xefstock/E+ via Getty Images

Introduction

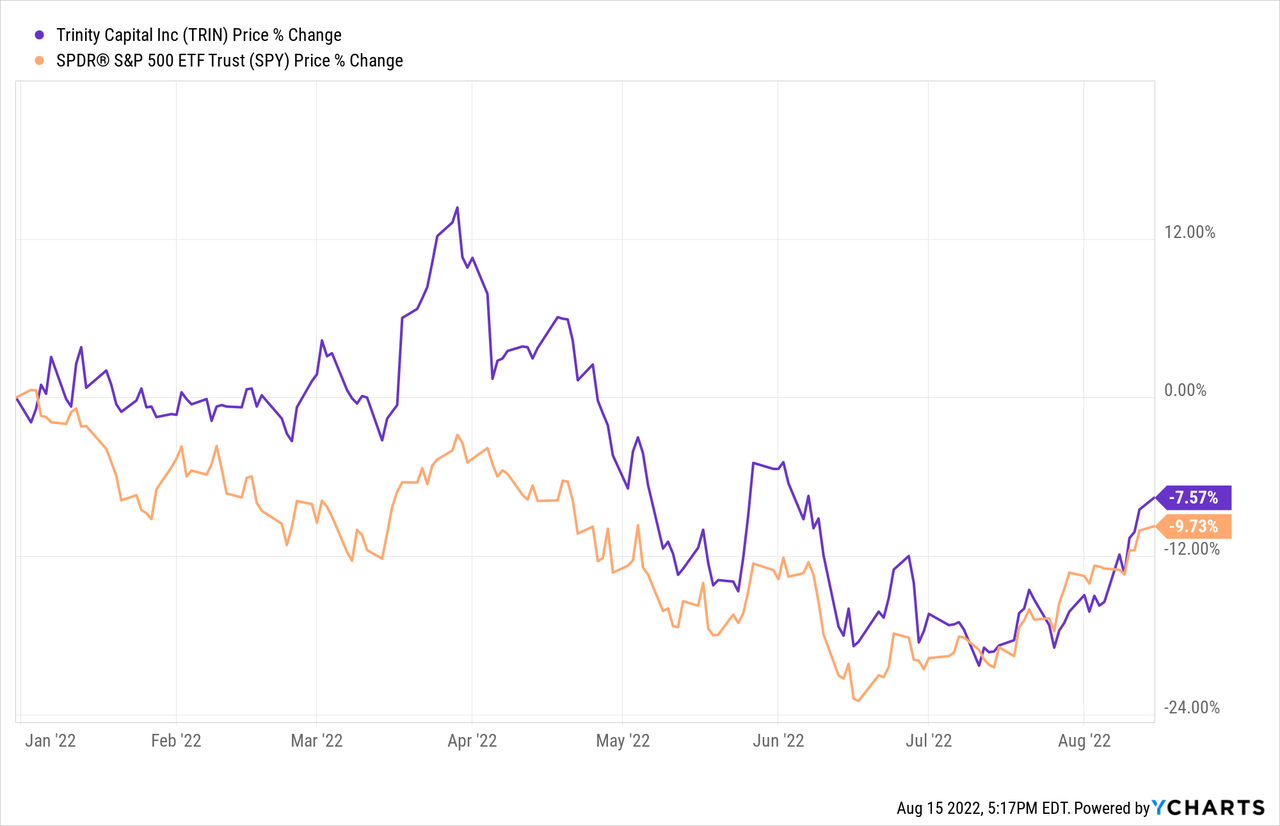

Trinity Capital Inc. (NASDAQ:TRIN) mainly provides debt and equipment financing to small and middle-market companies in the Asset Management and Custody Banks Industry. Year to date, the company has slightly outperformed the market, losing 7.57% of its market value while the S&P 500 (SPY) lost 9.73% in the same time period.

However, I strongly believe that TRIN stock is an attractive long-term investment at its current price. I see many bullish signals that all hint at future growth: solid 2Q 2022 financial results, shareholder-friendly decisions, insider buying activity, and more. Let’s start off with an in-depth company activity analysis.

