Floortje

Dear readers,

It’s always fun to write about a well-known company, especially one that you know everyone knows but not everyone might know is publically traded. Several of my Scandinavian readers did not know this one is publically traded either, which makes it a fun thing to research and get into.

I’m talking about Levi Strauss (NYSE:LEVI) – the company I’m going to be looking at in this specific article and try to get a bit of a thesis going on.

Without further ado, let’s get going.

Levi Strauss – Looking into the company

Levi’s is an interesting business to look at. Almost everyone knows Levi Strauss – it’s one of the world’s largest apparel companies and well-known names in clothing – specifically jeanswear. Since its inception, the company has sold clothing.

Its products are sold in over 110 countries in the world, using a combination of chain retailers, department stores, online stores, and specific Levi’s-dedicated stores that number around 3,000. From a high level, there are similarities between a business like Levi’s and a business like adidas (OTCQX:ADDYY) or NIKE (NKE).

Both work with manufacturing capabilities, usually outsourced, and have taken stances with regard to owning or outsourcing those capacities. Both require substantial logistical solutions, deploying its product from manufacturing bases to sales points around the world.

The company began its history during the California Gold rush – and since then, it has grown into a global-spanning apparel empire, including brands like Levi’s, Dockers, Signature by Levi Strauss & Co.™, and Denizen brands. The company designs, markets, and sells its own products – either through third-party retailers or using its own stores. Its products include jeans, pants, tops, shorts, skirts, dresses, jackets, and even footwear and other accessories for adults and children both. The company also owns tertiary brands, with the latest M&A being Beyond Yoga, a body-positive premium athlete brand.

The company’s organization has gone through a number of changes over the past few years. Since 2021, the organizational structure is simplified. It currently holds the Levi’s Brands business, which is then geographically split into three segments – Asia, Americas, and Europe. The Dockers segment meanwhile as well as the Beyond Yoga brand is not reported geographically, but in “other brands”, as it does not meet the quantitative sales threshold for other reporting.

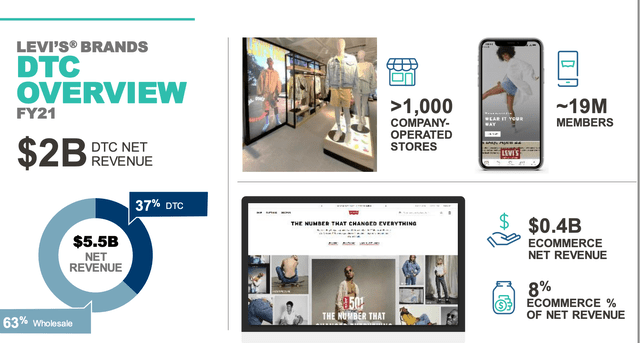

Like most apparel companies or design companies, Levi’s has moved to an increasing share of DTC – online-based or technology-based. From a 20% sales share in 2011, it’s grown to 40% in 2021, and the company target is 60% going forward. The DTC channel, as with other companies, is the preferred sales method due to the direct connection potential to consumers, because the company can to a high degree control the experience and also collect analytics. The company, therefore, seeks to increase investments in both its stores and its online platform.

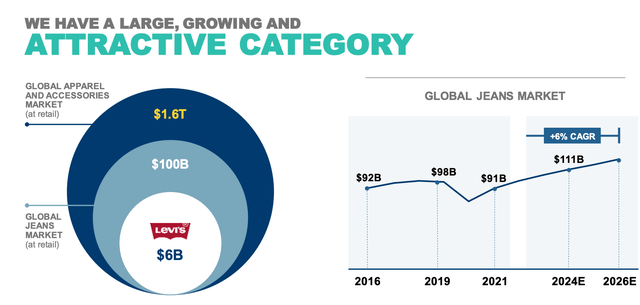

The company has some impressive stats. We’re talking net revenues of close to $6B, with a gender split of around 65% sales to men and the rest to women. In terms of what types of products, Levi’s is mostly a bottoms company – meaning jeans and pants – only 5% of sales are footwear/accessories, and 20% of sales are tops.

Out of brands, 87% of sales are the original Levi’s brands, with 5% Dockers and the rest split between the other brands, including Beyond Yoga.

The company is the strongest in the Americas, with over 50% of sales. Europe is only 30%, and Asia is around half that.

The company’s products, aside from its 3,000 owned locations in one way or another, are sold in 50,000 retail locations. The company has a strong leadership team, with most of the team at close to, or above 10 years of experience at the company. With $6B in sales, the company is targeting a worldwide apparel and accessories market that is many-fold the size.

As to the fundamental question, if whether Levi’s sells attractive products, I believe the question fairly is answerable with a resounding “Yes”. When it comes to Jeans, I only wear Levi’s as experiences with other brands have shown me that the company’s quality is easily among the better – as is its fit. As to the other, peripheral products I say that I’m mostly interested in its signature products, and I believe the same is true for most consumers.

