Justin Sullivan/Getty Images News

Since September 2021, Meta Platforms’ (NASDAQ:META) stock price has corrected more than ~50% from an all-time of ~$384. Meta Platforms has been facing a variety of headwinds like stiff competition from the new generation of social media companies especially short-form video services like TikTok, revenue losses resulting from iOS anti-tracking privacy changes, and the impact of the Russia-Ukraine conflict. Moreover, Snap Inc.’s (SNAP) recent warning regarding depressed online advertisement demand due to inflation and a shift in spending towards offline marketing as the economy reopens indicates a tough macro-economic environment in the coming quarters.

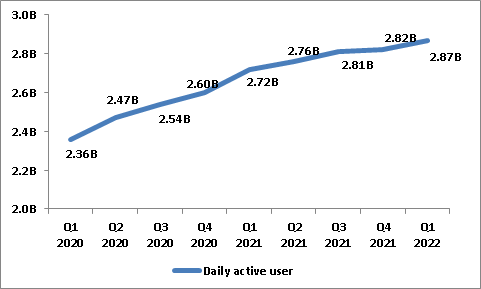

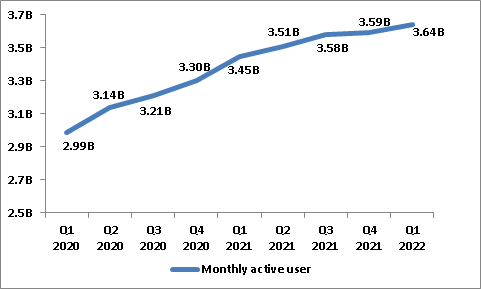

In Q1 2022, the average DAU (Daily Active User) and MAU (Monthly Active User) were 2.87 billion and 3.64 billion, respectively. As the Russian invasion of Ukraine began in late February, the consequences will likely linger into the second quarter. As a result, there is a high likelihood of declining numbers of active users in Q2 2022.

In addition to war-related headwinds, the company is also getting negatively impacted by iOS-related privacy changes. Although the losses incurred by the changes in iOS are difficult to quantify, the company anticipates a sales loss of ~$10 billion in FY22. However, the numbers may vary depending on how users respond to the new prompt and whether they are comfortable with data collection and tracking activities through a third-party app.

Short format video trends have picked up and are taking over from the Newsfeed and stories in terms of engagement. Reels already make up more than 20% of the time that people spend on Instagram. Video overall makes up 50% of the time that people spend on Facebook and Reels has grown quickly there as well. This has resulted in a shift in people’s preferences and engagement time toward Reels, which are not yet fully monetized. This means that the company will be losing revenues from this shift from highly monetized properties like newsfeeds to Reels.

Furthermore, the rising inflation may have an adverse impact on advertising dollars. Recently, Snap Inc. also warned investors regarding a depressed advertisement demand environment in the coming quarters. Also, with the resumption of economic activity, some of the advertiser allocations are shifting towards offline advertising. The company will have a tougher comparison throughout the FY2022 as it starts lapping the elevated online advertisement spending during the pandemic.

From a longer-term perspective, there are a few positive developments as well like the new Trans-Atlantic Data privacy framework which allows free flow of data across the Atlantic; and investments in machine learning and artificial intelligence to enhance efficiency and provide analytics with a fewer set of data points which should help to mitigate the effects of iOS changes to some degree. Additionally, the monetization of Reels is expected to improve in the long run which bodes well for the economy.

Although the company’s stock has corrected meaningfully and is trading at a P/E Non-GAAP (forward) of ~14.48x based on current consensus estimates, I believe the stock can see another leg down as the online advertising demand continues to be under pressure in the near term. Also, one of the company’s key management personnel Sheryl Sandberg stepped down during these challenging times. This further increases the company’s woes. I would prefer to wait and see how the company responds to the near-term challenges before becoming more positive on the stock.

Last Quarter Earnings

Meta Platforms Inc reported disappointing earnings of $27.91 billion, falling short of the consensus estimate of $28.2 billion. However, due to higher-than-expected margins, earnings per share of $2.74 exceeded analyst expectations ($2.56). Cost of revenue increased by 17%, primarily due to core infrastructure investments, payments to partners, and content-related costs. R&D increased by 48% due to hiring to support the Family of Apps (Instagram, Facebook, WhatsApp, etc.) and Reality Labs. Marketing and sales increased by 16%, owing primarily to increased hiring and marketing spending. Finally, G&A increased by 45% due to legal and employee-related costs. Operating income decreased ~25% to ~$8.52 billion compared to ~$11.3 billion in Q1 2021. Net income for the first quarter increased ~21% to ~$7.46 billion from ~$9.5 billion in the same quarter last year

Meta Stock Key Metrics

Daily Active Users

DAU (Daily Active Users) increased by 6% to 2.87 billion on average in March 2022, up from 2.72 billion in March 2021. It only increased by 1.77% sequentially. The conflict in Ukraine and the Russian government’s ban on Facebook are likely to cause a drop in DAUs. As a result, we should expect a slowdown in DAU growth in the next quarter.

Meta Daily Active Users (Company Data, GS Analytics Research)

Monthly Active Users

The MAU (Monthly Active Users) is another crucial metric for the company. The increasing monthly active users influence the advertisement-related spending decisions as advertisers like reaching out to more potential customers. As of March 31, 2022, there were 3.64 billion MAU, an increase of 6% from 3.45 billion as of March 31, 2021. From 3.59 billion MAU in Q4 2021, the sequential growth was 1.4% in Q1 2022. We expect MAU to follow a similar trend as DAU and see a slowdown in growth next quarter.

