Jarmo Piironen/iStock via Getty Images

Overview

I view government inefficiency as an indirect tax on constituents’ time and money as well as a drain on societal resources. Just think of all the hours we have waited in line at the local Department of Motor Vehicles to get our driver licenses renewed or at border controls to get our passports inspected–time that we could have enjoyed with family or on productive work.

Unfortunately, governments are monopolies that have little incentive to move aggressively to improve the quality or efficiency of their services, and few elected officials appear to have made it a priority to do so. Even though members of the public would like to receive improved service and better access to information on public entities, most of us have limited resources and energy to push for changes, and are resigned to putting up with the inefficiency (sadly, many of the situations portrayed in Parks and Recreation, the political satire/mockumentary sitcom, resonate for those of us who have felt helpless against the tyranny of government bureaucracy).

Tyler Technologies, Inc. (NYSE:TYL) is a leading integrated information management solutions and services software provider to local and state governments as well as for the federal government. The company offers a broad line of software application solutions and professional services to address the information technology (IT) “back office” functions of major areas of operations for cities, counties, schools, states, and other government entities. This helps them to operate and provide essential services, many of which are mission critical, to their constituents.

As the company wrote in its 2021 10-K filing:

We partner with clients to make government more accessible to the public, more responsive to the needs of citizens and more efficient in its operations.

Market overview

Large and growing “govtech” market

The state and local government technology (“govtech”) market is one of the largest and most decentralized IT markets in the U.S., comprising of all 50 states, approximately 3,000 counties, 36,000 cities and towns, and 12,900 school districts. This market is also comprised of approximately 38,000 special districts and other agencies, each with specialized delegated responsibilities and information technology requirements unique to government.

Collectively, the market is $167.1 billion in 2022 and growing at a compounded annual growth rate (CAGR) of 8.1% through 2025 (figure 1).

Figure 1: Size and growth rates of govtech markets

|

Segment |

Software spending ($’B) |

Service and support ($’B) |

Total ($’B) |

|

State and local government |

$23.6 (2022) to $32.3 (2025) CAGR: +11.3% |

$32.0 (2022) to $38.4 (2025) CAGR: +6.3% |

$55.6 (2022) to $70.7 (2025) CAGR: +8.3% |

|

Primary and secondary education |

$4.9 (2022) to $6.0 (2025) CAGR: +7.0% |

$5.1 (2022) to $6.3 (2025) CAGR: +7.3% |

$10.0 (2022) to $12.3 (2025) CAGR: +7.1% |

|

National and international government |

$38.5 (2022) to $53.8 (2025) CAGR: +11.8% |

$63.1 (2022) to $74.4 (2025) CAGR: +5.6% |

$101.6 (2022) to $128.2 (2025) CAGR: +8.1% |

|

Total |

$167.1 (2022) to $211.2 (2025) CAGR: 8.1% |

Source: Gartner, Inc., a leading information technology research and advisory company.

Tyler is a leader in govtech

Historically, Tyler has focused primarily on providing the information technology needs of local governments, which includes cities, counties, and schools. In addition, it is also the nation’s largest provider of outsourced property appraisal and billing services for taxing jurisdictions.

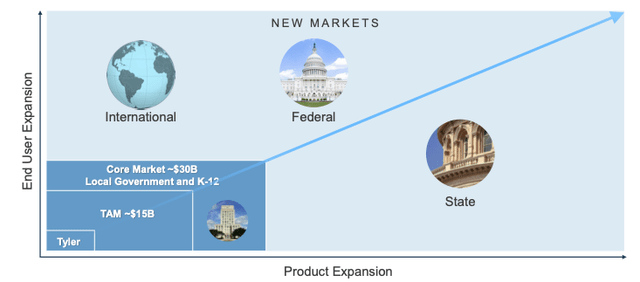

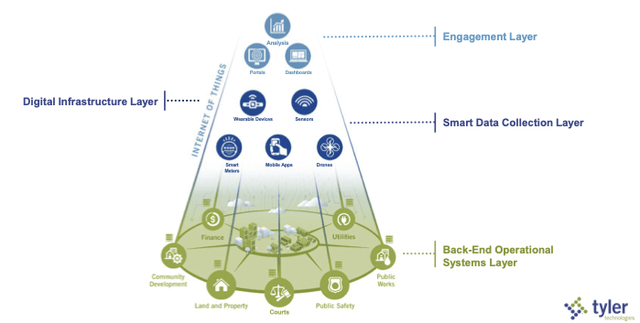

Tyler estimates its TAM (total addressable market) at $15 billion, for which its TTM (trailing twelve month) revenues of $1.8 billion represents a leading but still small ~15% share (figure 2). Furthermore, Tyler’s core market is relatively under-penetrated. According to Tyler, two-thirds of local governments continue to run antiquated systems–many of which are 20+ year old legacy systems or in-house custom solutions.

Furthermore, government offices continue to operate using Excel spreadsheets, and utilize pen and paper for their functions. As a result, valuable and actionable pieces of information that can contribute to the well-being of constituents are often trapped in unusable analog or unstructured digital formats, while structured data continued to be held in separate silos that are hard to access. This leaves large potential opportunities for Tyler and other govtech IT companies to serve and improve government efficiency.

