Sundry Photography

Zebra Technologies remains a buy after Q2

Zebra Technologies (NASDAQ:ZBRA) reported earnings last week and beat on both the top and bottom lines. The company remains a buy, like in my last article, on good execution, a widening moat and great capital allocation. Zebra Technologies had some sort of a perfect storm over the last months, which now seems to abide. For simplicity’s sake, I’ll refer to the company as Zebra. I’ll refer to the Q2 earnings call several times in this article, read the full transcript here.

My personal experience with Zebra at Wacken Open Air

Last week I made some personal experiences with Zebra at the Wacken Open Air festival, the largest heavy metal in the world with roughly 80,000 visitors and another 10000 employees/contract workers. The festival banned all cash payments and switched to a cashless payment system via an RFID chip attached to the festival wristband. This system has already been used at the Rock am Ring festival earlier this year. The company (get systems) primarily uses RFID scanners from Zebra to scan the RFID chip to verify identify and perform payments. The experience was smooth and mostly worked without issues. The only issues arose from the website being down due to the number of requests, but that’s not Zebras’ fault. Eliminating cash made the festival experience a lot better, and I believe that this change will occur in most festivals of a big enough scale to implement it.

RFID is a small, but fast-growing part of Zebra’s portfolio. The technology is competing with its main business, barcode printers and scanners, but is a lot more expensive (5-10x) while offering more use cases. Zebra doesn’t break its RFID revenue out, but in the earnings call CFO Nathan Winters said:

We know growth has been double digits and solidly in the double digits for us for quite a while.[…] So retail has been the primary or the first vertical to really deploy RFID […]but we are seeing RFID expand into health care, transportation logistics, manufacturing, and also globally

I expect “solidly in the double digits” to mean a growth rate of around 20-35%, well above the company’s revenue growth rate. While retail is the primary adopter of RFID, I see many use cases in areas like events and payments but also the mentioned health care, transportation and manufacturing business.

RFID Chip at Wacken Open Air (Author’s vacation pictures)

Q2 earnings report recap

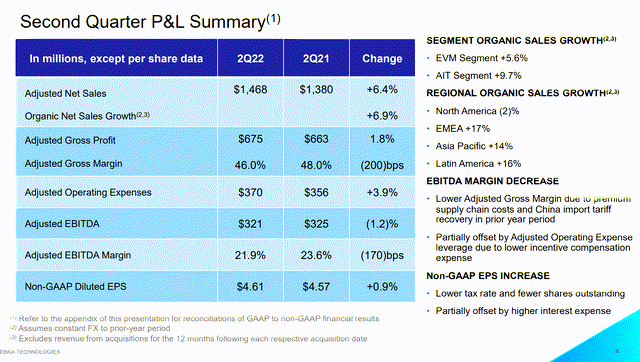

Zebra reported earnings above analyst and internal expectations. Adjusted net sales grew 6.4% versus 3-7% guidance and beat analysts by $20 million. Non-GAAP EPS beat the $4.05-$4.35 guidance and the $4.20 analyst expectations. It is worth noting that GAAP earnings were a net loss of $1.87 per share, driven by the accounting recognition of the $372 million settlement payment that will be paid out over 8 quarters.

ZBRA Second quarter P&L summary (Zebra Technologies IR)

The results and guidance are impacted by elevated supply chain costs, the exit of all Russian operations (1-2% impact) and the strong dollar.

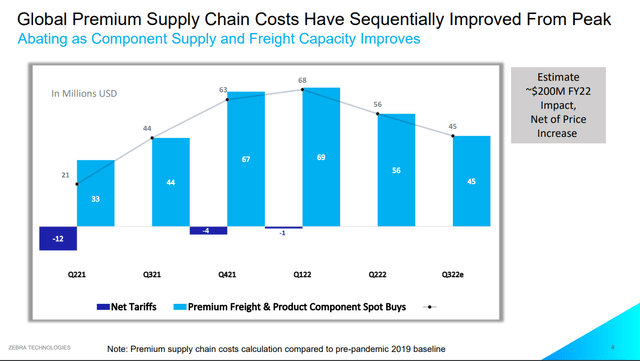

Supply chain impacts

High premium supply chain costs have been a massive drag on Zebra’s results for the last few quarters. The global increase in supply chain costs is having an estimated $200 million impact on gross profits for FY22, a major reason why Free cash flow is down significantly YoY. To combat these costs CEO Anders Gustafsson mentioned the following in the earnings call:

Premium Supply Chain Costs (Zebra Investor Relations)

