deepblue4you/E+ via Getty Images

Whether you love it or not, it’s undeniable that the modern era is defined not by physical products but by data. Through the use of data, actionable insights can be realized and the end result can be incredibly beneficial for the parties that can use said data the best. One company that is dedicated to using its technology to provide data-oriented solutions to its customers is CalAmp (NASDAQ:CAMP). Given the direction that the world is moving, constantly generating and consuming more and more data every day, you might think that the fundamental picture of the company has been robust. Unfortunately, the opposite has been the case. Although it’s true that the enterprise is going through something of a transition aimed at reinventing itself for the long haul, the overall fundamental picture looks weak. Sales have been falling and profits have been following that trajectory as well. On the other hand, it is also true that if the company were to revert back to the kind of profitability it experienced in prior years, shares might offer some upside potential. But until we see some degree of stability, investors would be wise to stay clear of the enterprise. And since there is no evidence of that stability today, I do believe that a more appropriate rating for the company at this moment would be a ‘sell’, reflecting my belief that its shares will likely underperform the market for the foreseeable future.

A data-oriented business that’s in trouble

According to the management team at CalAmp, the enterprise operates as a connected intelligence company that leverages a data-driven solutions ecosystem aimed at helping people and organizations improve operational performance. For the most part, the enterprise focuses on serving customers in the transportation and logistics, commercial and government fleets, industrial equipment, and consumer vehicles categories. Using the solutions that it provides, it hopes that customers can be presented with data and insights that offer real-time visibility into their vehicles, assets, drivers, and cargo. The end result here is to provide a greater understanding and control of a customer’s operations to that customer so that visibility, safety, efficiency, maintenance, and sustainability can all be optimized.

As of the end of its latest fiscal year, CalAmp was generating data for a global customer portfolio across an installed base of roughly 10 million devices that actively report data to the company’s cloud-based platform. But this is only the tip of the iceberg when it comes to what the company engages them. To best understand the firm, we should dig into its various solutions one by one. At the top of the list, we have the CalAmp Telematics Cloud offering. This platform seamlessly integrates with the company’s edge computing products in order to provide customers with detailed information and insights as part of a SaaS (Software-as-a-Service) subscription product. Customers have the ability to engage in a number of activities using this technology, such as managing fleet video intelligence, remote asset tracking, real-time crash response, and more. Under the Intuitive SaaS Applications bracket, the company offers customers intelligent analytics and reporting solutions such as the CalAmp iOn, which has been built specifically for fleets, transportation and logistics needs, and industrial equipment. This particular offering turns multiple data feeds from previously unconnected networks of assets into clear and actionable insights aimed at helping customers optimize their own data. Other solutions under this umbrella include Bus Guardian, which enables contact tracing and hygiene verification in order to keep students, drivers, and other school staff safe during the COVID-19 pandemic, and Here Comes The Bus, which is an application that provides real-time school bus location services using push notifications and e-mail alerts.

Under the CalAmp Marketplace offering the company has, it provides enhanced contextual information from third-party systems or partners that augment the company’s telematics data in order to provide customers with an even better understanding of their businesses. The Developer Portal the business provides enables the seamless management of data across a diverse set of assets. And the Flexible Edge Computing Products the enterprise offers involve a series of telematic edge products that ultimately collect data insights from various assets.

At the end of the day, the company’s operations are really centered around two key segments. The first of these is the Software & Subscription Services segment, which offers the company’s cloud-based application enablement and telematics service platforms to its customers. Services under this category include tracking and monitoring when it comes to vehicle fleets, as well as supply chain integrity and international vehicle location data. The other segment, meanwhile, is referred to as Telematics Products. Through this, the company offers advanced telematics products like asset tracking units, mobile telematics devices, fixed and mobile wireless gateways, and routers.