Figure 2: Tyler’s addressable markets

The company’s software solutions are grouped around nine product areas (figure 3):

Figure 3: Tyler’s range of product offerings

|

Area |

Products/services |

Reporting Segment |

|

Financial Management and Education |

Enterprise resource planning (ERP) systems for the public sector and K-12 schools, including fund accounting, billing, and collection of metered and non-metered services, such as permits, inspections, licenses, citations, as well as school bus route optimization, fleet management. Facilitates online access where applicable. |

Enterprise software |

|

Courts and Justice |

Complete court case management system designed to automate the tracking and management of information involved in all case types; court management, public access, payment processing (including traffic and parking tickets) |

Enterprise software |

|

Public Safety |

A fully unified and comprehensive software solution for law enforcement, fire, and EMS, including 911 / computer aided dispatch, records management, mobile computing, jail/corrections management |

Enterprise software |

|

Planning, Regulatory, and Maintenance |

Help public sector agencies manage, streamline, and automate day-to-day business functions in community development, permitting, planning, building, code enforcement, tax and revenues, public works, transportation, land control, environmental, fire safety, storm water management, regulatory controls, and engineering |

Enterprise software |

|

Land and Vital Records Management |

Help local governments and school districts enhance and automate operations involving records and document such as deeds, mortgages, liens, UCC financing statements and vital records (birth, death, and marriage certificates). Fully integrates receipting and cashiering systems, and Web-enabled public access |

Enterprise software |

|

Data and Insights |

Analyze, visualize, and securely share data that across multiple departments and programs to derive insights that improve lives, positively impact local economies, and improve operations |

Enterprise software |

|

Platform Technologies |

Low-cost, low-code application development platform solution for case management and business process management |

Enterprise software |

|

Property Appraisal and Tax |

Automate the appraisal and assessment of real and personal property (including use of image and video) to enable record keeping, mass appraisal, inquiry and protest tracking, appraisal and tax roll generation, tax statement processing, and electronic state-level reporting. Systems support tax billing, collections, lock box operations, mortgage company electronic payments, and various reporting requirements |

Appraisal and tax |

|

NIC Digital Government Services, acquired in 2021 |

Digital services that ease ability for citizens and businesses to interact with government without visiting a government office in areas such as unemployment insurance, business filings, renewing licenses, accessing information, and making payments |

NIC |

Source: TYL 2021 10-K filing.

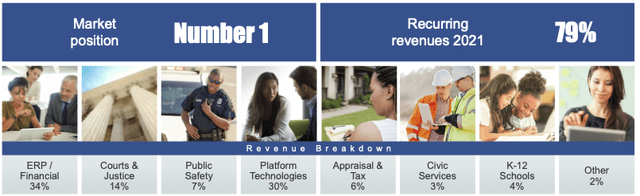

In a recent investor presentation, Tyler noted that it is the number one provider of public service software solutions, with a majority of revenues from ERP/financial systems, platform technologies, and courts & justice software (figure 4).

Figure 4: Revenue breakdown by product line

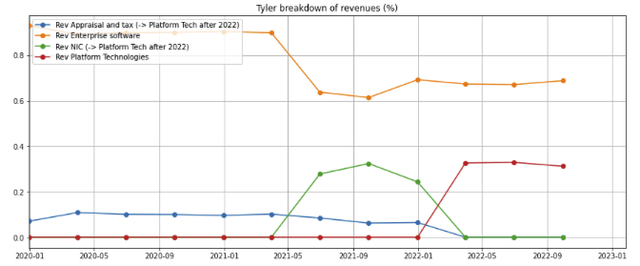

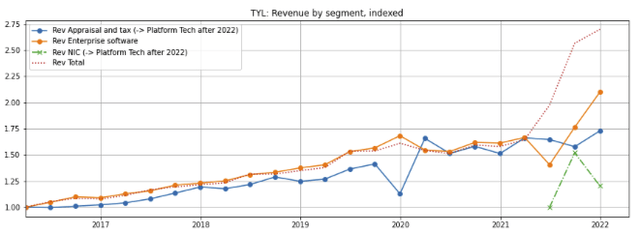

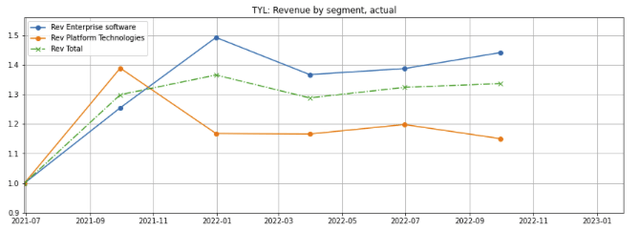

For reporting purposes, Tyler segments its revenues into enterprise software, appraisal & tax, and NIC (acquired in 2021), which are broken down in figure 5 (orange, blue and green lines). In 2022,

appraisal & tax and NIC (the blue and green lines) were merged into Platform Technologies (red line).

Figure 5: Revenue breakdown by reporting segment

Created by author using publicly available financial data

Competition

There is a wide universe of govtech companies ranging from enterprise resource planning to airspace, child welfare, election, law enforcement, pollution, prison, traffic, urban planning, and water management. However, many are private companies. Tyler competes with several very large software companies, including Oracle (ORCL), SAP (SAP), Constellation Software (OTCPK:CNSWF), Workday (WDAY), and Infor (privately held, owned by Koch Industries), all of which serve a broad range of client segments in addition to govtech. It also competes against ServiceNow (NOW) in the low code segment. None of these companies disclose the percentage or magnitude of their govtech revenues, indicating that it is not their predominant area of focus.

Figure 6: Tyler’s competitors

Tyler also competes against a number of middle-market govtech-focused companies, including Accela (private), Axon Enterprise (AXON), CentralSquare (private), Cognyte Software Ltd. (CGNT), Edmunds Govtech (private), Hexagon Safety (private), Mark43 (private), Motorola Solutions (MSI), and Palantir Technologies (PLTR), as well as a number of payment platforms. In addition, Tyler competes against leading software consulting firms such as Accenture (ACN) and Booz Allen Hamilton Holding Corporation (BAH) that create bespoke solutions for larger clients, particularly at the state and federal levels.

