ayo888/iStock via Getty Images

WTI crude oil prices have fallen sharply in recent weeks to trade at around US$71.70/bbl at the time of writing, reversing the entire year’s worth of gains to date. This brings crude oil prices to a level that we think presents an attractive opportunity for initiating a short-term tactical trade. To be clear, we are not expecting crude prices to spike back above the US$100/bbl level anytime soon, but we see the potential for a rebound in the magnitude of around 10%-20% within the next 1-3 months.

The sharp sell-off in crude oil appears to have caught the market by surprise, given that the Russian-Ukraine war is looking increasingly like a drawn-out proxy war with no signs of a peace deal, while China is finally taking steps to reopen its economy. Both of these developments should be fundamentally bullish for crude oil, but it seems concerns over weakening economic growth may be weighing more heavily on the minds of commodity traders.

Conveniently, we hold a much more optimistic view of the U.S. economy and expect only a mild and shallow recession ahead. As such, we view the sharp selloff in crude oil prices as an opportunity to take a contrarian view against the overwhelming pessimism that has plagued risky assets all year. Macroeconomic fundamentals continue to suggest to us that global oil markets will remain tight in 2023 and should be supportive of higher crude prices. This view is also in line with the latest oil forecasts published by the EIA on December 6, which sees WTI crude prices averaging US$86/bbl in 2023.

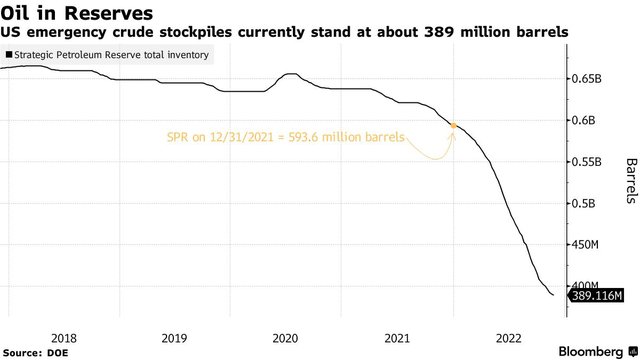

Strategic Petroleum Reserve Targeting US$70 Oil

The Biden administration has announced plans to purchase crude oil to replenish the Strategic Petroleum Reserve (SPR), after 180 million barrels of oil were released this year in response to surging prices during the first half of 2022. The administration aims to replenish the SPR at around US$67-US$70/bbl, which essentially provides support for crude prices at around current levels. The SPR, which has the capacity to hold around 700 million barrels of oil, has seen inventories fall to just 389 million barrels, according to data released by the Energy Department.

OPEC+ Under Pressure To Slash Output

OPEC+ decided to maintain its existing policy of curtailing oil output during a virtual meeting last week, just hours before Western sanctions on Russian crude exports come into force. The group said that members will continue to restrict supply by 2 million barrels per day, a policy last set in October that started last month and is due to run through the end of 2023. Although we see scope for OPEC+ to announce further cuts should crude prices break below US$70/bbl, we see risks being skewed towards the upside for crude prices as economic conditions in the U.S. and China continue to improve.

ProShares Ultra Bloomberg Crude Oil ETF

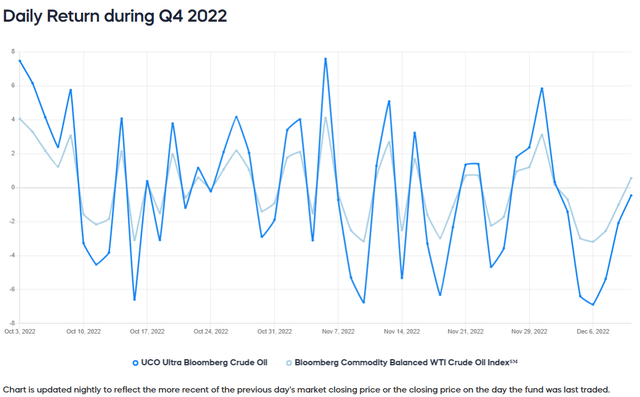

For investors looking for enhanced returns and are comfortable with the risks associated with leveraged ETFs, we think the ProShares Ultra Bloomberg Crude Oil ETF (NYSEARCA:UCO) may be an excellent choice. According to fund information provided by ProShares, UCO is leveraged to seek a return that is 2x the daily performance of the Bloomberg Commodity Balanced WTI Crude Oil Index (target index), as measured from one NAV calculation to the next. The target index tracks the performance of three separate contract schedules for WTI Crude Oil futures with different roll dates. To maintain the long position of the futures basket, contracts are rolled from the expiring futures contract to a new contract further down the curve with a longer expiry date.

