simpson33/iStock via Getty Images

(Most of this article was originally written on the morning of April 1, 2022, before the opening bell. I updated a few sections to reflect the trading action, over the past two trading days)

Last Thursday night, after the bell, Chicken Soup For the Soul Entertainment (NASDAQ:CSSE) reported very good Q4 FY 2021 earnings and offered really strong FY 2022 guidance. CSSE is a leading ad-supported VOD streaming company (AVOD). The company owns and operates a number of stream apps including Crackle Plus, Chicken Soup for the Soul, Popcornflix, and a few others. The company has its own original content as well as streams third party content, including exclusive third party content. Recently, the company has acquired additional IP at attract valuations to build its media library and increase its Adj. EBITDA margin profile.

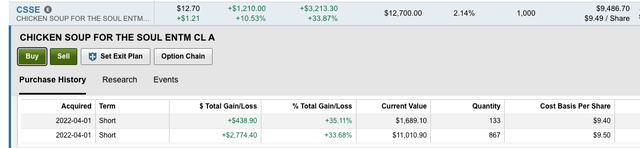

Since the March 31, 2022 close, or over the past two trading days, CSSE shares have leapt 59%, cumulative, closing at $12.70 per share on April 4, 2022. Ahead of its Q4 FY 2021 print, the market expressed a very pessimistic view towards CSSE, at least if you are using its stock price as your barometer. For example, from its June 29, 2021 52 week high through March 31, 2022, CSSE shares were down 83%. Secondly, as of March 15, 2021, 14.4% of its Series A shares were sold short.

Fidelity

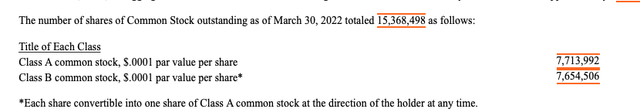

Given the big leg up, and on monster volume (3.4 million shares changed hands over the past two days, representing 44% of all Series A shares outstanding), investors and speculators alike might be wondering if this is just a sweet short squeeze or perhaps an inflection point. If it is the latter then that would mean real buy side money has entered the stock. For perspective, as March 30, 2022, CSSE had 7.714 million Series A shares and 7.66 million Series B shares outstanding. The Series B shares have enhanced voting rights (10 to 1 or super voting rights) and these shares are held and controlled by CSSE’s CEO and Chairman, William Rouhana Jr.

Although it would be fun to find a few compelling data points and then ipso facto I could simply declare that this 59% move is definitely just the buy side moving in, unfortunately, I’m just not smart enough to leap to that conclusion. There just isn’t enough definitive evidence, at least not yet.

That said, as a consolation prize, as readers have read this far, I will share why I loved CSSE’s Q4 FY 2021 results, its conference call as well as its FY 2022 guidance.

The Inflection Point?

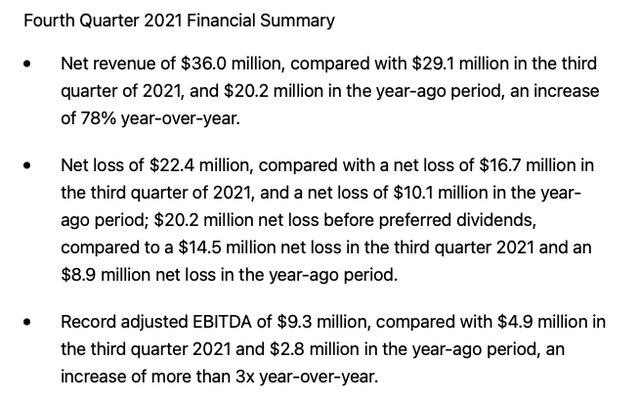

1) CSSE reported record Q4 FY 2021 revenue, with growth 78% compared to Q4 FY 2020. Q4 FY 2021 Adj. EBITDA of $9.3 million was more than three times higher than the $2.8 million in Q4 FY 2020.

(Enclosed below is a snapshot of the Q4 FY 2021 earnings report highlights.)