However, I believe its closest comparable and competitors are Accela and CentralSquare, which was formed by the 2018 merger of three smaller government tech companies and is now co-owned by two private equity firms (Bain Capital and Vista Equity).

Attractive SaaS economic model

Tyler shares many of the highly attractive characteristics of SaaS (software as a service) and payment platforms, and it is well-positioned to both add value to and benefit from mining its customers’ data for insights. However, it is also subject to the unique needs of its government clientele.

The attractive economic characteristics of SaaS and transaction processing companies

(1) Mission critical function, sticky revenue, and high retention rates

Tyler’s software provides the mission critical back-office functions of its government clients’ enterprises operations, planning, records, public safety, justice/court, payments, and school systems. In addition, its software also manages property appraisals, which drives tax revenues for most local governments.

The high setup cost to switch systems, perceived risks of switching due to Murphy’s Law, and the time incurred to train users in a new system is a deterrent to switching.

Even though government contracts typically require the purchasing offices solicit multiple RFPs (request for proposal) and compare proposals from each vendor, RFPs can be potentially written to favor the incumbent. Furthermore, non-incumbents are typically disadvantaged by initial set-up and training costs, often expected to match the features of the incumbent product, and may have to provide additional functionality to displace the incumbent provider. As a result, Tyler has a very high historical retention rate of 98%.

This can work in Tyler’s favor when it is the incumbent, but also creates a challenge in situations where it is endeavoring to displace an incumbent, legacy system, or in-house developed system.

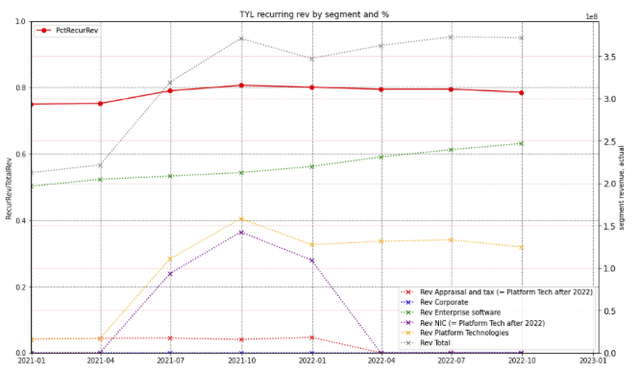

Tyler’s recurring revenues as a percentage of total revenues has hovered around 80% since 2021 (figure 7, solid red line, left axis), which is driven by recurring revenue growth in its enterprise software segment (dotted green line, right axis).

Figure 7: Percentage of recurring revenues (solid line, left axis) and recurring revenues by segment (right axis)

Created by author using publicly available financial data

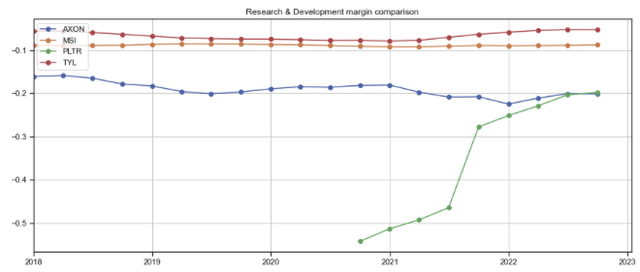

(2) Scale drives R&D and marketing spend

The large, best-in-class SaaS providers have substantial advantages over smaller competitors and in-house teams who do not have the large revenue base on which to spread out their R&D budgets, stock options, and perks for talent acquisition. This is particularly true for government in-house IT departments, where compensation and benefits are typically less generous and inflexible.

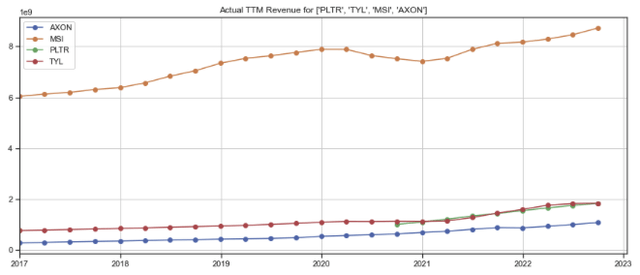

In contrast, leaders like Tyler have the advantage of being able to allocate bigger budgets to hire proven senior management, software developers, and sales & marketing teams over its smaller software competitors such as Axon (figure 8), many of whom have relatively limited access to expansion capital and are often limited to working within narrower market niches.

Figure 8: Revenues of Tyler vs. middle-market govtech comps

Created by author using publicly available financial data

Furthermore, the larger or higher-growth software firms can access public markets to facilitate partial liquidity for founder and employee equity through IPOs, stock sales, venture debt, or funding from venture or private equity firms. Smaller firms typically have fewer alternatives–consequently, some stay private for a long time while others sell out to larger strategic acquirers.