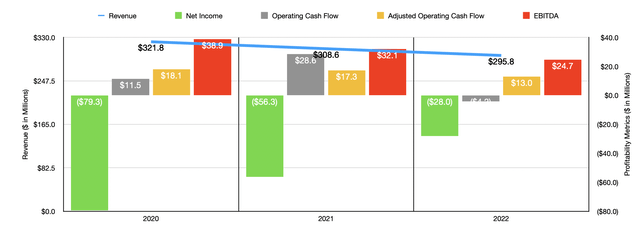

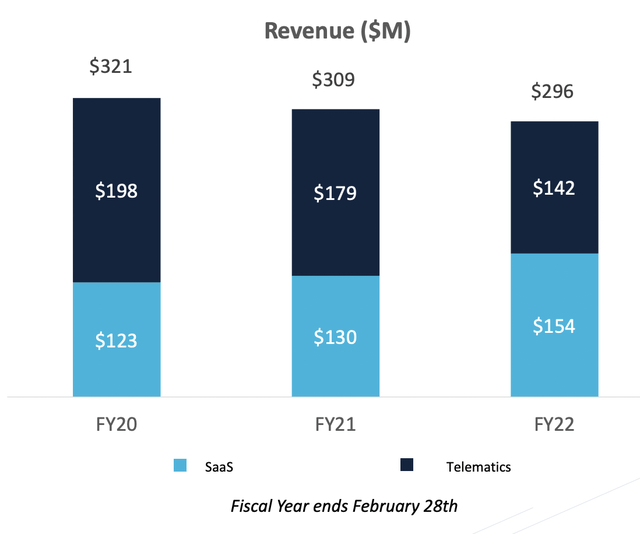

Fundamentally speaking, the picture for CalAmp has been rather rough in recent years. From 2020 through 2022, sales of the company declined from $321.8 million to $295.8 million. It is important to note, however, that this decrease in sales on its own can be rather deceptive. In addition to engaging in one asset sale as well as multiple acquisitions, the company is also transitioning its business model away from the telematics products that it has historically primarily focused on. Back in the 2020 fiscal year, for instance, the company generated $198.3 million from its telematics offerings. By the end of its 2022 fiscal year, these operations accounted for a more modest $141.5 million in revenue. Part of this decline, management said, was largely due to a global supply imbalance that limited the company’s ability to fulfill customer orders. Over that same three-year window, however, the company did see some nice growth in the software and subscription activities that it engages in. Revenue there rose from $123.5 million during the 2020 fiscal year to $154.3 million in 2022. Most of this increase came during the 2022 fiscal year, with revenue surging by 18.8% largely because of a $20.9 million rise in transportation and logistics revenue. This, in turn, was driven primarily by 3G to 4G equipment upgrades, particularly with the company’s largest customers. The company also benefited to the tune of $13.4 million on this front from the transition of certain Telematics Products customers onto subscription arrangements the company has been moving in the direction of.

When it comes to profitability, the picture for the company has also been rather disappointing. But at the same time, things could have been worse. For instance, between 2020 and 2022, the company went from generating a net loss of $79.3 million to a more modest net loss of $28 million. At the same time, other profitability metrics worsened. Operating cash flow went from $11.5 million in 2020 to $28.6 million in 2021. But then, in 2022, it came in negative to the tune of $4.2 million. If we adjust for changes in working capital, the trend is even clearer, with the metric going from $18.1 million in 2020 to $13 million in 2022. That same downward trend can also be seen when looking at EBITDA, which went from $38.9 million to $24.7 million over the past three years.

On September 23rd, shares of CalAmp plunged by nearly 17%. This decline came largely as a result of a disparity between what management has been pushing toward and what has ultimately come through the pipeline. For instance, in its latest investor presentation, the company said that it is aiming to achieve annual revenue growth of 10% or more moving forward. They also said that they anticipate adjusted EBITDA which equates to roughly 20% of said revenue. The company hopes to achieve this while moving ever more in the direction of the SaaS offerings it provides, with the target of making 70% of revenue coming from those activities compared to the 52% of revenue that it comprised in the 2022 fiscal year. Unfortunately, the data provided by the company did not come even close to resembling that.