CSSE Q4 FY 2021 Earnings (Seeking Alpha)

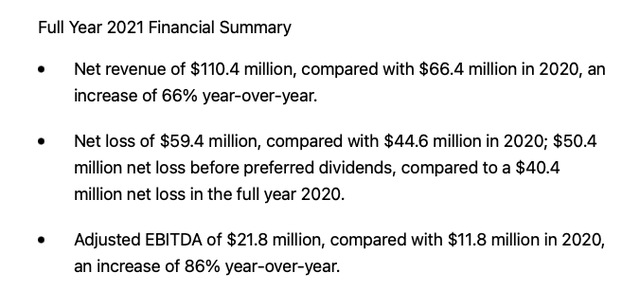

2) Full year revenue up 66% YoY and Adj. EBITDA up 86% YoY ($21.8 million compared to $11.8 million).

(Enclosed below is a snapshot of the Q4 FY 2021 earnings report highlights.)

CSSE Q4 FY 2021 Earnings (Seeking Alpha)

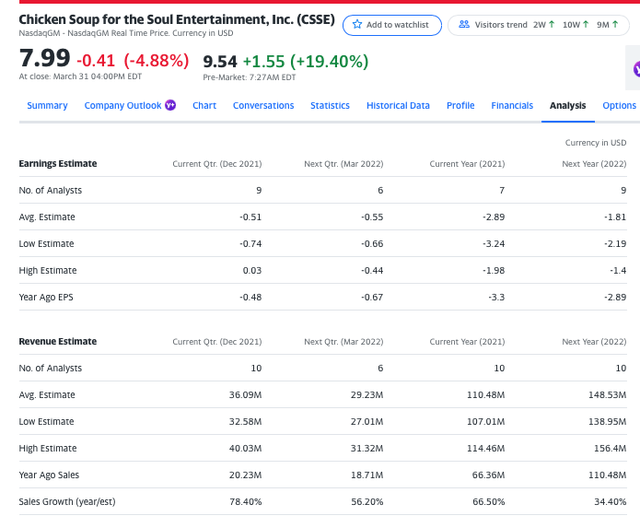

3) Really strong FY 2022 guidance and Q1 FY 2022 appears to be in the bag!

A guide of 35% FY 2022 revenue and 50% Adj. EBITDA growth.

As we look ahead to 2022 from a financial projection perspective, we are expecting 35% top line growth and approximately 50% adjusted EBITDA growth for the full year without any further acquisitions. Revenue for our first quarter, which ends today, will come in at approximately 25% over last year. Implied in our 2022 outlook is an expectation that our top line and adjusted EBITDA growth will accelerate through the second half of the year as it has in the prior 5 years.

Adjusted EBITDA outperformance relative to revenue growth is expected as a result of the increased investments in our new tech as well as marketing and M&A and will primarily — that will primarily be reflected in the first quarter performance.

(Source: CSSE Q4 FY 2021 conference call)

FY 2022 Consensus Revenue Estimates of $148.5 million. So 35% growth translates to $149 million in FY 2022 revenue.

Yahoo Finance

Enclosed below is compelling commentary, from the Q4 FY 2021 conference call, that more or less indicates that Q1 FY 2022 results are in the bag.

Exhibit A

And for those of you who don’t remember the history, last year’s first quarter was incredibly strong because we had had to defer some revenue from 4Q to 1Q. So, we’re having a 25% increase off of what was a very strong first quarter last year. We are off to a great start for the year, and the numbers we see this year look pretty strong. So, I’m pretty optimistic. But we haven’t had that kind of impact, Dan, that I’ve heard of or seen in other places. It may be just because it’s such a long queue to get onto our networks that we are not noticing any kind of impact. I don’t see any really big changes in the way — in the dispersal of customers who are signing up.

We’ve had a big, really pretty substantial jump in sponsor integration activity, which was something I think I told everybody I expected to start to see because of the scarcity of ads. So, all in all, not yet, but maybe. I can’t tell you how it will turn out. Obviously, what’s going on internationally is horrible.

The Qualitative Highlights

As I noted, the Q4 FY 2021 conference call was fantastic and here are some key excerpts that jumped out at me.

(All quoted material is from the Q4 FY 2021 conference call)

1) Old School Spiderman February 2022 was a big driver:

If you take a look at February, for example, where we had the three Spider-Man, the old Spider-Man titles on our network. I’m not going to preannounce the results. But suffice it to say, it was an unbelievably good month because the content was there and people wanted it. And they came, they watched that, and they watched other things. And they found it. We didn’t even really have to promote it.