(3) Strong margins, cash flow generation, and returns on tangible capital

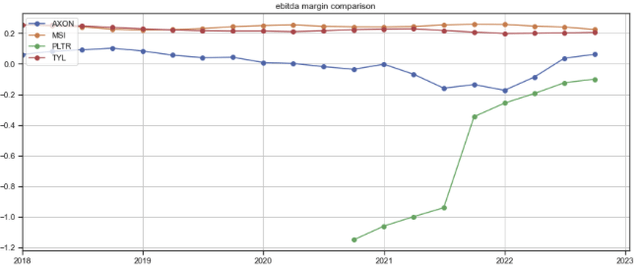

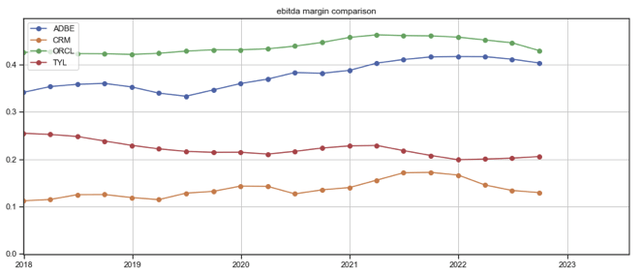

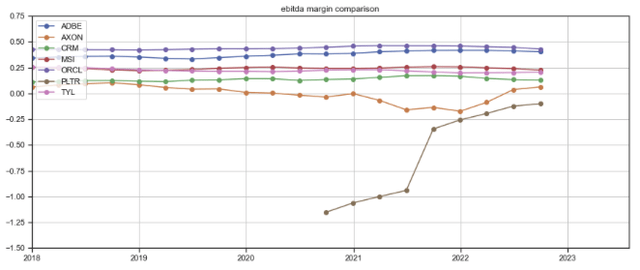

Tyler’s EBITDA margins are high (figure 9, red line) compared to its middle-market govtech competitors. However, Tyler’s EBITDA margin remains below that of mega-cap SaaS companies Adobe (ADBE) and Oracle (ORCL) (figure 10, red line), which suggest that there is potential room for Tyler’s EBITDA margin to expand as its revenue scales up.

Figure 9: EBITDA margins of Tyler vs middle-market govtech comps

Created by author using publicly available financial data

Figure 10: EBITDA margins of Tyler vs mega-cap SaaS firms

Created by author using publicly available financial data

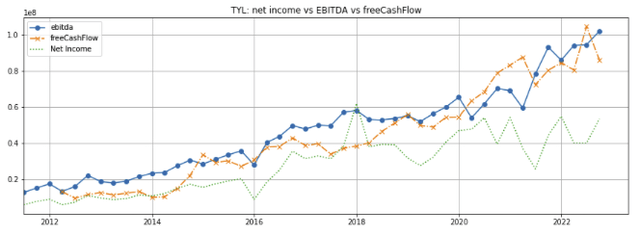

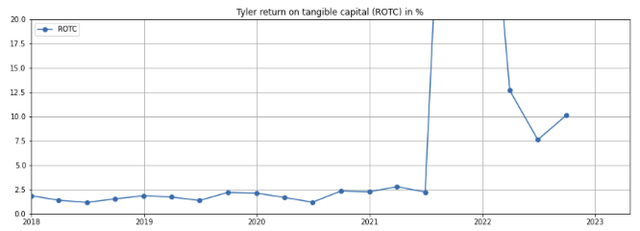

Furthermore, as software and SaaS companies typically require relatively little capital expenditures and the incremental cost of each additional unit of software sold is very low, they typically have a high cashflow conversions and very high returns on tangible capital (ROTC). Tyler’s free cash flow tracks EBITDA closely (figure 11, orange dashed line vs blue solid line), and its ROTC, which is greater than 100% for every quarter over the last five years, is very high (figure 12).

Figure 11: Tyler’s growth in free cash flow compared to EBITDA and net income

Created by author using publicly available financial data

(Free cash flow is presented on a four-quarter rolling average basis to smooth out seasonal fluctuations.)

Figure 12: Tyler’s return on tangible capital

Created by author using publicly available financial data

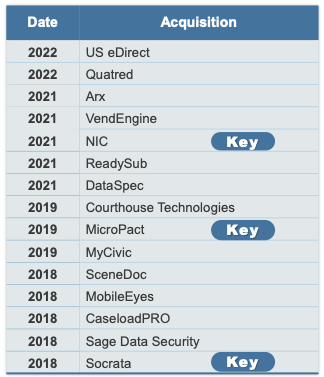

(4) Potentially synergistic and accretive acquisition strategies

Large, industry-leading firms like Tyler are able to employ acquisition strategies to expand their addressable market, fill holes in their product lines, purchase intellectual knowhow, or add customers–all of which serve to further widen its competitive moat.

Tyler’s fifteen acquisitions since 2018 (figure 13) certainly fit this mold. The acquisitions have enabled the company to both complement its product offerings, enter transaction the payment processing space, and expand its TAM to include states, federal agencies, and other government entities.

Figure 13: Tyler’s recent acquisitions

Company investor presentation

As examples:

-

Socrata (acquired in 2018): Socrata is the industry leader in open data and data-as-a-service solutions for government, capturing, organizing, and providing cloud-based data integration, visualization, analysis and reporting solutions for state, local and federal governments and agencies, as well as internationally. Socrata’s data is crucial for big data analytics and a differentiating factor that Tyler has successfully bundled into many of its new sales, which I will discuss in the next section below.

-

MicroPact (acquired in 2019): MicroPact provides business progress management applications for 350 large federal government entities, including the Department of Justice, Department of the Treasury, Social Security Administration, and the National Aeronautics and Space Administration. This acquisition gave Tyler an entry into the federal market, and has already helped the company capture several large contracts, including a $54 million deal with the U.S. State Department, and could potentially play a long-term role in its connected communities vision.

