John Phillips

Twilio (NYSE:TWLO) plunged after releasing second quarter earnings results. TWLO continues to grow rapidly even after lapping tough pandemic comparables. The management team has made it clear that the macro environment is barely impacting their business, but their stock trades as if growth will plunge at any moment. With the stock trading at just 3x sales, TWLO stock is a highly compelling buy here.

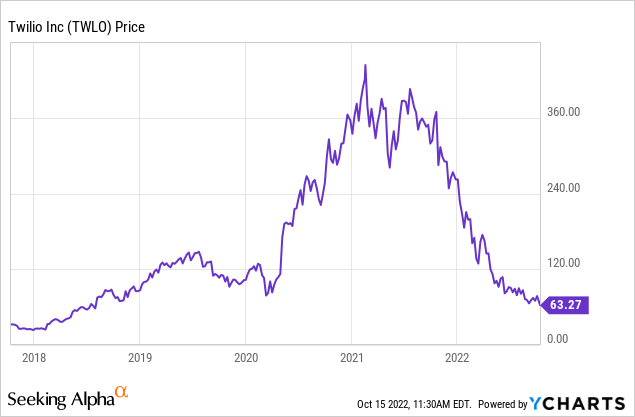

TWLO Stock Price

Like many tech stocks, TWLO has done a round-trip back to pre-pandemic levels. The stock peaked at around $440 per share in early 2021 but has since fallen 85%.

I last covered TWLO in July where I rated it a strong buy on account of the secular growth and valuation. The latest earnings release showed the resilience of TWLO’s business model, warranting inevitable multiple expansion.

What is Twilio?

TWLO empowers its customers with programmable communication. This includes being able to program text messages, voice calls, and more.

Twilio

For instance, customer Airbnb (ABNB) uses TWLO to facilitate messaging between its hosts and tenants. TWLO is one of the companies helping to bring forward the digital world.

TWLO Stock Key Metrics

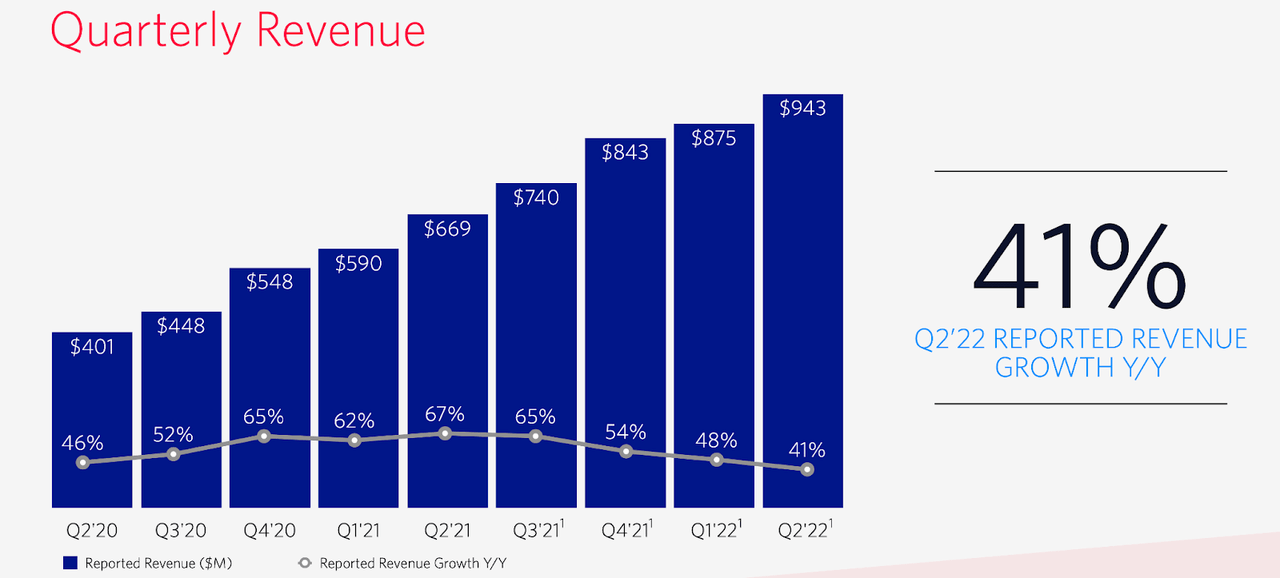

TWLO grew revenue by 41% in the latest quarter.

