niphon

Investment Thesis

The Toro Company (NYSE:TTC) has strengthened its dealer network with the acquisition of the Intimidator Group in the first quarter of this year. This acquisition positions the company as the market leader in the large and growing zero-turn mowers space. The company is raising its prices to offset inflation and the good demand for its products is enabling it in doing so. This has helped the company generate higher revenue during the recent inflationary environment and, as these price increases take hold and higher priced backlog flows through the revenues, it should continue to aid the revenue growth in coming quarters. Additionally, with the inflation easing and the supply chain conditions improving, the margin can improve in the coming quarters. With the economy reopening the company should also benefit from its products’ relatively essential nature in doing necessary outdoor environment work.

TTC also launched the “Drive for Five” programme, a three-year employee initiative in the first quarter of this year with the aim of reaching $750 million in adjusted operating earnings and annual sales exceeding $5 billion by the end of the company’s fiscal 2024. This initiative should benefit the company’s medium-term growth.

TTC Q3 2022 Earnings

Last month, The Toro Company reported net sales of $1.16 billion for the quarter ended July 2022, which was slightly below the consensus estimate. Net sales for Q3 2022 increased by 18.8% year-over-year and declined by 7.66% sequentially from the second quarter, as sales for both the Professional and Residential segments declined on a sequential basis. EPS for the third quarter was $1.19, topping the consensus estimates by 6 cents. The adjusted operating margin for the third quarter was 14.1%, up from 13.1% in the prior year. Growth in margin for the third quarter was primarily driven by net price realization, productivity improvements and incremental revenue from the acquisition of the Intimidator Group. This was partly offset by higher material, freight and manufacturing costs and the addition of the Intimidator Group at a lower initial margin relative to the segment average.

Revenue Outlook

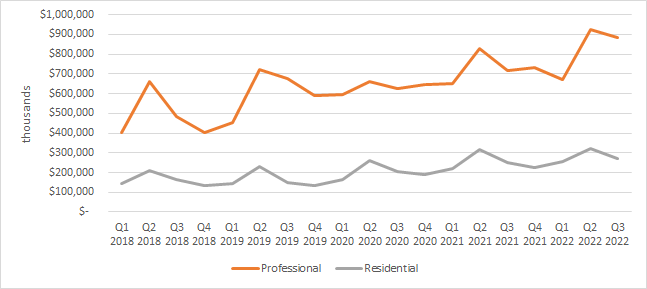

TTC Sales by segment (Company Data, GS Analytics Research)

Net sales for the professional segment in the third quarter were $886.2 million, up 23.3% year-over-year driven by net price realization, increased shipments of zero-turn mowers in both residential and professional segments, and incremental revenue from the acquisition of the Intimidator Group. Residential segment net sales for the third quarter were $270 million, up 7.1% from last year despite unfavourable hot and dry weather patterns in certain regions this year. Single-digit growth for the quarter shows demand moderating in line with more typical seasonal trends and the segment returning to normalized trends after two years of double-digit growth (this business grew by more than 50% from 2019 to 2021.)

TTC, although impacted by inflation and supply chain constraints, is working on its field inventory for the past few quarters to catch up with the demand. Inventory for the third quarter was $939 million, up 41% compared to last year. Higher finished goods, work-in-process, and incremental inventory from the acquisition of the Intimidator Group all contributed to this rise. This increase in inventory should help the company as the demand continues to be robust in the professional segment. The field inventory for the professional category is still lower than the normal level but the company is working on it and we expect further improvement looking forward.

With strong demand in golf, seasonal demand trends from retail landscape contractors and healthy pre-season bookings for snow and ice management, along with incremental improvements in the supply chain and manufacturing efficiency, we believe the company should continue to post good revenue growth in the coming quarters. Underground and specialty construction business is providing a multiyear tailwind as the company is seeing strong demand in both private and public infrastructure investments and, on its recent earnings call, management has talked about their preparedness to capitalize on this heightened demand. The 5G infrastructure build-out will provide opportunities in the underground business, and the $1.3 trillion infrastructure bill passed in November 2021 provides opportunities for the underground and irrigation business of the company. Allocations of $65 billion for broadband, $7.5 billion for charging stations, $65 billion for improving the power grid, and $55 billion for water and sewer infrastructure in the infrastructure bill are the markets where The Toro Company does business.

