J. Michael Jones

For fans of the restaurant industry, one company that should not be overlooked is a firm called Brinker International (NYSE:EAT). As opposed to owning only one brand, the company owns multiple. Over the past few years, the financial trajectory of the company has been a bit lumpy, with sales and profits all over the map. Part of this is due to the effects of the COVID-19 pandemic. But at the same time, the picture has also been hindered to some degree by a change in the number of locations the company has in operation. Most recently, sales continue to rise but profits and cash flows have come under pressure. More likely than not, these pains will be temporary in nature. And once the company returns back to more stable cash flow generation, shares will look cheap enough to warrant some amount of upside for those who are patient enough to stay on for the ride.

Mixed results

According to the management team at Brinker International, the company operates as a major player in the restaurant space. The company currently owns, develops, operates, and even franchises some of its brands. Chief among these is Chili’s Grill & Bar, which is a casual dining brand that has been in operation for over 47 years. These days, Chili’s features a menu that has more traditional American fare. Examples include baby back ribs, fajitas, burgers, and more. The company also prides itself in offering a digital experience for customers who want to pick up food. And by partnering with other firms, the enterprise also provides its customers with a variety of delivery options. To put in perspective exactly what kind of brand Chili’s is, keep in mind that during the 2022 fiscal year entree selections at the restaurant ranged from a low price of $8 to a high price of $21.63. The average revenue per meal, inclusive of alcoholic beverages, is around $16.37, while the average revenue per restaurant location stands at $3.2 million.

This is undoubtedly the largest of the brands that Brinker International owns. However, another brand in its portfolio is Maggiano’s Little Italy. Under this brand, the company provides a casual restaurant experience that offers its customers Italian-American cuisine. The pricing under this brand name is a bit higher, with entrees ranging from $8.99 to $42.99. The average price per guest, inclusive of alcoholic beverages, is around $29.40. Interestingly, sales per location is substantially higher than at the Chili’s locations, with average revenue per spot of $8.1 million. 12.5% of sales at these locations involve events at the company’s banquet facilities. On top of these two primary brands, Brinker International also has a history of investing in virtual brands that are only available through online order. The most notable example is Just Wings, which was launched in 2020 and offers a fare that includes chicken wings, curly fries, ranch dressing, and a variety of other items.

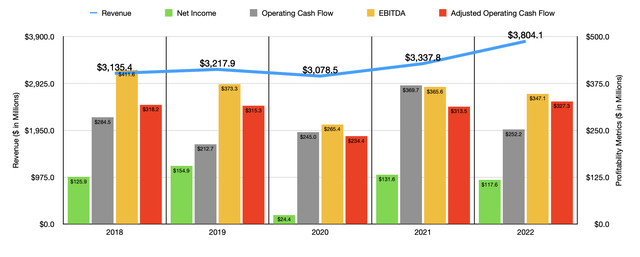

Over the past few years, the financial trajectory experienced by Brinker International has been a bit lumpy. After seeing revenue rise from $3.14 billion in 2018 to $3.22 billion in 2019, sales dropped to $3.08 billion in 2020. By 2022, however, sales had spiked to $3.80 billion. Interestingly, this all has taken place at a time when the total number of locations the company has in operation dropped, falling from 1,686 in 2018 to 1,650 by the end of its 2022 fiscal year. but as is often the case with investing, the devil is in the details. Although the number of locations in operation dropped, this decline has really only involved the number of franchised locations in its portfolio. The number of company-owned restaurants actually increased, rising from 997 in 2018 to 1,188 by the end of 2022. The good side to increasing the number of company-owned locations is that this will result in greater revenue coming to the company since revenue from franchised locations only involves the franchise fees that they collect. The downside is that margins associated with company-owned restaurants are often smaller than the margins from franchised locations. In 2022, the company also benefited from a 13.2% surge in comparable restaurant sales, driven by the economy’s reopening.

While it’s great to see revenue increase, profits have also been rather volatile. Net income has been all over the map, ranging from a low point of $24.4 million to a high point of $154.9 million. In 2022, profits came in at $117.6 million in all. The picture has been more or less the same when it comes to other profitability metrics. Both operating cash flow and EBITDA have been rather volatile as the first chart in this article demonstrates. In 2022 though, operating cash flow totaled $252.2 million. But if we adjust for changes in working capital, it would have totaled $327.3 million. Meanwhile, EBITDA came in at $347.1 million. While that is down from the $365.6 million generated one year earlier, it is at least higher than what the company achieved in 2020.