-

NIC Inc (acquired in 2021): NIC delivers digital services that make it easier and more efficient for citizens and businesses to interact with government. It also provides valuable conveniences such as online unemployment insurance applications, business filings submissions, license renewals, information access, and secure online payments. It is a leading player in the government payments arena, processing more than $24 billion in payments on behalf of citizens and governments in 2020, and it is expected to accelerate Tyler’s strategic payments initiatives. NIC bolsters Tyler’s strength and presence in state governments and is highly complementary to Tyler’s own strengths in the local government segment.

Acquisitions can be accretive to earnings when the acquirer is able to quickly trim costs by eliminating duplicative costs (e.g., back-office functions and some senior management positions) and raise revenues by cross-selling products to each other’s customers. However, due to competition amongst potential buyers in today’s environment, most high-quality companies are richly priced (for us accounting geeks, this means paying well above the value of tangible capital for the acquired company). The accounting goodwill paid lowers the return on the investment in the acquired company, which requires acquirers work hard to cut costs and grow revenues to create value for their shareholders.

(5) Network effect from serving more clients and owning more data

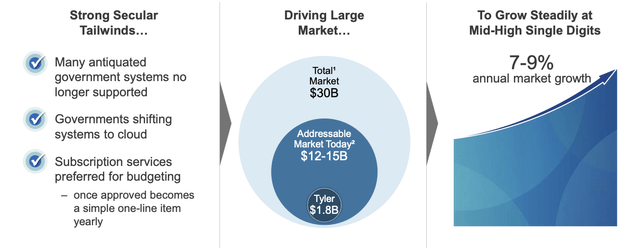

At present, most government IT systems are highly siloed (figure 14), making it notoriously difficult to exchange data even at the local government level, which impedes efficiency, limits the quality of services, and compromises public safety.

Figure 14: Currently siloed government back-office systems

In 2017, Tyler put articulated its vision of “connected communities” (figure 15), in which it sees a world where all city, county, and regional government services are connected within a healthy digital infrastructure that connects data, processes, and people (figure 14), making communities safer, smarter, and more responsive to the residents’ needs.

Figure 15: Tyler’s connected communities vision

Tyler’s wide range of software offerings (outlined in figure 3 above) makes it well-positioned to execute on this vision by creating software that facilitates interconnection across the multiple levels of government:

(1) Intra-city: Tyler software can facilitate the connection and exchange of data and information across different services within a city. Simple examples: police department data can be connected to court systems to improve the efficiency of the judicial system, and parks and recreation departments connected to homeowner demographic data to optimize park siting decisions.

(2) Inter-city: As a start, police department databases across adjacent cities can be inter-connected to deter crime and speed up crime investigation; and tax and appraisal systems can be inter-connected to ensure more equitable property taxes. This is just scratching the surface–the possibilities are endless and bring potentially big benefits to constituents.

(3) Data and insights product: Tyler’s Socrata cloud and low-code application development platform enables organizations to more easily combine data in Socrata’s databases with clients’ own data to extract and derive insights using big data and artificial intelligence algorithms. As an example, the Utah Department of Transportation uses Socrata data to answer questions such as “How many fatalities have we had over the last five years?” and “how many of those occurred on pavements in poor condition?” Similarly, law enforcement agencies can use Tyler Technologies’ Socrata-based cloud application, Law Enforcement Analytics, to quickly visualize their crime trends and define actionable tactics to help make their communities safer.

In addition, Socrata connected government cloud makes it possible for government departments to predict, detect, and rectify problems early (e.g., potential lead poisoning in municipal water systems), as well as prioritize issues according to severity (e.g., restaurants with poor health records) so the department can allocate its scarce resources accordingly.

Tyler’s CEO Lynn Moore noted in the Q1 2021 earning call that the company has focused on pushing Socrata into the market by adding it as a component to new software sales. Judging from the number of recent contracts that include Socrata, the company’s data and insights products have been a success.

(4) Well-positioned to become the de facto government data company: Tyler has received FedRAMP cybersecurity certification, which authorizes it to hold federal government data in cloud-based computing systems. Between its software applications, NIC payment platform, and Socrata, Tyler holds a massive amount of government data which can be, subject to the classification, made available to its clients and their contractors, other government agencies, or members of the public, who can utilize the data to generate valuable insights or create performance benchmarks. As the amount of data grows over time, Tyler’s data will become far more valuable, and its competitive moats inevitably widen.

Unique characteristics of Tyler and govtech:

(1) Under-penetration of best-in-class software in the industry

As governments are monopolies that face no competition, they are not ROI (return on investment) driven. While government officials say they would like to improve the quality and efficiency of services for their constituents, this is typically superseded by resource allocation decisions (i.e., IT is often considered lower priority), budgetary constraints, political agendas, and inertia. Older government records in some cities are still stored in paper files at the local city hall or courthouse, some functions done on Excel spreadsheets, and many government agencies continue to run on decades-old legacy software that are typically developed in-house by COBOL programmers. I have not been able to find empirical data on the penetration or use of up-to-date software, but anecdotal evidence suggests that it is low.

Tyler management points out that there is no urgency for city managers to install or update software, which is run for as long as possible (put another way, “if it ain’t broke, don’t fix it”). However, when the existing system breaks or is no longer supported, there is no choice and often little time to get the system replaced. It is not a matter of if, but when, the aging systems will be replaced.

