Disciplined Long-Term Investing Frederick Doerschem/iStock via Getty Images

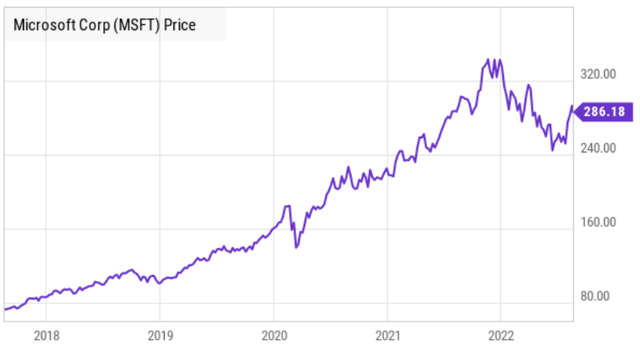

*Note: This article revisits and updates a Seeking Alpha article by essentially the same title, published on October 2, 2020. Since that time, Microsoft has increased its dividend by 21.6% and delivered a total return of 43.2%, thereby outperforming the S&P 500 (SPY) and the Nasdaq 100 (QQQ) by double digits.

As a long-term investor, I believe in owning a prudently-diversified portfolio of many stocks. However, if I could own just one stock, I’d want it to be a leader in the important categories of revenue growth, dividend income and financial strength (including profitability, a strong balance sheet and an attractive valuation). Following its latest quarterly earnings release, this report reviews Microsoft’s (NASDAQ:MSFT) business, its strengths (in the categories listed above), the risk factors it currently faces and then concludes with my strong opinion on whether Microsoft would be “the one.”

Microsoft

Business Overview:

Co-founded by Elon Musk (TSLA) nemesis, Bill Gates (and Paul Allen), in 1975, Microsoft has grown into a behemoth juggernaut of a company with a $2.1 trillion market cap; it’s currently the 3rd largest publicly traded company in the world (behind Apple (AAPL) and Saudi Aramco (ARMCO)). Since its inception, Microsoft has not only cemented itself as the leader in the operating system space (with Windows), but it has also grown into an enormous conglomerate of software, services, devices and technology solutions separated into three main operating segments:

Productivity and Business Processes

Microsoft’s Productivity and Business Processes segment offers Office, Exchange, SharePoint, Microsoft Teams, Office 365 Security and Compliance, and Skype for Business, as well as related Client Access Licenses (CALs); Skype, Outlook.com, OneDrive, and LinkedIn; and Dynamics 365, a set of cloud-based and on-premises business solutions for organizations and enterprise divisions.

Intelligent Cloud

Microsoft’s Intelligent Cloud segment licenses SQL, Windows Servers, Visual Studio, System Center, and related CALs; GitHub that provides a collaboration platform and code hosting service for developers; and Azure, a cloud platform. It also offers support services and Microsoft consulting services to assist customers in developing, deploying, and managing Microsoft server and desktop solutions; and training and certification on Microsoft products.

More Personal Computing

Microsoft’s More Personal Computing segment provides Windows original equipment manufacturer (OEM) licensing and other non-volume licensing of the Windows operating system; Windows Commercial, such as volume licensing of the Windows operating system, Windows cloud services, and other Windows commercial offerings; patent licensing; Windows Internet of Things; and MSN advertising. It also offers Surface, PC accessories, PCs, tablets, gaming and entertainment consoles, and other devices; Gaming, including Xbox hardware, and Xbox content and services; video games and third-party video game royalties; and Search, including Bing and Microsoft advertising. It sells its products through OEMs, distributors, and resellers; and directly through digital marketplaces, online stores, and retail stores.

Furthermore, Microsoft has collaborations with Dynatrace, Inc. (DT), Morgan Stanley (MS), Micro Focus (MFGP), WPP plc (WPP), ACI Worldwide, Inc. (ACIW), and iCIMS Holding Corp. (TLNT), as well as strategic relationships with Avaya Holdings Corp. (AVYA) and Wejo Group Limited (WEJO).

To put it mildly, Microsoft is a massive company with a far reaching ecosystem.

