kali9/E+ via Getty Images

What image do I conjure up in your mind when I say the words “stock picking?” Those words tend to fill my mind with images of retail traders losing impressive quantities of both time and money as they attempt to outguess the market, identify the next hot new thing, and then buy and sell the shares over a relatively short interval (usually very much to their regret and financial misfortune).

There is, however, another way to pick stocks: passively hold a diversified index of individual shares for the very long-term. Shares that you have selected based on your own, personal idiosyncratic criteria that happen to make YOU feel comfortable with YOUR financial choices in life. The criteria could be as simple as “I feel comfortable owning the top 50 stocks in the S&P 500.” The criteria could be far more involved than that. The key point is that directly owning a passive index of individual stocks is no different from owning any passive and broad-based index fund: you don’t trade, you don’t concentrate heavily in any single industry or individual company, and you hold for the long-term irrespective of news.

And every once in a while, you might decide to add positions to your index. That’s precisely what I have done today.

Lower Stock Prices Mean Higher Portfolio Income

My portfolio is down this year – probably just like yours. At the same time, my portfolio income has grown thanks to three factors: (1) most of the companies I own pay dividends; (2) some of the companies I own have raised dividends this year; and (3) I live like a miser (sometimes at least) and reinvest savings regularly.

By the way, did you know that I once did an experiment with a border collie named Walter? I wanted to see how many minutes it would take before Walter got bored of chasing a tennis ball that I’d throw across the lawn. Three hours later, my exhausted arm was ready to drop off my body and land on the ground with a meaty thud, whereas Walter’s eyes were still spinning like bright, shining, chestnut-colored pinwheels of never-to-be-diminished excitement each and every single time that I tossed that sloppy, foamy tennis ball. So in case you are wondering the answer is no, I never did find out how long it takes for a border collie to grow bored of the game of fetch. So too, I have never yet discovered how long it will take before I grow bored of the magic of compounding portfolio income by reinvesting portfolio income.

But the next logical question becomes “HOW, specifically, does one go about compounding portfolio income?” Not that my approach works for anyone else besides me, but for illustrative purposes here’s what I’m doing this year.

Let me first backtrack a bit. I am sure that you have found that most individual stock analysis is scientific in nature, involving graphs and a large measure of ratios. Today I’d like to discuss a far less scientific stock selection process that you could call the “oh…. now I get it” approach. Would you like an example of what I mean by that? Take Berkshire Hathaway’s investment in Apple (AAPL). According to Tripp Mickle’s book “After Steve: How Apple Became a Trillion Dollar Company and Lost Its Soul,” Warren Buffett’s epiphany regarding AAPL stock arrived when a 90 year old member of Berkshire’s board of directors lost his prized iPhone in the back of a taxi and reported to Buffett that he felt he had just lost a piece of his soul.” Buffett thereupon grasped the fundamental importance of Apple’s leading product to its customers, which helped compel him to build AAPL into the largest Berkshire Hathaway holding.

I can think of other closer-to-home examples, too, like the time when I realized that the company Hermes (founded nearly two centuries ago in 1837) consistently benefits from an inimitable ability to sell raw materials that cost two to three figures for four or even five figures. Hermes doesn’t bother with serial numbers on some of their handbags for one simple reason: the quality of the workmanship is so high that it cannot be knocked off. Those two facts gave me a very strong incentive to want to own a small piece of that business (possibly even for the rest of my life) as long as I could buy the stock for a reasonable price.

I had a similar “oh, now I get it” reaction to Home Depot (HD) last summer while I was helping to fix up a home that was going to be listed for sale. It seemed like I was walking into Home Depot on a daily basis that summer (sometimes more than once per day), and each time I did, I found that the people who worked there were helpful, knowledgeable, friendly and oftentimes offered very useful advice about whatever home repair project I happened to be working on. Based on my frequent excursions into the store, I started to grasp how customers could easily spend one or two weekends per month shopping at Home Depot and why they’d want to keep coming back. A company that sells necessary products and offers reasonable (although not low) prices and a pleasant shopping experience is precisely the kind of business that does better and better over time – which is THE KEY ingredient for any long-term investment.

