Antonio Masiello/Getty Images News

The iShares MSCI Turkey ETF (NASDAQ:TUR) would be a low-cost way to get an exposure to the Turkish economy. The question is why you’d want an exposure like that? While 80% inflation, not driven so much by cost-push effects, is already enough of a concern, there are further forces that in particular doom the Lira to some more years of decline. While the ETF contains some exposures that might see limited Lira decline effects, not all of them are insulated, and there are plenty of sectors that could become exposed in an oncoming global recession. Especially on FX risks, we pass on TUR.

TUR Breakdown

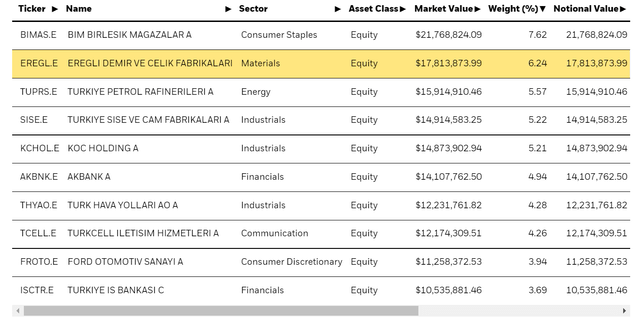

Let’s start with some of the top holdings.

Going through them, they include a couple of businesses whose end-markets trade in the dollar, the reserve currency. Things like steel production, refinery, other manufacturing and commodity products do trade in dollars on global markets and therefore are a long position against the dollar as opposed to the Lira.

It is essential to avoid the Lira, especially now. While the Lira has already been in substantial decline for years, and this has caused precipitous imported inflation, there is more gas on the fire now with the Turkish central bank pushing unbelievably for more dovish policy, lowering reference rates by 1% from 13% to 12%. A country like Japan might be able to afford a move like this, especially when it has the threat of deflation brought on by cultural and demographic challenges. Turkey has no clear reason to do this, and it only exacerbates the economic problems with the Lira, and with the Fed in the US pushing with rate hikes on their already advantaged reserve currency, the Lira will continue to fall.

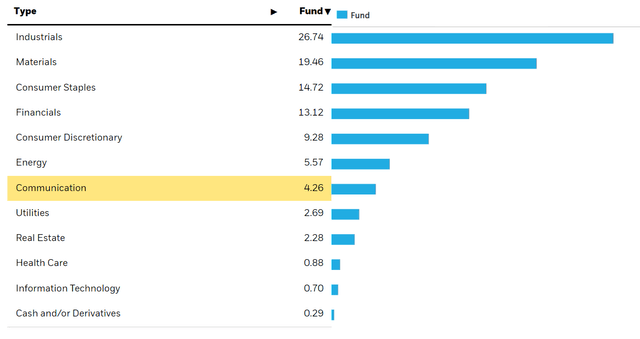

The sectoral exposures aren’t ideal either. There’s a fair bit of retail exposure and consumer discretionary stuff that would be levered to economic declines that may appear the world over. Then there are plenty of segments that directly suffer from rate hikes, and have no innate Lira protection like financials.

Remarks

While many of these businesses should be capable of hedging some of the Lira risk, those hedges will be expensive and unlikely to be long in duration. If the Lira decline is protracted, those hedges will not stop longer-term threats to the earnings line, in addition to the immediate ones associated with hedging a currency that is almost universally understood to be in decline. Unfortunately, the monetary situation remains such a complication that advantages that Turkey has with respect to Russia, that is a privileged position to be able to import Russian oil, cannot be capitalised upon and save the country from cost-push inflation that even established western economies are dealing with.

The PE of this ETF is 10x, which certainly isn’t high but doesn’t appear particularly enticing given the economic concerns around inflation, a central bank persisting with MMT, and definite costs associated with the Lira decline relative to the dollar. With sectoral exposures that are also rather levered to spending declines, the uncertainties are substantial here, and we would pass given our current level of insight.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment