peepo/E+ via Getty Images

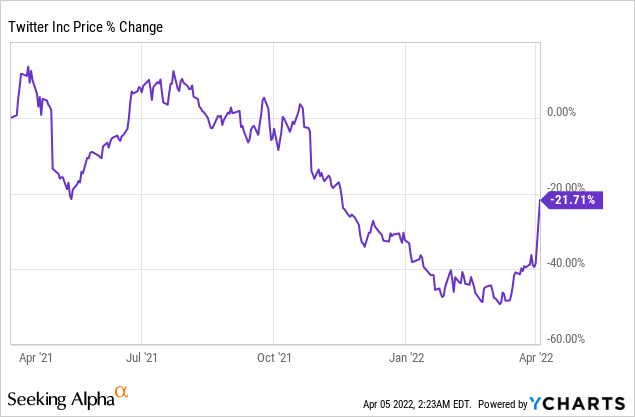

Shares of Twitter (NYSE:TWTR) are back in play after billionaire and Tesla founder Elon Musk disclosed a massive 9.2% stake in the micro-blogging platform yesterday. Despite a large increase in the valuation of Twitter, I believe the firm’s commercial growth is still cheap and the risk profile remains heavily skewed to the upside.

Previous position on Twitter

Months ago, I presented Twitter as a potential investment due to the firm’s undervalued ad business, strong user growth and significant free cash flow generation of the platform. While Twitter may be a controversial investment for some, I do not take political sides and have been focused solely on the firm’s strong platform metrics, especially with respect to average monetizable daily active usage.

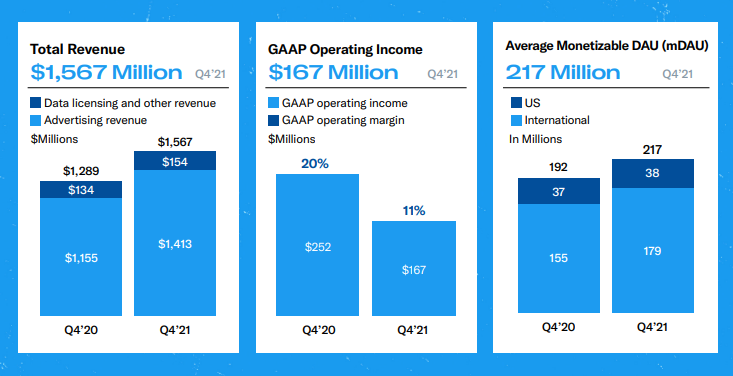

Twitter’s mDAUs soared to 217M in Q4’21 with growth especially pronounced in the platform’s international business. International mDAUs surged 24M in Q4’21, year over year, to a record of 179M. In percentage terms, the international business grew at a 15% year over year rate. While growth is much more modest in the U.S., Twitter is still growing in its domestic market: the micro-blogging platform added 1M new mDAUs to its business in the last quarter, which calculates to a 2% year over year growth rate.

Twitter

Elon Musk’s investment in Twitter is a potential game-changer for the micro-blogging platform

It was revealed yesterday that Elon Musk acquired a 9.2% stake in Twitter, sending shares of the platform soaring more than 27%. The Tesla chief acquired 73,486,938 shares in the social media company on March 14. The purchase immediately made Elon Musk the single largest shareholder of Twitter and raised speculation as to how “passive” the out-spoken billionaire is going to be. While Elon Musk’s ultimate ambition regarding Twitter is not known, the market has been electrified by the acquisition, which could translate to additional valuation gains. Twitter has often been criticized for violating principles of free speech and a more activist role of Elon Musk could result in some positive change on Twitter’s platform.

Significant free cash flow value

The acquisition of a 9.2% stake in Twitter has been a strong catalyst for shares of Twitter so far, but the real value of the social media company is its large user base and potential for material advertising revenue and free cash flow growth in the coming years. Twitter’s free cash flow margins decreased in FY 2021, but this is chiefly due to higher capital expenditures and a one-time litigation-related net charge of $766M in the third-quarter. If it wasn’t for the settlement of a shareholder class action lawsuit, Twitter’s free cash flow would have been positive in FY 2021.

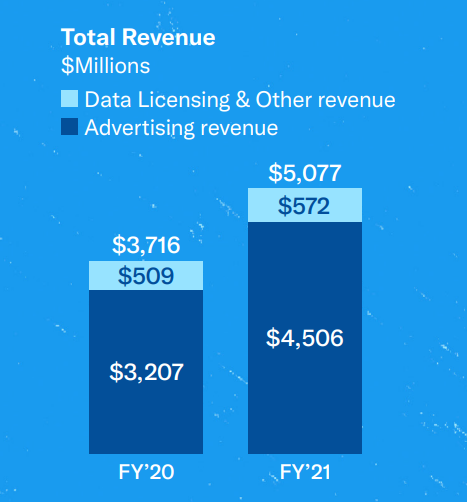

Twitter’s ad business shows a lot of promise as well. The ad business recovered strongly in FY 2021 and total advertising revenues surged 40% year over year to $4.5B. Twitter’s ad revenues in the fourth-quarter soared 22% year over year to $1.41B.

Twitter

I believe Twitter could generate up to $600M in free cash flow in FY 2022 which would calculate to a free cash flow margin of around 10%. Because Twitter already settled its shareholder class action lawsuit in FY 2021, the firm’s free cash flow margins are set to turn positive again in FY 2022.

|

$ in 000’s |

FY 2018 |

FY 2019 |

FY 2020 |

FY 2021 |

|

Revenues |

$3,042,359 |

$3,459,329 |

$3,716,349 |

$5,077,482 |

|

Cash Flow From Operating Activities |

$1,339,711 |

$1,303,364 |

$992,870 |

$632,689 |

|

Purchases of PPE |

-$486,950 |

-$534,530 |

-$864,184 |

-$1,003,084 |

|

Free Cash Flow |

$852,761 |

$768,834 |

$128,686 |

-$370,395 |

|

Free Cash Flow Margin |

28.0% |

22.2% |

3.5% |

-7.3% |

(Source: Author)

Risks with Twitter

There are a couple of risks that affect an investment in Twitter. The social media company is growing its user and revenue bases, but there is a risk of new messaging platforms popping up and stealing away users. Meta Platforms (FB) reported its first-ever DAU decline last quarter and the stock reacted sensitively to this announcement. Should Twitter also start to lose users to other platforms, shares of Twitter may be up for a major revaluation.

Another risk I see is slowing platform revenue and free cash flow growth. Twitter’s revenues soared 22% in the last quarter to $1.57B, but if revenue growth slowed, Twitter’s valuation could come under increasing pressure.

Final thoughts

Elon Musk’s engagement with Twitter is a potentially big deal for investors if he turned activist or increased his investment in the social media company.. which I believe is not out of the question. While Tesla’s founder has said that he sees his stake in the micro-blogging platform as a passive investment, it won’t take much for him to get more actively involved in Twitter’s business. Besides Elon Musk’s investment, the best reasons to buy Twitter are possibly the firm’s strongly growing ad business as well as the firm’s material free cash flow ramp that I expect for FY 2022!

Be the first to comment