparel, footwear, home goods, and other consumer products. Unifi was founded in 1969 and went public in 1980 at $1.37 a share, after giving effect to one reverse and seven forward stock splits. The stock trades just below $8.00 a share, translating to a market cap of approximately $140 million.

The company operates on a fiscal year (FY) that ends on the Sunday nearest June 30th.

Approximately ~65% of U.S. textile output is synthetic fibers, which is predominantly polyester (55%) with nylon, acrylic, and polypropylene contributing the other 10%. Natural fibers such as cotton and wool account for ~30%, with balance coming from cellulosic fibers. Unifi manufactures polyester products that include partially oriented, textured, twisted, beamed, and draw wound yarns (amongst others) and nylon products such as textured, solution-dyed, and spandex-covered yarns. Both are available in virgin and recycled forms. The company’s flagship product is ESG-friendly REPREVE, which is recycled from plastic bottles and comes in polyester or nylon as either staple fiber or filament, as well as polyester polymer beads (chips). The filament is sold to apparel and footwear manufacturers, as well as the automotive industry; staple fiber is used in bedding and insulation in heavy jackets; and the chips are found in flooring, plastic bottles, and packaging.

That said, Unifi’s largest end users are the apparel, hosiery, and footwear verticals, which are responsible for ~70% of its top line. Industrials (~9%), furnishings (~8%), and automotive (~5%) comprise its other largest end markets.

Reporting Segments

The company has three geographically-oriented reportable segments: Americas; Brazil; and Asia.

The Americas consists principally of North and Central America and generated FY22 segment profit (equal to gross profit with depreciation expense added back) of $45.6 million on revenue of $483.1 million versus $57.5 million on revenue of $386.8 million in FY21.

Brazil accounted for FY22 segment profit of $28.6 million on revenue of $126.1 million as compared to $33.0 million on revenue of $96.0 million in FY21.

Asia also includes end markets in Europe and was responsible for FY22 segment profit of $28.9 million on revenue of $206.6 million versus $25.4 million on revenue of $184.8 million in FY21.

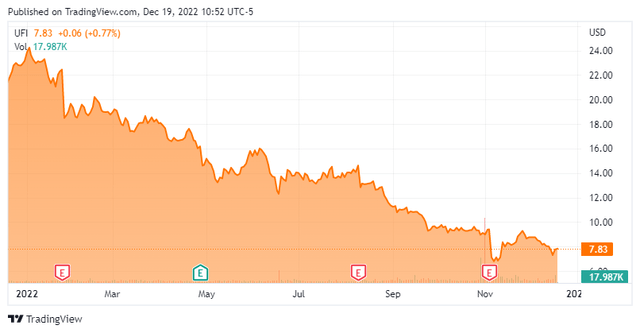

Stock Performance

As can be gleaned from these metrics, all segments saw increases at the top line (amounting to a total increase of 22%, FY22 vs FY21), but margins suffered in the Americas and Brazil segments as supply chain challenges, rising input costs, and a tight labor pool (predominantly in the U.S.) acted as drags. In the past, Unifi has been able to protect margins by passing along higher input outlays to customers, but with significant increases in all aspects of those costs, price increases could not keep pace in those two geographies. Owing mostly to this dynamic, shares of UFI have been hammered approximately 75% since hitting a multi-year high of $30.94 in March 2021.

Growth Strategy

One way for Unifi to improve performance is to sell more REPREVE fiber, which comprised 36% and 37% of total revenue in FY22 and FY21, respectively. Recycled REPREVE is cheaper to manufacture than virgin material, owing to the fact that Unifi has developed a supply chain infrastructure in which its recycling partners provide it with more than enough plastic bottles for REPREVE. Overall, margins on REPREVE are ~200 to 300 basis points higher than virgin fiber. Asia performed better in FY22 because REPREVE comprised ~80% of its top line versus ~25% in the Americas and only ~5% in Brazil. The company announced a major expansion of its Textile Takeback program in late November.

Until its most recent quarterly financial report, half of management’s FY25 revenue objective of $1.1 billion – representing a CAGR of 19.5% from FY22 – would be derived from REPREVE sales. Put another way, REPREVE was expected to contribute 80% of the growth over the next three fiscal years. Significant market share gains (FY19 to FY25) were anticipated across all geographies – 29% to 40% in the Americas; 12% to 18% in Brazil; and 3% to 8% in Asia – as the company looks to expand its focus beyond apparel and into other verticals such as automotive, industrial, and home.