2) P&G is now a partner/ sponsor.

And what we’ve seen, I mentioned a couple of them in the script, Verizon in Smart Home Nation; P&G, first time we’ve done a P&G integration in Comfort Kitchen; and quite a few others. Obviously, at some point, we will say that we are going to go — we are going to do going from Broke Season 3, and that will have a bunch of integrations in it as well. This process is really going pretty well.

A lot of it is being enhanced by the fact that we are going to run — this is the second half of your question, Dan, that we are going to run a number of these programs on the Chicken Soup for the Soul streaming service. And so, advertisers like that idea. They love the idea of that demographic. They love the idea of being associated with that brand. That network is off to a really good start, but it’s very early days. But the streaming services have done well. They’re growing rapidly.

3) 3 year exclusive with BBC – Including Sherlock

Exhibit A

Beyond our originals, bigger media players are finding our streaming services to be a home for their great content. These include the BBC, who has given us a 3-year exclusive AVOD license to the smash hit series Sherlock, and more recently signed a multiyear deal for premium content with screen media, whereby we’ll add more than 2,500 hours of BBC originals on our services.

Exhibit B

The distribution platforms promoted it for us, Brian, because they recognize that it’s the content that drives [indiscernible]. And so that kind of promotion that we normally would have to buy, we got quite a bit of it for free. You watch what happens with Sherlock. Sherlock is a long-term opportunity to lock up a piece of programming. That’s one of the most popular pieces of programming in history. And we are the only ones who will have it for 3 years.

4) 40 million active members on Crackle Plus

On average, we continue to add between 400,000 and 450,000 viewers with new touchpoints, The Crackle Plus network is now available on more than 70 touchpoints and our average totally monthly — total monthly active users for the Crackle Plus now exceeds 40 million. We also launched our new Chicken Soup for the Soul streaming service on several fast channels and on Vizio as an app earlier this month.

5) Distribution Deals – VIZIO and Samsung

Exhibit C

With the VIZIO and Samsung new tech launches, we’ve seen great progress with our user engagement. VIZIO tech is beginning to have the impact we hoped. In February, watch time on VIZIO averaged over 88 minutes per engaged viewer, a 40% increase. VIZIO unique were up 25% month-over-month. VIZIO MAUs were up 28% month-over-month. VIZIO start time increased 42%. And here’s one that went down, and we’re happy about it. There was a 196% decrease in ad exits on the VIZIO platform, and that makes our advertisers happy.

Exhibit D

Samsung’s much more recently launched app has started off strong with engaged viewer watch time up around 70% since the launch. We are also on track to add new tech to Roku, Fire TV, LG and other major platforms in this quarter, Q2. We expect the continued rollout of our updated apps will mirror these increased watch times. While we are highly focused on executing on these strategic growth pillars, we remain optimistic and opportunistic about the consolidating media marketplace.

Valuation And Capital Structure

CSSE has been aggressively buying back stock since Q4 FY 2021 and bought back more shares during Q1 FY 2021.

During the fourth quarter of 2021, we repurchased roughly 879,000 shares for a total of $12.6 million. And in the first quarter through yesterday’s close, we repurchased approximately 765,000 shares for a total of $8.5 million.

15.4 million shares x $12.70 equals a $195 million market cap.

CSSE FY 2021 10-K (sec.gov)

At year end, the company had $44.3 million of cash and $31.5 million of 9.5% debt. The company also has 3.7 million shares of preferred stock outstanding (9.75% and $25 par value). So inclusive of the preferreds, $92.5 million in cumulative par value, as well as the quarter to date share buybacks, the company has no net debt.

So we are looking at a pro-forma enterprise value of about $288 million.

A $288 million EV (including the preferred stock) / Adj. FY 2022 guidance of $33 million translates to a valuation of 8.73X. Not exactly a frothy valuation for a business that has just exhibited lots of MO (momentum) and appears to be inflecting.