2022 Q2 Slides

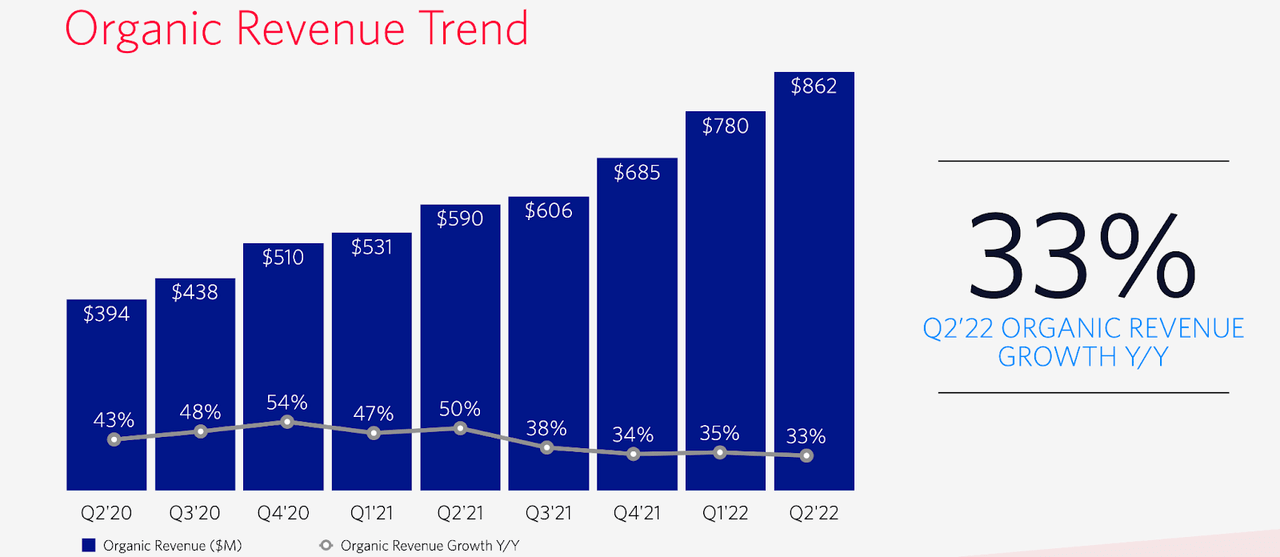

That growth rate included revenue from recent acquisitions like Zipwhip. Excluding those revenues, revenues grew by 33% on an organic basis.

2022 Q2 Slides

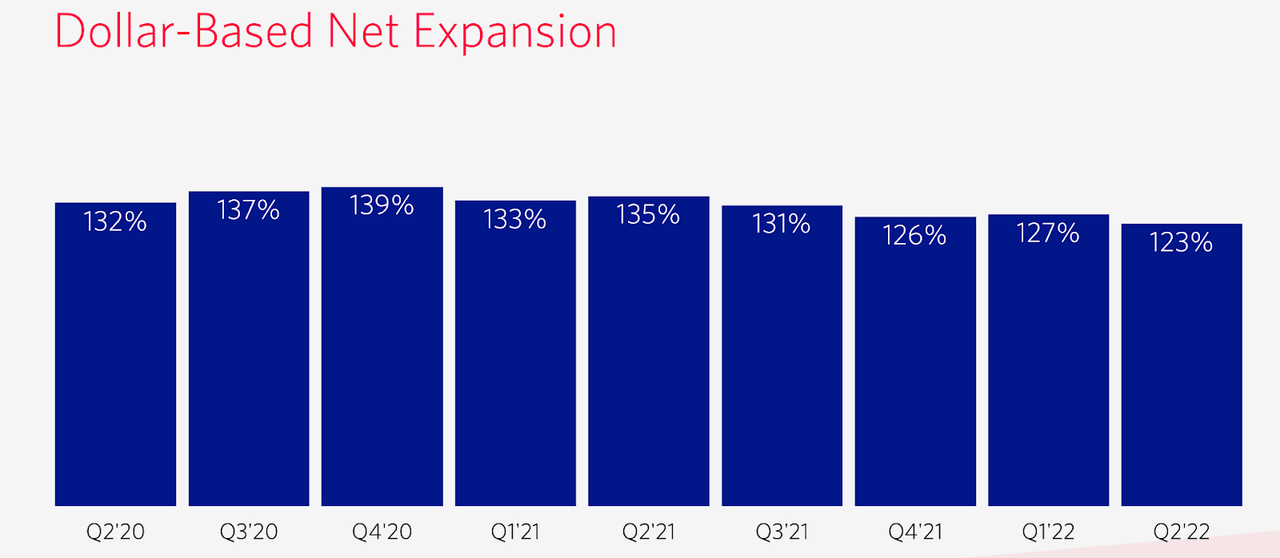

TWLO drove that strong organic growth number through a 123% dollar-based net expansion rate.

2022 Q2 Slides

TWLO ended the quarter with $4.4 billion of cash versus $1 billion of debt. That $3.4 billion net cash position makes up over 25% of the current market cap.

Looking forward, TWLO has guided for the third quarter to see up to 30% organic revenue growth. On the conference call, management reiterated their 30+% long term growth guidance and for non-GAAP profitability beginning in the next fiscal year. They also explained their current approach to managing through the slowing economy:

And so we are readying ourselves for a variety of scenarios. And you probably noted that we’ve taken some actions with respect to slowing down hiring except for some key areas. We’re taking — we guided based on having a real estate charge, which I think reflects our kind of remote-first approach to the way that we’re going to work going forward. And I think both of those things will drive profitability into next year. And I think irrespective of the macro environment, we’re intending to be profitable next year no matter whether it has an impact on growth or not.

