hapabapa

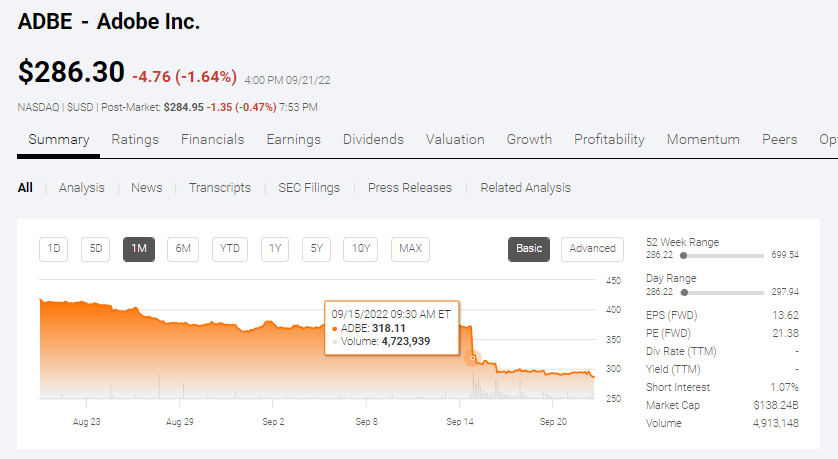

The ongoing investor rage against Adobe (NASDAQ:ADBE) is an emerging opportunity. Watch, wait, and pounce. This leading SaaS company’s stock got bullied down from $318 down to below $290 in less than 10 days.

Seeking Alpha

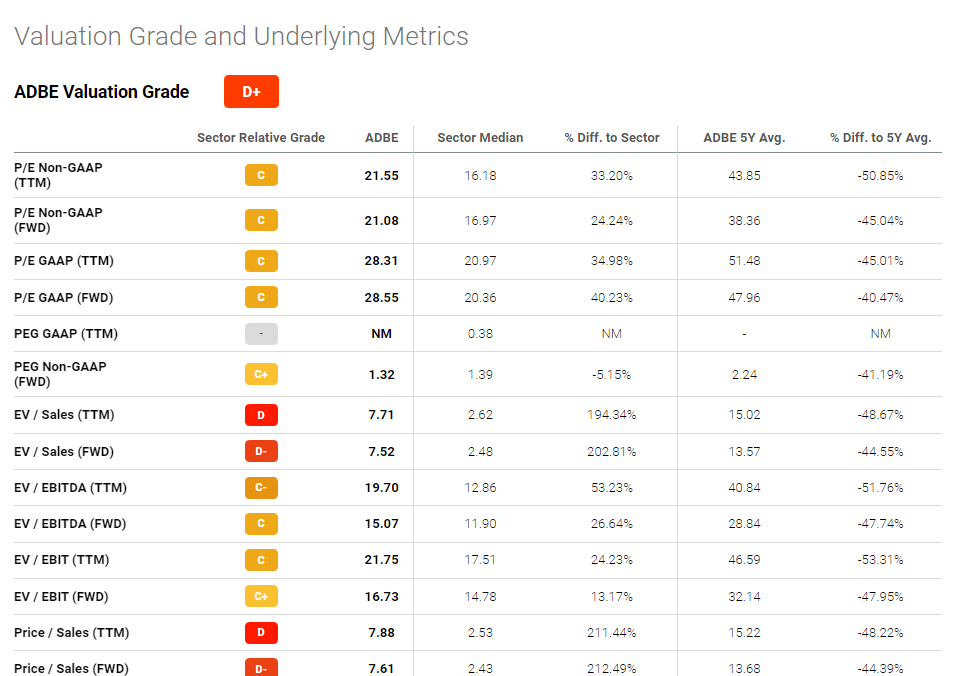

Figma’s estimated gross sales for fiscal year 2022 is $400 million. Management valued Figma at 50x Price/Sales. ADBE’s Price/Sales valuation is less than 8x. The rebellion-inducing buyout of Figma will eventually give ADBE a valuation grade of C+ soon. Be grateful of this investor negativity.

