ArtemisDiana/iStock via Getty Images

It wasn’t that long ago when the market was scrambling to find vaccine plays as the world began to mobilize against the COVID-19 pandemic. At that time, governments and health organizations were searching for potential vaccines that could be quickly developed and distributed to the world’s population. Right out of the gate, Pfizer (PFE)/BioNTech (BNTX) and Moderna (MRNA) were considered front runners thanks to their rapid development from mRNA vaccine technology. These vaccines were given the red carpet treatment and the tickers surged as governments signed contracts for millions of doses of their COVID-19 vaccines. Other vaccine companies discovered and presented their vaccine candidates, but they didn’t have the lobbying power and the connections to receive the VIP regulatory experience. Eventually, it became obvious that there was only going to be a handful of chosen winners and the remaining companies would have to take the long road. As a result, the tickers were punished for being associated with COVID-19 vaccines with relentless selling pressure for over a year. Gritstone bio (NASDAQ:GRTS) is one of these COVID plays and was able to develop a self-amplifying mRNA vaccine that would have several advantages over the currently authorized mRNA vaccines. What is more, Gritstone has an HIV candidate as well as several oncology programs. Sadly, GRTS has dropped ~77% over the past 12 months and has a market cap of roughly $168M. I believe the market has taken selling too far and has provided me with an opportunity to invest in premium mRNA technology at discounted value.

I intend to provide a background on Gritstone and highlight the technologies that have produced their pipeline programs. In addition, I take a look at the company’s valuation metrics and will discuss why I think GRTS is undervalued at these prices. Finally, I reveal my plans for initiating a position in GRTS.

Background on Gritstone bio

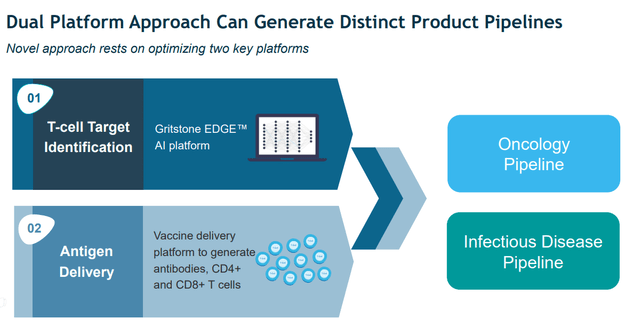

Gritstone bio is developing targeted immunotherapies for infectious diseases and cancer by enhancing the body’s immune system to recognize and destroy unhealthy cells by targeting specific antigens. Gritstone is attempting to achieve this by employing two technologies. Their machine learning EDGE database technology is intended to identify the antigen and neoantigens that are fixed on a cell surface to allow CD8+ T cells to lock on and destroy. These antigens are to be used in the high immunogenic samRNA vector to deliver the payloads, which educates our adaptive immune system to attack the unhealthy cells that are capable of evading our body’s defense mechanisms. Essentially, Gritstone is attempting to teach the immune system to recognize targets on the surface of abnormal cells and tailored vaccines to create both anti-tumor and anti-viral immunity.

Gritstone bio Dual Platform Approach (Gritstone bio)

The company’s initial efforts were on tumor-specific neoantigens, but they have expanded their programs to include viral antigens exhibited on the exterior of cells that are infected with a virus. As a result, Gritstone’s candidates could offer the benefits of immunotherapy across numerous diseases.

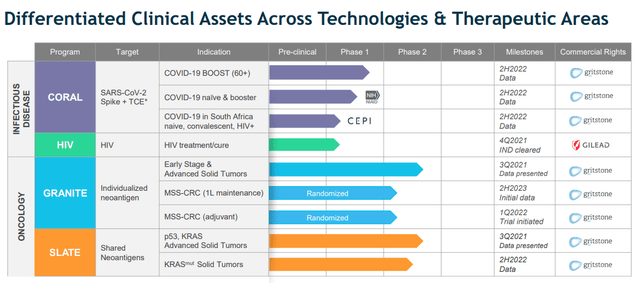

Gritstone bio Pipeline (Gritstone bio)

