Vertigo3d

Earnings of TrustCo Bank Corp NY (NASDAQ:TRST) will likely surge this year on the back of steady loan growth. Further, the company will likely continue to deploy its excess cash, which will boost the margin. Overall, I’m expecting TrustCo Bank to report earnings of $3.51 per share for 2022, up 10% year-over-year. For 2023, I’m expecting earnings to remain flattish as loan growth will likely counter the growth in operating expenses. The year-end target price suggests a moderately-high upside from the current market price. Based on the total expected return, I’m adopting a buy rating on TrustCo Bank.

Cash Deployment to Help the Margin

TrustCo Bank’s net interest margin jumped by an impressive 17 basis points in the second quarter of 2022 as the company deployed some of its excess cash into higher-yielding assets. TrustCo Bank still has plenty of excess cash on its books that provides further opportunities to lift margins. The following chart shows the trend of federal funds sold and other short-term investments, which are cash components.

SEC Filings

The following table shows the large difference between the yields of various asset classes.

| Asset Class | Average Yield in 2Q 2022 |

| Loans | 3.52% |

| Available-for-sale securities | 1.85% |

| Fed funds sold and other short-term investments | 0.82% |

| Source: 2Q 2022 10-Q Filing | |

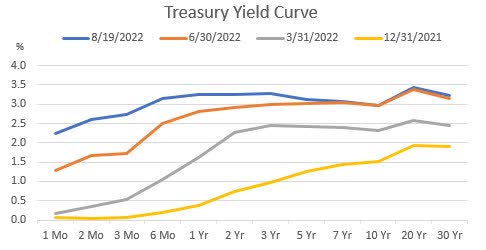

If TrustCo Bank could approach a more normal asset mix, then the margin could significantly improve. If the management isn’t successful in cash deployment, then TrustCo can still earn a higher yield on its cash, albeit to a lower degree. The upward shift in the short end of the treasury yield curve will help TrustCo earn more on its cash balances.

The U.S. Treasury Department

Apart from asset mix improvement and greater earning on cash, there isn’t much opportunity to benefit from a rising-rate environment. Historically, TrustCo Bank’s margin has moved independently of interest rates. The company primarily focuses on residential real estate, which by nature has fixed rates. Therefore, the average loan yield will remain upward sticky in a rising-rate environment. At the same time, the deposit book is quick to reprice because it is heavy on interest-bearing, flexible-rate deposits, namely money market, savings, and interest-bearing checking accounts. These flexible-rate deposits made up of whooping 65.7% of total deposits at the end of June 2022, according to details given in the 10-Q filing.

Considering these factors, I’m expecting the margin to increase by a further five basis points in the second half of 2022 before stabilizing in 2023.

Loan Growth Trend to Remain Unchanged

TrustCo Bank’s loan growth has remained consistently in the mid-single-digit range in the past. I’m expecting loan growth to remain near the historical average through the end of 2023 as the effect of higher rates will counter the effect of strong job markets. Higher borrowing costs will discourage home buyers, who will try to put off new home purchases till a more feasible time. On the other hand, strong job markets will ensure more and more people have the means to afford a home.

