Douglas Rissing

What were some strong insider buys in Q3?

We analyzed thousands of S-4 fillings to find companies that have experienced periods of unusually concentrated purchasing activity by their corporate insiders. We have attempted to place emphasis on companies that enjoyed buying across the board from multiple insiders, in quantities that were not recorded previously, often after a period of selloffs.

In the today’s edition, we will focus our discussion solely on large-cap stocks, but the series will be followed up with a third installment covering popular small-caps in the quarter. For this analysis, we stand behind the definition of large-cap companies as publicly listed companies carrying a market capitalization larger than $10 billion. Below is our list of research-worthy large-caps that in our view enjoyed a period of unusual and atypical interest from corporate insider’s. They are worthy of a further dive:

Freeport-McMoRan (FCX)

-

Active Corporate Insiders: 2

-

YTD Performance: 10.90%

- Total Bought Back: $1,074,669

Freeport McMoRan or better known as just “Freeport” is a more than a hundred-year-old US-based diversified mining company headquartered out of Phoenix, Arizona. It represents the largest producer of molybdenum in the world, but also produces a significant amount of copper, otherwise known as operating Grasberg, the world’s largest gold mine in Papua, Indonesia. A boom in worldwide commodity prices alongside issues relating to inflation has caused a surge in demand for commodities this year. This allowed FCX to actually outperform the S&P 500 (SPY) by generating a year-to-date return of -10.90% and a one-year return of -3.05%. After the slight pullback this year, FCX was selling for a relatively fair NTM EV/EBITDA of 7.70x, NTM P/E of 22.69x, and an NTM P/FCF of 17.70x. The company is also offering a token yield of 0.81% at this price. Both Seeking Alpha Authors and Wall Street Analysts have held the company in relatively high regard, assigning it a “Buy” rating with an average score of 3.61/5.00 and a “Buy” rating with an average score of 3.55/5.00, respectively. This seemingly attracted some interest during the third quarter from corporate insiders including Directors Sara Grootwassink Lewis and Ryan Lance. They bought back $1.07 million worth of Freeport McMoRan shares at an estimated average price of $30.33. The company currently trades at $38 per share.

Freeport McMoRan vs S&P500 YTD Return (Seeking Alpha)

Energy Transfer LP (ET)

-

Active Corporate Insiders: 3

-

1 Year Performance: 40.59%

- Total Bought Back: $54,867,668

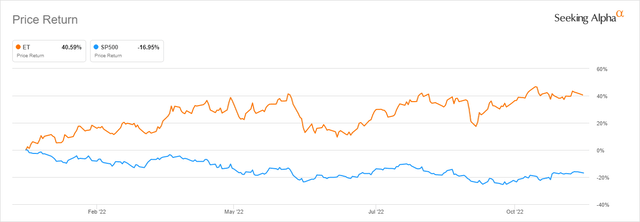

Energy Transfer Partners is one of the largest and most diversified midstream energy companies in the United States that owns and operates approximately 120 thousand miles of pipelines and associated energy infrastructure in 41 different states. The company was founded in 1995 by Kelcy Warren and Ray Davis, who still serve as the Chairman and CEO to this day. ET has enjoyed years of confidence from its insiders, expressed through dozens of purchases throughout the years, which led to insiders owning close to one-fifth of the company. This can be considered impressive as we are dealing with a company with a market capitalization of about $38 billion. A boom in worldwide energy prices alongside the European energy crisis opened the way for some extraordinary performance by ET. The company has managed to generate a year-to-date return of 40.59%, combined with a one-year return of 41.99%. Energy Transfer LP is currently trading at an attractive NTM EV/EBITDA of 7.68x, an NTM P/E of 10.35x, and an NTM MC/FCF of 6.96x. On top of that, ET is also offering a very enticing 8.58% dividend yield for potential investors. Seeking Alpha Authors are positive about the general outlook and rate ET as a “Buy” with an average score of 4.07/5.00. Wall Street Analysts are even more enthusiastic and have assigned the company a “Strong Buy” rating with an average score of 4.70/5.00. In the third quarter, shares of Energy Transfer LP were purchased by the Chairman of the Board Kelcy Warren, CFO Bradford Whitehurst, and Director Richard Brannon. Together, they bought back a total of $54.86 million worth of ET shares at an average estimated price of $11.20. The company is currently selling for $11.68 per share.

Energy Transfer LP vs S&P500 YTD Returns (Seeking Alpha)

TransUnion (TRU)

-

Active Corporate Insiders: 1

-

YTD Performance: -48.29%

- Total Bought Back: $1,985,450

TransUnion is an Illinois-based consumer credit reporting agency that collects and aggregates information on over one billion individual consumers in over thirty countries including almost every credit-active consumer in the U.S. It has been experiencing pain in the markets due to the ever-degrading macroeconomic environment, most importantly surrounding high inflation and rising interest rates. Shares of the agency are noticeably underperforming the market, as TransUnion generated a negative year-to-date return of 48.29% and a negative one-year return of 45.77%. TransUnion is currently being valued by the market at an NTM EV/EBITDA of 12.55x, an NTM P/E of 17.06x, and an NTM MC/FCF of 21.99x. At this price, it also offers a token yield of 0.68%. Seeking Alpha Authors are nonetheless still bullish on TransUnion, rating the company as a “Buy” with an average score of 4.00/5.00. Wall Street Analysts share the same sentiment, assigning TRU a “Buy” rating with an average score of 4.10/5.00. In the third quarter, shares of TransUnion were only bought by President and CEO Christopher Cartwright. In what we can view as a huge vote of confidence in the company, he bought back 25,000 shares worth $1.98 million at an average estimated price of $79.42. TRU is currently selling for $57.25 per share.

