Elena Safonova/iStock via Getty Images

Although the packaging industry may not be viewed as particularly appealing or exciting to many investors, it does offer some intriguing prospects because of how cheap many of the companies that operate here are. One firm that has been especially interesting as of late is Sonoco Products Company (NYSE:SON). After acquiring another competitor earlier this year, the company has ballooned in size compared to what it was previously. Fundamental performance seems to be rather robust so far this year and shares are trading on the cheap both relative to similar firms and on an absolute basis. So despite shares of the company actually rising in recent months at a time when the market has fallen, I still see further upside existing for long-term, value-oriented investors. And because of that, I have decided to retain my ‘buy’ rating on the firm for now.

An attractive play in packaging

Back in March of this year, I wrote an article about Sonoco Products Company that showed the company in a bullish light. I acknowledged that the company’s performance up to that point had been rather attractive thanks to strong market conditions, and I concluded that it was an attractive prospect in the packaging space. Management’s forecast bolstered my opinion, with their own thoughts also influenced in a positive light by the company’s acquisition of Ball Metalpack Holding in a transaction valued at $1.35 billion in a deal that closed in January of this year. As a result of all of this, and my overall conclusion that shares of the company looked undervalued, I ultimately rated it a ‘buy’, reflecting my belief that it would generate returns that would outperform the broader market for the foreseeable future. Since then, the company has done just that. While the S&P 500 has dropped by 12.1%, shares of Sonoco Products Company have generated a profit for investors of 3.7%.

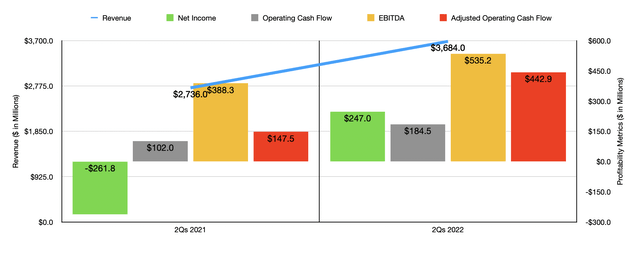

For those wondering if this return disparity has been justified, my answer to you is yes. To see why, we need to only look at recent financial performance covering the second quarter of the company’s 2022 fiscal year. This was the first full quarter during which its aforementioned acquisition was fully integrated into the enterprise. According to management, revenue for the quarter came in at $1.91 billion. That represents an increase of 38.3% over the $1.38 billion generated the same time one year earlier. It should come as no surprise that the lion’s share of this growth came from its acquisition of Ball Metalpack. Growth for the Consumer Packaging segment was an impressive 66%, largely thanks to the acquisition we already covered. However, the company also said that solid pricing performance and improved volume and product mix associated with global rigid paper containers and flexible packaging products also helped modestly. Sales growth under the Industrial Paper Packaging segment was a more modest but still impressive 19.5%, thanks to strong pricing performance. However, volume and product mix declined by approximately 2% during the quarter, reflecting either somewhat weaker demand in the face of rising prices or increased competition from other players. Without more data, we cannot know which one was the case. Regardless of this, overall revenue for the first half of the year came in strong, rising to $3.68 billion compared to the $2.74 billion generated the same time one year earlier. That translates to a year-over-year increase of 34.6%.

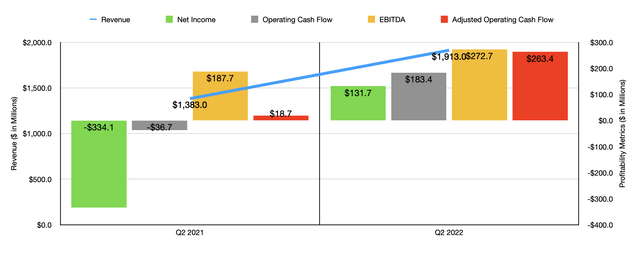

On the bottom line, the picture continued to improve as well. Net income of $131.7 million in the latest quarter dwarfed the $334.1 million loss generated one year earlier. Operating cash flow went from a negative $36.7 million in the second quarter of 2021 to a positive $183.4 million the same time this year. If we adjust for changes in working capital, the increase would have been from $18.7 million to $263.4 million. Meanwhile, EBITDA for the company also improved, rising from $187.7 million to $272.7 million. The strong performance in the second quarter of the year helped to push results for the full first half up as well, which can be seen in the chart below.

For the 2022 fiscal year as a whole, management has not provided any guidance from a revenue perspective. But they do see earnings per share coming in at between $6.20 and $6.30. At the midpoint, that would translate to net income of $616.8 million. Operating cash flow should be between $690 million and $740 million. No guidance was given when it came to EBITDA, but if we assume that it will increase at the same rate that operating cash flow should, then we should anticipate a reading of $1.16 billion.

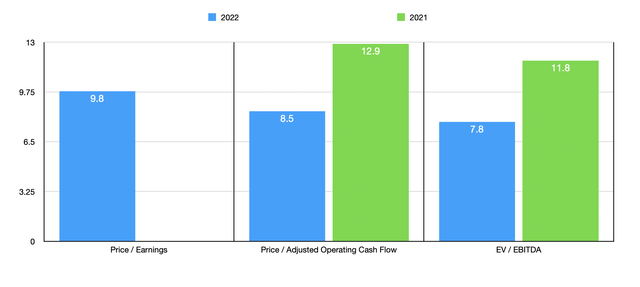

Taking this data, it’s easy to value the company on a forward basis. The firm is trading at a forward price-to-earnings multiple of 9.8. The price to adjusted operating cash flow multiple is even lower at 8.5 while the EV to EBITDA multiple should come in at 7.8. The company actually had a net loss in 2021, so there is no reasonable comparison there. But we do know that the price to adjusted operating cash flow multiple stacks up nicely against the 12.9 achieved in 2021 and the EV to EBITDA multiple compares favorably to the 11.8 we got for 2021 as well. But, of course, those were before the aforementioned acquisition. To put the pricing of the company into perspective, I also compared it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 13.8 to a high of 26.4. On a forward basis, Sonoco Products Company was the cheapest of the group. Using the price to operating cash flow approach, the range was from 5.3 to 13.7. And using the EV to EBITDA approach, the range was from 6.4 to 12.6. In both of these cases, only one of the companies was cheaper than our prospect.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Sonoco Products Company | 9.8 | 8.5 | 7.8 |

| Graphic Packaging Holding Co. (GPK) | 26.4 | 12.0 | 12.3 |

| Packaging Corporation of America (PKG) | 14.0 | 10.5 | 8.4 |

| WestRock Co. (WRK) | 13.8 | 5.3 | 6.4 |

| Sealed Air (SEE) | 16.3 | 13.1 | 10.8 |

| Amcor plc (AMCR) | 20.7 | 13.7 | 12.6 |

Takeaway

Based on the data provided, I must say that I continue to find myself impressed by the fundamental performance and low share price of Sonoco Products Company. It’s unclear if current market conditions will persist, but given how cheap shares are relative to similar firms and how cheap shares are on an absolute basis, I cannot help but to look upon the company in a favorable light. And because of that, I must keep my ‘buy’ rating on the firm for now.

Be the first to comment