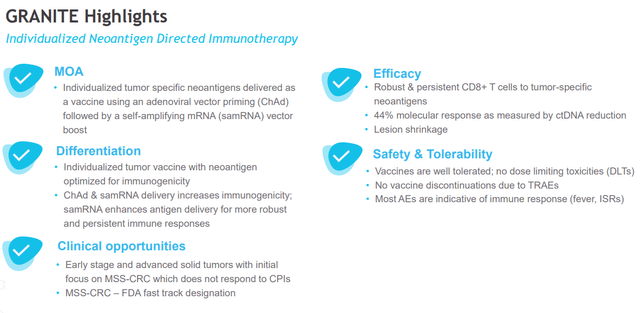

On the oncology side, the company has their GRANITE program, which is Gritstone’s personalized neoantigen immunotherapy. This process begins with a clinical biopsy of the patient’s tumor. Using the company’s EDGE platform they are able to ascertain specific tumor mutations that are capable of converting into patient-specific neoantigens that made-to-order immunotherapy to train the patient’s CD8+ T cells. Gritstone’s program is the microsatellite stable colorectal cancer “MSS-CRC”. At the moment, the contemporary standard of care for CRC is checkpoint inhibitors that require the tumors to be “hot” that can trigger an immune response. Unfortunately, MSS-CRC tumors are typically less immunogenic and “cold”, meaning they can evade the immune system and diminish the efficacy of PD-1/L1 inhibitors.

Granite Highlights (Gritstone bio)

Thus far, the company has reported encouraging data in MSS-CRC from their Phase I/II GRANITE study. Recently, the company presented updated OS data at ASCO, which revealed 4 out of 9 treated patients with MSS-CRC that had a molecular response now have an observed median overall survival that surpasses 18 months as opposed to 7.8 months in non-responders. What is more, “All patients with MSS-CRC assessed for molecular response and alive at the time of the ESMO 2021 data presentation remain alive after an additional 35 weeks of follow-up.”

If Gritstone can prove their therapy is safe and effective against MSS-CRC, it would be a huge opportunity both clinically and commercially due to CRC being the second leading cause of death of any cancer type. In fact, there were an estimated 104,610 new cases and 53,200 deaths caused by CRC in the U.S. in 2020. So, if Gritstone can turn these tumors from cold to hot, they could be unlocking the MSS-CRC door for blockbuster drugs like Merck’s (MRK) KEYTRUDA and Bristol-Myers Squibb’s (BMY) OPDIVO. Not only would this be an extraordinary breakthrough for patients and providers, but it would also mean that Gritstone holds the keys to a sought-after market.

What is more, the GRANITE program has additional cohorts including gastroesophageal adenocarcinoma “GEA” and non-small cell lung cancer patients “NSCLC”, where GRANITE has produced impressive results as well. As a result, Gritstone has already started enrollment in their pivotal Phase 2/3 for frontline maintenance immunotherapy in metastatic, MSS-CRC patients. The company has also started enrolling their Phase II trial of GRANITE adjuvant immunotherapy in Stage II/II MSS-CRC patients who are ctDNA+ after definitive surgery.

The company’s SLATE program is an “off-the-shelf” version of its GRANITE program. Instead of being a tailored product like Granite, SLATE uses a variety of shared neoantigens to teach CD8+ T cells. Using translational immunology data and the company’s cassette design proficiencies, the company developed SLATE-KRAS, a KRAS-specific version of SLATE that is currently in a Phase II study for advanced NSCLC as well as CRC. The company hopes this Phase II study will show how SLATE-KRAS triggers a more robust CD8+ T cell responses to mutant KRAS than their first candidate, SLATE v1. Gritstone expects to have Initial data from this study in the second half of this year.

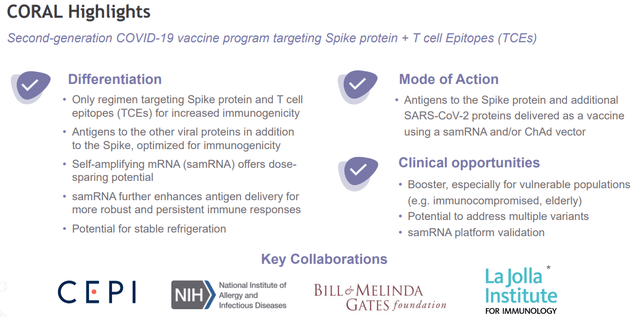

Gritstone’s CORAL program for COVID-19 is sponsored by the NIAID/NIH. The company’s candidate is a second-generation COVID vaccine that is intended to generate a vigorous neutralizing antibodies reaction, as well as facilitate a broad CD8+ T cell response against highly conserved non-Spike SARS-CoV-2 epitopes. Gritstone believes that the added layer of immunological response will enhance the defense against emerging variants that have sidestepped contemporary vaccines.