Seeking Alpha Premium

This acquisition will compel Adobe to add to its $4.64 billion debt. Adobe’s total cash is only $5.76 billion. My fearless assessment is that ADBE will end 2022 as a $300-ish stocks. Most investors are emotional. The negativity over ADBE will eventually evaporate.

Why The Negativity?

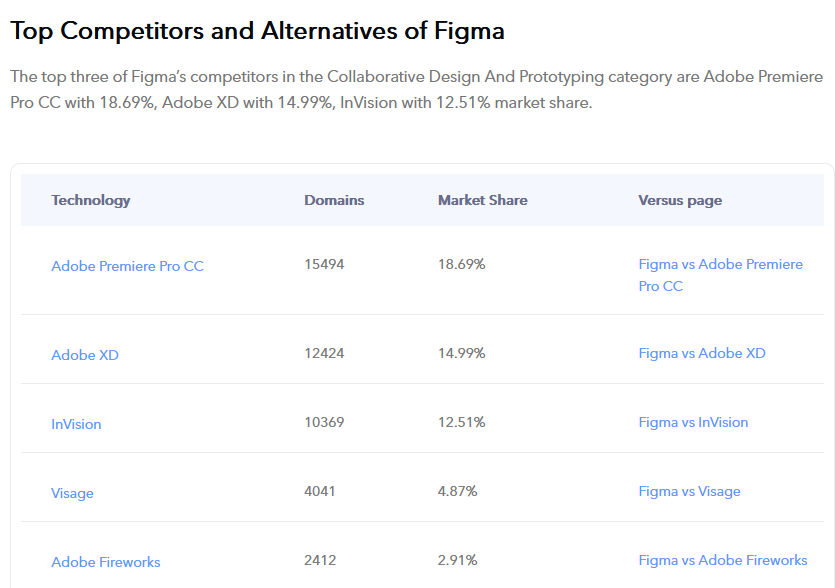

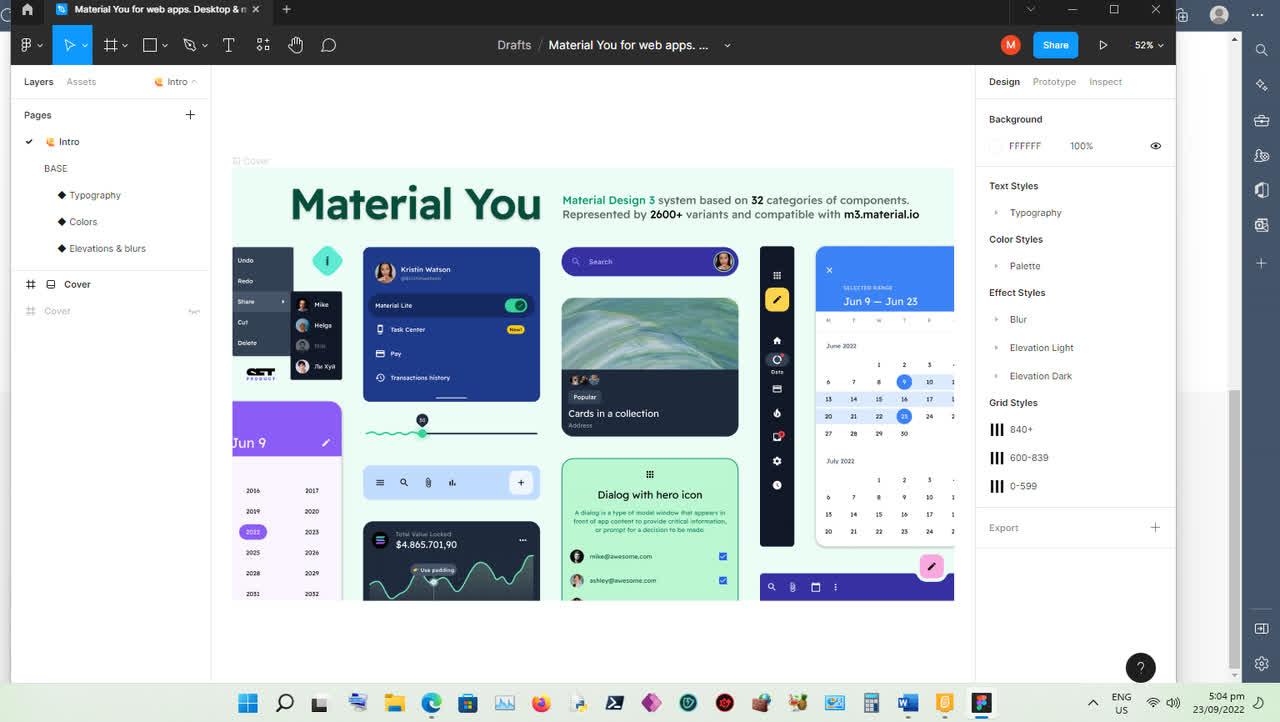

Many are infuriated by management’s pricey $20 billion gambit to delete Figma as a rival. Figma’s valuation last year was only $10 billion. Adobe’s hired programmers could have built clones of Figma’s two popular browser-based collaborative products for less than $1 billion. The main $15/month Figma software below convinced me it is easy to clone using C++ or C# and WebAssembly.

The $9.99/month desktop PC-only Adobe XD UI/UX product could be redeveloped through Rust, C# C++ programming languages. After which, Adobe XD could be transformed into a browser-based rival of Figma via WebAssembly. The desktop PC-only Adobe XD has 14.99% market share in global collaborative design and prototyping software. Figma has 31.41%.