The stock nosedived around 15% after releasing earnings anyways. It appears that the market is skeptical regarding the company’s ability to sustain growth and show non-GAAP profits amidst the tough macro backdrop. Regarding the latter point, I note that based on operating leverage alone, TWLO should be able to reach non-GAAP profitability in FY23 assuming 30% growth. Wall Street seems to underestimate how much tech companies invest for growth as well as their ability to scale back such investments to show profits if they wish to.

TWLO Stock Valuation and Price Target

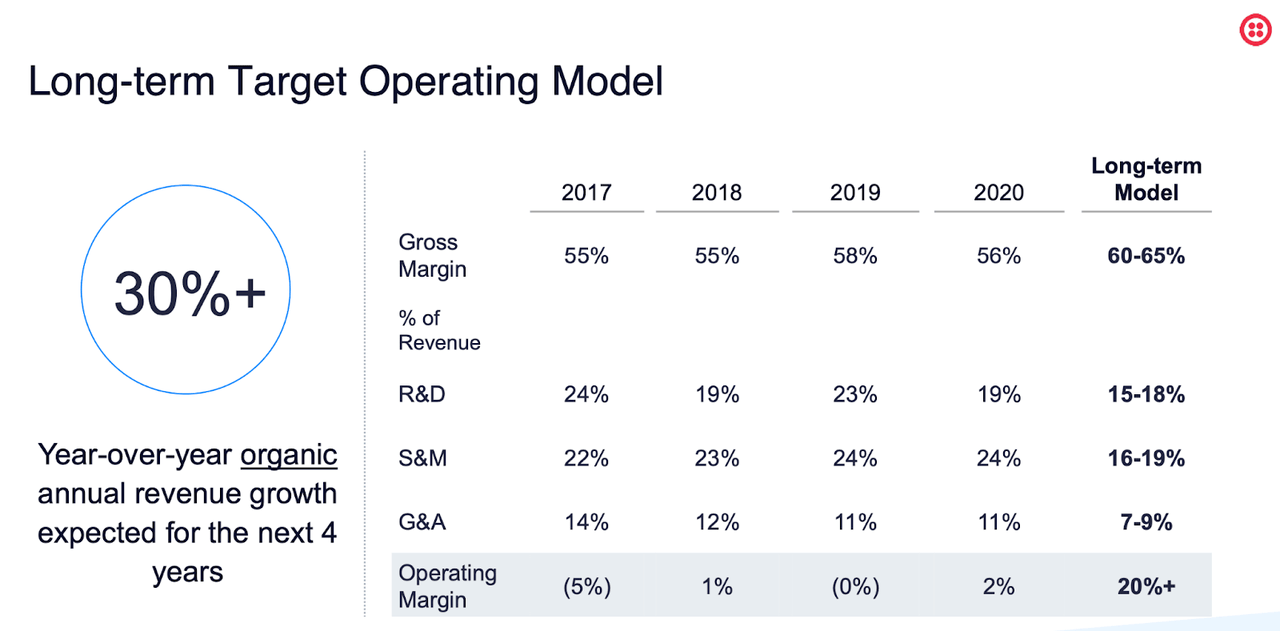

At recent prices, TWLO is trading at just 3x sales. This is a name which has guided for 20% long term operating margins and 30% organic growth through 2024.

2021 Investor Presentation

Given TWLO’s resilient growth rates, you’d think that it’d be trading closer to a name like Cloudflare (NET) which is trading at 25x sales versus 48% growth. Instead, TWLO is trading like a broken story. Assuming 20% long term net margins and a 1.5x price to earnings growth ratio (PEG ratio), I could see TWLO trading at 9x sales or $191 per share in 12 months, implying 203% potential upside. TWLO never should have traded at the levels it did in 2021, but it had previously commanded that premium valuation due to being one of the clearer secular growth stories in the market. That hasn’t changed – though investor sentiment has turned downwards. I expect TWLO to regain investor love gradually as it continues to deliver on growth and profitability plans. Key risks here include decelerating growth. Without profits, this investment thesis hinges on TWLO’s ability to sustain high-growth rates. If growth unexpectedly decelerate, then the projected upside declines though the current valuation arguably already prices that in. Another risk is inability to drive margin expansion. In addition to helping to support the valuation, the high-growth rate is also necessary to drive operating leverage. I view TWLO’s services to be mission-critical and recession resistant, with the ability to continue growing rapidly in spite of macro headwinds. The company’s strong balance sheet validates their decision to continue investing aggressively and non-GAAP profitability next year would help to further derisk the thesis. I have discussed with Best of Breed Growth Stocks subscribers my view that a diversified basket of beaten-down tech stocks can outperform the broader market. TWLO fits right into such a basket as an ideal blend of undervaluation and secular growth. I rate the stock a strong buy as one of the more mispriced names in the tech sector.

Be the first to comment