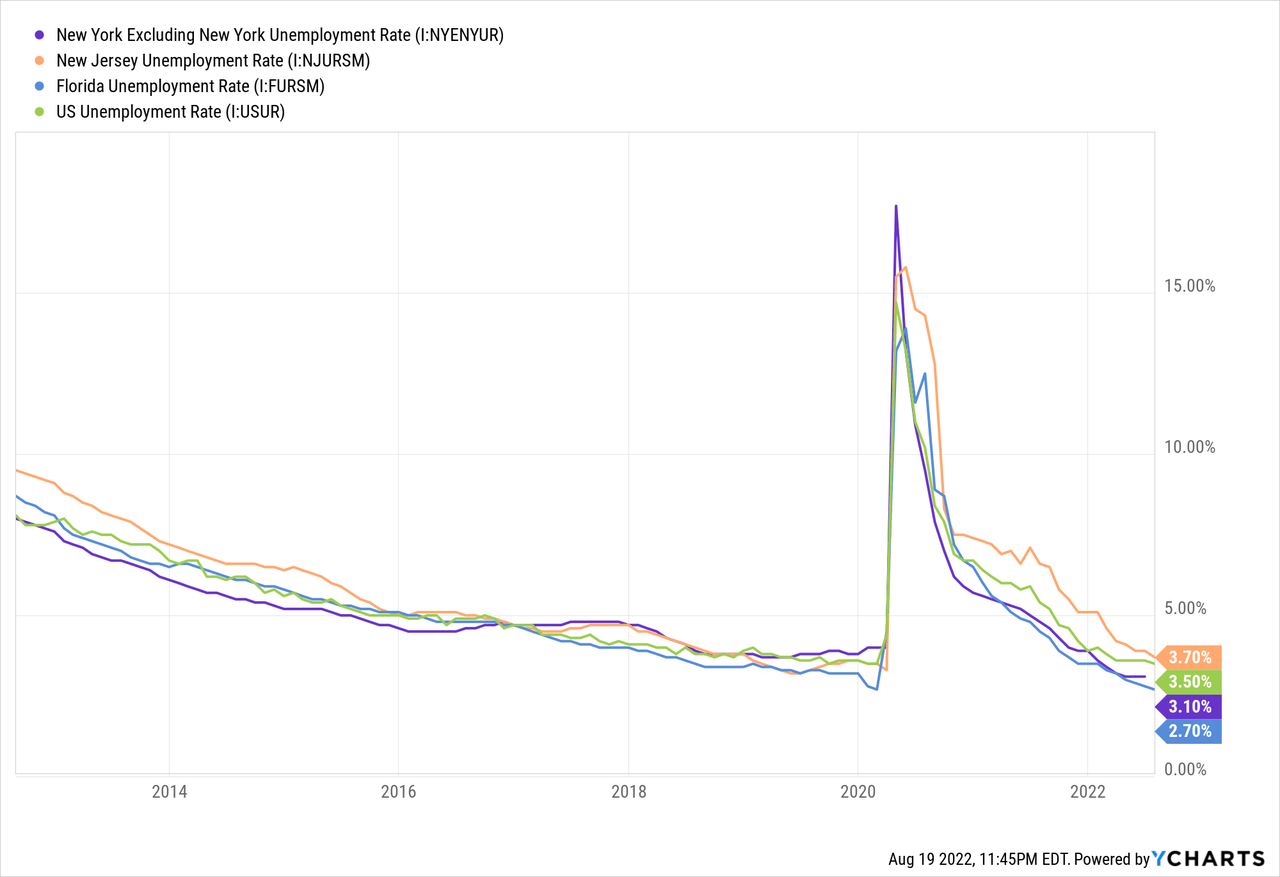

TrustCo Bank operates in New York, New Jersey, and Florida, which provide good geographical diversification as the economies are very different. The job market of New Jersey is weaker than the national average, while that of Florida and New York, excluding New York City, is stronger. Nevertheless, all three are doing much better than in the last several years. (Please note that TrustCo does not operate in New York City, which is why it’s not included in the chart below.)

Considering these factors, I’m expecting the loan portfolio to grow by 4.3% in 2022 and by 4.1% in 2023. Further, I’m expecting other balance sheet items to grow more or less in line with loans. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 3,829 | 4,018 | 4,195 | 4,395 | 4,586 | 4,772 |

| Growth of Net Loans | 6.6% | 4.9% | 4.4% | 4.8% | 4.3% | 4.1% |

| Other Earning Assets | 987 | 1,010 | 1,518 | 1,594 | 1,456 | 1,515 |

| Deposits | 4,274 | 4,450 | 5,037 | 5,268 | 5,505 | 5,729 |

| Borrowings and Sub-Debt | 162 | 149 | 268 | 297 | 191 | 199 |

| Common equity | 490 | 538 | 568 | 601 | 614 | 654 |

| Book Value Per Share ($) | 5.1 | 5.6 | 29.4 | 31.2 | 32.0 | 34.1 |

| Tangible BVPS ($) | 5.1 | 5.6 | 29.4 | 31.2 | 32.0 | 34.1 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Normal Level of Provisioning Likely

Allowances were 2.36 times the non-performing loans at the end of June 2022, which is a comfortable position. As most of the loans are based on fixed rates, the increase in interest rates is unlikely to affect the portfolio’s credit quality. Further, TrustCo Bank’s loan portfolio inherently carries less risk than peer banks’ portfolios because an overwhelming majority of TrustCo’s loans are backed by real estate.

Considering these factors, I’m expecting the provisioning to remain at a normal level through the end of 2023. I’m expecting the net provision expense to make up 0.02% of total loans in 2022 and 2023, which is the same as the average for the last five years.