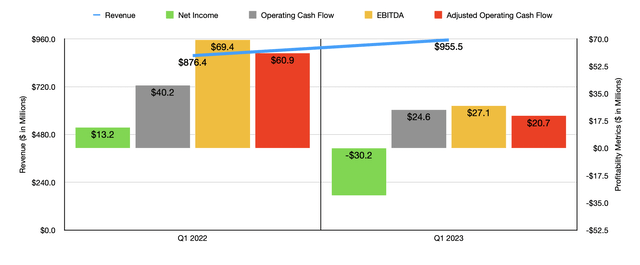

When it comes to the 2023 fiscal year, the picture has been somewhat mixed. Revenue did come in higher at $955.5 million during the first quarter of the year. That compares favorably to the $876.4 million reported the same time last year. A rise in the number of company-owned restaurants from 1,145 to 1,182 was instrumental in this regard, as was the 5.5% increase in comparable store sales. Unfortunately, profits have been a bit problematic. During the quarter, the company generated a net loss of $30.2 million. That compares to the $13.2 million profit achieved the same time last year. Operating cash flow, meanwhile, dropped from $40.2 million to $24.6 million. Even if we adjust for changes in working capital, it would have taken a beating, plunging from $60.9 million to $20.7 million. A similar path can be seen by looking at EBITDA, with the metric dropping from $69.4 million to $27.1 million.

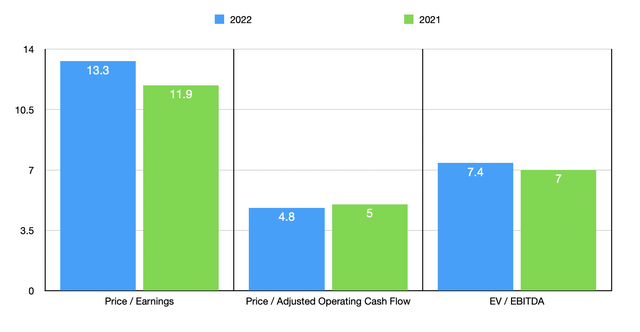

Truth be told, it’s too early to know what to expect for 2023 as a whole. Clearly, the picture is looking less than ideal. Management attributed this pain largely to inflationary pressures, both in regard to food costs and labor costs. At some point though, the picture will adjust, either through management having to increase prices or prices coming down as inflation is dealt with. When that does come to pass, shares will be looking fairly cheap. Using data from 2022, we can see that the company is trading at a price-to-earnings multiple of 13.3. The price to adjusted operating cash flow multiple is even lower at 4.8, while the EV to EBITDA multiple comes in at 7.4. As part of my analysis, I decided to compare the company to five similar businesses. Using the price-to-earnings approach, these five companies ranged from a low of 12.4 to a high of 34.3. In this case, only one of the five companies was cheaper than our prospect. When it comes to the price to operating cash flow approach, the range was from 5.1 to 13.8. In this scenario, Brinker International was the cheapest of the group. And when it comes to the EV to EBITDA approach, the range was from 7.2 to 14.5. In this scenario also, only one of the companies was cheaper.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Brinker International | 13.3 | 4.8 | 7.4 |

| Texas Roadhouse (TXRH) | 24.8 | 12.7 | 14.5 |

| Bloomin’ Brands (BLMN) | 21.9 | 5.1 | 7.2 |

| The Cheesecake Factory (CAKE) | 34.3 | 8.5 | 14.3 |

| Dine Brands Global (DIN) | 12.4 | 9.3 | 9.2 |

| Darden Restaurants (DRI) | 18.2 | 13.8 | 12.9 |

Takeaway

Based on all the data provided, I would make the case that Brinker International is a decent player in a highly competitive space that has undergone some pain in recent years. Based on the volatility the company has experienced, particularly when it comes to its bottom line, I would not call it a high-quality firm and I would even go so far as to say that there are healthier prospects to be considered. But one thing that the company does have going for itself is that shares look quite cheap on both an absolute basis and relative to similar firms. In the event that the business can achieve consistent growth in the future, this could result in material upside for shareholders. But even with financial performance continuing along like it has been doing in perpetuity, I think that some upside could be warranted.

Be the first to comment