Company Activity

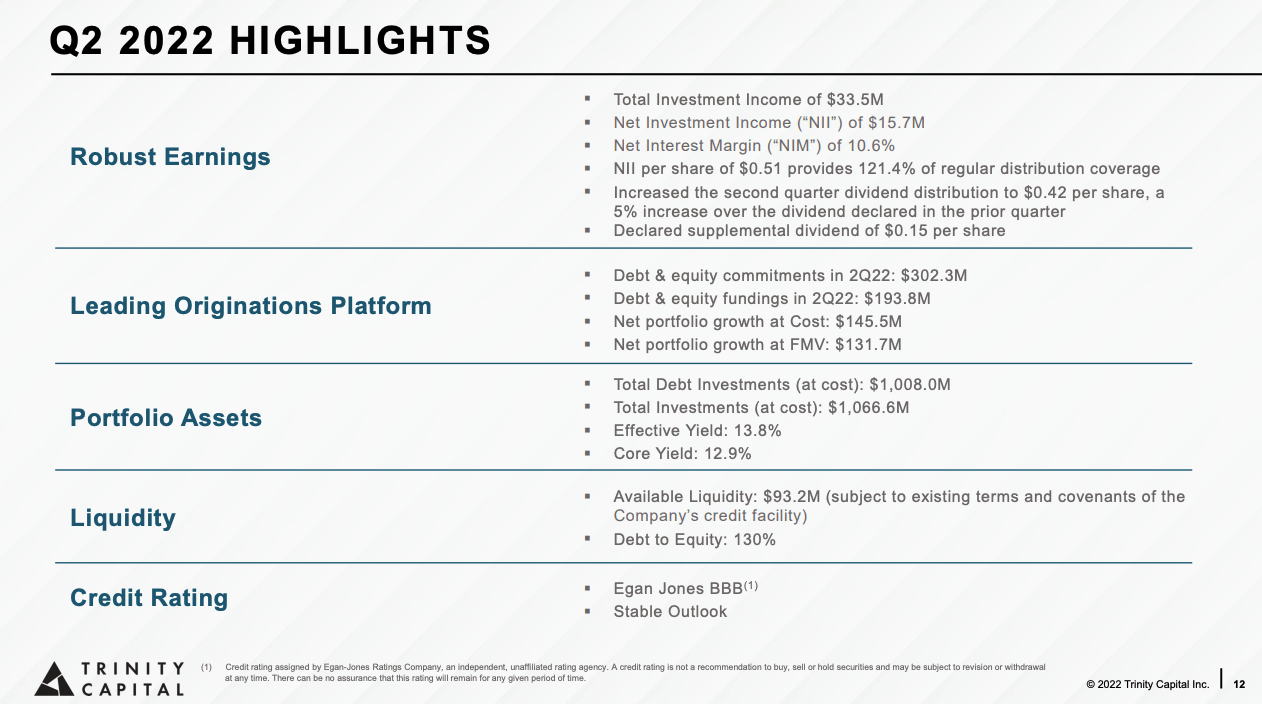

Trinity Capital recently hosted their conference call to discuss their strong 2Q2022 financial results. I saw that they have been moving off of a good momentum, and here is a snippet from their earnings call presentation that I find worth noting for key highlights.

Q2 2022 Investor Presentation

Management has also made great progress on their capital allocation priorities to provide more shareholder-friendly decisions. Chief Accounting Officer, Mike Testa, further elaborates on this matter:

We are actively managing our liquidity and continuing to explore full capital options, while we’ll be accretive to our shareholders, such as investments under the RIA once approved. With regards to RIA progress, the review process is still within our expected time line, and we continue to work with the SEC to complete the review of our application.