CORAL Highlights (Gritstone bio)

The company believes that this method offers the prospect of a “more durable clinical protection and broader immunity against SARS-CoV-2 variants than first-generation products by inducing potent CD8+ T cells in addition to neutralizing antibody responses.”

At the moment, Gritstone is assessing five separate SARS-CoV-2 product candidates in four ongoing clinical trials including a homologous and heterologous prime-boost regimen. The CORAL-BOOST study is in a Phase I clinical trial assessing a T cell enhanced samRNA vaccine as a booster in the UK. In January, Gritstone publicized positive clinical data from the initial cohort and then expanded the study. The CORAL-CEPI trial is in South Africa assessing T cell-enriched omicron- and beta-spike constructs in “virus-naïve, convalescent, and HIV+ patients.” The CORAL-IMMUNOCOMPROMISED trial is ongoing in the UK assessing T cell enhanced samRNA and ChAd vaccines in B cell-deficient subjects. The CORAL-NIH trial is ongoing in the U.S. assessing T cell boosted samRNA and/or ChAd vaccines in previously vaccinated subjects. Initial data from all of these trials are expected during the second half of this year.

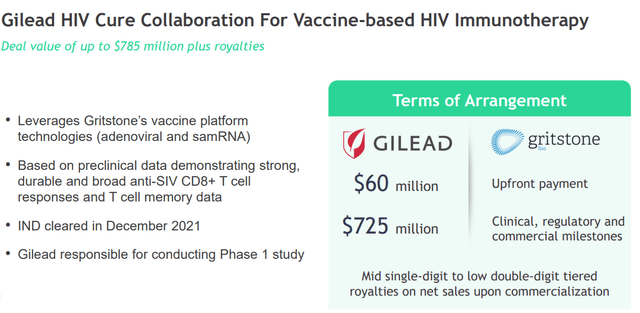

Gritstone has an HIV vaccine-based immunotherapy to cure patients with HIV that is partnered with Gilead (GILD). Back in February 2021, Gilead made a $30M equity investment in Gritstone at a premium and also paid a $30M upfront payment in cash with up to $725M in milestone payments.

Gilead HIV Overview (Gritstone bio)

What is more, the two companies are working on an HIV-specific therapeutic vaccine. Gritstone is applying simian immunodeficiency virus “SIV” derived antigens, which are comparable to those in HIV-1. The initial data established robust, durable, and broad anti-SIV CD8+ T cell responses and T cell memory data. Gritstone and Gilead are preparing to move the program into a Phase I clinical trial which got an IND in December 2021.

A Discount Valuation

Gritstone’s current market cap is roughly $164M, which I believe is significantly undervalued when you look at a few key valuation metrics. Firstly, Gritstone bio had $186.8M in cash or marketable securities at the end of Q1 of 2022, which means the stock is currently trading under its cash value. In fact, GRTS has a total cash per share of $2.56 while the shares are trading at around $2.25. Furthermore, Gritstone has a price-to-book of 0.87, which is under the sector median of 1.98x.

Looking at Street revenue projections, we can see Gritstone is projected to report undulating revenue over the next several years, however, the Street expects Gritstone’s revenue to skyrocket in the second half of this decade.

GRTS Revenue Estimates (Seeking Alpha)

One Street analyst expects $591.20M in 2029, which would represent a 0.28x forward price-to-sales. It might be hard to believe that Gritstone could be pulling over half a billion in revenue down the road, however, one must remember that Gilead alone could be forking over $725M in milestone payments. So, I believe these projections are not absurd and it is possible we see incredible growth in the coming years. Considering the industry’s average price-to-sales is roughly 5x, we can say that GRTS is trading at a discount for their projected future revenue.