Slintel.com

Adobe is buying the most successful UI/UX software and its customers. By next year, Adobe will have almost 70% market share of the global collaborative design software industry. The overall global collaboration software market was worth $21.69 billion last year. Its estimated CAGR until 2030 is 9.5%.

Browser-based collaborative design is the way to go. I am sickly but still involved in the graphic design/content creation industry. I still use my old $599 Adobe Photoshop CS6, but I no longer subscribe to any Adobe Creative Cloud product.

Motek Moyen

The donationware and browser-based Photopea is a good alternative to the $9.99/month Photoshop CC. Figma’s pen tool and Boolean operations feature also convinced me not to pay for the $19.99/month Illustrator CC. The browser-based vector drawing app, Vectr, is decent enough to create 2D mobile/web video game assets.

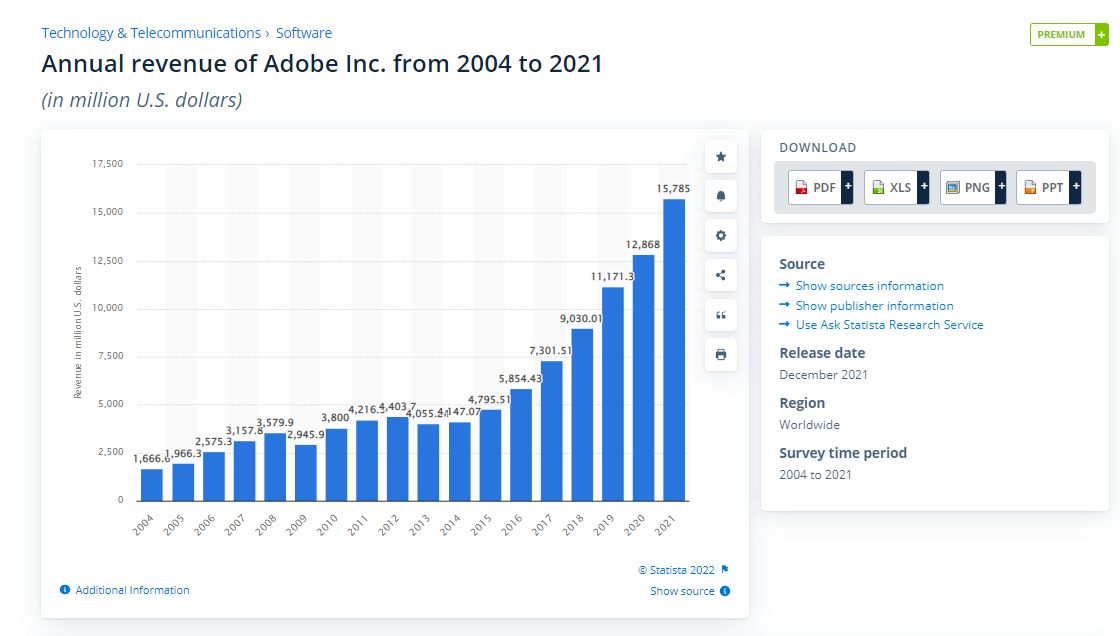

Adobe’s $15.7 billion/year SaaS business is threatened by browser-based software products.