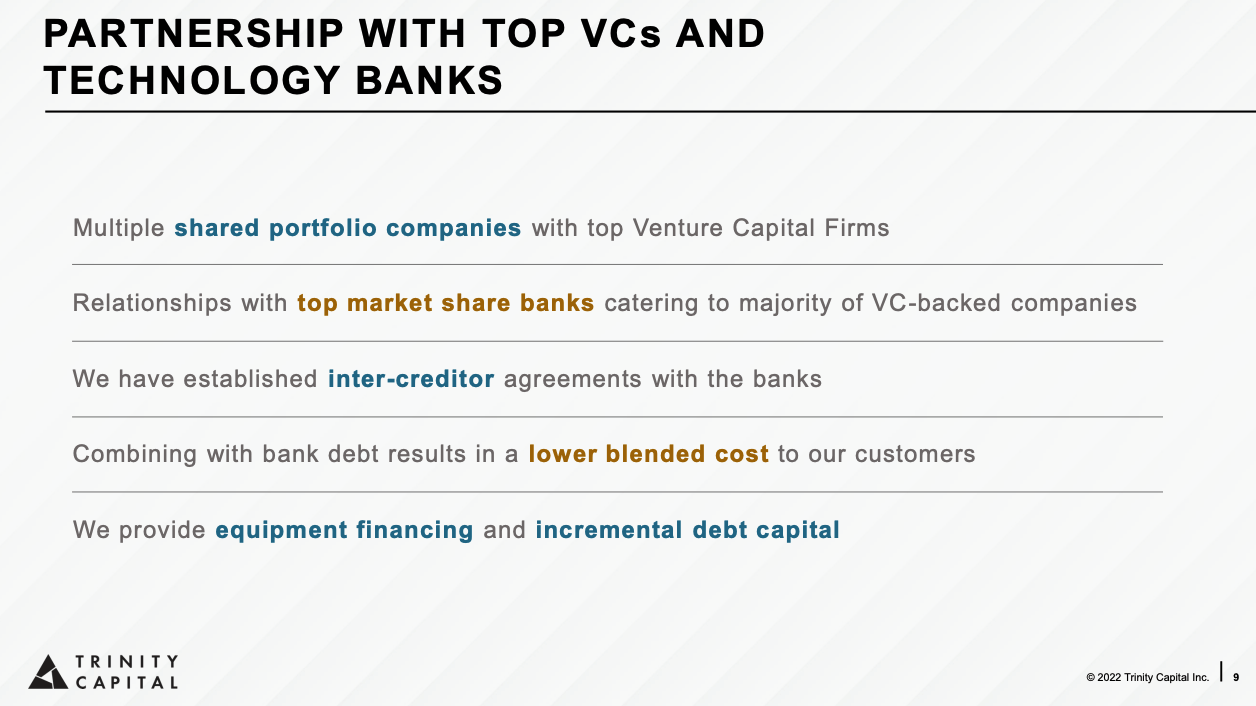

Additionally, the company also has made partnerships with top venture capital firms and technology banks. Relationships with top institutions like these show me that the company is well-trusted among reputable institutions and that they will be able to make good on strong commitments to successfully carrying out its stated financial goals.

Q2 2022 Investor Presentation

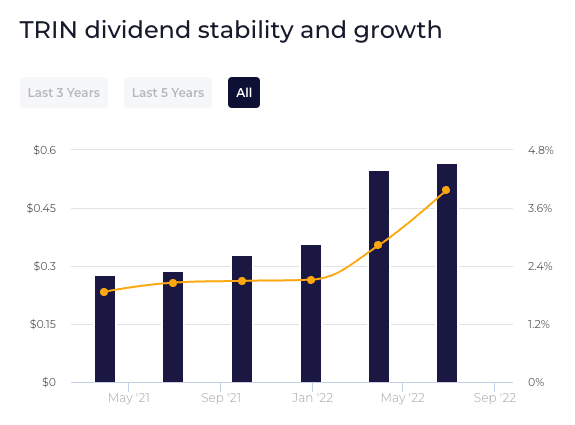

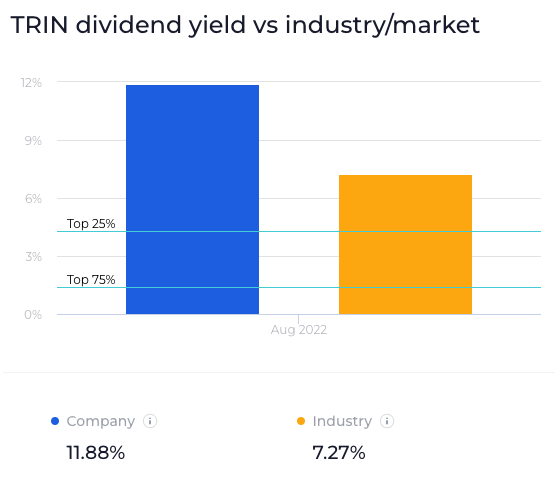

What is more remarkable is the fact that Trinity Capital has been successfully growing its dividends at a very high rate ever since its IPO on January 29th, 2021. Currently, TRIN has a dividend of $1.66 per share which provides an attractive 10.44% annual yield-this is much higher than the US industry average of 7.27% and market average of 3.64% (also ranks the company well over the top 25% of US dividend-paying companies). Furthermore, the company’s strong EPS of $2.51 is more than enough to cover the annual dividend per share costs, leading to a sustainable payout ratio of 57.37% (derived by dividing the annual dividend per share EPS). Dividend yield rates additionally have grown exceptionally by 112.83% in the span of a single year, and I believe that their effective capital investments will continually benefit shareholders during these uncertain times. Management is anticipating to pay dividends for 3Q 2022 in September, and I recommend income-seeking investors to buy in to not miss out on this opportunity.