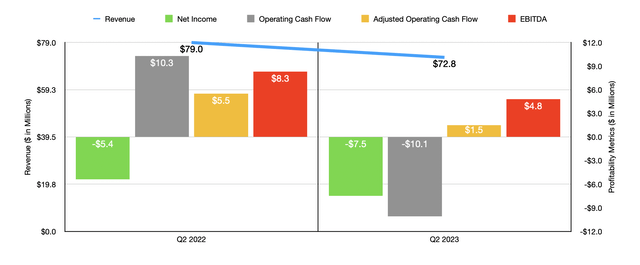

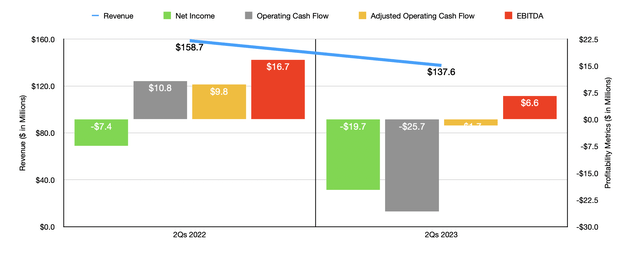

Revenue for the company came in during the quarter at $72.8 million. That’s down from the $79 million reported one year earlier. This brought total results for the first half of the year down to $137.6 million compared to the $158.7 million reported in the first half of the 2022 fiscal year. The company also saw its bottom line post some pretty dismal results. In the latest quarter, its net loss came in at $7.5 million. This compares to the $5.4 million loss reported the same time last year. Operating cash flow went from $10.3 million to negative $10.1 million. Even if we adjust for changes in working capital, it would have gone from $5.5 million to $1.5 million. Meanwhile, EBITDA for the company also worsened, dropping from $8.3 million to $4.8 million.

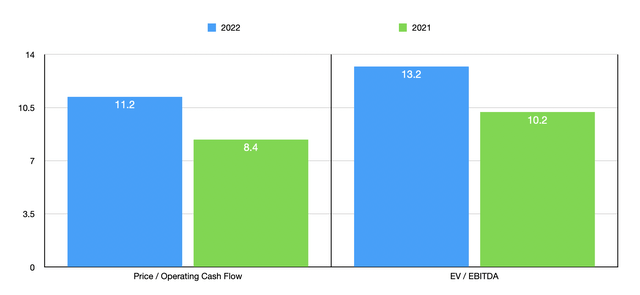

When it comes to the 2023 fiscal year as a whole, we don’t really know what to expect. But if we were to price the company based on data from 2022 or 2021, shares would look quite affordable. In the chart above, you can see this pricing while in the table below, you can see the pricing of four similar companies. What this suggests is that shares of CalAmp look incredibly cheap if we assume that business can eventually stabilize. But with revenue continuing to fall and its bottom line results worsening in a space that is expected to grow nicely for the foreseeable future, there isn’t much to be optimistic about.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| CalAmp | 11.2 | 13.2 |

| KVH Industries (KVHI) | 58.3 | 18.2 |

| Ceragon Networks (CRNT) | 39.5 | 16.5 |

| Lantronix (LTRX) | 74.7 | 188.4 |

| Quarterhill (OTCQX:QTRHF) | 3.2 | 2.4 |

Takeaway

Based on the data available, I must say that I find CalAmp interesting, but I also don’t believe that it makes for a high-quality prospect. I don’t like the idea of trying to catch a falling knife even though I recognize that the firm is in transition to focusing more and more on software and subscription activities. I normally would find such a shift to be attractive, but given the fundamental condition of the enterprise here and the absence of clarity moving forward, I would make the case that there are certainly better prospects to be had today. So until that picture changes, I have decided to rate the business a soft ‘sell’ for now.

Be the first to comment