bjdlzx

Main Thesis & Background

The purpose of this article is to discuss the ProShares Ultra Bloomberg Crude Oil ETF (NYSEARCA:UCO) as an investment option at its current market price. UCO is a double long instrument, designed to return two times the daily performance of the Bloomberg Commodity Balanced WTI Crude Oil Index. This is a futures market product, so it may not directly follow the current price of crude, but I personally feel it is as good a way as any to access the oil market.

UCO continues to capture my attention because it has been a major winner in 2022. This is significant because most stocks/funds/sectors/themes have had a rough go of things this year. By contrast, UCO’s leveraged exposure to a rising commodity has allowed it to post generous returns YTD:

YTD Price – UCO (Seeking Alpha)

Of course, this graphic also shows that UCO is not prone to steep sell-offs either. It has fallen markedly from its high in late May, suggesting that investors need to approach positions carefully and within their risk tolerance.

That said, I believe positions in UCO here are very justifiable. I like crude as a hedge against equities, commodity plays in general can perform well if inflation stays high, and production cuts from OPEC+ as well as a dwindling SPR balance in the U.S. are all factors that could drive prices higher. While global demand could be challenged going forward, I expect rising demand in China specifically to counter-balance that. Therefore, I see justification for a “buy” rating on UCO, and will explain why in detail below.

OPEC+ Showing It Will Support Market

As I stated above, I see multiple reasons why crude can push higher in the months to come. A primary reason for this is because OPEC+ has recently taken action to support prices in the short-term. This is significant in the fact that a production cut will help to limit supply (and therefore push up prices all things being equal). But it also shows their willingness to respond to market conditions and take action regardless of political consequences from their primary buyers (i.e. the U.S.). To me, that latter part is much more significant because it will limit drops in crude going forward. If the market believes that prices are getting too low and OPEC+ is going to cut production again, that threat acts as an inherent control preventing much lower prices.

Specifically, OPEC+ agreed on a production cut of 2 million/bpd in early October. This act of reducing production is a sharp reversal of policy for OPEC+. The last time the group slashed oil production was in May 2020, when demand plummeted in the early days of the Covid-pandemic. To see them take action now, when demand had been rising in 2022 generally, is a bold move.

Ultimately, my takeaway is investors can use this as justification to buy crude. OPEC+ controls a large percentage of global supply and their decision to cut production impacts current prices positively and acts as a buffer against lower prices longer term. Clearly, the world is not in alignment with crude demand and supply expectations, and I would use that uncertainty as a signal to buy.

Using SPRs To Lower Prices Is A Fool’s Game

My next topic concerns the current U.S. administration’s use of Strategic Petroleum Reserves (SPRs) as a tool to combat higher prices. Generally, I see this as very foolish and the net result has not been too effective. The idea is that the U.S. can lower prices by releasing SPRs and therefore putting my supply on the market. This is meant to ease the burden on consumers and has lately been seen as a political tool to boost President Biden’s popularity.

I see two problems with this. One, releasing SPRs does not alter the general demand-supply imbalance around the globe. SPRs consist of existing crude oil. They are already factored into global supply – even if they are not technically on the market “for sale” prior to “release”. But the market is aware of their presence and, therefore, they are already partially reflected in current prices. Therefore, the impact is minimal. Two, the U.S. doesn’t have enough in SPRs to truly alter the demand-supply balance on a global scale with modest releases on a scheduled basis. This announcement can be easily combated by others reducing production to keep the current demand-supply scale at its current balance – and that is precisely what is happening when we consider OPEC+’s latest decision.

Three, perhaps most importantly, these SPRs will need to be replaced if the U.S. wants to manage an effective supply of crude for emergency purposes (the original intent to having them in the first place!). Therefore, while the “supply” on the market is supposed to force prices lower, the reality is the market is going to now price-in the replenishment of that supply. So, again, the net impact is very minimal and is not a productive tool.

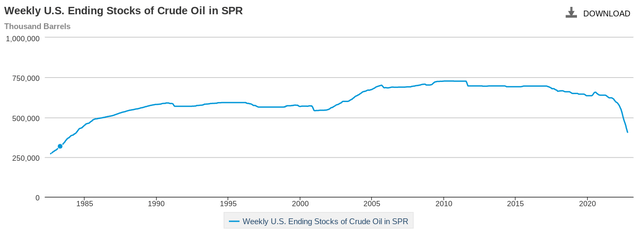

To consider the implication I am talking about let us look at the SPR balance. Upon the continuous release of SPRs by the Biden administration, reserve levels have now fallen to their lowest levels since 1984!

SPR Balance (U.S. Energy Information Administration)

My conclusion here is that any short-term benefit to crude will be mitigated by the long-term implication of having the U.S. become a net buyer again to replace these dwindling reserves. Therefore, I see the release of SPRs as an ineffective way to bring down crude prices, and I simply ignore this as a headwind when suggesting funds like UCO are going to move higher.

Strong Dollar Has Kept Prices In-Check. If Fed Eases, The Story Changes

I will now reflect on a key risk that I do see for my buy thesis going forward. As mentioned, I am an oil bull right and stand by my “buy” call on UCO. But that is not to suggest this play is not without risk. While I don’t see the release of SPRs as a risk, there are other real risks out there. One in particular is a strong U.S. dollar. The dollar’s rise is generally negatively correlated with commodities like oil and gold that are priced in dollars. Therefore, it is not overly surprisingly that oil’s recent weakness has come at a time when the USD has been rising consistently:

Dollar Index (Bloomberg)

So – why does this matter?