WallStreetZen WallStreetZen

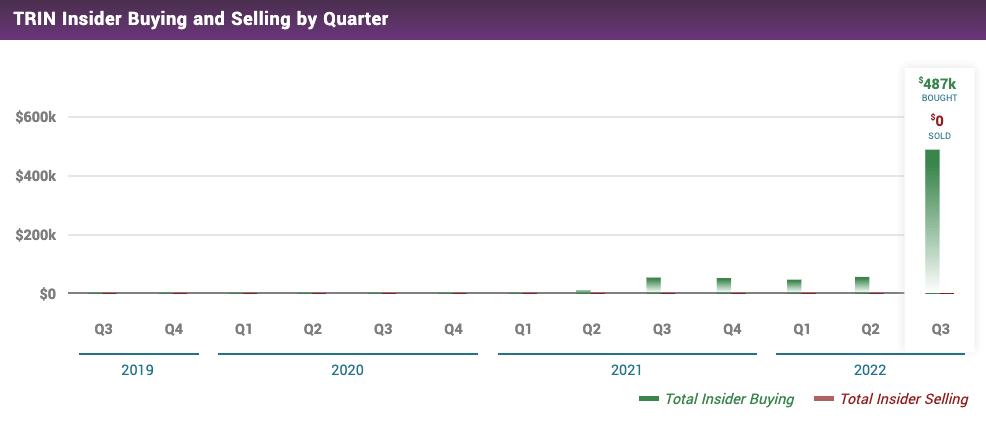

Finally, there has been considerable insider buying activity within the past year. Insiders have purchased roughly $689,920.50 in the past year, bringing up the cumulative insider ownership of the company to 6.90%, and I strongly believe that this confirms insider confidence and shows that insiders also believe that there are bullish tailwinds that will help TRIN’s momentum continue to move forward onto Q3 and more.

MarketBeat

Stock Valuation

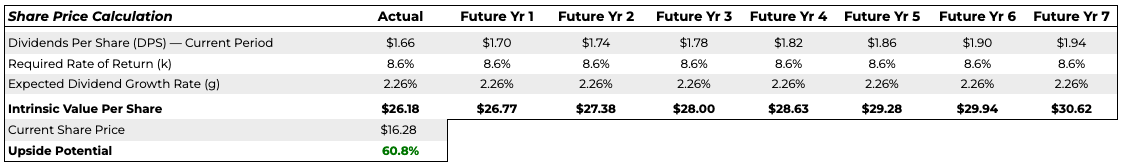

TRIN has a very attractive dividend yield as mentioned above and I believe that the incoming tailwinds will further provide growth for the company. Because of this reasoning, I decided to value the stock under conservative estimates using the Gordon Growth Model (GGM) on dividends. The GGM valuation method works by assuming a constant sustainable dividend growth rate to discount it back into the current stock price with the required rate of return, summed up into this equation: “value of the stock” = “dividend per share” divided by “discount rate – dividend growth rate”. GGM typically undervalues the stock price as the dividend growth is conservatively assumed to be constant.

That being said, I first based my model on an annualized $1.66 dividend per share from adding up the recently announced $0.15 supplemental dividend to the previous 4 quarters (price history can be found here). Then I reasonably derived a discount rate of 8.6% from the cost of equity based on a 3-year levered-beta of 0.88. To be very conservative, I then estimated that dividends will, at the very least, grow in line with inflation, so I calculated the average 5-year growth rate of the 10-year treasury yield to be 2.26%. Plugging these three key values into the equation, which I found reasonable given the stable growth trends so far, resulted in an intrinsic value of $30.62 per share and a 60.80% upside from its current price.

Google Sheets

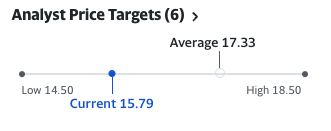

To further support my valuation, I noticed that Wall Street is also bullish on TRIN. Yahoo Finance reports 6 analysts having a mean price target of $17.33 and the range spanning from as low as $14.50 and $18.50. Even though my dividend model resulted in roughly $12 more than the highest, I believe that this is comparable to the price ranges among professional analysts’ methodologies. This is further evidence that TRIN stock is currently undervalued by the market as it has already surpassed the lowest price target.