Investors should also take note that UCO effectively amplifies daily returns as well as losses. The chart below shows the daily return for the UCO and that of the target index during Q4 2022. As we can see, UCO tracks the daily directional movements of the target index and generates the intended 2x return of the target index’s daily performance.

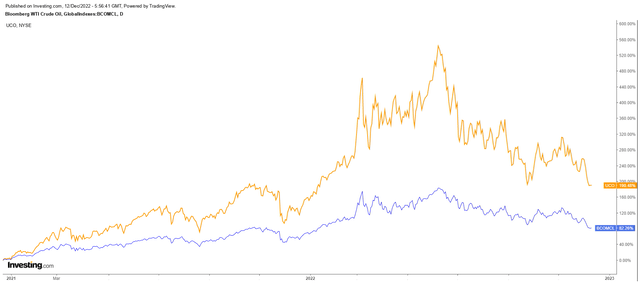

UCO is designed specifically for short-term trading as performance may differ significantly from the target index over longer holding periods. This is essentially due to the compounding effect of daily returns. To demonstrate this, the below chart shows the performance of UCO (orange line) compared to the target index (blue line) over the last 2 years. Over this period, the target index returned 82% while UCO return more than 2x of that with a 190% return. This effect may be even more pronounced for funds that use greater leverage or track more volatile benchmarks.

For our purposes of positioning for a tactical rebound in crude oil prices with a relatively short trading window of just 1-3 months, we think UCO is ideal. Although UCO’s expense ratio of 1.10% is reasonable given that the exchange-traded fund (“ETF”) manages a basket of leveraged crude oil futures and that daily moves are quite often greater than 2%.

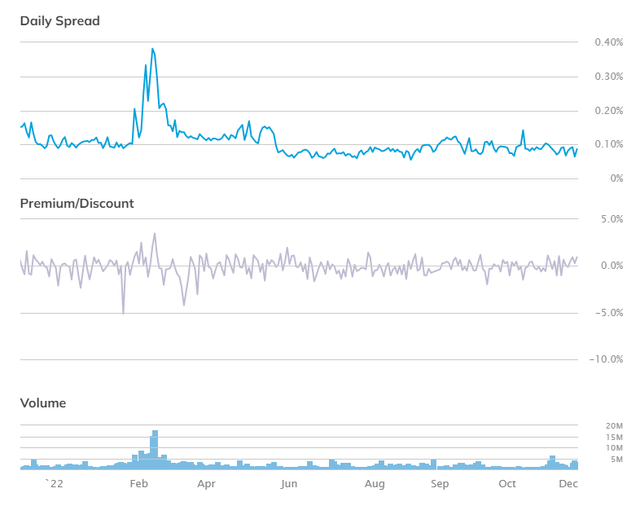

In terms of trading metrics, daily spreads for UCO are narrow and the ETF trades closely to NAV with stable and healthy volumes.

In Conclusion

Macroeconomic fundamentals continue to suggest to us that global oil markets will remain tight in 2023 and should be supportive of higher crude prices. This is further supported by the Biden administration’s plan to replenish the Strategic Petroleum Reserve at around US$67-US$70/bbl, and growing pressure on OPEC+ to cut oil production.

The ProShares Ultra Bloomberg Crude Oil ETF is ideal for our purposes of positioning for a tactical rebound in WTI crude oil prices with a relatively short trading window of 1-3 months. We see the potential for a 10%-20% rebound in crude oil prices within this time frame, and we target a 2x amplified return through a leveraged exposure through UCO.

We initiate coverage of UCO with a “Buy” rating.

Be the first to comment