jaanalisette

Thesis

Speculative growth stocks like CPaaS leader Twilio Inc. (NYSE:TWLO) have continued to come under selling pressure, but the underperformance has not worsened relative to the broad market.

Accordingly, we revised TWLO to Speculative Buy in August, as we anticipated the market to hold its lows. However, the market had other ideas, rejecting the attempted bullish reversal (no validation), and continued to test its March 2020 COVID lows. However, TWLO’s -14.6% decline since our article is in line with the S&P 500 ETF’s (SPY) -14.6% return over the same period. Hence, we posit that the current bottoming process remains valid (until proven otherwise), with a bullish reversal price action still pending validation over the next couple of months.

The market environment remains hostile for speculative growth stocks, given the Fed’s aggressive rate hikes. Moreover, it could likely worsen if the Fed decides to raise its terminal rate (the median terminal rate was 4.6% as of the most recent FOMC) at its upcoming November meeting.

But, it’s reasonable in suggesting that the market has priced in these challenges in TWLO’s valuation. Notwithstanding, TWLO is still priced at a premium, so investors should not rule out further value compression.

Coupled with Twilio’s execution risks through FY24 as it attempts to lift its profitability amid a global recession, investors need to be prepared for more pain.

However, we think the reward-to-risk profile from the current levels is reasonable. Therefore, investors willing and able to tolerate near-term downside volatility can consider adding. However, as a speculative opportunity, investors are encouraged to use robust risk management strategies to take profit/cut losses accordingly.

We reiterate our Buy rating on TWLO but cut our medium-term price target (PT) to $80 (implying an upside of 26.4%), reflecting lower target multiples.

Structurally Low Gross Margins Affect Its Profitability

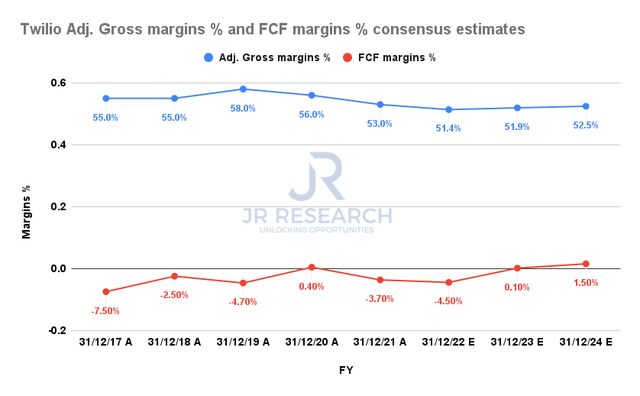

Twilio Adjusted gross margins % and Adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Twilio CEO Jeff Lawson’s commentary at a recent September conference highlighted the structural challenges embedded in Twilio’s current CPaaS business model: low gross margins.

We believe he made it clear that Twilio needs to execute well as it moves into the software space to improve its structural profitability, even as management reiterated its guidance to achieve non-GAAP operating profitability by 2023. Lawson accentuated:

So the way I think about it is this, right, messaging has a structurally lower gross margin than software. It just does. There [are] only so many levers we have to change that. We believe we have a superior product; we believe we have superior distribution, et cetera. But it’s never going to be, in and of itself, a software gross margin business. (Goldman Sachs Communacopia + Technology Conference 2022)

As seen above, the consensus estimates suggest that Twilio is projected to post gross margin improvement through FY24. However, its FY24 adjusted gross margin estimates of 52.5% are nothing to shout about compared to its pure-play SaaS peers. For example, under Public Comps’ high-growth SaaS peers comps, the gross margins at the 50th percentile average about 72%. At the same time, SaaS leader Salesforce (CRM) is expected to post gross margins of 77.7% for FY23 (ending January 2023).

Therefore, we urge investors to consider significant execution risks as Twilio attempts to move into the coveted SaaS space. It’s a highly competitive space that would likely lift Twilio’s profitability significantly if successful. However, Twilio has not proved its execution prowess with its go-to-market. Furthermore, even the bullish Street analysts are not too excited about its gains.

Therefore, we believe investors need to be wary of expecting Twilio to see its valuation mean-revert substantially to the highs after the Fed pivots subsequently. Let us explain why.

TWLO’s Valuation Is Not Undervalued

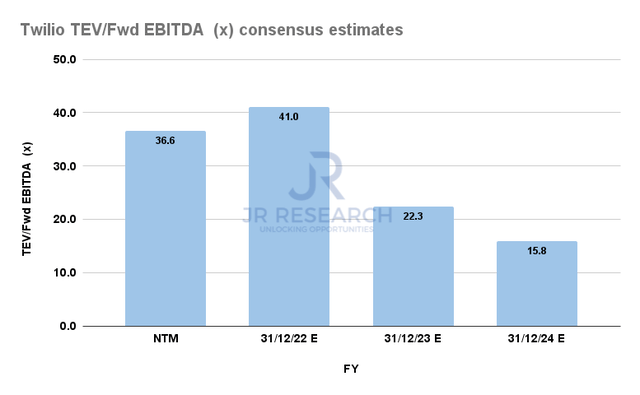

TWLO TEV/Fwd EBITDA consensus estimates (S&P Cap IQ)

As seen above, TWLO is valued at an FY24 EBITDA multiple of 15.8x. Therefore, we deduce it’s more reasonable but not undervalued even when compared with its pure-play SaaS peers.

Accordingly, CRM is valued at an NTM EBITDA of 17.5x, with its peers’ median at 15.3x. Hence, TWLO’s current valuation assumes that Lawson & team could execute its strategy well through FY24. However, investors should consider that the market could force further compression if Twilio demonstrates further weakness in its ability to drive operating leverage growth.

Is TWLO Stock A Buy, Sell, Or Hold?

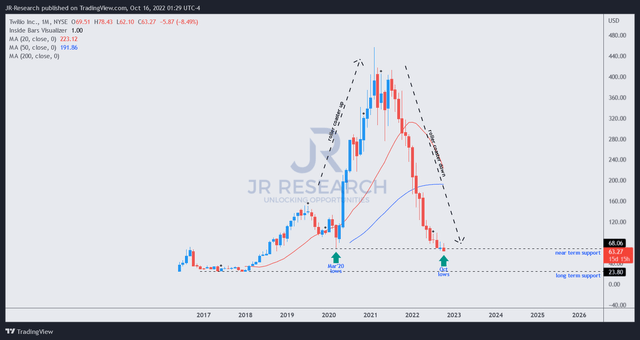

TWLO price chart (monthly) (TradingView)

TWLO’s massive surge from its COVID lows toward its 2021 high made its round trip over the past few months as the Fed-induced bubble on unprofitable growth stocks burst spectacularly.

However, our analysis indicates that TWLO is not undervalued even at the current levels.

We had anticipated its September lows to hold, but the market had other ideas. Notwithstanding, its COVID-basing action remains in play; therefore, a bullish reversal validation is still possible.

As such, we reiterate our Buy rating on TWLO stock but rein in our medium-term PT to $80.

Be the first to comment