Marko Geber/DigitalVision via Getty Images

Intro

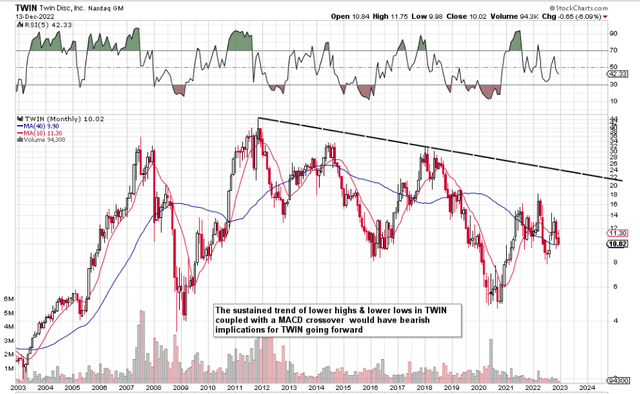

If we pull up a long-term chart of Twin Disc, Incorporated (NASDAQ:TWIN) (Industrial Machinery Player), we see that the down-trending 10-month moving average could soon result in a sell signal by means of the MACD technical indicator. This indicator is a solid read in Twin’s momentum and long-term trend and is especially noteworthy at present due to the sustained pattern of lower lows on the technical chart. As we see from the chart, when this happened in previous years, shares of TWIN always underwent a sustained move to the downside. Suffice it to say, trend followers may enter the frame once more here as any convincing sell signal would be in alignment with the stock’s long-term trend (bearish).

Long-term charts are an invaluable tool to have in one’s arsenal when digesting stocks because they enable investors to study far more information than on shorter-term charts. In fact, given that history repeats itself many times in financial markets (Due to human psychology remaining constant), any potential long-term MACD sell signal should not be underestimated in this play.

Twin Technical Chart (Stockcharts.com)

Valuation

The sustained drop in the share price over the past decade has resulted in a very keen valuation of Twin at present and this is without question. Shares now trade with a forward sales multiple of 0.51 and a forward book multiple of 1.04. Although these multiples are considerably lower than the sector at large, it is the company’s profitability or lack thereof that value investors should be mindful of. Suffice it to say, when a company is struggling with positive profitability, extra risk invariably comes to the table no matter how much demand or how strong Twin’s balance may very well be at the time.

For example, Twin’s forward GAAP multiple of 31.31 (Compared to the trailing counterpart of 32.35) remains very high due to constrained profitability trends at least over the near term. Furthermore, positive cash-flow generation over the past few quarters has been non-existing due to working capital commitments & sluggish growth.

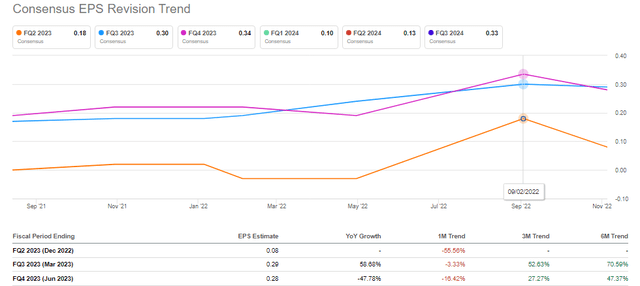

Q1 Earnings

The downswing in the share price was compounded by the recent unconvincing earnings miss where -$0.15 was the bottom-line print for the first quarter (Considering $0.54 per share was the bottom-line number in Q4 last year). Management is expecting a rebound in profitability over the remainder of the year (Earnings of $0.08, $0.29 & $0.28 per share respectively in Q2, Q3 & Q4) but these estimates continue to be revised down as we see below.

TWIN Earnings Revisions (Seeking Alpha)

The strong US dollar continued to be a headwind in Q1 but the weakening of the greenback was noteworthy in November and this momentum has pushed on into December. This will help with products being sold into Europe in Q2 but trading conditions simply have to stack up in general for management to be able to really make inroads into Twin’s now sizable backlog. Electrical components were once more the segment with the most shortages in Q1 and margins continue to remain under pressure due to inflationary costs which continue unabated.

This really is the key with Twin in that it needs to keep gross margins elevated in order to protect the income statement from a profitability standpoint. In order to turn over sales much faster (Which is a necessity for companies with low net profit margins), a larger percentage of the company’s supply-chain issues must be resolved in order to return to positive cash-flow generation once more.

Suffice it to say, a return to the company’s 2020 lows is a possibility if indeed an aggressive down move gains traction here shortly. The market remains keyed into present problem areas such as the above-average European costs, shipyard headwinds, and whether the bullish fundamentals of the electrification and hybrid projects can be realized over time. As mentioned, it is all about turning over profits quickly from the demand which is clearly evident in several markets. We will take our cue from the forward consensus earnings estimates which simply have to stabilize to avoid any potential down move gaining traction.

Conclusion

Contrarians may be eyeing up Twin Disc, Incorporated at present because the stock is unquestionably cheap, the company has a strong balance sheet and the backlog has never been higher. The absence though of positive earnings as well as free cash flow plus the bearish technicals illustrate that we may get a better entry in here. We look forward to continued coverage.

Be the first to comment