Scott Olson

Readers know my hesitation with utility stocks. So many are richly valued in a market where valuations have retreated. One company recently underwent a transition, though. Exelon (NASDAQ:EXC) spun-off Exelon Generation (Constellation), a merchant power provider effective last February. That allows EXC to focus on being a regulated utility. So far, investors like the spin-off as EXC is up more than 16% over the last six months, beating the S&P 500 and the Utilities sector.

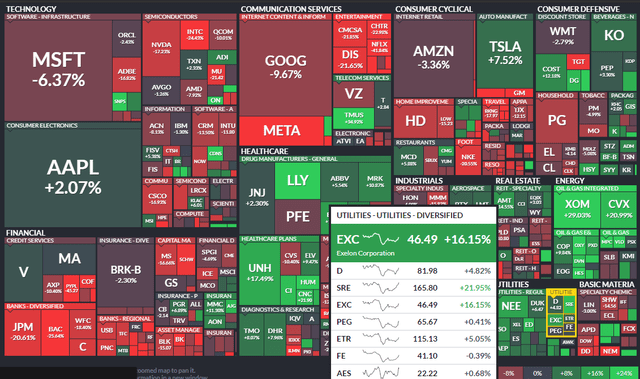

Exelon Outperforming Its Sector and the Broad Market

Finviz

According to Bank of America Global Research, Exelon is a predominately transmission & distribution electric utility operating in Illinois, Pennsylvania, Maryland, Washington DC, New Jersey, and Delaware. Primary utilities include Commonwealth Edison in IL, PECO Energy Company in PA, PEPCO in MD/DC, Baltimore Gas & Electric in MD, Atlantic City Electric in NJ, and Delmarva Power in DE/MD. Exelon is the largest public regulated utility by customers (more than 10.5 million). The $46 billion market cap Chicago-based company stands to benefit from the relatively low-risk T&D niche of the industry.

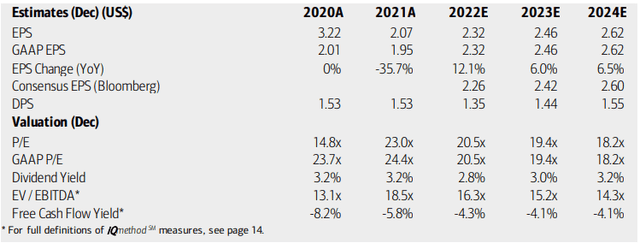

Analysts at BofA see decent EPS growth from standalone EXC. While its P/E ratio is about 18 times last year’s earnings, that is a substantial discount compared to the industry average. Moreover, the stock sports a 2.9% dividend yield according to The Wall Street Journal. Still, its EV/EBITDA and free cash flow metrics are not the most attractive. BofA estimated Constellation to be worth about $16 per share, so the share price drop you might see on the chart six months ago aligns with that figure.

Exelon: Earnings, Valuation, Dividend Forecasts

BofA Global Research

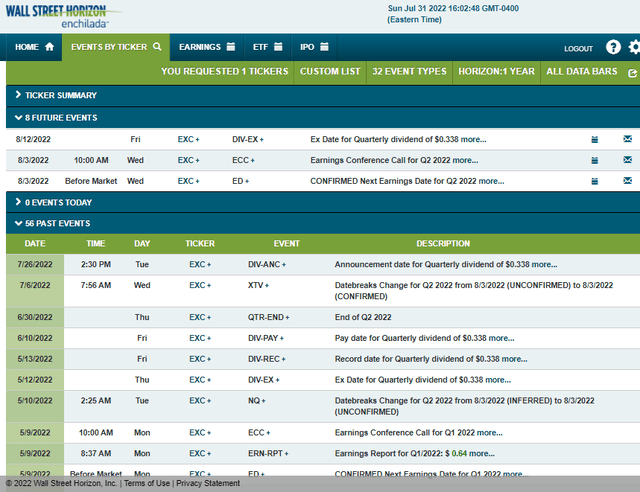

Exelon reports earnings Wednesday morning with a conference call to follow at 10 a.m. ET. Analysts expect $0.46, according to I/B/E/S data. Investors should also be aware of the next ex-dividend date of Friday, August 12, according to Wall Street Horizon.

Earnings On Tap Wednesday BMO

Wall Street Horizon

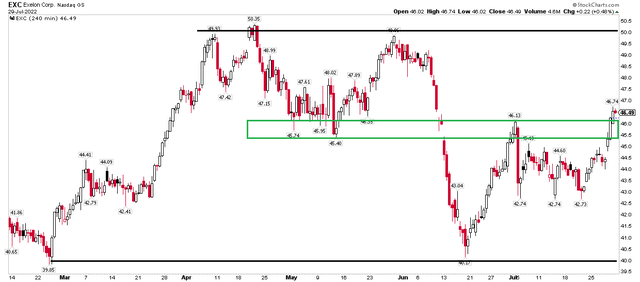

The Technical Take

Following the February 1 distribution date of the spinoff of CEG/Constellation Energy from Elexon, the share price naturally adjusted downward. Since then, though, there have been interesting technical developments.

The stock rose sharply from about $40 to above $50 in about two months. EXC failed to break to new highs in late May before cratering back to $40 support. Note that the stock traded in a $5 range from April through early June – once that range broke, a downside measured move price objective was hit with precision about when the broad stock market bottomed.

A brief rally in late June and early brought the stock back to ‘the scene of the crime’ at $45 in mid-May. Shares pulled back before a thrust through last week developed.

So here we are – with a weekly settle above $46, I think the stock can get back to $50 in the near term. If $50 breaks, then a $60 target is in play. Support is at $45-45 and $42-43. Overall, I think a near-term rally is in play.

EXC: Moving Above Resistance, Eyes on $50

Stockcharts.com

The Bottom Line

Exelon’s spin-off of Constellation allows it to focus on a low-risk part of the utility industry. The valuation isn’t great, but it is better than what you will find in other diversified utility firms that likely face more risks than EXC’s T&D business. Technically, the stock looks poised to revisit $50 – perhaps post-earnings on Wednesday.

Be the first to comment