Looking forward, the company is entering the fourth quarter as well as 2023 with strong momentum along with improvements in the labor market, supply chain issues, and inflation. There are some expectations of normalization in the residential segment, but the professional segment appears strong and should offset any normalization in the residential section.

In addition to organic growth, the company will also benefit from the M&As. Earlier this year, the company also acquired VSI’s liquid de-icing assets to enter the liquid de-icing industry. This acquisition, along with the acquisition of the Intimidator Group, should provide help growth in the near to medium term.

The company’s medium-term growth should also benefit from a 3-year employee initiative “Drive for Five” which it launched earlier this year to align and engage its teams across the enterprise towards achieving collective goals like innovative business and product categories. The aim of this initiative is to exceed $5 billion in annual sales and $750 million in adjusted operating earnings by the end of fiscal 2024. While this is an employee initiative or set of internal goals and not the actual guidance, we are optimistic about it given the success of TTC’s previous initiative – Power Forward. Power Forward, a one-year employee initiative which the company completed last year, was successful in achieving goals of net sales of $3.7 billion and adjusted operating earnings of $485 million. These initiatives help the company come up with new and enhanced products which add meaningfully to its net sales growth.

TTC Margin Outlook

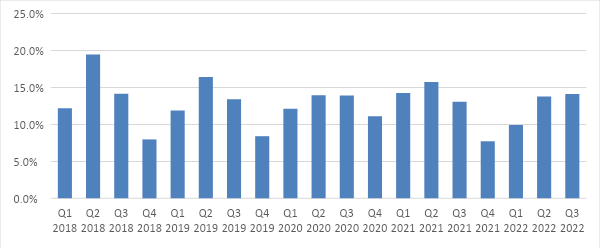

TTC Adjusted operating margin (Company data, GS Analytics Research)

For Q3 2022 the company reported an adjusted gross margin of 34.5%. This was a 60-basis point improvement compared to 33.9% year-over-year and 200 bps sequential improvement from the second quarter. S,G&A as per cent of net sales for the third quarter was 20.5% compared to 21.4% in Q3 2021 (when it was impacted by net legal settlement with Briggs & Stratton Corp.) The management is anticipating more normalized S,G&A spending in the fourth quarter. Adjusted operating margin increased 100 bps year-over-year to 14.1% and 30 basis points sequentially from Q2 2022.

We expect net price realization to drive improvement in gross margin in the coming quarters. The acquisition of the Intimidator Group has resulted in some margin headwind as it has a lower margin than the rest of TTC’s businesses, but the company is working on improving the margin within the Intimidator Group through leveraging TTC’s technology, operational efficiencies and net price realization.

As the overall end market demand remained solid, the company is confident in its ability to navigate through the headwinds like inflation and interest rate hike. The company has guided the adjusted operating margin for the full year 2022 to be similar to fiscal 2021 level i.e. 12.8%, considering continued supply chain, inflationary pressure as well as the acquisition of the intimidator group. The segment margin for the professional segment is expected to be slightly higher than the last year’s ~17.3% while the margin for the residential segment is expected to be lower than its prior year’s margin of ~12%. We believe the net price realization, normalized SG&A expenses and operational efficiencies have helped the company generate decent margins through the challenging supply chain and inflationary environment, and as the inflation and supply chain constraints ease, the company should be able to improve its margins over the medium to long term.

Valuation And Conclusion

TTC is currently trading at 21.3x FY22 (ending October 22) consensus EPS estimates of $4.15 and 18.28x FY23 consensus EPS estimates of $4.85. This is below its historical 5-year average P/E (forward) of 24.67x. Given the company’s attractive valuations compared to its historical average as well as good revenue and earnings growth prospects, I believe the company is a good buy at the current levels.

Be the first to comment