It matters because on a relative basis the USD is gaining in value against a basket of foreign currencies. Many of these are emerging market currencies, but also the Yen, British Pound, Euro, etc. The end result is that for oil consumer nations whose currencies are not linked to the greenback, oil prices have increased much more in local currency terms. This means it costs more of their local currency to buy the same amount of crude. Generally, this puts pressure on those local markets and demand suffers. If this continues, it will limit the upside to crude because global demand as a whole could suffer.

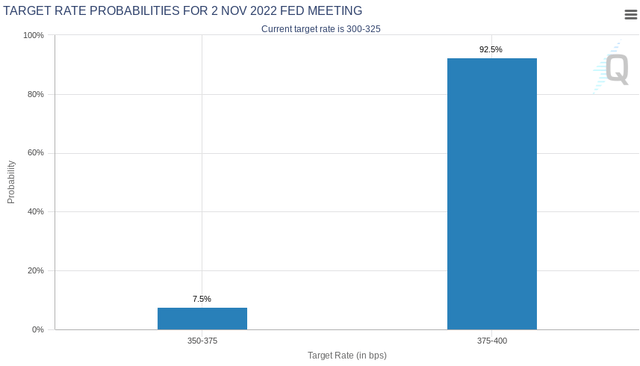

The makes me ponder how likely this is. Importantly, we have to recognize that the strength of the USD is being driven (in part) by the Federal Reserve’s aggressive interest rate increases. As rates go up, the currency often follows. As most central banks have not been quite as aggressive as our Fed has, the USD has been rising. The risk here is that the Fed continues on this path, and that is very likely. Futures markets are indeed predicting another Fed increase in November, and more could be on the way:

The general thought here is that more rate hikes will lead to continued strength in the USD. If so, we could see the price of oil come under pressure, despite some of the positive catalysts I already discussed. This is a real risk to contend with, so readers should monitor inflation reports and commentary from Fed officials very closely going forward.

The counter-argument here is that if inflation in the U.S. has already “peaked” (or is about to), then the Fed’s outlook could shift. With the market pricing in rate hikes through early 2023, a change in tone and action by the Fed will send yields lower along with the USD. This will likely push both equities and crude prices higher.

The fact is that nobody knows right now what inflation or the Fed are going to do 3-6 months from now. All we can do is come up with our best estimate and invest accordingly. But the mood of the market does seem to be shifting. As reported by Fortune, more fund managers are of the belief the worst of inflation is indeed behind us:

Survey Results (Bank of America)

Again, sentiment doesn’t always translate to reality. But it does show that the Fed hawkishness/USD rise that has been keeping a lid on oil prices could be nearing the end of its cycle. If so, UCO is set to rally.

China The Wild-Card

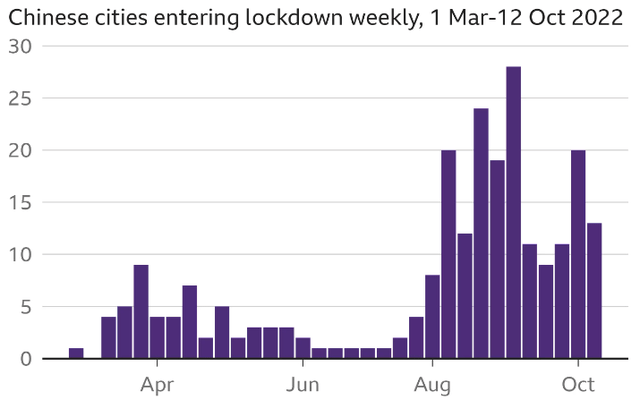

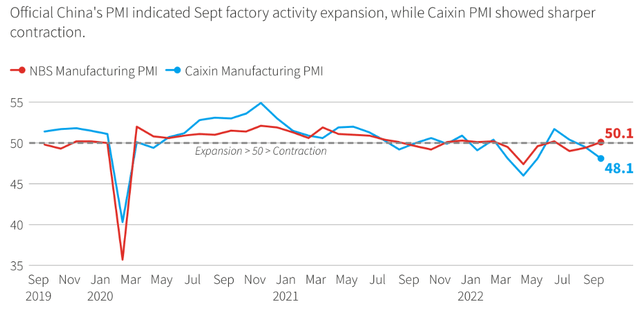

My last topic concerns the economic realities in China. As readers are likely aware, the Chinese government has taken a strict approach to Covid-19 this year. This is in sharp contrast to how most nations around the globe are coping with the continued pandemic. Other top oil consumers like the U.S., Euro-zone, India, and others have mostly opened their economies back up and seeing demand for energy increase.

China, on the other hand, has instituted travel lockdowns and quarantine rules that have stifled economic activity and lowered oil demand considerably:

Chinese Cities in Lockdown (BBC) China’s Economic Activity (Reuters)

The takeaway for me is that China is the wildcard on how the oil market is going to be shaped in early 2023. If the country hits lockdown fatigue and it joins the rest of the developed world is opening back up, then demand for crude is likely to see an immediate boon and that is going to drive up prices quite markedly until supply catches up. On the other hand, if China remains in relatively strict lockdown mode, all bets are off. We will have to focus more closely on what happens with production in the U.S. post the November election, as well as further moves by OPEC+. This speaks to the general uncertainty in the oil market right now, and why investors in UCO need to prepare for continued volatility ahead.

Bottom-line

UCO has had a great year, although in recent months it has struggled. I see the weakness since late June as a buying opportunity to profit off rising oil prices at the end of 2022 and early 2023. I see OPEC+ willingness to cut production, lack of coherent energy policy in the U.S., a potential rebound of demand in China, and a less aggressive Fed next year as all catalysts for higher prices going forward. If so, UCO is set to rally from these levels. I plan on building on my current stake in the fund, and suggest readers give this idea some consideration at this time.

Be the first to comment