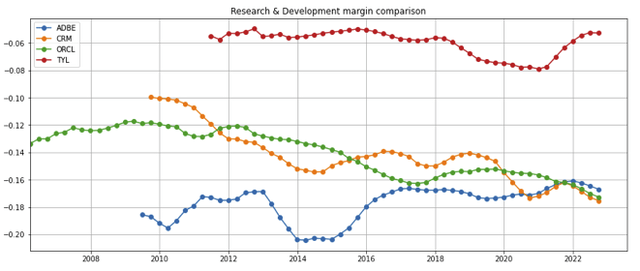

(2) Tyler has surprisingly low R&D as a percentage of its revenues

For a long and sustained period of time, Tyler’s R&D margin has been significantly lower than both large cap SaaS companies (figure 16, red line) as well as its middle-market govtech peers (figure 17, blue line) (Note that R&D is presented as negative numbers in both charts, so higher R&D margins are positioned lower on the chart). I posit that Tyler’s strong position in its wide range of specialized government SaaS software gives it some level of pricing power, but this is just a conjecture that I do not have empirical data to back up.

Figure 16: Tyler’s R&D as a percentage of revenues compared to large cap SaaS companies

Created by author using publicly available financial data

Figure 17: Tyler’s R&D as a percentage of revenues compared to middle-market govtech companies

Created by author using publicly available financial data

(3) Stable funding for installed government systems

According to the Urban-Brookings Tax Policy Center, almost half of local government funding comes from property taxes, which are typically very stable. The federal and state governments are more dependent on income, payroll, and sales taxes that fluctuate with the economic cycle, but they can raise money through bond issuances. As such, it is unlikely that government offices will allow invoiced bills on their IT systems, which are typically viewed as mission critical, to go delinquent.

(4) Approval of new installs need to go through a formal and fairly transparent procurement process

As an example, Dallas County of Texas issued RFP 2021-026-6893 in 2021 with detailed specifications for its jail management system. As the county had already implemented Tyler’s Odyssey Court System at a cost of $10 million in 2020, it specifically required (in section 7.9.1) that potential vendors’ software be able to integrate with Tyler’s Court system. Tyler subsequently won the contract at $6.7 million.

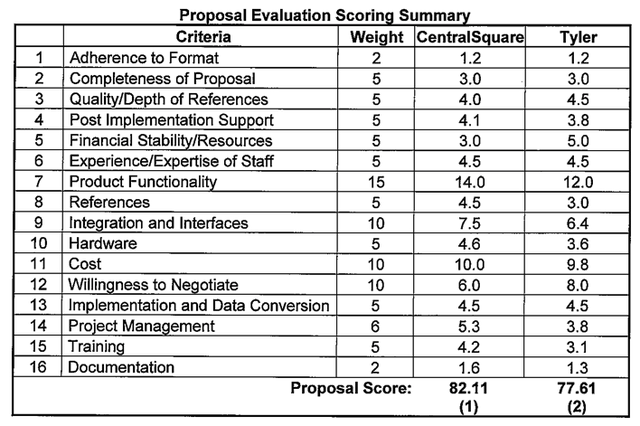

The decisions and votes of committee members are usually disclosed to the public, but details of the potential vendors’ proposals or staff deliberations are also occasionally published (e.g., the RFP for the Police computer-aided dispatch/records management system for the City of Glendale in California in 2019)

Growth and financial analysis

Market growth

With an under-penetrated large market and a fleet of antiquated government systems, the Gartner Group projects that the govtech software market will continue growing at a rate of 7-9% p.a. (figure 18).

Figure 18: Growth drivers of Tyler’s addressable markets

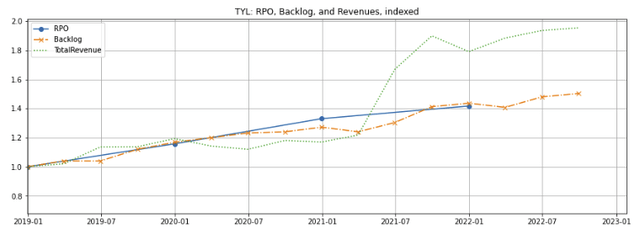

Backlog

Over the last three years, Tyler’s backlog and remaining performance obligations have grown at by 40%, or approximately 11.9% p.a. (figure 19, orange and blue lines). As a note, total revenues (green dotted line) jumped in 20221 due to the acquisition of NIC, as discussed above.

Figure 19: Tyler’s backlog and RPO

Created by author using publicly available financial data

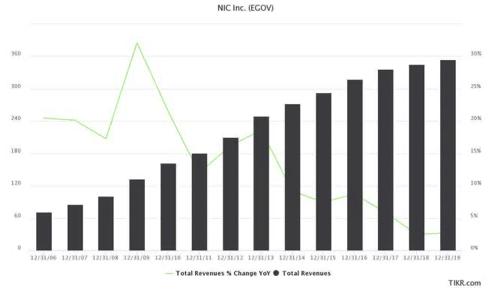

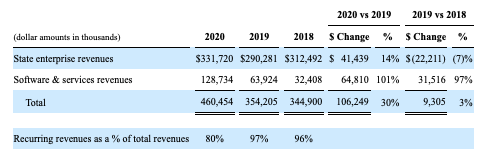

Revenue by segment prior to 2022

From the six-year period from 2016 through 2021, Tyler’s enterprise software and appraisal & tax segments grew by over 70% (figure 20, orange and blue lines), or over 10% per annum. While it appears that the growth has moderated since 2020, this slower growth is the result of the company’s transition of its revenue model to an annual subscription basis, which will be discussed below in my outlook.

The 2021 NIC acquisition (green dashed line) contributed to the overall revenue growth (red dotted line).