Statista.com

Figma and the $5/month FigJam might just help Adobe reach $20 billion in annual sales by 2024. FigJam is a whiteboarding software. Adobe will share in the fast-growing (18.36% CAGR) $1.7 billion collaborative whiteboarding software opportunity.

The graphic designers’ market is worth $45.8 billion (print/digital). Owning Figma keeps those highly-paid graphic artists/content creators under the Adobe Creative Cloud umbrella. Adobe XD will probably get killed quickly. It will be replaced by a $19.99/month Adobe Figma next year. The $20 billion Figma will solidify Adobe’s dominant graphic design and UI/UX/prototyping products like Illustrator CC, Photoshop CC, and Premiere CC.

Let ADBE Fall

Unless activist shareholders go to court, Adobe cannot back out from this $20 billion acquisition. Nearsighted herd mentality will keep pushing down ADBE from the lofty 52-week high of $699. The quantitative AI gives ADBE a momentum grade of D. This stock’s 30-day performance is at -31.52%.

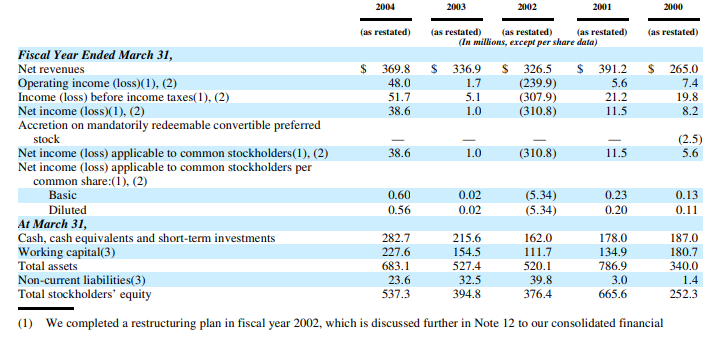

Let others fume that Figma is Adobe’s most expensive acquisition to date. The $20 billion price tag (50% cash, 50% in ADBE shares) might be greater than the sum of what Adobe spent on its previous 55 acquisitions. The Figma deal is far more expensive than the $3.4 billion (all stock, no cash involved) Adobe paid for Macromedia. Figma has two browser-based products. Macromedia had dozens of products. Its fiscal 2004 revenue was $369.8 million. Adobe bought Macromedia at less than 9x Price/Sales.

Source: Macromedia, Inc. Form 10-K/A

Technical indicators are also saying ADBE is headed for more dips. This stock’s RSI score is 19.91. ADBE is under Oversold Buried. It means the RSI score is below 30 for the past 3 trading days and signifies a short-term bearish alert.

The pessimism over ADBE might worsen when emotional investors start getting scared that templates-driven browser-based graphic design platform Canva touts a 2021 market valuation of $40 billion. Canva’s freemium online platforms caters to small-budget customers who cannot afford graphic designers. Canva therefore hurts Adobe software products’ appeal to tight-budget customers.

Adobe already has a freemium browser-based rival against Canva. It is called Adobe Express (created from the old AI-driven mobile app Adobe Spark). I have not tried Adobe Express, but I hope they retained the AI-driven procedure to create multiple versions of a template-based design.