Yahoo Finance

Risk Headwinds

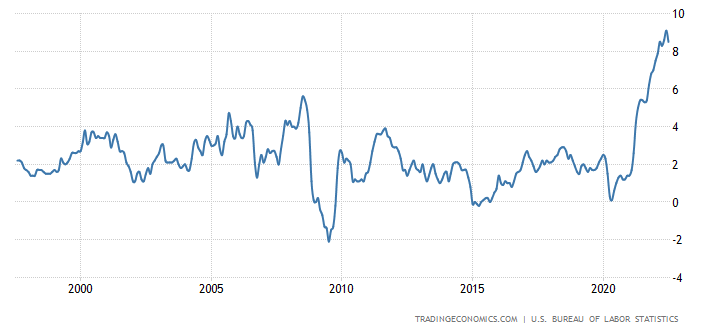

The biggest risk that I see applicable for TRIN is the impact of the rising inflation rates on the equity markets as the company has been a bit volatile because of it. The annual inflation rate currently fell from its record high of 9.1% to 8.5% in July 2022 but, as Dominic Rushe, a business editor for the US Guardian, puts it, “still close to multi-decade high”. We can see this in the graph below of the inflation rates in the past 25 years.

Trading Economics

However, I think that TRIN is a reliable stock after seeing its continued growth in dividend yields and the continued profitability of the business model. The dividend will also serve as an inflation hedge for investors. These all can act as a moat in place to prevent the inflation rates from substantially affecting this company. To sum it up, here is President and Chief Investment Officer, Kyle Brown recapping Trinity Capital’s success and forward-looking statements:

We are capitalizing on market conditions while taking a judicious approach towards investment decisions. Our fundamentals are as strong as ever and we are focused on executing on a strategy that is versatile in an evolving financial landscape. We have strong momentum heading into the second half of the year and look forward to driving long-term value for our shareholders.

Competitor Comparisons

The last part of my thesis is based on Trinity Capital’s strong competitive positioning within the Asset Management and Custody Banks Industry. They are seeing nice recovery and yet still ranks 3rd within the sector among 90 companies. I created a table below to compare Trinity Capital’s financial performances among top competitors like Fidus Investment Corporation (FDUS), Gladstone Investment (GAIN), and more that investors might seek out as an alternative investment.

As a result, my table of shareholder return metrics from Yahoo Finance yielded impressive results. Trinity Capital has only been paying out dividends for a little over a year and is able to provide a yield that outperforms all of the companies listed below. They also are able to provide returns that are on the upper echelon of comparable companies with regard to Return on Equity. So, what’s next? I believe that there is still way more room for growth ahead. Having solid Q2 results and committing to shareholder value make me think that management is well aware of the current undervaluation by the market, and they have moved fast to well-position themselves competitively to outperform the industry and advance as an industry leader for the foreseeable future. Income-focused investors should not miss out on this wonderful opportunity.

|

Company |

Ticker |

Dividend Yield |

Return on Equity |

|

Trinity Capital |

TRIN |

10.64% |

15.63% |

|

Fidus Investment Corporation |

FDUS |

7.13% |

21.54% |

|

Gladstone Investment |

GAIN |

5.98% |

15.50% |

|

Newtek Business Services |

(NEWT) |

16.25% |

15.67% |

|

Crescent Capital BDC |

(CCAP) |

9.68% |

12.79% |

|

Carlyle Secured Lending |

(CGBD) |

9.42% |

12.63% |

|

TriplePoint Venture Growth |

(TPVG) |

10.52% |

10.90% |

|

Hercules Capital |

(HTGC) |

9.03% |

1.01% |

Conclusion

Trinity Capital Inc is a strong contender in its industry and after its second quarter announcement, the stock is looking more and more like an attractive buy opportunity for investors. Their growth potential should not be ignored as insiders have realized this and bought $689,920.50 in shares. Continued redistribution of capital for high dividend yields to supplement recovery made me use my GGM model to evaluate this stock, resulting in a 60.80% upside under conservative and historical assumptions. With all of these reasons and more mentioned in my previous sections, I recommend a “Buy” for TRIN before the market realizes the true value of the company.

Be the first to comment