sankai

Some of the most popular sectors among those seeking income have long been utilities and infrastructure companies. This makes a great deal of sense as these companies tend to enjoy remarkably stable finances due to their respective business models. In addition, the fact that most of these companies have relatively low growth rates results in them paying out a high percentage of their cash flow to investors in the form of distributions or dividends.

It is quite difficult to construct a portfolio consisting of these companies, especially if capital is somewhat limited. One possible solution to this problem is to invest in a closed-end fund that specializes in the sector. These funds provide investors with easy access to a professionally-managed diversified portfolio that can in most cases deliver higher yields than pretty much anything else in the sector.

In this article, we will discuss one of these funds, the Gabelli Global Utility & Income Trust (NYSE:GLU). This closed-end fund (“CEF”) yields an attractive 8.22% at the current price, which is certainly quite attractive in today’s market. I have discussed this fund before, but nearly two years have passed since that time so obviously a great deal has changed. This article will focus specifically on these changes and provide an updated analysis of the fund’s finances as we attempt to determine if an investment in it makes sense today.

About The Fund

According to the fund’s webpage, the Gabelli Global Utility & Income Trust has the stated objective of providing its investors with a consistent level of after-tax total return. The fund states that it specifically emphasizes dividend income as a way to deliver this total return. This is not exactly surprising, as utilities are renowned for the dividends that they pay out. The fund focusing on total return is also not surprising for a common equity fund. After all, equities are a total return instrument as people buy them both for dividend income and for capital gains.

The fund states that it may include things other than utilities in its portfolio, which is not surprising. The description does imply that the fund will not purchase anything that does not pay a dividend, however. Curiously, the fund does not state if it invests only in common equity or if it can include fixed-income investments issued by the same companies. If it can include preferred stock, then it could help reduce the fund’s volatility since preferred securities typically are more stable over time. As preferred securities typically have much higher yields than common stock issued by the same company, the inclusion of these securities could boost the fund’s income. However, the inclusion of preferred stock would also reduce the fund’s potential to generate capital gains or a growing income since preferred stock does not generally increase its dividend as the issuing company grows nor does it deliver the same capital gains that common stock can.

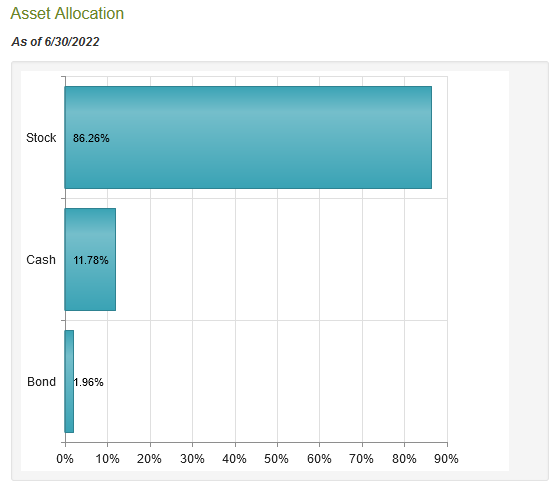

Although the inclusion of preferred stock may work to the benefit of more risk-averse investors, the GLU fund does not currently include any in its portfolio. In fact, the fund currently only includes common stock and a very small amount of bonds:

CEF Connect

This is not the best portfolio to protect against market volatility, but it also may not be as bad as some might expect. As I pointed out in a recent article, dividend-paying stocks tend to hold up better than non-dividend-paying stocks during times of market turbulence. This is because dividends act as a reassurance to the market that the company is profitable, which removes some of the speculations that may otherwise be present. In addition, the dividend sends a signal that management is confident of the firm’s business and financial strength regardless of the conditions in the broader economy. This sort of confidence is exactly what many people need today, as the global economy is obviously heading toward a recession if it is not already in one. As the majority of the fund’s assets are in dividend-paying stocks as opposed to speculative ones, the fund’s portfolio will likely still be a source of comfort despite being mostly in common stocks as opposed to a mix of common stock and fixed-income securities.

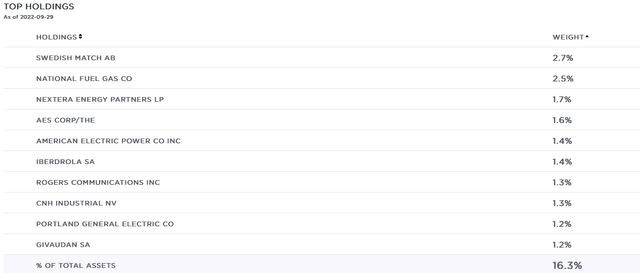

The largest positions in the fund reinforce its focus on dividend-paying stocks. Here they are:

We certainly see a number of utilities here, including NextEra Energy Partners (NEP), The AES Corporation (AES), American Electric Power (AEP), Iberdrola (OTCPK:IBDSF), and Portland General Electric (POR). We also see companies like National Fuel Gas (NFG) and Rogers Communications (RCI) that are basically utilities. Interestingly, we also see Swedish Match (OTCPK:SWMAF), which is a tobacco company, and CNH Industrial (CNHI), which manufactures industrial and agricultural equipment. These are certainly not utilities, although admittedly Swedish Match is going to enjoy many of the same characteristics such as stable cash flows.