Final Thoughts

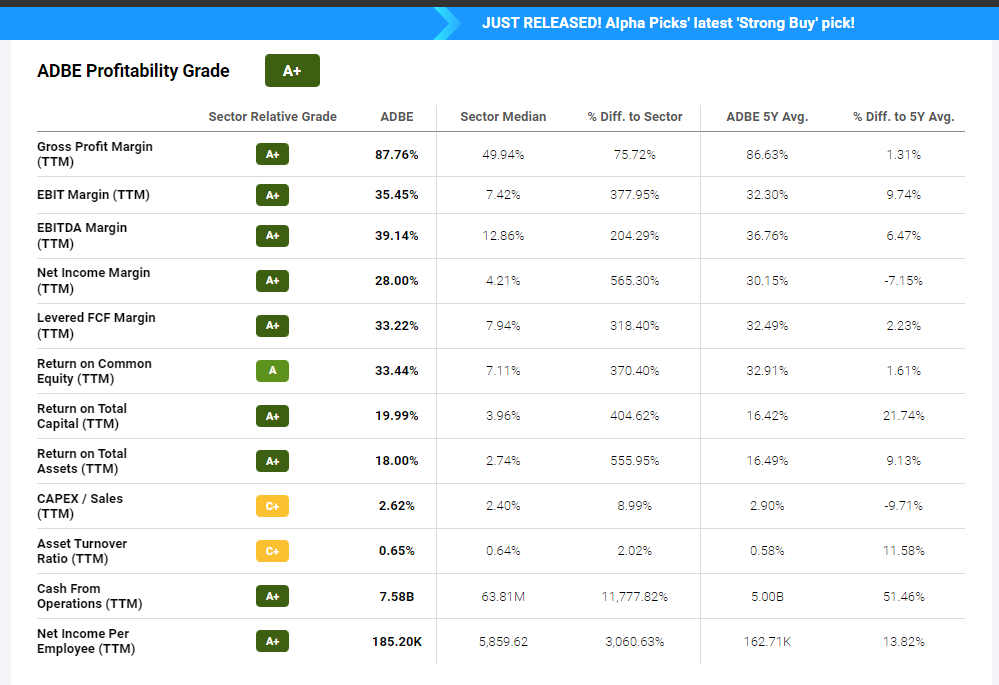

The $20 billion gambit on Figma is worth it. It is never cheap to buy a rival with superior/more successful products. The most compelling reason to go long on ADBE is its high profitability. Going big on browser-based collaborative design software might improve ADBE’s 28% TTM net income margin.

Seeking Alpha Premium

This high-profitability is thanks to Adobe’s invidious dominance of the graphic design software industry. With Figma under its thumb, Adobe’s subscription-only products are now available for any computing device that can run Google (GOOG) (GOOGL), Firefox, Microsoft (MSFT) Edge, Windows, macOS, Android, and iOS.

Buying the competition means Adobe will have no fear raising its monthly subscription fees. Adobe will definitely remove that free-but-limited Figma plans. They will get replaced by a free 7-day trial option. In the old days, Adobe used to give a 30-day trial for all of its products.

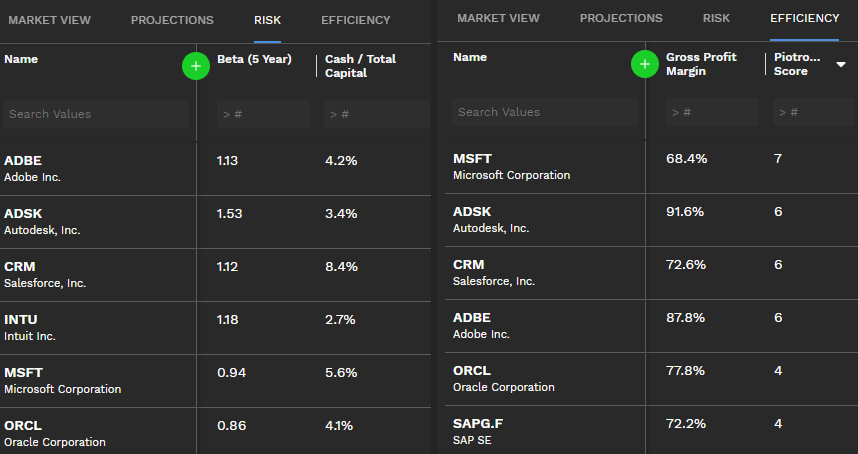

We cannot deny ADBE remains an efficient, safe growth stock. Its Piotroski score is 6 and the 5-year average beta is 1.13.

Finbox.io Premium

Don’t panic, Adobe’s moat has no leaks. Figma and FigJam fortify Adobe Creative Cloud’s dominant appeal inside the $45.8 billion graphic designers market.

Be the first to comment