Massive Revenue Growth Trajectory

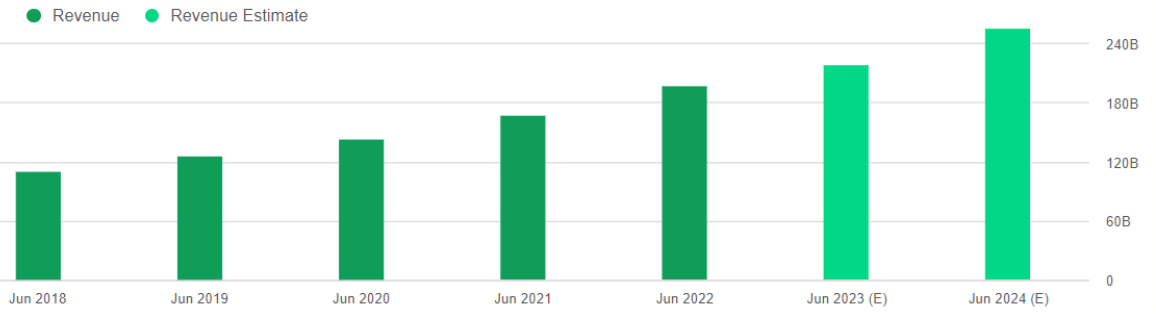

And one of the most impressive things about Microsoft is that even though it is already a truly massive company, it continues to put up truly incredible revenue growth rates (see chart below) that make many much smaller businesses jealous (for reference, revenue is expected to grow 11.4% this year and 13.9% next year).

Seeking Alpha

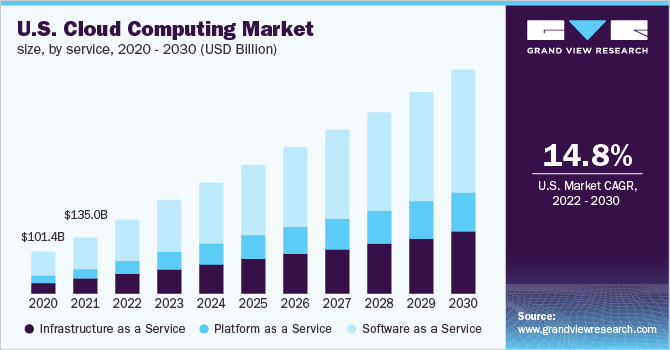

And even more impressive, Microsoft’s high revenue growth rate can continue for a very long time considering the truly massive total addressable market opportunities provided by the secular digital revolution (whereby just about everything everywhere is being digitized, analyzed and stored in the cloud). For example, here is a look at how the US cloud computing market is expected to grow in the years ahead.