Expecting Earnings to Grow by 10%

Earnings will likely grow in 2022 on the back of an increase in loans and margin expansion. Further, I’m expecting earnings to remain flattish next year as the growth of expenses will likely cancel out loan growth. Moreover, I’m expecting the margin to remain mostly stable next year. Overall, I’m expecting TrustCo to report earnings of $3.51 per share for 2022, up 10% year-over-year. For 2023, I’m expecting the company to report earnings of $3.49 per share, down by just 0.6% year-over-year. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 161 | 156 | 154 | 160 | 171 | 179 | ||||

| Provision for loan losses | 1 | 0 | 6 | (5) | 1 | 1 | ||||

| Non-interest income | 18 | 19 | 17 | 18 | 20 | 20 | ||||

| Non-interest expense | 98 | 98 | 96 | 102 | 101 | 109 | ||||

| Net income – Common Sh. | 61 | 58 | 52 | 62 | 67 | 67 | ||||

| EPS – Diluted ($) | 0.64 | 0.60 | 2.72 | 3.19 | 3.51 | 3.49 | ||||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

Actual earnings may differ materially from estimates because a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Significant Total Expected Return Calls for a Buy Rating

TrustCo Bank is offering a dividend yield of 3.9% at the current quarterly dividend rate of $0.35 per share. The earnings and dividend estimates suggest a payout ratio of 40.1% for 2023, which is in line with the historical trend. Therefore, I’m not expecting an increase in the dividend level.

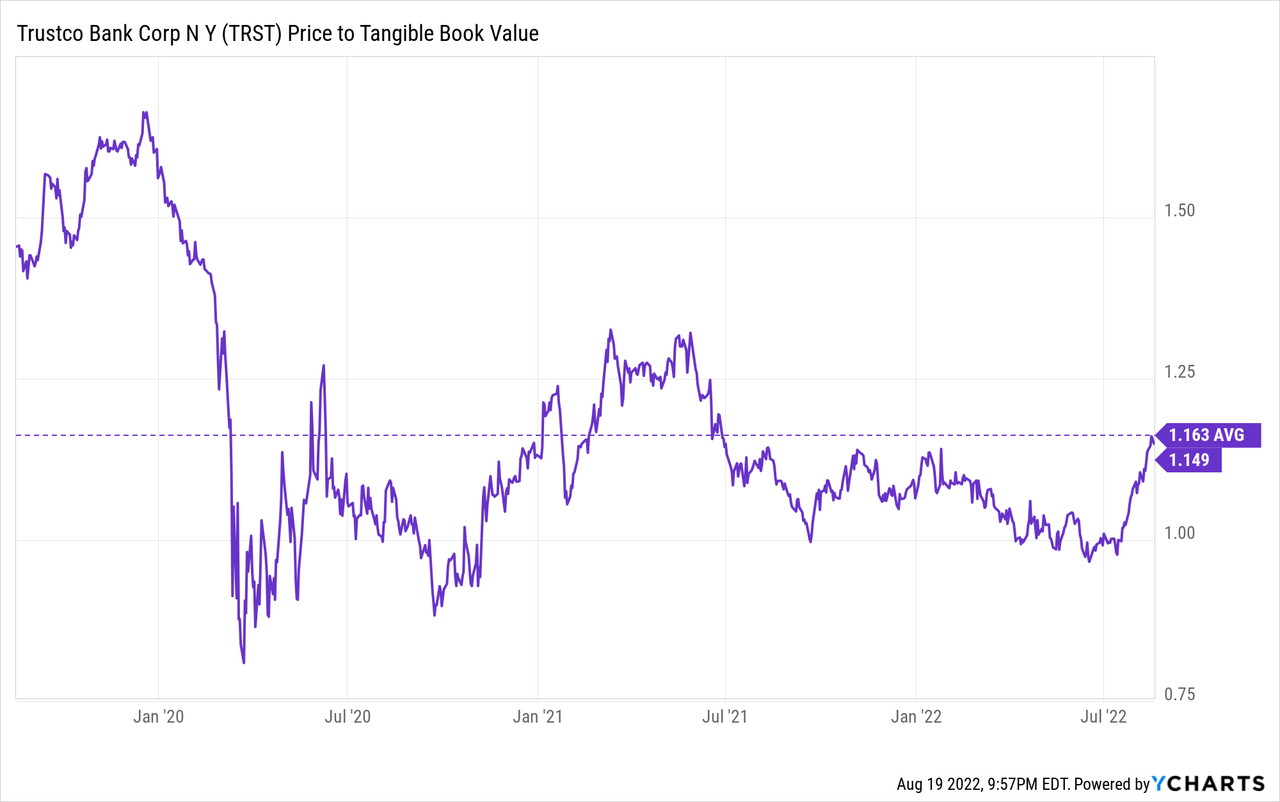

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value TrustCo Bank. The stock has traded at an average P/TB ratio of 1.16 in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $32.0 gives a target price of $37.3 for the end of 2022. This price target implies a 4.3% upside from the August 19 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.96x | 1.06x | 1.16x | 1.26x | 1.36x |