To combat these costs, CEO Anders Gustafsson mentioned the following in the earnings call:

One would be continued improvement in overall premium supply chain costs, as we are taking actions here in the third quarter to reduce air freight, moving print ocean that you’ll see the benefit for in the fourth quarter

The company is looking to ship more products via the ocean instead of much more expensive air transportation. Furthermore, Anders mentioned that the company used to ship the majority of printers by ship, but was forced to shift to air due to shortage based on long lead times. To keep customers happy, Zebra shipped the products via air primarily in the last quarter. This trend is expected to go back to primarily ship transport for the heavy items and thus a lower cost profile. This step will lower Q3 growth and delay some revenue recognition into Q4, but help improve the cost structure. Zebra ensures its profitability with this move.

Is weak NA revenue a concern?

Zebra saw strong growth across the board besides NA. This dragged overall growth down by around 8%. With over 50% of revenue NA is the largest region for Zebra, so is this a reason to be concerned?

| Region | Regional Organic Sales Growth |

| North America |

-2% |

| EMEA | +17% |

| Asia Pacific |

+14% |

| Latin America | +16% |

| Overall | +6.9% |

Not really, management cited supply constraints and tough comparables in Q2 2021 as the reason for a decline in NA. With supply chains going back to normal, I expect NA to continue to grow at a decent pace. CEO Gustafsson on the matter:

And maybe on North America just say that we saw a very solid broad-based demand. We had strong wins across all our core verticals, and we also saw attractive strength in our run rate business. The results here were impacted by supply chain constraints and some over-allocations, some were on timing. But we recovered very nicely in printing and so strong growth in data caption or equity. And for North America, the biggest impact is really recycled some very strong prior year comparisons, USPS was particularly strong in Q2 of last year.

No signs of a recession

While the whole world is screaming about the recession, CEO Anders Gustafsson said the following:

And I’d say the bookings velocity has remained pretty stable this year. So it’s very strong. We haven’t seen evidence of a recession or predicted a slowdown.

This makes sense if you think about it. In a recession, companies trim the fat and try to be more cost-efficient. This is where automation tools like Zebra’s product portfolio come into place. Zebra works closely together with its big customers, making outlooks and putting the pipeline together. According to Chief Revenue Officer Joe Heel, the company has had much better visibility and record backlog since the pandemic started.

One good thing about the pandemic is that it has driven our customers to be much more forthcoming with their expectations of their business. We now have much better visibility than we had before, with some customers giving us up to a year’s worth of at least visibility in some cases, even orders.

Zebra here is in a strong position as an enabler of technology that companies rely on to remain competitive and drive down costs. Some people expect a declining demand with big players like Amazon (AMZN) having overbuilt a lot of capacity over the last year, but Gustafsson thinks that most companies still play catch up:

There are certainly a few customers that are ahead of their investment curves. But I would say most are playing catch up with investments in solutions like ours, particularly in a labor-constrained environment, where they need to improve productivity, inventory accuracy and customer service levels.

Honeywell settlement

At the end of June, Zebra finally settled the patent lawsuit with Honeywell (HON), one of its biggest competitors. Zebra ended up agreeing to pay $360 million over the next 8 quarters. The companies now share a royalty-free cross-license for their product portfolios to avoid future infringement cases. Although this is a lot of money for Zebra to pay, the settlement has been a drag on the company for a while. The market hates uncertainties, and it is positive that there has been an agreement that excludes all future issues.

Matrox Imaging acquisition

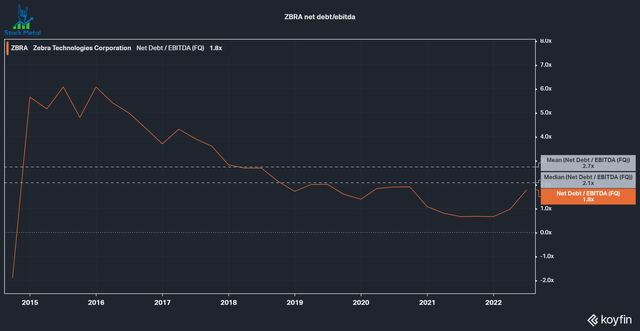

In March, Zebra acquired Matrox Imaging in an $875 million deal. The deal closed in June and was financed via cash and debt. As a result of this, Zebra’s net debt/EBITDA increased to a 1.8x ratio, which is still an okay level and below its mean and median levels. Matrox adds to the fixed industrial scanning and machine vision portfolio and is a great addition to upsell existing customers on new products and services. According to CEO Gustafsson, the integration is going well, and the cultures are mixing well together. Matrox primarily operated in the manufacturing industry, but now can get introduced to Zebra’s customer base in the transportation & logistics sector. This doesn’t just offer revenue synergies, but also another customer branch with different cyclicality to the manufacturing industry. This will improve the stability of Matrox operations inside Zebra.