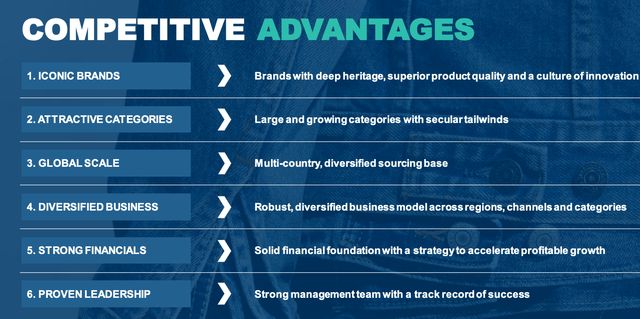

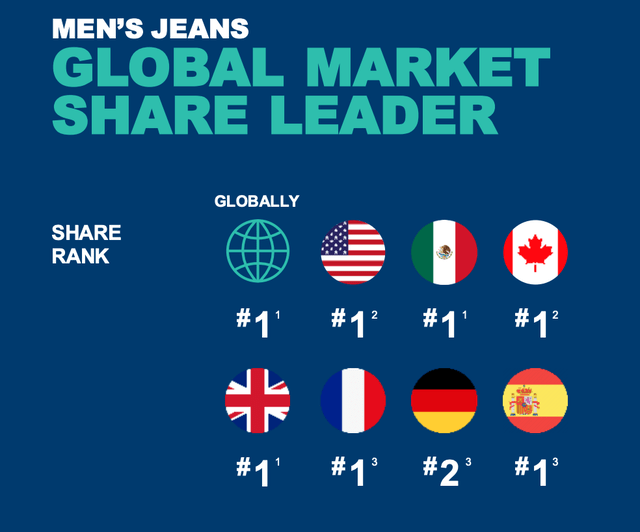

The company’s market position means that Levi’s generates impressive margins. 50-60% on a gross basis is a good baseline for a premium company like this. Levi’s manages 58%, and a 12.4% pre-tax profit margin. It’s been gaining market share for the past several years, and while all companies need to spend money on marketing, a brand like Levi’s much like other premium brands, have what we can call unaided brand awareness.

It’s market position and share across the world is impressive.

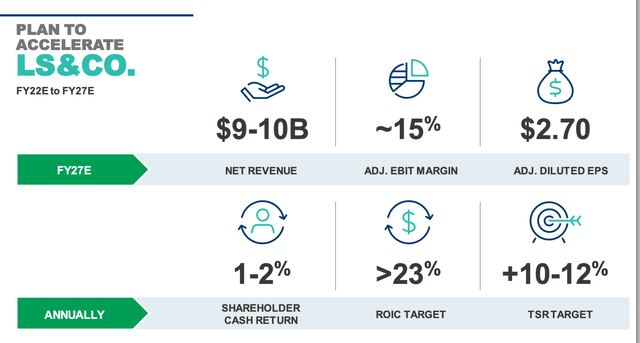

The company’s future strategy is to be a DTC-first, brand-led apparel business with diversification and specialization with brands like the Beyond Yoga brand. Operational excellence and expansion should bring about sales increases, while at the same time expanding the EBIT Margins by another 250 bps, pushing it to or above 15%, which would be impressive.

At the same time, the company wants to return 10-12% RoR to shareholders on an annual basis. This is the company’s 5-year plan to 2027E.

From a historical perspective, this is going very well. Sales are showing a growth of around 6-7% per year, and if the company manages the same going forward, will climb to double-digit billions in sales.

How?

By pushing marketing, diversification, and really growing that profitability by cutting out middlemen to as high a degree as is considered possible here. DTC leadership is being established and is being pushed as well.

Recent results suggest the company’s work is seeing progress and success – at least on a high level. For the past few quarters and due to current macro, we do see some deterioration based on export flows and cost increases – but those are not unique to LEVI, and pretty much just need we need to be paying a little less for the company – not in any way that it’s not investable here.

Retail overall is in a difficult position at this time, and almost all companies in the space are seeing limitations to short as well as medium-term earnings visibility. This has caused many analysts to cut their targets on LEVI – and I certainly won’t go into the company with a massively positive stance here either.

The company’s dividend history is limited. This also limits its appeal. Aside from this, the company’s credit rating isn’t good. it’s BB+, so it’s not abysmal, but it’s not investment-grade rated. I’m not too worried about this, because after all we’re talking about Levi’s. It’s crucial that investors not use credit ratings as a blunt instrument, either yay or naying a company based on them but understand the underlying trends.

As for the dividends, these are expected to massively increase – more than triple – in less than 3 years, which would put the yield above 3-4%.