Grand View Research

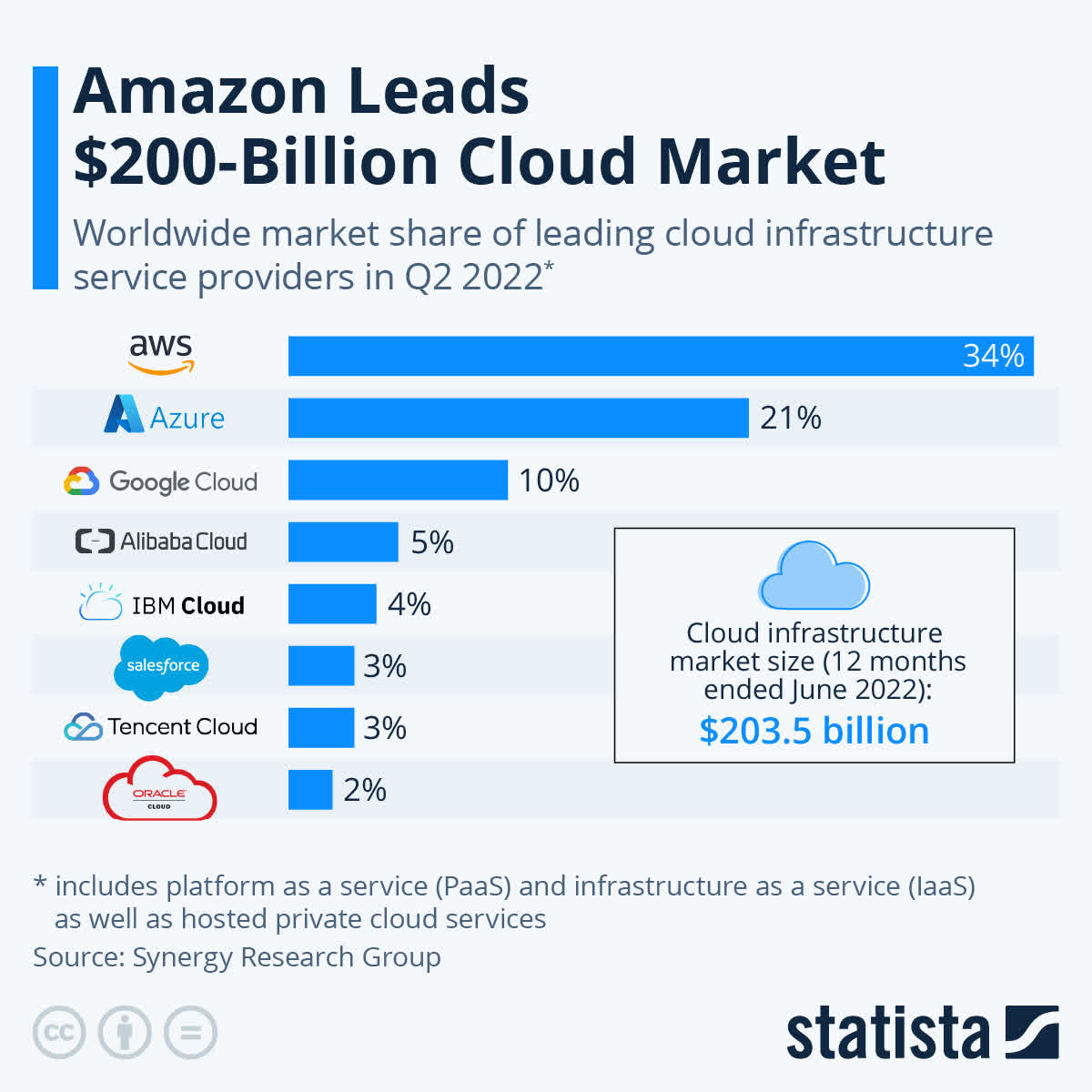

Furthermore, cloud is a big part of Microsoft’s business (40.2% of revenues), and it is growing rapidly. For example, revenue in Microsoft’s Intelligent Cloud was $20.9 billion and increased 20% (up 25% in constant currency). And Azure (the cloud computing service operated by Microsoft) had revenue growth of 40% (up 46% in constant currency). Azure is a growing part of the growing cloud market, as you can see in the following graphic (Amazon Web Services (AMZN) and Google Cloud (GOOG) (GOOGL) are the other leaders, followed by IBM (IBM), Salesforce (CRM), Tencent (OTCPK:TCEHY) and Oracle (ORCL)).

Statista

Massive Dividend “Yield on Cost”

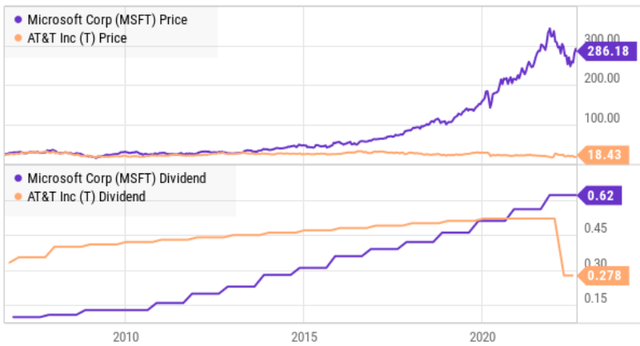

A lot of people don’t think of Microsoft as a dividend stock, but it is actually one of the most impressive dividend growth stocks in recent decades. And if you have owned the shares for a long time (or plan to own them for a long time into the future), you likely have a lot of appreciation for the concept of “yield on cost.” Yield on cost basically means comparing the current dividend payment to the cost you initially paid for the shares. This is a great metric because it shows just how much bigger Microsoft’s dividend yield really is compared to companies with high current dividend yields but no dividend growth and no share price growth. For example, here is a look at the historical share price and dividend payment of Microsoft versus AT&T (T) since 2006.

As you can see in the chart above, both companies traded at about the same price back in 2006, but AT&T offered a much bigger dividend yield. But if you had chased after AT&T’s bigger dividend yield back then, you’d have missed out on the tremendous share price appreciation offered by Microsoft, and Microsoft’s dividend has grown so much that it would still now be bigger than AT&T’s (even if AT&T hadn’t cut theirs). From a yield on cost basis, if you paid $18 for a share of Microsoft in 2006, you’d be receiving a $0.62 per quarter and $2.48 per year—that’s a whopping “yield on cost” of over 13.7%! (Whereas AT&T’s yield on cost is less than half of that.)

Microsoft does not get enough credit for its truly massive dividend payments to long-term shareholders. And going forward, I fully expect the dividend to continue to grow at a powerful clip. If you want the best long-term dividend income, don’t chase the highest current yield; invest in the best long-term yield.

Incredible Profitability

Microsoft just made $16.7 billion in profits last quarter, on revenue of $51.9 billion, which equates to a net profit margin of over 32%. That is spectacular! There are a variety of companies that can match Microsoft’s revenue growth rate, but few that can also do it with such high profit margins, and almost none that can do both and at Microsoft’s scale. Microsoft’s profitability is incredible and it will likely stay that way (and grow) for many years to come considering the truly massive digital revolution and considering Microsoft’s massive ecosystem, cost savings (through economies of scale) and high switching costs for customers. Microsoft is an impressive business.