The general stability of utilities comes from the fact that they provide a product that most people consider to be a necessity for our modern way of life. After all, many people today could not imagine a life without electricity or heating in their homes. The same largely applies to telecommunications companies as it is quite difficult to function without a cellular phone or an Internet connection today. As a result, most people will prioritize paying their utility bills ahead of discretionary expenses. The same is mostly true for tobacco companies like Swedish Match as the product that they sell is quite addictive. This could be especially important during difficult economic times such as recessions.

We have already started to see consumers cutting back on their discretionary spending, as is evident in the earnings reports released by Walmart (WMT), Target (TGT), Amazon (AMZN), and other retailers. It seems highly unlikely that consumers are going to be willing to sacrifice their electric service in favor of some new electronic gadget so utilities are going to be much safer investments. This is especially true when we consider that governments and charitable organizations are usually willing to help people who are struggling with utility bills.

One thing that we notice by looking at the largest holdings in the fund is that the companies in the list are almost identical to what the fund had nearly two years ago. In fact, the only changes were William Hill (OTCPK:EIHDF) and Sony Group (SONY) being replaced with CNH Industrial and Portland General Electric. The fact that so few changes were made over the past two years will likely lead one to believe that the fund has a very low annual turnover. This is indeed the case as the Gabelli Global Utility & Income Trust only has a 10% annual turnover, which is one of the lowest figures that I have ever seen for a closed-end equity fund. This is something that is nice to see because trading assets costs money, which is billed to the shareholders. This is one of the reasons why index funds have become so popular over the years since their limited trading and minimal expenses make it easier to deliver high returns. This does not, of course, mean that a fund that does a lot of trading will underperform but it does create a challenge for management to both regain the money spent in trading as well as deliver a return that appeals to investors.

Unfortunately, this fund has significantly underperformed the index year-to-date. Since January 1, 2022, the iShares Global Utilities ETF (JXI) is down 7.75% yet the Gabelli Global Utility & Income Trust is down a whopping 31.28%:

The Gabelli fund does have a considerably higher yield but that is not nearly enough to close the performance gap. This is certainly not going to appeal to any investor, although the fund’s actual portfolio has only returned -24.80% since that time. The difference can be accounted for by the fact that closed-end funds do not trade in lock-step with their actual portfolio performance. Either way, though, the fund underperformed the index by quite a lot.

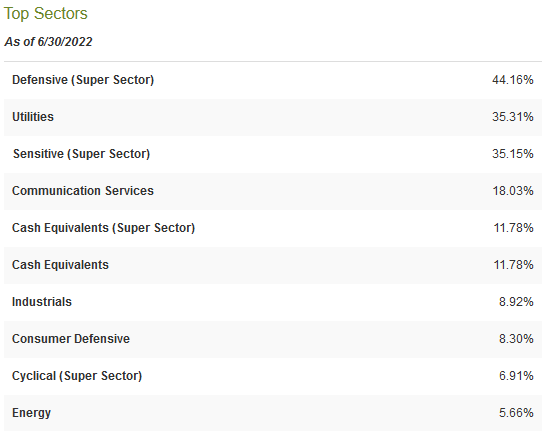

The Gabelli fund invests in much more than simply utilities, though, which we may be able to guess by looking at the largest positions listed above. In fact, only 35.31% of the portfolio is invested in utilities:

CEF Connect

As such, it may not be entirely fair to compare the fund to the global utility index when evaluating its performance. The fund’s underperformance likely came from some of the other assets in the fund. The fund investing in other sectors could also work to its advantage at times, though. The fund has been known to invest in vice sectors during times of economic trouble. For example, it had a position in British gambling giant William Hill (now 888 Holdings) back in 2020. It is a reasonable thesis, as online gambling was a somewhat popular pastime during the lockdowns. We saw the same thing in the United States as the consumption of alcohol and drugs surged during that period of time. It would be a reasonable thesis that these vices could be a good place to be invested as the economy worsens and the fund can very easily position itself to take advantage of this once again.

Distribution Analysis

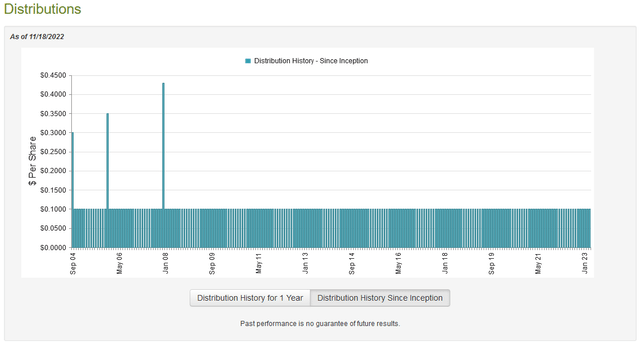

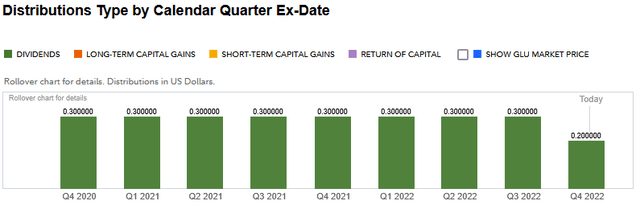

As was already mentioned, the Gabelli Global Utility & Income Trust invests in utilities and other generally stable dividend-paying companies. The fund also specifically states that it wants to provide much of its total return to investors through the distributions that it pays out. As such, we can likely assume that the fund would boast a reasonably high distribution yield. This is certainly the case, as the Gabelli Global Utility & Income Trust pays a monthly distribution of $0.10 per share ($1.20 per share annually), which gives it an 8.22% yield at the current price. The fund has been remarkably consistent about this distribution over the years. In fact, the distribution has been totally flat for many years:

The fact that the fund has been remarkably consistent in its distribution is something that any income-focused investor can certainly appreciate. However, it is pretty difficult to believe that its actual returns were that consistent, especially since this is a period of time that includes two recessions, a bull market, and multiple bear markets. However, all of the fund’s distributions are classified as dividend income:

The fact that these distributions are entirely classified as dividend income will likely be appealing to many risk-averse investors. This is because dividend income tends to be much more consistent than return of capital distributions and does not have the aura of unsustainability that accompanies a return of capital distribution. However, as I have shown in a past article, it is possible for these distributions to be misclassified. As such, we will still want to examine the fund’s finances to determine how exactly it is financing these distributions so that we can determine how sustainable its distribution is likely to be.

Fortunately, we have a fairly recent report that we can consult for this purpose. The fund’s most current financial report corresponds to the six-month period ending June 30, 2022. As such, it should give us a pretty good idea of how well the fund did in the volatile market that dominated the first half of this year. During that six-month period, the fund received a total of $2,201,917 in dividends and another $38,452 in interest from the assets in its portfolio. This gives it a total income of $2,240,369 net of foreign withholding taxes. The fund paid its expenses out of this amount, leaving it with $1,532,381 available for investors. This was nowhere close to enough to cover the $18,999,679 that the fund actually paid out in distributions during the period. Obviously, these distributions are not entirely funded by dividend income.

The fact that these distributions are not funded by dividend income does not necessarily mean that the fund cannot afford them, though. This is because it has other ways that it can obtain money. One of these is through capital gains. Unfortunately, the fund failed miserably at this as it had net realized gains of $110,335 but this was more than offset by $19,409,018 net unrealized losses. Overall, the fund’s assets fell by $13,034,323 during the six months. This is not a positive sign, especially since the fund had fewer assets on June 30, 2022 than it did on December 31, 2020. On December 31, 2020, the fund had $104,632,025 but it only had $99,894,898 on June 30, 2022. The distribution might be reasonably safe if it manages to grow its assets again in the second half of 2022 but otherwise, we do have some cause for concern.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Gabelli Utility Trust, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are purchasing the fund’s assets for less than they are actually worth. That is indeed the case with this fund. As of November 18, 2022 (the most recent date for which data is currently available), the fund had a net asset value of $15.80 per share. However, the shares actually trade for $14.59 per share. This gives the shares a discount of 7.66% at the current price. This is quite a bit better than the 4.94% discount that the shares have averaged over the past month. Thus, the price certainly looks reasonable today.

Conclusion

In conclusion, utility companies are a popular investment for retirees and others that are seeking stability and income. Despite its name, the Gabelli Global Utility & Income Trust does not invest solely in utilities but it does try to invest in dividend-paying companies that share many of the same qualities as utilities. It has largely been successful at that, although the fund does significantly lag utility indices. Fortunately, the distribution is probably reasonably safe and the valuation looks quite attractive. GLU might be worth purchasing as we enter into a recession, although the disappointing performance should be considered before buying.

Be the first to comment