Meta Monthly active users (Company Data, GS Analytics Research)

Average Revenue Per User

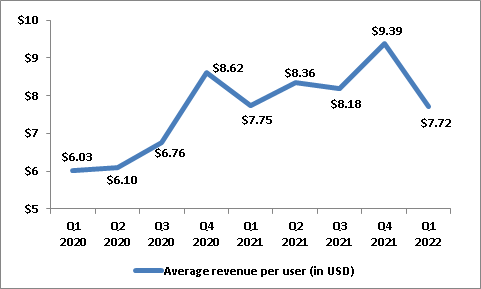

ARPU was $7.72 in the first quarter of 2022, a slight decrease from the first quarter of 2021. The fourth-quarter accounts for a large portion of advertising revenue as advertisers tend to spend more during this time to capitalize on the holiday shopping frenzy. Hence, it would not be meaningful to compare the figures sequentially. ARPU is getting negatively impacted by rising inflation and the shift towards offline marketing as the economy reopens. So, I expect ARPUs to be under pressure for some time.

Meta Average Revenue Per User (Company Data, GS Analytics Research)

Operating Margin

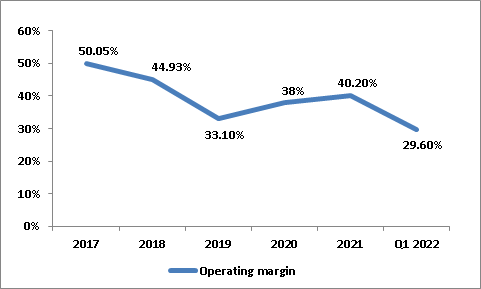

META’s operating margin declined from 2017 to 2019 and then increased from 2019 to 2021. The operating margin fell from 50.05% in 2017 to 44.93% in 2018 as a result of a $3.90 billion increase in the cost of revenue due to operation expenses related to data centres and technical infrastructure and higher costs associated with partnership agreements, including traffic acquisition and content acquisition cost. The decline in 2019 was primarily attributable to ~$5 billion in legal settlement costs with the Federal Trade Commission. The last two years have been good in terms of operating margin owing to strong demand. However, an increase in offline marketing advertising spending, the initial stage of Reels monetization program coupled with revenue losses from iOS-related changes should have a negative impact on revenue, resulting in the deleveraging of fixed costs. Hence, Operating margins are expected to be under pressure in the coming quarters.

Meta Operating margin (Company Data, GS Analytics Research)

Is Meta A Good Long-term Buy?

Meta Platforms has ambitious long-term growth plans, especially its “Metaverse” project. The company envisions the “Metaverse” as an innovative medium that will allow people to interact globally through a virtual reality ecosystem and it is investing heavily to bring this idea to life. The company aims to generate sufficient operating income growth from Family of Apps to fund the growth of investments in Reality labs. As of the last quarter, the Reality Lab incurred a total operating loss of $2.9 billion. While Metaverse can be a big long-term growth driver, I believe it will take some time for it to gain traction and a lot needs to be seen in terms of how Meta executes its plan. So, there is a good deal of uncertainty attached to it. Meanwhile, there are a lot of near-term headwinds for META.

As previously stated, the shift to short-form video will have a negative impact on revenue. The recent changes in iOS regarding app tracking transparency, which prevents apps from accessing identifiers for advertisers, are weighing on the company’s top line. While the company is working towards better monetization of Reels and using AI and machine learning to offset some of these headwinds, it will take some time to overcome these headwinds and things might trend downhill for a while.

While we can certainly envision a long-term scenario where Metaverse gains enough traction and becomes profitable and near-term headwinds dissipate, it is best to wait on the sidelines as we get some visibility on the company’s progress towards its long-term targets especially related to Metaverse.

Is Meta Platforms Stock Overvalued Now?

META is trading at a significant discount to its historical valuations. The company’s stock is trading at a P/E Non-GAAP (forward) of ~14.48x versus its 5-year average adjusted P/E (forward) of 25.09x. META is also one of the cheapest stocks among its peers. So clearly, it is not overvalued.

|

PE (forward) FY22 |

PE (forward) FY23 |

|

|

Meta Platforms, Inc |

14.48 |

12.15 |

|

Amazon (AMZN) |

126.67 |

40.33 |

|

Apple (AAPL) |

22.04 |

20.71 |

|

Snapchat |

53.84 |

20.83 |

|

Microsoft (MSFT) |

27.16 |

23.53 |

|

Twitter (TWTR) |

33.43 |

32.25 |

META Relative Valuation (Source: Seeking Alpha Consensus Estimates)

However, the worrying thing with Meta is not its valuation but business fundamentals. The company’s key metrics whether it is DAUs, MAUs, ARPU, and operating margins are all expected to remain under pressure thanks to the headwinds associated with the Russia-Ukraine war, iOS changes, stiff competition (especially short-form videos, from competitors like TikTok), lesser monetizing of Reels and depressed advertising demand. This justifies the cheaper valuation of the stock. Moving forward, these challenges are likely to persist and cause a drag on the company’s valuation. So, I don’t think the stock is undervalued given these headwinds which are likely to result in poor business performance.

Is META Stock A Buy, Sell, Or Hold?

The stock is currently trading at ~14 times FY2022 earnings per share. Because of the spate of challenges faced by the company the stock prices have come down from an all-time high of ~$380 to now trading at $169. In light of interest rate hikes, investors are being conservative and technology stocks have suffered the most. In addition to macro headwinds, META is also facing a lot of company-specific headwinds. Unless these headwinds subside and clarity on the company’s long-term trajectory elves, I believe the stock will trade sideways. Hence, I have a neutral or hold rating on the stock.

Be the first to comment