Zebra Net Debt/EBITDA (Koyfin)

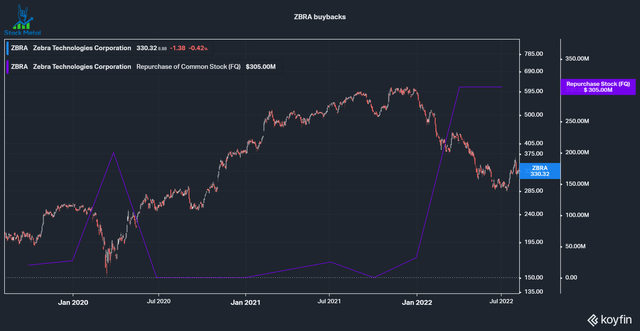

Share buybacks done right

Most companies destroy shareholder value with poorly timed buybacks above intrinsic value. A common way companies buy back shares is with excess capital after a great year. Most of the time, this also causes the stock price to rise above intrinsic value, thus destroying shareholder value with the buybacks. Zebra is a great case study of how to allocate capital correctly. If there are no great ways to reinvest into their own business or acquire new businesses with portfolio synergies and great products at fair prices, the company buys back shares if the price is right. In the past, Zebra showed an excellent execution of this policy. The company bought back a lot of shares during the Covid crash and started to buy back shares aggressively with $305 million a quarter in 2022. During the exuberant stock price in 2021, the company hardly spent money on buybacks, as a rational capital allocator should do.

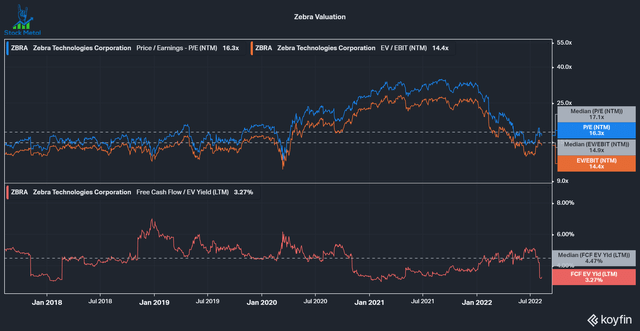

Zebra is fairly valued and I am a buyer

I believe Zebra to be fairly valued considering the high quality of the business and management team. Zebra also is one of the rare companies with a good capital allocation track record (organic growth investment and strategic acquisitions and buybacks under intrinsic value).

I looked at valuation from two angles. First I looked at historical multiples. After a severe overvaluation and exuberance in 2020-2021, Zebra trades slightly under its median 5-year PE ratio of 17.1 times and 5-year EV/EBIT ratio of 14.9 times. On a free cash flow basis, the company seems to have plummeted, but this is largely from the settlement with Honeywell, which will drag this metric down for the next 8 quarters.

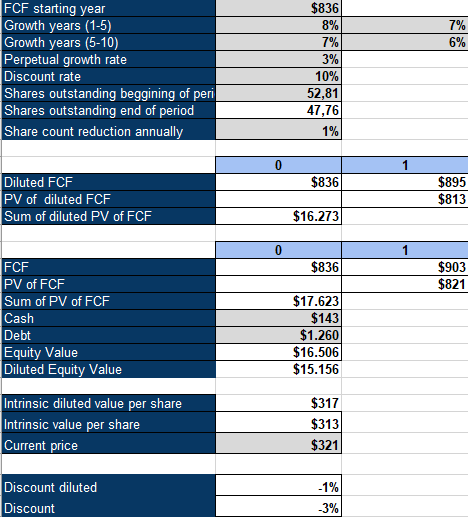

I also looked at a reverse DCF model. A reverse DCF model calculates what kind of growth the market expects. I used a 3% perpetual growth rate, a 10% discount rate and assumed an average 1% share count reduction. I used a higher Free Cash Flow than the reported numbers to account for the settlement charge. At current prices, the market expects 7-8% Free cash flow growth on an undiluted and 6-7% growth on a diluted basis. I believe that Zebra will be able to grow much faster than this, considering its great product portfolio and industry tailwinds. I am a shareholder of Zebra Technologies with a 4% position, and I’m excited to see the company evolve in the next decade and beyond.

Zebra Reverse DCF Model (Author’s model)

Be the first to comment