Once I had my “oh, now I get it” moment with HD, I felt that I only needed a few more crucial bits of information before buying the stock. I found that the company has A-rated credit according to S&P Global – I never consider owning any company at any price unless the balance sheet is rock solid. I then saw that the company has a consistent record of paying dividends for 32 years according to Seeking Alpha (including 9 dividend annual dividend increases over the past 9 years). I learned that the company’s year-over-year earnings growth averages 19.46 percent for the past five years. The final bit of information that I needed before buying the stock was just price. When I first started looking at HD, I felt like the stock price was simply too high but one year later, the stock has a forward price/earnings ratio of 17.51 – which is a price I am very comfortable paying.

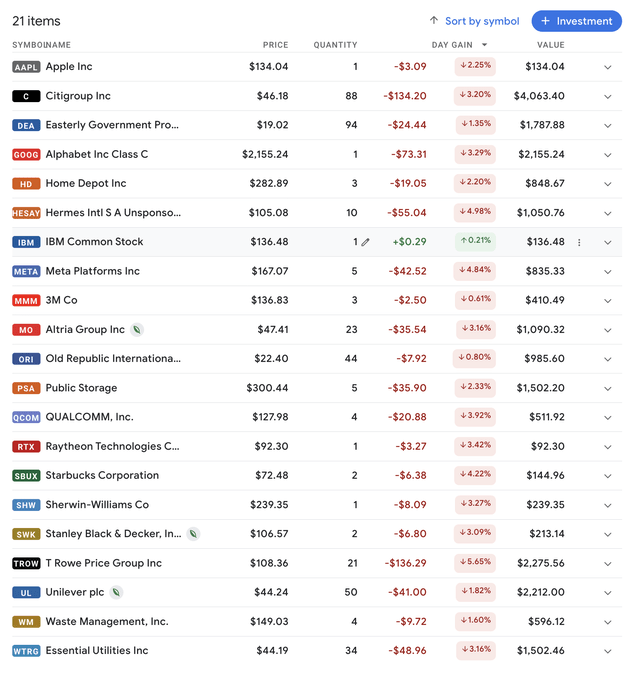

What else have I been investing in since March this year? Here’s the full list.

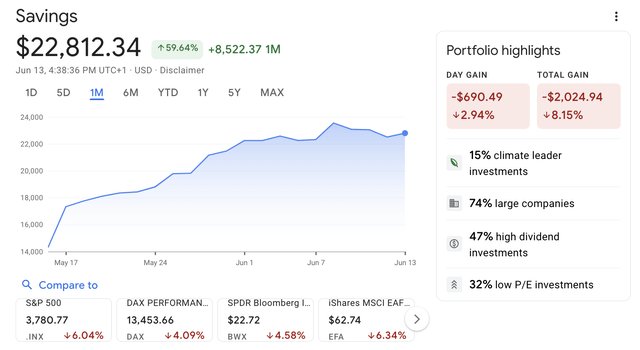

My Savings and Investments since March (GoogleFinance.com)

You can see that my investments so far since March are down by over 8%, which isn’t much fun and nothing I’m going to boast about.

My Savings Performance Since March (GoogleFinance.com)

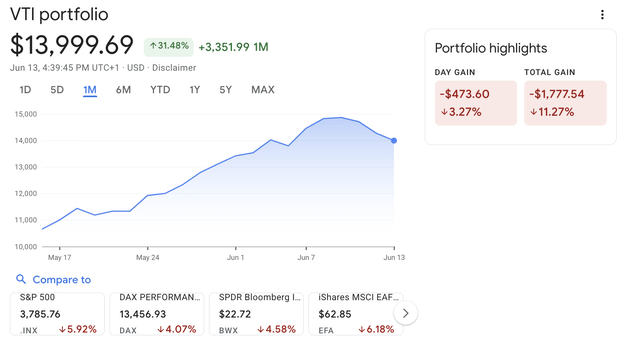

On the other hand, if I had simply bought one share of the Vanguard Total Stock Market Index Fund (VTI) per day every day since March 2nd, I’d be down by over 11% according to Google Finance.

Daily Investments in VTI (GoogleFinance.com)

Losing less isn’t as much fun as earning more but in a bear market you take what little consolation you can get along the way and keep your eye on reaching distant and unambitious targets.

Be the first to comment