Spencer Platt/Getty Images News

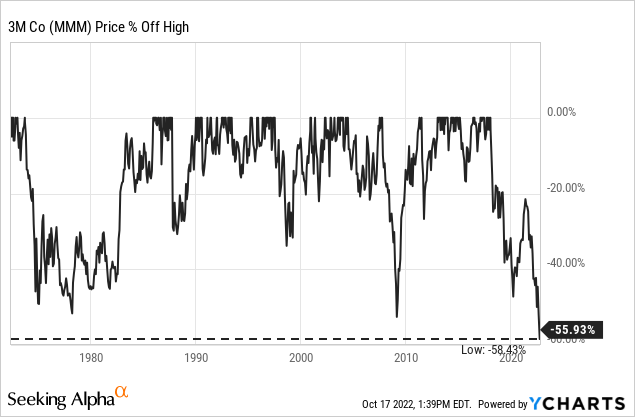

Reporting that a stock declined in the last few months is not really newsworthy, as almost every stock declined in 2022. However, 3M Company (NYSE:MMM) declined 35% year-to-date and clearly underperformed the S&P 500 (SPY). And not only did the stock underperform the broader market this year, 3M Company is constantly declining since 2018 (for almost 5 years now).

When looking at the stock performance since the early 1970s, the current decline is the biggest drawdown for 3M Company during these 50 years. Declining 56% from the previous all-time high is unprecedented and raises the question if 3M Company is a screaming buy or actually a broken business.

Quarterly Results

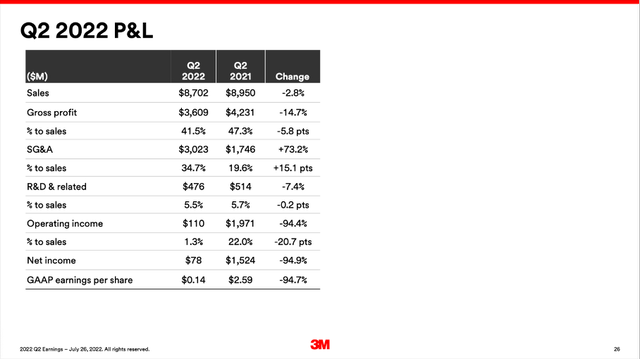

Among the bad news for 3M Company were the second quarter results for fiscal 2022. When looking at the top line, net sales slightly declined from $8,950 million in the same quarter last year to $8,702 million this quarter – resulting in a decline of 2.8% YoY. But 3M Company only had to report a declining top line due to the strong U.S. dollar; organic sales growth was 1% year-over-year. Operating income, however, declined extremely steeply: from $1,971 million in the same quarter last year to only $110 million this quarter, resulting in a 94% decline. Diluted earnings per share also declined 95% year-over-year from $2.59 to $0.14.

3M Company Q2/22 Earnings Presentation

When looking at adjusted numbers, the picture is a bit brighter. Non-GAAP EPS declined only from $2.75 in Q2/21 to $2.48 in Q2/22 – resulting in a 9.8% year-over-year decline. And the adjusted free cash flow in Q2/22 was $1.0 billion.

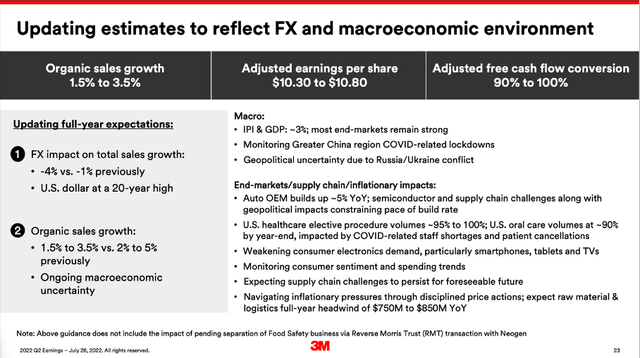

3M Company Q2/22 Earnings Presentation

Aside from reporting mediocre quarterly results, the company also had to lower its guidance for fiscal 2022. Total sales are now expected to decline between 0.5% and 2.5% (compared to expected growth of 1% to 4% before). Organic sales growth is expected to be between 1.5% and 3.5% (instead of 2% to 5% growth before). And while adjusted EPS is expected to be between $10.30 and $10.80 compared to $10.75 to $11.25 before, GAAP earnings per share are now expected to be only $7.32 to $7.82 instead of $9.89 to $10.39 in the previous guidance.

Recession

When looking for reasons for the mediocre results in Q2/22, the potential upcoming and pending recession could be an aspect we should look at a bit closer. And 3M Company’s quarterly results could actually be the harbinger of the upcoming recession.

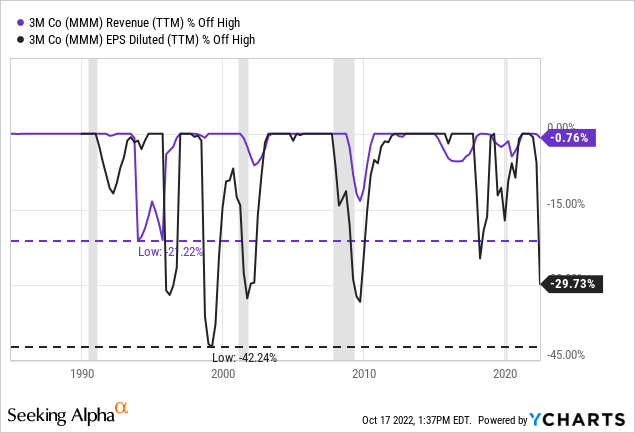

Looking at the performance of 3M Company during the last few decades, 3M Company can’t be described as recession-resilient. We should also not badmouth 3M Company, as the business was profitable in every single year since the early 1980s (I don’t have data going back further). However, when looking at the performance during past recessions, we see declining revenue as well as declining earnings per share almost in every single recession.

And 3M Company has customers in the personal safety industry, semiconductor, automotive or shipping – and these are industries usually affected by a recession. It seems likely that in an upcoming recession 3M Company will see declining revenue and declining earnings per share again. It is also worth mentioning that 3M Company will spin off its Health Care business – and in case of a recession, this business segment would probably be the most stable one.

Earplugs and PFAS

And while the looming recession is one reason for the horrible stock performance, it is not the sole explanation. The countless lawsuits 3M Company is facing right now due to combat earplugs as well as PFAS is creating high levels of uncertainty. As investors usually don’t like uncertainty, they punish the stock.

During the last earnings call, 3M Company reported it is facing more than 235,000 lawsuits (115k filed claims and 120k claims on an administrative docket) accusing the company of selling defective earplugs to the U.S. military. And management is expecting the issue to take a long time. CEO Mike Roman stated during the earnings call:

As of June 30, 2022, there were approximately 115,000 filed claims and an additional 120,000 claims on an administrative docket. The multi-district litigation process and the highly variable outcomes it has generated has not provided certainty or clarity. We believe that litigating these cases individually could take years, if not decades.

As investors, we are trying to reduce the high level of uncertainty and are trying to estimate what fines and penalties 3M Company could face in the coming years (like we are trying to estimate what revenue and free cash flow a business might generate). And looking back in history at the highest fines corporations faced might be a good starting point (I actually talked about this in previous articles about 3M Company as well as Bayer AG (OTCPK:BAYZF; OTCPK:BAYRY).

And, of course, Bayer as well as 3M Company might set new records, but assuming fines of $20 billion to $30 billion might already be reasonable assumptions that are limiting the risk of being too optimistic. In my last article I assumed $25 billion in fines; now I will be even more pessimistic and assume $30 billion in my intrinsic value calculation (see below).

But right now, these are only assumptions, as it is extremely difficult to make estimates. And the court ruling in August that the bankruptcy of a subsidiary does not stop lawsuits against the non-bankrupt parent company (3M Company in this case) was clearly a setback – for the company and the stock. As a result, 3M Company now needs a new defense strategy.

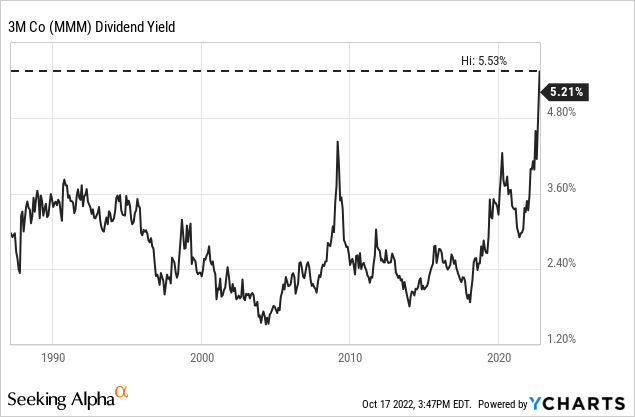

Record-High Dividend

Despite all the negativity surrounding 3M Company right now, the business is certainly interesting for its dividend. Not only is 3M Company one of only six companies listed in the Dow Jones Industrial Average with a dividend yield above 5%, but it is looking at a history of more than 100 years of uninterrupted dividend payments and 64 years of consecutive dividend growth. And with its dividend yield above 5%, the stock is right now trading for the highest dividend yield in the last 35 years (I don’t have prior data).

At the time of writing, 3M Company is paying a quarterly dividend of $1.49, resulting in an annual dividend of $5.96 and a dividend yield of 5.2%. And although 3M Company has increased the dividend only in small steps in the recent past to keep its status as dividend king, the 5-year growth rate is still 5.12%.

And although 3M Company will be able to increase the dividend, we probably must expect dividend increases in small steps as the payout ratio is rather high. When using the expected GAAP EPS for fiscal 2022 ($7.57; midpoint of guidance), we get a payout ratio of 79%; when using the non-GAAP EPS according to guidance for fiscal 2022 ($10.55), we get a payout ratio of 56%. We can also compare $3,404 million in dividends paid in the last twelve months to $4,310 million in free cash flow resulting in a payout ratio of 79%. Summing up, I would say the payout ratio is rather high and we should not expect huge dividend increases although a dividend cut will also be avoided.