Figure 20: Tyler’s segment growth

Created by author using publicly available financial data

On a standalone basis, NIC’s growth tapered to below 5% in 2019 (figure 21), but its software and services segment doubled to $128 million in 2020 (figure 22, second row) primarily due to its sales to Virginia, New Jersey, and Wisconsin’s Department of Vehicles, an increase in online digital payments due to the COVID-19 outbreak, and the $32 million implementation of COVID-19 related revenues, including the TourHealth testing solution providing testing services to the states of Florida, South Carolina and Kansas as well as the Alabama Department of Corrections and the University of Mississippi. I expect COVID-related sales to go away as the COVID-19 pandemic finally tapers off.

Figure 21: NIC growth prior to 2019

ValueZen article on Seeking Alpha

Source: NIC (NIC is a stock to keep on your watch list by ValueZen).

Figure 22: NIC growth from 2018-2020

NIC Inc 2020 SEC 10-K filing

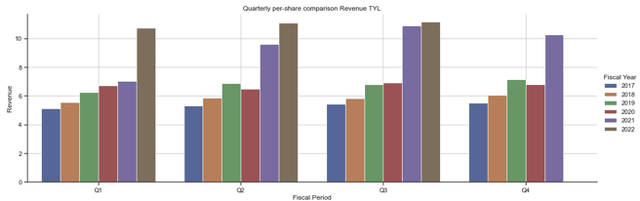

Outlook

Tyler’s revenue grew strongly in 2021 due to the acquisition of NIC (figure 23, purple bars) as discussed above. However, the growth has slowed in Q3 2022 to about 2.7% (Q3, brown vs purple bar).

Figure 23: Tyler quarterly revenues

Created by author using publicly available financial data

The slowdown is a result of two effects:

(1) the tapering of COVID-19 revenues from the NIC acquisition discussed above (which are reported under Platform Technologies) (figure 24, orange line). Tyler management did not disclose the exactly amount of COVID-19 related revenues but based on the 101% growth in software and service revenues in 2020 after the pandemic outbreak (see figure 22 above), COVID-19 revenues are not insignificant.

Figure 24: Tyler revenues since June 2021

Created by author using publicly available financial data

In the Q3 2022 earnings call, management noted that if COVID-19 related revenues were excluded, the company’s Q3 2022 year-over-growth would be about 9%.

(2) Shift to cloud-based subscription revenue model: Tyler is in the process of transitioning customers from its historical licensing model, in which customers pay a one-time upfront fee for the right to use the software plus smaller annual maintenance fees, to a subscription-based cloud revenue model in which customers enter into a contract for the right to use the software on an ongoing basis for a specified price each year. As a customer’s annual subscription fee is lower and has smaller margins compared to the one-time upfront licensing fee, this has caused revenue growth to slow down temporarily and margins to compress. However, as subscription revenues recur annually and appear a line item in the customer’s budget, they are stickier and of higher quality than historical revenue model, in which each new sale has to be vetted and approved by the city council.

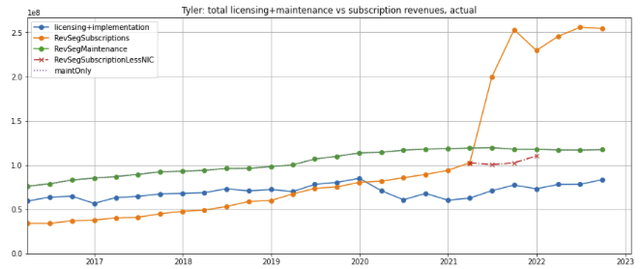

Tyler’s overall licensing and implementation/training (categorized as software services) revenues have flattened since the transition began about three years ago (figure 25, blue line), as have the associated maintenance revenues (green line). Meanwhile, subscription revenue has climbed steadily (orange line; red dashed extension excludes revenues from the NIC acquisition) and has exceeded licensing & implementation revenue and catching up with maintenance revenue.

Figure 25: Tyler’s split of overall revenues from licensing & implementation, maintenance, and subscriptions

Created by author using publicly available financial data

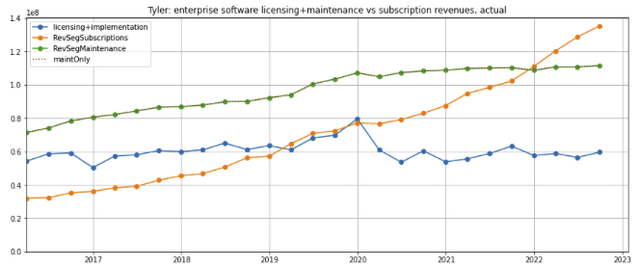

In the enterprise software segment, subscriptions have grown rapidly and now constitutes the largest portion of revenues (figure 26, orange line). Over the last several quarters, revenue from licensing & implementation has dropped (blue line), and maintenance revenue to has steadily grown to twice the licensing & implementation revenue. I expect the stream of maintenance revenue from legacy contracts to continue for a period of time until substantially all customers are converted to subscription contracts (green line). The company notes that 80% of new contracts are now sold under the subscription model and expects the transition of new sales to subscription to be completed by the end of 2024. However, it will take more time before all existing legacy contracts are converted to subscription contracts.

Figure 26: Tyler’s split of enterprise software revenues from licensing & implementation, maintenance, and subscriptions

Created by author using publicly available financial data

Comparison of per-share revenue and earnings growth to govtech and mega-SaaS firms

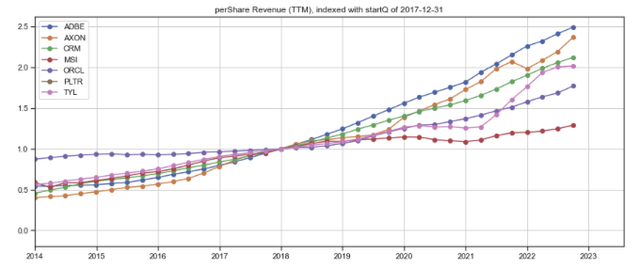

Tyler’s per-share revenue growth doubled over the last five years (figure 27, pink line), behind Axon, Adobe (ADBE), and Salesforce (CRM).

