gece33

Intro

We wrote about Tutor Perini Corporation (NYSE:TPC) back in July post the company´s first quarter earnings when we backed the company due to how its cash flow generation efforts had meaningfully changed for the better. In fact, the company managed to generate $121 million of operating cash flow in the first quarter and management also cited on the earnings call that cash flow generation would remain elevated for the remainder of the year. We actually saw this once more in Q2 when TPC managed to generate $58 million of operating cash. However, the seismic shift in operating cash flow has not interested the market up to this point. Currently, with shares trading at roughly $5.72 a share, TPC has actually lost almost $3 a share or 34% since we penned our most recent piece back in July. Suffice it to say, Tutor Perini´s valuation is now getting to ridiculous levels but this will be of no consolation to the suffering longs who have remained committed to this play.

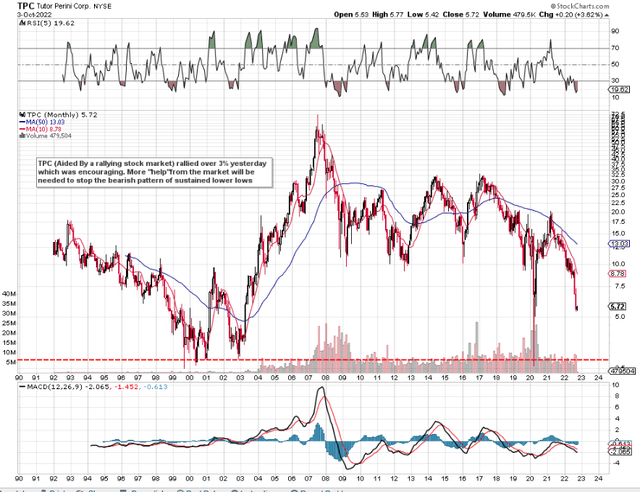

Given the breakdown we have seen in the technicals where lower lows have been the norm for quite some time, it is now a distinct possibility that shares will drop to their 2000 lows. Short interest has been rising and there have been no insider purchases or share buyback programs of late which would have fostered confidence among present shareholders. Therefore, let´s delve more closely into TPC´s valuation (Sales & Assets) to try and ascertain how cheap shares really are in this play.

TPC Long-Term Technical Chart (StockCharts)

We have always stated in our commentary that if a company (with a manageable debt profile) is profitable (Positive P/E ratio), and has a low book, sales, and cash flow multiple, then the possibility of outlasting whatever crisis the respective company may be going through is significantly improved. This is why we believe growth rates in beaten-up stocks such as TPC are not important at this moment in time. In essence, it is all about longevity and staying in the game long enough to ensure the market MUST take notice sooner rather than later.

Price To Sales

Based on a projection of roughly $3.8 billion in sales this year, TPC´s forward sales multiple comes in at 0.08 which obviously is an ultra-low number. Although the company´s sales have never been as cheap, we must also take into account the fact that top-line sales have not been returning the same profitability. Gross margins over a trailing 12-month average now come in at a much lower 6% with gross profit actually coming in negative in the recent second quarter. Suffice it to say, higher costs combined with negative top-line growth are not the trends shareholders want to see here going forward. Better execution in the civil, building, & specialty contractors segments is what is needed going forward to ensure profitability can be registered on the income statement.

Price To Book

Tutor Perini´s forward book multiple comes in at 0.18 which essentially means that investors attain more than $5 of assets for every $1 invested in the company. $1.567 billion of equity was reported on the balance sheet at the end of Q2 with the stock´s market cap currently standing at $293.77 million. The cash balance surpassed $300 million and long-term debt came in at $937 million at the end of Q2. However, when we look at the company´s assets, we see that over 68% of assets are comprised of account receivables ($3.2 billion). How much of this money will be recovered is the key question when evaluating TPC´s balance sheet. I think we all know it will be significantly less but that is not the point here. Management´s objective is to collect close to $300 million over the next couple of years in old receivables which they will most likely combine with the cash balance to pay off company debt as much as possible. Then the pressure on the income statement would subside significantly due to much less interest expense over time.

Conclusion

Despite the ultra-cheap valuation, TPC´s growing backlog, and a significant jump in operating cash due to some successful settlements, the market remains uninterested because of its negative earnings. The company´s assets and sales (both of which are trading for pennies on the dollar) have the potential to reverse the earnings trend and put some type of forward-look guidance back on the map. We need to see capital being turned over faster. We look forward to continued coverage.

Be the first to comment