Incredible Balance Sheet Strength

And Microsoft’s incredible profitability contributes to its incredible balance sheet. In fact, Microsoft is one of only two companies in the world with an “AAA” credit rating (the other is Johnson & Johnson (JNJ)). Even the US government’s credit rating was downgraded to only AA+ in 2011 (thanks to Washington DC dysfunction). And for a little more perspective, Microsoft generated an amazing $17.8 billion in free cash flow last quarter alone, and it currently has over $13.9 billion in cash sitting on its balance sheet to fund whatever the heck it wants to in the future. Worth mentioning, Microsoft is well known as an exceptional steward of its capital, allocating prudently between investment opportunities, acquisitions, dividends, share repurchases and all to the benefit of shareholders.

Compelling Valuation

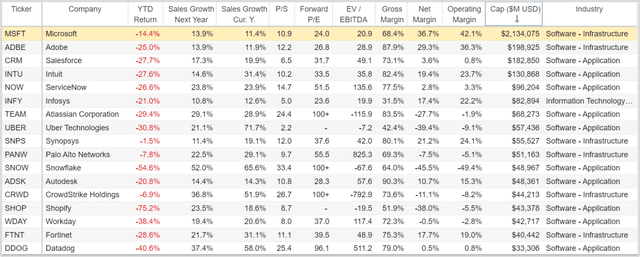

Versus other companies with such high growth rates, Microsoft shares trade at a very compelling valuation, especially considering its very strong margins. For a little perspective, here is a look at Microsoft versus other large software companies.

data as of Fri 19-Aug-22 (Stock Rover)

As you can see, other companies match (or even exceed) Microsoft in sales growth rates, but essentially none can grow so fast with such high net profit margins and such low valuation multiples (e.g. EV/EBITDA, forward P/E).

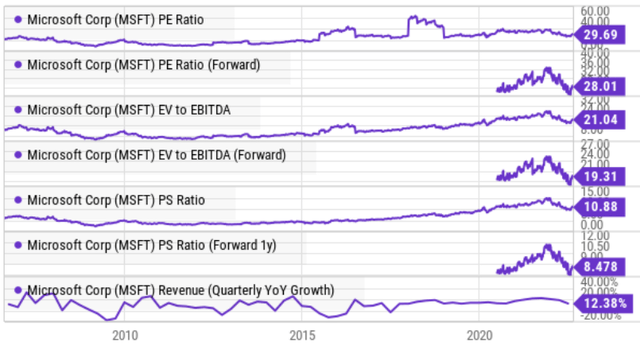

And for more perspective, here is a look at Microsoft versus its own history in terms of various valuation metrics.

As you can see in the chart above, Microsoft is relatively inexpensive compared to its own history, and this is even more impressive considering the revenue growth rate (bottom chart) is high by historical standards.

Current Risk Factors

Obviously, Microsoft does face risk factors. For example, earnings took a hit from foreign currency exchange rates (the US dollar has been strong and Microsoft is a global company). Also, Microsoft always faces regulatory risks and antitrust concerns (when you are as big and profitable as Microsoft—you have a target on your back). Furthermore, a global economic slowdown would hurt Microsoft too.

Further still, Microsoft has many additional risks by products and segments, but the fact that the business is so diversified (it has so many products and services) helps to reduce the risks. Not to mention, the incredible network effects of these businesses, the high switching costs (to help ward off competitive threats) and the economies of scale (that provide Microsoft with significant competitive advantages).

Conclusion: Selecting “The One”

I can think of lots of stocks that will likely post much higher revenue growth numbers than Microsoft for many years into the future (such as some of the names in our earlier table in the valuation section of this report). However, those businesses still struggle mightily with profitability (achieving Microsoft net margins is no small feat) and face a variety of more significant risk factors.

I can also think of a bunch of businesses that have bigger dividend yields than Microsoft and that have grown their dividends for even more years in a row than Microsoft (for example, there are over 60 “dividend aristocrats.” However, from a yield-on-cost standpoint, almost no one can compete with Microsoft (plus those other businesses don’t have the same impressive revenue and earnings growth potential as Microsoft).

And from a balance sheet strength standpoint, only Johnson & Johnson is in Microsoft’s league (it’s the only other AAA rated stock). And as impressive as Johnson & Johnson is (I own a few shares, by the way), its valuation and growth trajectory are not as compelling as Microsoft, in my view.

In fact, Microsoft is one of only 15 stocks that passed my recent screener requiring at least 10% revenue growth (this year and next), at least 20% gross margins, at least 10% operating margins, and has increased its dividend for at least 10 years in a row (there are a few other impressive names on the list).

However at the end of the day, if I could only own one stock (which is a ridiculous way to invest, by the way—prudent diversification is much smarter), my pick might actually be Microsoft. In fact, Microsoft is one of only two stocks that I currently own in both my Disciplined Growth Portfolio and my Income Equity Portfolio. When it comes to growth, income and financial strength, Microsoft is truly special.

Be the first to comment