Chun han/iStock via Getty Images

The Chemours Company (NYSE:CC) was spun out of DuPont (DD) in 2015. Its four segments are titanium technologies, thermal and specialized solutions, advanced performance materials, and chemical solutions. They are the world’s largest supplier of TiO2, and overall have 29 production facilities in nine countries. They have vertical integration through owning and operating two titanium mines

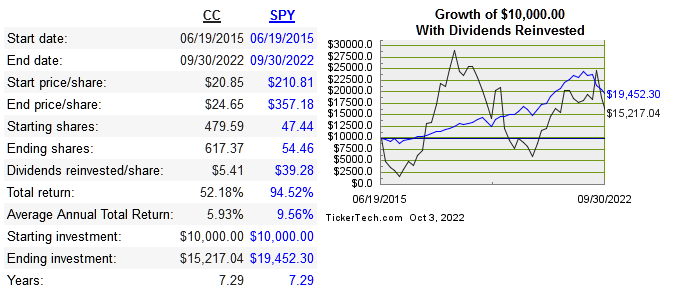

Below is the share price returns since IPO:

dividendchannel

The return on capital metrics are below:

|

Company |

10-Year Median ROE |

10-Year Median ROIC |

EPS 10-Year CAGR |

FCF 10-Year CAGR |

Revenue 10-Year CAGR |

|

21.1% |

11.9% |

-7.5% |

-7.2% |

-2.3% |

|

|

29% |

13.2% |

20.1% |

18.1% |

2.4% |

|

|

20% |

6% |

16.6% |

32.% |

-2.8% |

|

|

11% |

7.7% |

-9.9 |

-4.2 |

0% |

|

|

-5.1% |

-2 |

-10.2% |

n/a |

6.9% |

Source: quickfs.net

Capital Allocation

They’ve had positive free cash flow since 2016, but negative earnings only in 2019. Far more capital has been allocated to paying down debt than to shareholder yield. In this case I think it’s definitely appropriate to place higher priority on deleveraging. The dividends haven’t been very stable and this should be considered before jumping in based on yield alone.

I do like that they have been reducing share count since 2017, but the cyclicality mitigates some of the benefits when shares are repurchased at various prices due to volatility. The stock currently has a beta of 1.8 so consistently timing the repurchases will be very difficult. In spite of this, I would like to see if consistent buybacks can smooth out EPS over the longer term. If the company faces turmoil and raises money by diluting, it will negate the previous buyback efforts. I’m not convinced that this will never happen, so capital allocation decisions will need to be monitored further.

Risk

Being in a commodity business implies no fundamental barrier to entry, so the only ways to differentiate is by better capital allocation and not inflicting damage from too much leverage. The bull part of the cycle leads to many companies loading up on debt that can sink them later on during the contraction.

|

Company |

Debt/Equity |

Debt/Assets |

Assets/Equity |

Current Ratio |

|

CC |

4.3 |

0.6 |

7.8 |

1.9 |

|

CE |

1 |

0.4 |

2.9 |

1.7 |

|

HUN |

1.4 |

0.4 |

3.7 |

2.1 |

|

KRO |

0.6 |

0.2 |

2.4 |

4.4 |

|

TROX |

2.2 |

0.5 |

3.9 |

2.2 |

Cyclicality will show up in the volatility of gross and operating margins, but CC hasn’t been through a full cycle as an independent public company. The first risk is to think of this as a buy and hold stock. Just because they pay a dividend yielding 4% doesn’t mean it’s appropriate for long-term investors.

The biggest risk is simply entering at the wrong part of the cycle. The other related risk is getting in at the right time and either selling too soon or too late. This is just the nature of a cyclical business, so make sure you are willing to endure a lot of volatility for what I consider a fairly limited upside.

Valuation

Using a DCF model isn’t as helpful in a cyclical industry like this so let’s focus on the multiples.

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

CC |

0.9 |

4.8 |

12.5 |

3.1 |

4% |

|

CE |

1.3 |

4.9 |

8 |

1.9 |

3% |

|

HUN |

0.6 |

4.2 |

5.9 |

0.9 |

3.4% |

|

KRO |

0.5 |

3.7 |

10.2 |

1.2 |

8.1% |

|

TROX |

1.2 |

4.6 |

16.3 |

0.8 |

4% |

The pricing indicates no discount for CC as it trades in line with its peers for the most part. If we look at short term price fluctuations, CC could seem appealing due to share prices declining 40% since May. This has driven up the dividend yield to a level where some income seekers might show some interest. The dividend is not and should not be considered the plot of this story. At the end of the day, CC doesn’t have any differentiator that leads to a competitive advantage over its peers. The multiples are also very similar to competitors, so there is little reason to invest on a price or qualitative basis.

Conclusion

The stock of CC has a beta of 1.8 and thus far hasn’t beaten the S&P. The company sits in a good position globally, but ultimately there is no unique advantage over competitors, and so far capital allocation hasn’t provided any advantage. The company is appropriately deleveraging while also returning capital to shareholders in smaller amounts.

Even though shares are down 40% over the past four months, this doesn’t mean the next phase of the cycle is beginning soon. Growth investors and value investors both should ignore this stock. The multiples provide no discount, and future growth is mostly dependent on the industry just like its peers.

Be the first to comment