| TBVPS – Dec 2022 ($) | 32.0 | 32.0 | 32.0 | 32.0 | 32.0 |

| Target Price ($) | 30.8 | 34.1 | 37.3 | 40.5 | 43.7 |

| Market Price ($) | 35.7 | 35.7 | 35.7 | 35.7 | 35.7 |

| Upside/(Downside) | (13.6)% | (4.7)% | 4.3% | 13.3% | 22.2% |

| Source: Author’s Estimates |

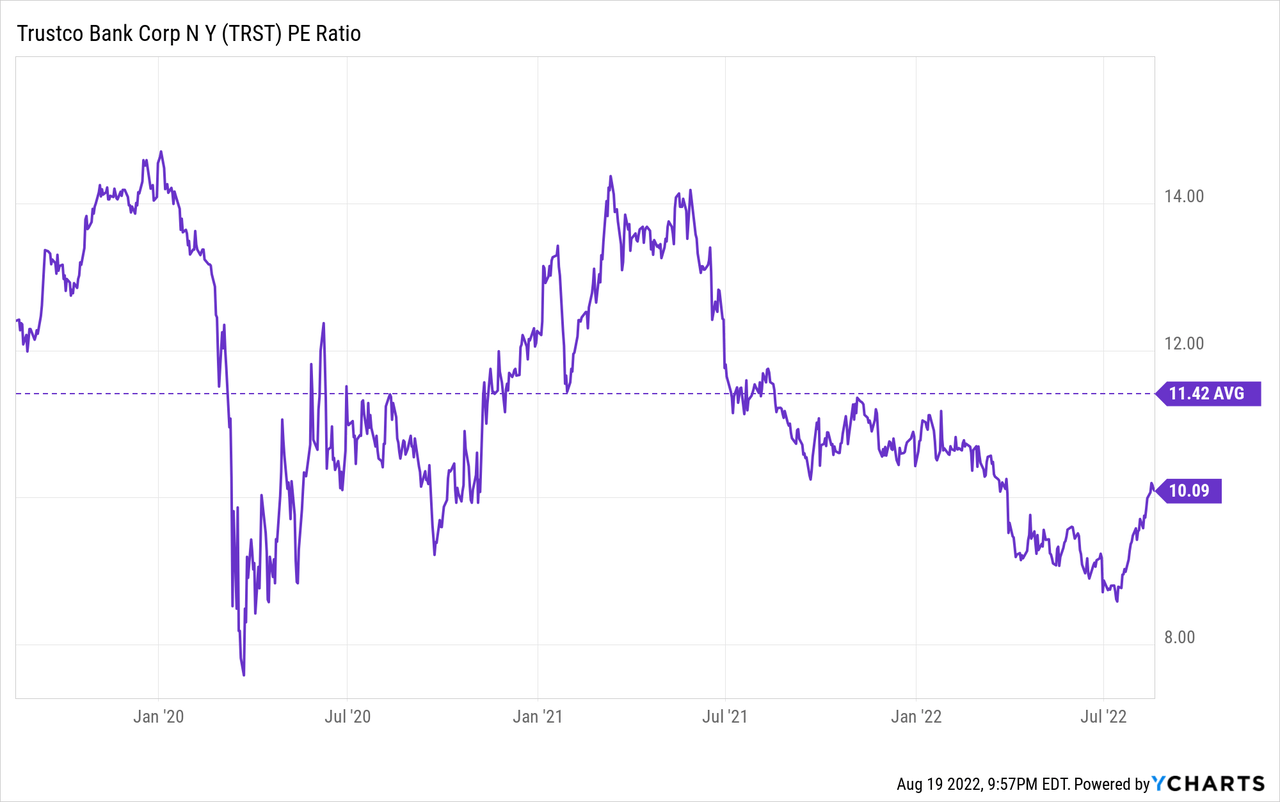

The stock has traded at an average P/E ratio of around 11.4x in the past, as shown below.

Multiplying the average P/E multiple with the forecast earnings per share of $3.51 gives a target price of $40.1 for the end of 2022. This price target implies a 12.3% upside from the August 19 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 9.4x | 10.4x | 11.4x | 12.4x | 13.4x |

| EPS 2022 ($) | 3.51 | 3.51 | 3.51 | 3.51 | 3.51 |

| Target Price ($) | 33.1 | 36.6 | 40.1 | 43.6 | 47.1 |

| Market Price ($) | 35.7 | 35.7 | 35.7 | 35.7 | 35.7 |

| Upside/(Downside) | (7.4)% | 2.4% | 12.3% | 22.1% | 31.9% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $38.7, which implies an 8.3% upside from the current market price. Adding the forward dividend yield gives a total expected return of 12.2%. Hence, I’m adopting a buy rating on TrustCo Bank.

Be the first to comment