1QFY23 Results & Outlook:

Unfortunately for Unifi, an uptick in REPREVE (or any) sales was not part of its 1QFY23 financials, reported on November 3, 2022. The company posted a loss of $0.44 a share (non-GAAP) and Adj. EBITDA of $2.3 million on net sales of $179.5 million versus a gain of $0.46 a share (non-GAAP) and Adj. EBITDA of $19.8 million on net sales of $196.0 million, representing an 8% decrease at the top line. Given that the Street was looking for a gain of $0.02 a share (non-GAAP), it goes without saying that the quarter was an unmitigated disaster, blamed on inventory destocking by apparel brands and retailers.

November Company Presentation

REPREVE revenue as a percentage of total fell from 37% in 1QFY22 to 27% in 1QFY23 as sales in Asia plunged 36% from $51.4 million to $33.0 million.

November Company Presentation

Worst still was the outlook for 2QFY23, which is now expected to be 10% to 15% lower than 1QFY23 at the top line and produce a negative Adj. EBITDA of $2.5 million (based on a range midpoint). Furthermore, its FY23 outlook that previously included Adj. EBITDA of $52.5 million on net sales of $870 million was withdrawn.

November Company Presentation

Not surprisingly, already in a protracted decline, shares of UFI fell 24% in the subsequent trading session to $7.13. Also not helping matters was thinly-traded Unifi’s removal from the S&P 600 on November 2, 2022.

November Company Presentation

Balance Sheet & Analyst Commentary:

The balance sheet is worth keeping an eye on. The company exited FY22 (July 3, 2022) with TTM Adj. EBITDA of $55.2 million and net debt of $61.0 million for net leverage of 1.1. After 1QFY23 (October 2, 2022), TTM Adj. EBITDA fell to $37.6 million while net debt rose to $79.8 million for net leverage of 2.1. Assuming no change in net debt – which is a stretch – according to management’s 2QFY23 Adj. EBITDA forecast, net leverage will jump to at least 3.3.

November Company Presentation

Unifi has a share repurchase authorization with $38.9 million remaining after buying ~617,000 shares at an average price of $14.84 in FY22 but elected not to buy back any stock in 1QFY23. The company does not pay a dividend.

November Company Presentation

The only Street analyst who has offered commentary in the past 22 months is CJS Securities analyst Daniel Moore. He downgraded shares of UFI from an outperform to a hold on August 11, 2022, after the company’s 4QFY22 financial report. He provided no price objective. Sidoti & Company also covers Unifi but has not made public remarks since March 2020. The one analyst with projections out has the company losing $1.47 a share in FY2022 on $750 million in sales. The two analysts (50 cents a share and 69 cents a share) with 2023 estimates have the company returning to profitability as revenues come in around $800 million in FY2023.

Despite the awful quarter and withdrawn FY23 forecast, two of the company’s board members (Ken Langone and Archibald Cox) used the pullback into the low $7 area as a buying opportunity, adding 100,000 and 50,000 shares to their respective positions on November 8, 2022. The company’s CEO added just over 5,000 shares to his holdings later in November.

Verdict:

The votes of confidence from Messrs. Langone and Cox notwithstanding, Unifi is in a very uncertain place. Apparel retail inventories have surged, causing a buying strike at its clothing manufacturing customers, while input costs continue to rise – and the macro backdrop provides little clue as to when buying patterns will return to normal. As such, shares of UFI traded to a 13-year low of $6.33 on November 4, 2022, and currently trade at a microscopic price-to-sales ratio of 0.2 (on FY23E net sales).

On the other hand, in this environment, input costs should drop, and demand for REPREVE from customers with ‘sustainability’ goals should continue to grow. Furthermore, the significant inventory build that was responsible for its terrible 1QFY23 has as much to do with overstocking in anticipation of more supply chain issues than a dismal macro environment. Its stock rallied 17% on November 11, 2022 to $8.36 a share, taking some starch out of the bullish investment thesis. Any pullback to the low $7 area, where the insiders purchased, would signify a buying opportunity to open a small ‘watch item‘ holding.

Every single cell in the human body replaces itself over a period of seven years. That means there’s not even the smallest part of you now that was part of you seven years ago.”― Steven Hall

Be the first to comment