Suspended Share Buybacks

In the case of 3M Company, share buybacks are also a tool the company is using regularly. In the last ten years, the diluted number of outstanding shares declined from 703.3 million ten years ago to 572.7 million in the current quarter. In fiscal 2021, the company spent about $2.2 billion on share repurchases and $773 million in the first quarter of fiscal 2022 but recently the company suspended share buybacks again. Management made the following statement during the earnings call:

During the quarter, we returned $848 million to shareholders through cash dividends. As we have communicated previously, share repurchases remained suspended in Q2 due to the pending food safety separation. We intend to complete the separation through a split-off with the closing date of September 1, subject to Neogen shareholder approval and other customary closing conditions.

I understand that 3M Company is focusing on its dividend and does not want to lose its status as dividend king. And obviously, the company is not generating enough free cash flow right now to buy back shares (and taking on debt would be stupid). However, now would be the time to spend money on share buybacks and management should suspend the dividend and use the money to buy back shares as the stock is deeply undervalued in my opinion (I know this won’t happen).

Intrinsic Value Calculation

In my opinion, 3M Company remains undervalued – even when taking into account the upcoming recession and the different lawsuits. The extremely high dividend yield is also hinting towards an undervaluation of the stock, but of course, a high dividend yield by itself is not proof of a stock being a bargain.

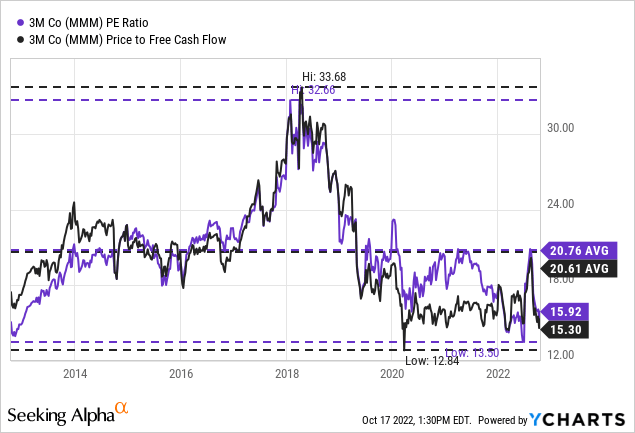

However, 3M Company has not only a rather high dividend yield but is also trading for rather low valuation multiples right now. Right now, 3M Company is trading for 15 times free cash flow and 16 times earnings. And while these valuation multiples are not necessarily screaming bargain, they are close to the lowest valuation multiple of the last ten years and seem at least reasonable for a high-quality business with a wide economic moat like 3M Company. And when using the adjusted expected earnings per share of fiscal 2022 ($10.55 midpoint of guidance), we get a P/E ratio of 10.8 which seems like a bargain.

Instead of looking at simple valuation metrics, we can also use a discount cash flow calculation. But here it is getting complicated again as we must make several assumptions and considering the high level of uncertainty mentioned above, making assumptions is tricky. As a basis for our calculation, we can assume about $6 billion in free cash flow (a number that is in line with past years). Let’s assume 3M Company must pay $30 billion in fines and settlements reducing the free cash flow to $0 for the next five years. And due to a struggling business (and recession), we assume no real growth for free cash flow in the next five years. Hence, we also assume $6 billion in free cash flow in 2027 and going forward 3M Company should be able to grow its free cash flow by 5% annually till perpetuity. When calculating with these assumptions (and 10% discount rate and 573 million outstanding shares) we get an intrinsic value of $130.04 for the stock.

Even in this scenario the stock is slightly undervalued, and we must consider once again how extreme the assumptions are. No growth for the next 5 years and $30 billion in fines and settlement are not only extreme assumptions, but it would be the highest fine an individual company ever had to pay (see chart above). Maybe we can be a little more optimistic and if we assume only $25 billion in fines and 6% growth from 2027 going forward (so still no growth for the next five years), we get an intrinsic value close to $170 for 3M Company.

I already mentioned countless times how difficult it is to calculate an accurate intrinsic value for 3M Company considering the circumstance. Nevertheless, I would see the fair intrinsic value for 3M Company somewhere between $150 and $200 – depending on the fines the company must pay. And if 3M Company should be able to settle for lower amounts, the intrinsic value would be even higher.

Conclusion

In my opinion, the risk-reward ratio is in favor of 3M Company. Aside from the rather unlikely scenario of bankruptcy (in which case the intrinsic value should be close to $0), the current stock price is reflecting a lot of negativities. Not only is an upcoming recession priced in, huge fines of $25 billion and more due to earplugs and PFAS are also reflected by the current stock price.

And with pessimism about 3M Company being rather high right now, 3M Company is a buy in my opinion. It is going hand-in-hand with basic investment philosophy that one should buy at the point of maximum pessimism (Templeton) and when everybody is fearful (Buffett) and 3M Company might be close to that point.

Be the first to comment