Souda/iStock via Getty Images

Elevator Pitch

I assign a Hold investment rating to Pure Storage, Inc. (NYSE:PSTG).

By fiscal 2025 (YE January 31), PSTG’s topline growth could potentially moderate to the mid-teens percentage range. Also, Pure Storage was still loss-making on a GAAP basis for full-year fiscal 2022, and the company should still remain unprofitable in GAAP terms for FY 2023 and FY 2024. On the other hand, Pure Storage’s current EV/EBIT and EV/EBITDA valuations are reasonable in my opinion, and a significant de-rating of the stock’s valuation multiples appears to be less likely. As such, I have a Neutral view of PSTG which supports my Hold rating for the stock.

PSTG Stock Key Metrics

On its investor relations website, PSTG describes itself as a company which “uncomplicates data storage, empowering organizations to run their operations as a true, automated, storage-as-a-service model seamlessly across multiple clouds.” In the company’s FY 2022 10-K filing, Pure Storage highlighted that it “pioneered the use of solid-state, All-Flash technology in enterprise storage.”

Pure Storage reported the company’s earnings for the first quarter of fiscal 2023 on June 1, 2022 after the market closed. PSTG’s key financial metrics disclosed in its Q1 FY 2023 financial results press release suggest that the company is less impacted by supply chain issues as compared to its peers.

The company’s revenue grew by +50% YoY from $412.7 million in the first quarter of fiscal 2022 to $620.4 million in the most recent quarter. Pure Storage also turned from a non-GAAP adjusted net loss of -$0.4 million in Q1 FY 2022 to generate positive non-GAAP adjusted earnings of $79.2 million (or $0.25 in earnings per share) in Q1 FY 2023.

PSTG’s topline and non-GAAP EPS for Q1 FY 2023 turned out to be +19% and +525% better than the sell-side analysts’ consensus revenue and earnings forecasts, respectively. After delivering above-expectations results in the first quarter, the company also revised its full-year fiscal 2023 revenue guidance upwards from $2.60 billion to $2.66 billion. In addition, Pure Storage raised its non-GAAP operating profit margin guidance for FY 2023 from 11.5% to 12.0%.

PSTG stressed at its Q1 FY 2023 results briefing on June 1, 2022 that the company’s “focus on a simplified, consistent and efficient architecture across our product line” translates into “fewer components” which “means lower cost, lower waste and less supplier risk.” Pure Storage also added at the company’s recent quarterly earnings call that “we design our own hardware” in contrast with “most of our competitors (which) are using commodity parts.” As such, it is understandable why Pure Storage is able to beat market expectations with its Q1 FY 2023 financial performance and is confident in the company’s full-year outlook as seen with its updated FY 2023 management guidance.

In the subsequent sections of this article, I touch on Pure Storage’s long-term profitability and growth outlook.

Is Pure Storage Profitable?

Pure Storage is currently profitable on a non-GAAP basis, but it is still suffering from GAAP losses.

As mentioned in the preceding section, PSTG achieved a positive non-GAAP EPS of +$0.25 in Q1 FY 2023. But Pure Storage still delivered a GAAP net loss per share of -$0.04 for the recent quarter, even though this represented a significant improvement from the company’s GAAP net loss per share of -$0.30 for Q1 FY 2022.

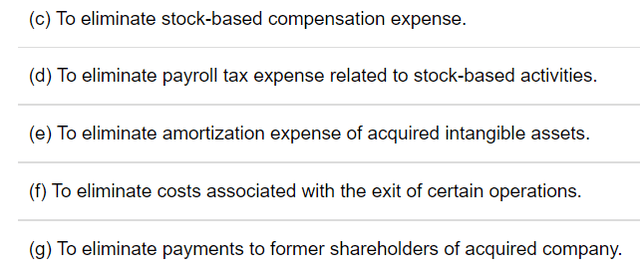

Key Adjustments To Arrive At Non-GAAP Earnings For PSTG

PSTG’s Q1 FY 2023 Results Press Release

According to the Wall Street analysts’ consensus financial projections obtained from S&P Capital IQ, Pure Storage’s non-GAAP EPS is expected to remain positive and increase from $0.67 in FY 2022 to $1.29 in FY 2025. However, sell-side analysts take the view that PSTG will stay loss-making on a GAAP basis in fiscal 2023 and 2024, and only deliver positive GAAP earnings ($0.30 GAAP EPS) in FY 2025.

In my view, expectations of PSTG turning profitable on a GAAP basis in fiscal 2025 are quite realistic.

At the company’s first-quarter earnings call, Pure Storage noted that it is maintaining a balance between “prioritizing innovation and growth” and “improving profitability.” PSTG also highlighted at its recent quarterly earnings briefing that it has relied on “continued investment in R&D (Research & Development) and, in particular, an investment in broadening out our sales focus and capabilities” to compete with its larger rivals.

In other words, Pure Storage should continue to invest significantly in R&D and marketing in the next couple of years, which means it is unlikely that PSTG can generate positive GAAP earnings prior to fiscal 2025.

Where Will Pure Storage’s Stock Be By 2025?

I continue to discuss Pure Storage’s 2025 financial outlook in this section of the article.

In the previous section, I noted that PSTG should only become profitable on a GAAP basis by fiscal 2025. In this section, I focus on PSTG’s revenue growth outlook in the next three years.

Pure Storage’s topline growth is forecasted to moderate from +29.5% in fiscal 2022 to +22.4% in FY 2023, before slowing further to +14.5% and +13.5% for FY 2024 and FY 2025, respectively as per S&P Capital IQ’s consensus data. This appears to be reasonable in my opinion.

PSTG’s implied revenue CAGR of +16.7% for the FY 2022-2025 period is already more than double the high single-digit (7.19%) CAGR for the flash market during the fiscal 2022-2026 time period as per forecasts by market research firm Technavio. Although Pure Storage is a beneficiary of the increased adoption of all-flash array or AFA, there is a limit to how much faster the company can grow as compared to the overall flash market. PSTG defines AFA as “a storage infrastructure that contains flash memory drives instead of spinning-disk drives” which provides “speed, performance, and agility for your business applications” on its corporate website.

In a nutshell, Pure Storage is expected to witness slower topline expansion by fiscal 2025, even though it should achieve profitability on a GAAP basis by then.

Is Pure Storage A Good Long-Term Stock?

I am of the view that Pure Storage isn’t a very good or particularly attractive long-term stock.

As touched on earlier in this article, PSTG is expected to see its revenue growth slow to the mid-teens percentage level in fiscal 2024 and 2025, while it will take another three years at the earliest to achieve positive GAAP net profit. In the current market environment, investors will place a greater emphasis on GAAP (as opposed to non-GAAP) profitability and be wary of companies with expectations of moderating topline expansion.

On the flip side, Pure Storage currently trades at consensus forward next twelve months’ EV/EBITDA and EV/EBIT multiples of 17.3 times and 22.6 times, respectively. For a company which is projected to grow its revenue by +13.5% and generate an EBITDA margin of +18.6%, PSTG’s current high-teens EV/EBITDA and low-twenties EV/EBIT valuation multiples seem fair.

In conclusion, PSTG is not a very appealing long-term investment candidate taking into account both its outlook and valuations.

Is PSTG Stock A Buy, Sell, Or Hold?

PSTG stock is a Hold. Its valuations aren’t expensive to the extent to warrant a substantial valuation derating. But the company’s outlook in terms of topline growth moderation and the timeline to achieve GAAP profitability isn’t great.

Be the first to comment