Figure 27: Tyler’s per-share revenue growth compared to its mega-cap SaaS and middle market govtech firms

Created by author using publicly available financial data

Subscription-based revenues are stickier and recurring but have lower margins than revenues from the sale of upfront licenses. Tyler’s EBITDA margins began dipping in 2019 as the company began the transition (see figure 9 above, reproduced in figure 28 for convenience). However, I expect Tyler’s EBITDA and free cash flow margins to expand from operating leverage as its revenues scale up as discussed in figures 10 and 11 above.

Figure 28: Comparison of EBITDA margins

Created by author using publicly available financial data

Summary of prospects

The government IT software market is expected to grow 7-9% over the next several years, but based on Tyler’s historical performance, I expect it to outgrow the market through a combination of market share gains, organic growth, and acquisitions. I also expect margins to grow due to the strong operating leverage inherent in Tyler’s software model. Furthermore, the company’s value and competitive moats will expand as it continues to build up its government public and private datasets.

Valuation

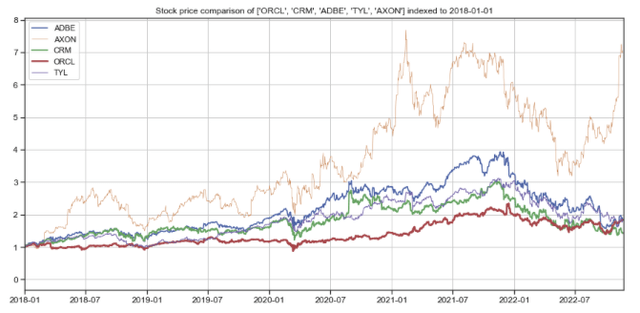

Tyler’s stock price has performed in line with its software competitors over the last five years (figure 29, purple line) but underperformed AXON (brown line), which successfully expanded beyond its early TASER product into body cameras and cloud software, transitioning from a hardware company into a hybrid SaaS business.

Figure 29: Stock price comparison vs software/govtech

Created by author using publicly available stock price data

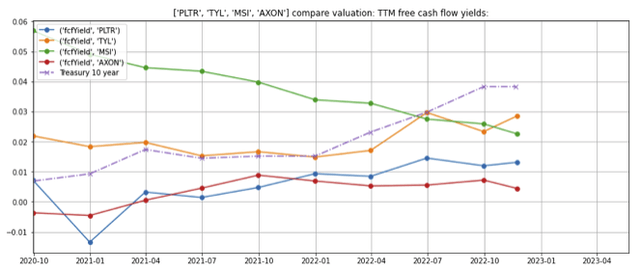

Tyler’s valuation, as measured by free cash flow yield (figure 30, orange line), has corrected and moved up along with 10-year treasury yields (dashed purple line) to around 3%, and is now higher than its govtech peers. While the company’s revenue and cash flow growth are temporarily understated as COVID-19 related revenues are tailing off and because of the margin compression incurred from its transition to subscription-based SaaS company, it is difficult to ascertain whether these factors have been priced into the valuation, but I believe the stock is fairly valued and not a steal.

Figure 30: Tyler’s free cash flow yield valuation vs govtech peers

Created by author using publicly available financial and stock price data

Concerns

(1) My primary concern is valuation:

Tyler possesses the attractive characteristics of SaaS companies and the stability of government funding, for which the market has awarded a premium valuation. However, this valuation is vulnerable to short-term market pullbacks, particularly if the Federal Reserve continues to raise interest rates. I believe a dollar cost average strategy will mitigate valuation risks for long-term investors.

(2) End of COVID-19 related revenues:

Will the decline in COVID-19 pandemic-related revenues cause Tyler’s overall revenues to fall short of expectations, triggering a sharp pullback in stock price?

(3) Price competition among government software providers:

As an example, Tyler competed against Central Square and Mark 43 in the City of Glendale’s 2020 RFP to replace its existing Police CAD/RMS (computer-aided dispatch and records management system). The city ruled that Mark 43’s product didn’t meet the necessary criteria. However, Central Square won the contract with a price of $2.8 million, compared to Tyler’s proposed $3.5 million (figure 31).

Even though the industry appears to have an oligopolistic structure and the potential client evaluates each provider’s software according to their unique strengths, I believe price is an important consideration.

Figure 31: Evaluation criteria scoring in City of Glendale’s proposals

In summary

-

The government technology IT space is large, growing, but under-penetrated, and there are many opportunities to drive efficiencies by improving and interconnecting government systems

-

Tyler Technologies has the attractive economic characteristics of typical of software as a services companies, including sticky revenues, advantages of scale, as well as high retention rates, margins, and returns on tangible capital.

-

The company continues to grow through market share gains, organic growth, and acquisitions, but its revenue and earnings growth are temporarily depressed due to the tapering of COVID-related revenues and as it transitions to a subscription revenue model.

-

Over time, Tyler’s connected communities strategy and the dataset it builds will inevitably widen its competitive moat and should create significant value for shareholders.

-

Valuations have come down with the Federal Reserve’s interest rate hikes, but I believe the stock is still fully valued. New investors could do well accumulating Tyler Technologies, Inc. shares with a dollar cost averaging strategy.

Be the first to comment