Another point to consider is how GRTS is valued compared to its peers. Obviously, I don’t think it is fair to compare GRTS with Moderna ($54.32B market cap) and BioNTech ($36.28B), considering they are collecting significant revenue from their COVID-19 vaccine efforts. CureVac (CVAC) is another mRNA company that has a market cap of roughly $2.93B. Translate Bio was acquired by Sanofi (SNY) for its mRNA tech for $3.2B. So, considering Gritstone is currently valued at around $164M, we can say that it’s dirt cheap compared to some of its peers. Indeed, some of the companies are at different stages of development, however, the contrasts do illustrate where Gritstone could be if they are able to get one of their programs across the finish line.

Admittedly, it is hard to determine what a fair value for GRTS is at the moment, but I am confident to say that the ticker is trading a significant discount for its cash; the company’s potential revenue growth; and, in comparison to its peers. Nevertheless, if I had to give it a shot, I would use the company’s 2028 revenue estimates with a 5x price-to-sales along with discounts for time and error to get a fair value of $10 per share.

Still Speculative

The company might have a healthy cash position at the moment, however, Gritstone has reported a net loss of roughly $25M-$29M per quarter for the past few years, so it is probably the company is going to report an increase in cash burn. Consequently, there is a strong likelihood that the company is going to need to raise more cash at some point in the middle of next year in order to fund their pipeline efforts and keep the lights on. Of course, there is the possibility the company will have to perform a secondary offering or take on debt. However, I believe there is a huge opportunity for the company to make some business development moves and make a partnership or licensing deal to help fund the company.

As a result, I am adding GRTS to the Compounding Healthcare Seeking Alpha Marketplace Service’s “Bio Boom” Speculative Portfolio and will keep the ticker there until the company is able to clear a profit.

My Plan

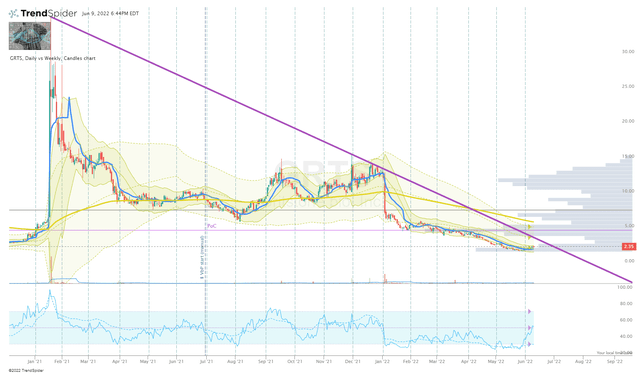

Finding a clean entry point for GRTS is not easy, however, I believe the company’s valuation and oversold state have given me the green light to pull the trigger on a starter position to get my feet wet. I am going to look for an entry under $2.50 per share and will add to the position once the share price is able to break the downtrend ray from the January 2021 high.

GRTS Daily Chart (Trendspider)

GRTS Daily Chart Enhanced View (Trendspider)

Admittedly, I am not going to amass a huge position in GRTS at this time due to the company still being highly speculative.

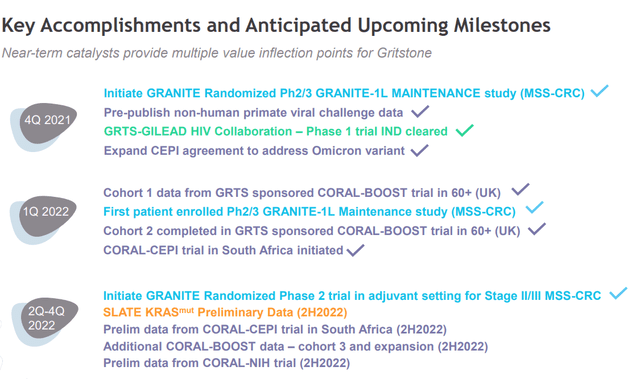

However, the company has several potent catalysts slated for the second half of this year that should give us a greater insight into both their oncology programs and their COVID programs.

Gritstone Upcoming Milestones (Gritstone bio)

If the data from these programs are positive, I will adjust my strategy depending on the market’s response.

Indeed, I will be looking to book profits and will attempt to move GRTS into a “house money” state as soon as possible. However, I anticipate holding a respectable GRTS position for at least five years in anticipation that the company will ultimately get one of their pipeline programs across the finish line and will be valued by its peers.

Be the first to comment