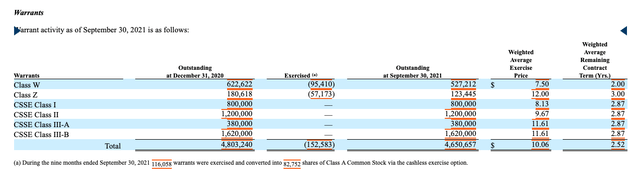

The Warrant Overhang

There are a number of warrants, 4.65 million shares, with an average exercise price of $10.06. That said, the weighted average contract term on these warrants was 2.52 years, as December 31, 2022. Therefore, given the optionality of these warrants, I would argue the stock has to move into the mid to high teens before the warrant holders might consider exercising them and giving up the inherent optionality value of the warrants.

Also, if these warrants were exercised, perhaps the company could use the proceeds to pay off its expensive debt.

CSSE FY 2021 10-K (sec.gov)

A Few Other Things Bullish Nuances To Consider

On Q4 FY 2021 the conference call, the CEO noted they have been aggressively investing for growth via technology investments to be able to scale to meet anticipated future growth. This is very bullish in that 1) the past Adj. EBITDA power has been masked by investments and 2) this means future growth should be more scalable and thus future EBITDA margin should improve.

(All three quotes are from the Q4 FY 2021 conference call).

Exhibit E

Gross margin in the fourth quarter was impacted by higher-than-expected technology costs as a percentage of sales as we launch new streaming apps and our investment in content ingestion from the Sonar library and the Screen Media library.

Exhibit F

I’d like to emphasize that despite heavier-than-normal technology spend in 2021, as previously discussed, gross margins increased to 32% in the fourth quarter, up from 29% in the prior year period and 21% in the third quarter of 2021. And gross margin increased to 28% in the 2021 full year, up from 21% in the prior year.

Exhibit G

One of the reasons we talked about Q1 the way we did was we wanted everybody to understand that there will be a little bit of a residual drag on the EBITDA. It’s not going to be bad. It’s still going to be quite positive, but that it will be a little bit less robust than it would have been if we weren’t investing. But as we roll through the year — as you can see from this year, as we get rolling through the year, we start to really generate a very different kind of EBITDA with scale. So, I’m very, very bullish on the year for that. And part of it is because much of the tech spend — while it never goes away, much of the tech spend that is not about scaling is behind us.

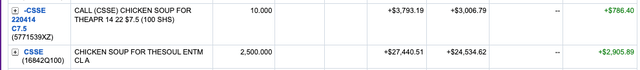

Full Disclosure

On the morning of April 1, 2022, I sized up this CSSE bet, allocating 15% of my capital by purchasing shares in the mid to high $9s and paying as high as $10 per share even. Given the big move, and as I only have so much dry powder, as a lot of my capital is tied up and invested in core ideas, I did harvest some profit. I am more inclined to believe this big move is fundamentally based, however, as I have learned the hard way, one too many times, you just never know with investing or speculating in highly shorted stocks.

Enclosed below are the realized gains.

Fidelity Closed Positions

However, just to be clear, I do maintain a current long position as I think a move to $15 (or higher) is certainly possible.

Fidelity

Putting It All Together

If you are into fundamentals, a person could make a strong case that this business is inflecting. You see it in the revenue growth and Adj. EBITDA growth. The company offered strong FY 2022 guidance and the company’s key metrics are moving in the right direction (content, viewership, CPMs, technology, and user experience).

Our core pillars of growth are content, viewership, CPMs, and technology, or the user experience. And we focus on all of these through both organic growth and opportunistic M&A.

The company has sold out its advertising inventory, which means its CPMs should go higher, especially as it attracts marquee CPG companies like P&G or other Blue Chippers, like Verizon.

For the fifth consecutive quarter, we virtually sold out all of our advertising inventory. Advertisers continue to be increasingly attracted to our strong and growing viewership as we add distribution touch points and increase the pace at which we release high-quality content. This in turn has driven our ability to not only grow existing sponsorship relationships with large commitments, but also engage with new and, in some cases, larger advertising partners.

The stock has made a big recent move and it might need to consolidate. However, there is clear evidence that CSSE’s business has momentum and that its original content has value (28% original content in December 2021). Either way, I hope this article provides curious readers with my perspective on the recent results, guidance, and strong recent price action.

Be the first to comment