Recent results show us company revenue growth reflects a very strong consumer demand that does not in turn reflect the current worries about retail. The company also managed to expand its EBIT margins alongside its targets – 90 bps in a single quarter YoY. I will say that I believe that the company’s strategy is working, and any shortcoming we might see in 3Q22 or 4Q22 is unlikely to be entirely due to the company’s own actions – but more related to overall macro.

In the end, LEVI at its current position is a consideration of value.

So let’s look at valuation.

Levi’s Valuation

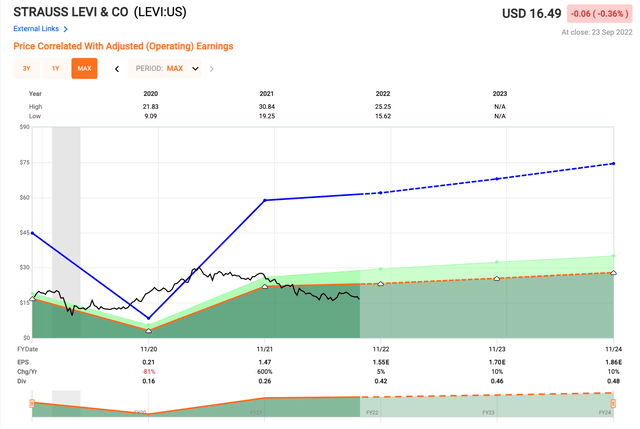

The thing is, that LEVI is currently at a relatively low multiple to their average earnings. The current multiple is close to 10.5x – no matter how you slice that, that’s a low multiple for world-leading brands such as this. And this is part of a history of share price decline that’s been ongoing for over a year.

LEVI Valuation (F.A.S.T. Graphs)

The upside even to a 15x P/E, which is conservative for the company, is significant – showing us over 75% RoR until 2024E. The yield may not currently be all that impressive, but is expected to grow going forward.

The company lacks a great deal of analyst history that would justify confidence in forecast accuracy. So while the company’s analyst hit 100% of the time on a 2-year basis with a 20% MoE, that’s with a very limited history which makes it of only limited value.

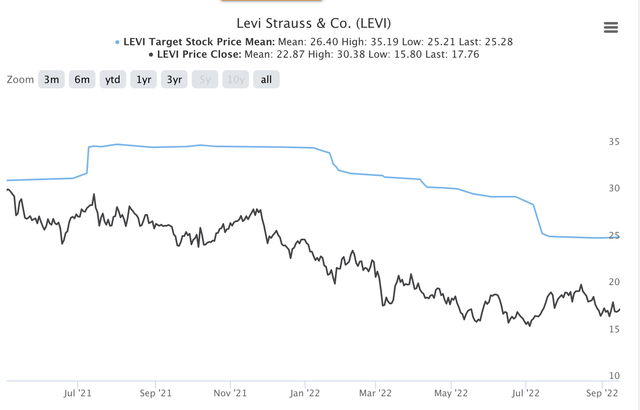

More valuable is the company’s share price history in relation to valuation targets. 13 analysts follow the company, and their targets have shifted quite a bit for the past year, dropping from $31/share to around $25/share, working from a range of $19/share on the low end to $33/share on the high end. 12 out of 13 analysts are either at a “BUY” or an “Outperform”, which is in line to my own stance here.

I consider the bullish perspective on Levi’s to be the most realistic one here. I believe LEVI will be able to expand its DTC on the basis of its incredible brand strength and awareness. This will go beyond the current macro challenges, even if we see a momentary drop or pressure in margins.

The result of this is obvious to me – at least eventually – appreciation and returns. Still, I wouldn’t want to overextend against the downsides of the credit rating and the dividend history. With everything said, the company is new as a dividend payer, and it’s far from as stable as some of the other investments I make.

LEVI share price targets (S&P Global/TIKR)

This in turn dictates limiting exposure, and not valuing the company as high as some of the other apparel companies that I invest in.

In the end, I can accept a 12x normalized P/E, which comes to around $20/share, and trends to the lower range that my analyst colleagues hold. I wouldn’t go any higher than this – there are better companies out there with higher quality scores.

But this company is still a great one – and there is a definite upside to be had from investing in it.

That’s why I’m considering investing here.

Thesis

My thesis for LEVI Is as follows:

- LEVI is one of the world’s premiere apparel companies and a leader in denim. It’s comparable to premium businesses in apparel, but lacks the credit rating and history of those companies, even if it shares other qualities in terms of margins and price points.

- As long as we can impair the company for those downsides or lacks, I have no issue investing in the company at a cheap price. That’s where we currently are. I’m considering investing in the company at an undervaluation.

- My PT for the company is $20/share – and to that price target, there is an upside and a “BUY” here.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment