turk_stock_photographer

Having a collection of safe and sound stocks is key to building a sleep well at night portfolio. What’s even better is if these holdings generate steady income such that the investor can spend more time reading, surfing, knitting, or whatever gives them pleasure rather than spend their time worrying about their investments.

This brings me to Phillips Edison (NASDAQ:PECO), whose share price performance has held up rather well amidst the market volatility in recent months. In this article, I highlight why PECO is set up for potentially strong long-term sleep well at night returns, so let’s get started.

Why PECO?

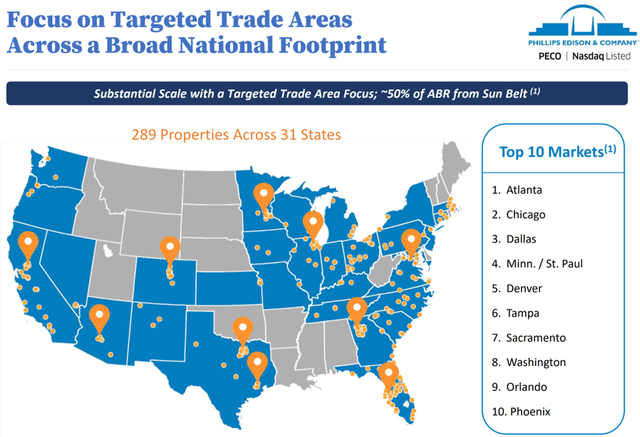

Phillips Edison is a large shopping center REIT that’s self-managed and was founded 31 years ago. It only recently became a publicly-traded after its IPO in July of 2021. PECO’s portfolio spans 289 shopping centers (269 of which are wholly-owned) comprising 31 million square feet across 31 states. Its top grocery tenants include familiar names such as Kroger (KR), Publix, and Albertsons (ACI). As shown below, PECO participates in many top markets from coast to coast.

PECO Locations (Investor Presentation)

What sets PECO apart from most of its peers is its very high exposure to grocery-anchored centers, which represent 89% of its annual base rent. In addition, nearly all (97%) of PECO’s ABR stems from either omnichannel or grocery anchored centers. PECO also aims to attract durable small-shop tenants, as 71% of total ABR is from necessity-based goods and services.

Contrary to the conventional mainstream narrative of a retail apocalypse, community centers such as the ones that PECO own are valuable real estate that serves as strategic last mile anchor points for top retailers. This is reflected by the fact that U.S. consumers visit grocery stores on average 1.6 times per week, and 90% of PECO’s grocers offer buy online, pick up in store options. This serves as a competitive advantage for the tenants, as it’s fairly obvious that higher foot traffic from customers picking up orders drives the potential for more sales.

Meanwhile, PECO has demonstrated continued robust growth, generating core FFO growth of 13% YoY to $144 million in the first six months of the year. This was driven in part by same-center net operating income growing by 4.3% YoY. Also encouraging, demand for PECO’s properties is high, as anchor occupancy increased by 190 basis points YoY to 98.7%, and total occupancy increased by 210 bps to 96.8%, driven by robust small shop leasing trends.

It’s worth mentioning that core FFO per share declined by $0.04 YoY to $0.56. I don’t find that to be concerning, however, as this is due to PECO’s July 2021 IPO, which resulted in an 18% share count. I don’t see the equity raise as being a conflict of interest, as PECO is internally managed with management having significant skin in the game, with 8% ownership of all outstanding shares.

Factors that could drive the share price down could be higher interest rates, which raise PECO’s cost of funding. This risk is mitigated by PECO’s strong balance sheet, which has 87% fixed rate debt and a low net debt to EBITDAre ratio of 5.5x (down from 5.6x at the end of 2021). It also maintains plenty of liquidity with $784 million in available capital.

Looking forward, I continue to see a strong outlook for PECO, as management targets an IRR in the 8.5% to 9% range on future acquisitions. It also has a strong footing in markets that are supply constrained. These strengths were highlighted by management during the recent conference call:

Higher costs and inflation headwinds are limiting new supply of grocery-anchored centers as the barriers for new construction are higher than they’ve ever been. We expect these trends will continue to positively impact existing shopping centers. There’ll be fewer new builds coming online and existing neighbors will be unlikely to relocate because of these costs and high occupancy levels.

While we’re not currently seeing a slowdown in the strong demand for space at our grocery-anchored centers, we remain cautiously optimistic in our actions and continue to incorporate macro-economic realities into our decision-making. We remain focused on managing our neighbor mix and credit quality as we prepare for market disruptions.

Meanwhile, PECO recently raised its dividend by 3.7% to a monthly rate of $0.0933 per share, equating to a very safe 50% payout ratio. This equates to a healthy 3.3% dividend yield based on the current price.

I continue to see value in PECO at the current price of $33.45 with forward P/FFO of 15.1. This is considering the very high quality nature of the underlying portfolio in supply constrained markets. Analysts have an average price target of $36.88 on the stock, equating to a potential one-year 14% total return including dividends, and the Quant system assigns a Strong Buy rating based on a number of different factors.

Investor Takeaway

PECO’s stable grocery anchored portfolio has sheltered the stock from experiencing much volatility. It has a strong growth outlook and the portfolio of grocery-anchored shopping centers in supply constrained markets makes it an “all-weather” business. Meanwhile, PECO has strong fundamentals, a solid balance sheet, and pays a growing and very well-covered dividend. I see value in PECO at its current price for growth and income.

Be the first to comment