Justin Sullivan

The Seeking Alpha quant ratings, while evolving, is already providing a nice value ad to investors, in addition to the data and analysis already available on the platform. Alerts like the ones shown below flash in my portfolio and watch list are helpful to at least get your attention onto something, even if you don’t necessarily agree with it.

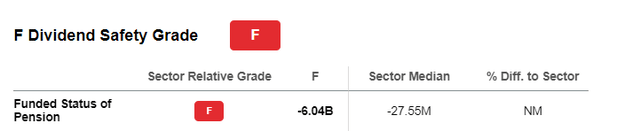

Ford Motor Company (NYSE:F) is a stock I’ve owned in the past and remains on my watchlist. Seeking Alpha has been flashing the warning shown below for a while now on Ford. I see Seeking Alpha’s ratings as more than a starting point that we can build on to come to our own conclusions. This article is an exercise in evaluating for myself and interested Ford investors if the dividend is indeed at risk. Let’s get started.

SA F warning (Seekingalpha.com)

FCF over EPS

When evaluating dividend safety, I prefer using Free Cash Flow (“FCF”) over Earnings per share (“EPS”). I prefer free cash flow as a better indicator of financial health for these reasons:

- Earnings tend to be up and down depending on rare events and write-offs.

- Earnings are more prone to GAAP-related fluctuations.

- Cash flow is king.

How does Ford’s FCF look? Healthier than you think

- Total shares outstanding: 4.02 Billion

- Current quarterly dividend per share: 15 cents

- Quarterly Free cash flow needed to cover dividends: $600 Million (4.02 Billion times 15 cents)

- Ford’s average quarterly free cash flow over the last 5 years: $2.362 Billion

- Dividend coverage using quarterly free cash flow: 25% ($600 Million needed to cover dividends divided by the average quarterly FCF of $2.326 Billion).

Wait, what’s the worry then?

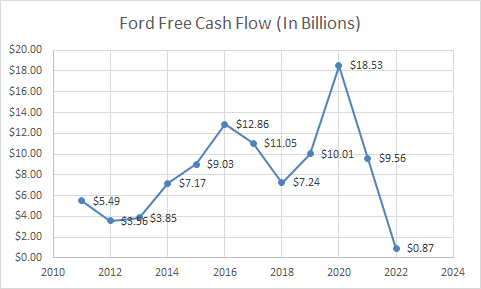

So, what’s the worry? In one word, trend. As shown in the free cash flow chart below, free cash flow has crashed since the 2020 highs (Please note the 2022 number is only for 3 quarters). Ford, being a cyclical company, is prone to ups and downs in general. However, this time the downturn is exaggerated by the once-in-a-lifetime tailwind Ford and many other companies benefitted from as a result of COVID induced shortages.

Depreciation? What depreciation, consumers asked. I am sure we all know many that profited from selling their used cars but this one is my favorite: early this year, a friend sold his used Toyota Camry for a profit of $10,000 on top of what he paid for his already used car 5 years ago. Basically, he and millions of other consumers were paid to have used their cars. Long gone are these days. Just ask Carvana Co. (CVNA), which has fallen from $245 to $4.

If we take out the COVID induced peaks below, it is easy to see how Ford’s free cash flow was basically flat on average during the general recovery of the cycle (2015 to 2019) and a return to the recent lows (2012 to 2014) is not out of question. This time though, with every company over-expanding to meet the COVID induced demand, the downside will likely be more pronounced than the natural ebbs of the past.

Ford FCF (Compiled by author with data from YCharts.Com)

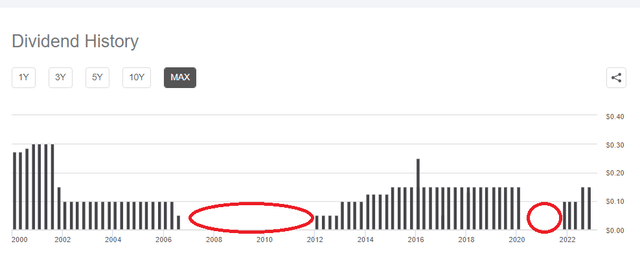

Once Bitten, Thrice Shy

It is fairly obvious that Ford will not make it to the holiday wish-list of dividend growth investors due to the gaps shown below. What can do wrong with a cyclical company nearing the end of the current super cycle with a history of eliminating dividends already? Investing is all about trust, especially when looking at stocks for their income.

F Dividend History (Seekingalpha.com)

Debt and Other Issues

- As I’ve stated in previous articles, only two viable options exist for companies to pay consistent and raising dividends: earn or borrow.

- Earn: Ford’s ability to earn is cyclical as we know and we are much closer to the end of the cycle than the beginning. On top of that, cost concerns are weighing up as reported here by Seeking Alpha. It is safe to say earnings will be under high pressure over the next few quarters at least.

- Borrow: Ford’s long term debt is about three times its total market cap. It is safe to say neither the investors nor the management would like to borrow more with interest rates at levels not seen for almost two decades.

- Ford’s pension obligations are well-known and the company has historically been at the top of the list of companies with pension obligations. Outside of International Business Machines Corporation (IBM), all the other companies in the top 5, including Ford, have a history of reducing, eliminating or not paying a dividend at all. Fair to say, not an enviable list to be a part of.

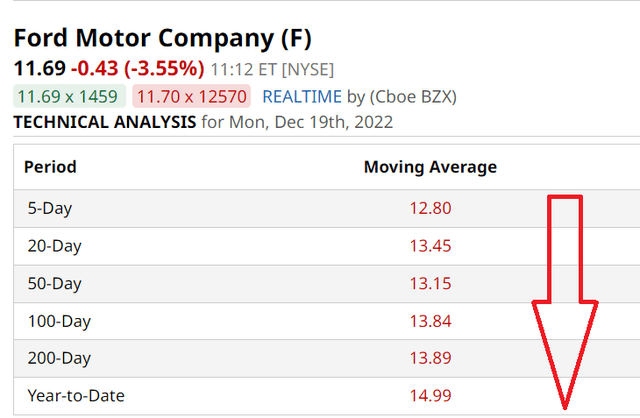

- Okay, if the dividend is not safe, how about capital appreciation potential? From a short to medium term perspective, it appears like the best maybe behind Ford there as well. As shown below, Ford is making lower-lows as the 5-, 20-, 50-, 100-, and 200- Day moving averages are almost progressively lower than each other (with only the 20-Day being above the 50-Day). This suggests more selling pressure as we enter 2023.

Ford Moving Avgs (Barchart.com)

Conclusion

I can hear questions like “Why would they eliminate the dividend this early after just reinstating it?”. Fair enough but it took a once in a life time windfall type of event for Ford to get the confidence to reinstate it. I am not saying it will be reduced or eliminated right away. But all the necessary ingredients are here to be prepared for an eventual dividend cut, if not elimination:

- Declining cash flow

- High-debt

- Pension obligations

- High interest rates

- And most important of all, end of an unusually rare high demand business cycle

Putting all those factors together, I recommend staying away from Ford as an investment here as it neither offers dividend protection nor capital appreciation potential. Ford is a good example of a stock not being a buy even after a 50% decline from highs as the future looks much more rockier than the recent past.

Be the first to comment