TransUnion vs S&P500 YTD Return (Seeking Alpha)

Stanley Black & Decker (SWK)

-

Active Corporate Insiders: 2

-

YTD Performance: -56.65%

- Total Bought Back: $4,048,142

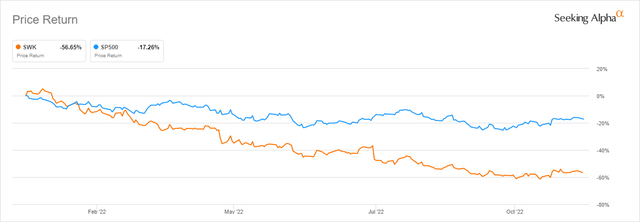

Stanley Black & Decker is one of the world’s largest industrial tool and household hardware manufacturers. Throughout a 170-year-long history, it built up a well-recognized lineup of brands that garner a loyal following including the likes of Dewalt, Craftsman, Black+Decker, Stanley, and Cub Cadet, among others. The company offers a diversified product lineup and operates across 60 countries. Throughout a 170-year-long history, it built up a well-recognized lineup of brands with a loyal following like Dewalt, Craftsman, Black+Decker, Stanley, and Cub Cadet, among others. Pressures surrounding a weak DIY market followed up by a painful downgrade opened the stock up for a lot of pain in the markets this year. In late 2021, the company was even selling for $217 per share but came all the way to 10-year lows. It generated a negative year-to-date return of 56.65% accompanied by a negative one-year return of 56.17%. SWK is currently trading at an NTM EV/EBITDA of 14.11x, an NTM P/E of 32.44x, and an NTM MC/FCF of 7.93x. Seeking Alpha Authors still remain relatively positive about SWK’s future prospects and have assigned it a “Buy” rating with a score of 3.50/5.00. Wall Street Analysts on the other end remained unconvinced and have assigned the company only a “Hold” rating with an average score of 3.26/5.00. Active corporate insiders in the third quarter were Directors Andrea J. Ayers and Robert J. Manning. They have bought back a total of $4.04 million worth of SWK shares for an average estimated price of $90.59. The company is currently trading at $76.68 per share.

Stanley Black & Decker and S&P500 YTD Return (Seeking Alpha)

V.F. Corporation (VFC)

-

Active Corporate Insiders: 2

-

YTD Performance: -55.60%

- Total Bought Back: $682,992

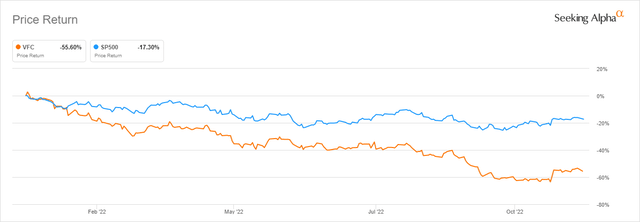

V.F. Corporation is one of the world’s largest apparel, footwear, and accessories companies that owns and operates more than 1,300 retail locations across 125 countries. The company controls popular brands such as Supreme, Eastpak, Timberland, and North Face, among others. VFC’s stock price got hammered in the markets as investors continue to worry about a cut-back in discretionary spending and lower consumer demand. As a result, V.F. Corporation is significantly underperforming in the market, as it managed to generate a negative year-to-date return of -55.60% and a negative one-year return of 55.67%. The Colorado-based company is currently being sold for an NTM EV/EBITDA of 12.39x, an NTM P/E of 13.65x, and an NTM MC/FCF of 14.07x. It also offers a very attractive dividend yield of 5.94%. Seeking Alpha Authors remain positive on VFC and have rated it a “Buy” with an average score of 4.00/5.00. Wall Street Analysts do not necessarily share the opinion, assigning the company a “Hold” rating with an average score of 3.47/5.00. With opinions on the future split down the middle, a 5.36% short interest has been built over the past couple of months. In the last quarter, shares of V.F. Corporation were purchased by Directors Richard Carucci and Rodney McMullen. They bought back $0.68 million worth of VFC shares during the third quarter at an average estimated price of $43.10. The company is currently trading at $26.40 per share.

V.F. Corporation vs S&P500 YTD Returns (Seeking Alpha)

Closing arguments

The year of 2022, even if quite memorable, will not go down as a happy one as the vast majority of individual investors had to part ways with an immensely lucrative thirteen-year-long bull market. The third quarter of this year saw what we now can define as the market bottom, with the S&P 500 briefly hitting 3,493.67 points and at that point marking a 21% year-to-date decline of the index. Since then, the market entered a persistent recovery phase, salvaging a portion of the prior loses, but it largely remains unclear for how long the current negative macroeconomic environment can sustain much higher securities prices. Amid such a difficult situation, insiders betting the farm on heavily beaten-down stocks of their own companies are that much more notable. The third installment of quick picks we have brought forward to you today, highlights large-cap companies that, in our view, enjoyed a period of unusual and atypical attention from corporate insiders that are possibly worthy of further research.

Be the first to comment