agnormark

It’s been a tough Q2 Earnings Season for the Gold Miners Index (GDX), with most producers reporting decent operational results but having to revise cost guidance higher. Fortunately, Centamin (OTCPK:CELTF) was an outlier in this sense, and while it did note that costs could come in at the upper end of its guidance range, costs should improve meaningfully by Q4 with a much better year ahead in FY2023.

Besides, FY2022 has been a very high-cost year from a capital expenditures standpoint, making its massive Sukari Mine look worse than it is from a financial standpoint. However, with major projects near completion, Sukari should shine in 2023, especially if it can get some help from the gold price. So, while I don’t see the stock as a Buy at US$1.09 after its sharp rally, I would view any pullbacks below US$0.96 as buying opportunities from a swing-trading standpoint.

Sukari Operations (Company Presentation)

H1 Production

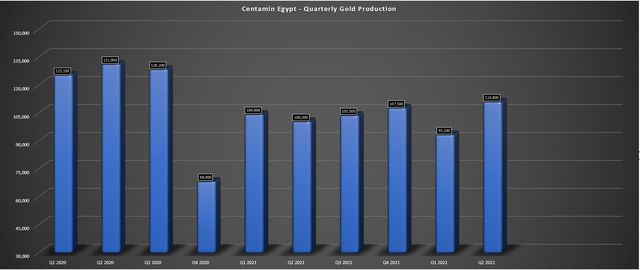

Centamin released its H1 2022 results this month, reporting Q2 production of ~110,800 ounces (+11% year-over-year) and H1 2022 production of ~203,900 ounces, which was flat from the year-ago period. This translated to H1 revenue of $381.8 million, a 4% increase from the year-ago period, and operating cash flow came in at $128.4 million, a slight decrease from the year-ago period (H2 2021: $141.9 million). While these results might not seem all that impressive (especially given that they were up against relatively easy comps) one must remember that Centamin is in the back half of a transition period after noticing movement in waste material in late 2020.

Centamin – Quarterly Production (Company Filings, Author’s Chart)

If we look past the headline results, we’ve seen much improvement under the surface. Not only did Centamin report a record quarter for material movement (33.4 million tonnes), but it also reported a much better quarter underground after a switch to owner-operator mining. This was evidenced by higher grades and tonnes from Sukari Underground, with 231,000 tonnes mined at an average grade of 4.74 grams per tonne of gold, including considerable development ore. Meanwhile, the accelerated waste stripping program has finally allowed access to higher-grade areas of the pit, with open-pit mined grades improving to 1.07 grams per tonne of gold.

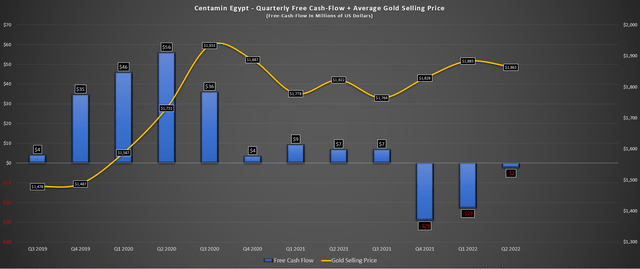

Centamin – Free Cash Flow & Average Realized Gold Price (Company Filings, Author’s Chart)

In addition to improved mined grades, the company is also making progress on its 36MW solar farm, which could lead to cost savings of more than liters of diesel fuel per year. This is expected to be commissioned in Q3, as is the final delivery of lightweight truck trays for its mining fleet. Unfortunately, these improvements did not show up in Centamin’s free cash flow figures due to this being a heavy-capex period, with the company a cash flow outflow of ~$25 million in H2 2022, a significant decline from the $16.3 million in free cash flow generated in H1 2021.

Costs & Margins

Looking at operating costs, the headline results disappointed here as well, with Centamin reporting all-in sustaining costs [AISC] of $1,357/oz in Q2 and H1 2022 AISC of $1,446/oz. These operating cost figures were up substantially on a year-over-year basis, with H1 AISC increasing 22% year-over-year from already above-average costs ($1,186/oz). While the company did get a little help from the gold price, which helped to offset the sharp decline in AISC margins, margins still slid from $613/oz to $426/oz. That said, Q2 AISC margins were much better than the H1 figures at $506/oz.

While these headline results might also turn off investors, it’s worth noting that this is an extremely capital-intensive period for Centamin, and sustaining capital soared more than 41% in H1 2022 to $78.2 million. Meanwhile, capex came in at 61% of the annual spending budget in H1 2022, and this annual budget was above historical levels due to ongoing projects (paste fill plant, tailings upgrades, solar plant). Therefore, it’s no surprise that costs were up sharply in the period and that free cash flow was negative. However, with the benefit of cost-savings initiatives, higher production in 2023, and lower capital spending, we should see a massive improvement in costs/margins in H1 2023.

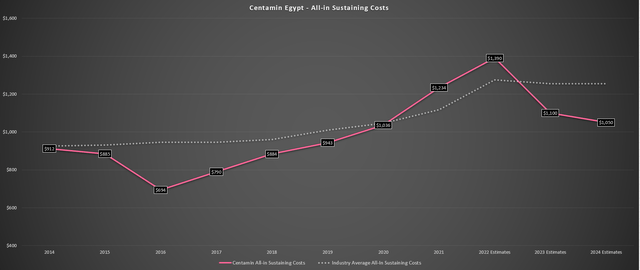

Centamin – All-in Sustaining Costs – Historical & Forward Estimates (Company Filings, Author’s Chart)

If we look at the chart above, Centamin’s costs will likely come in near $1,390/oz this year due to inflationary pressures, much higher sustaining capital spending, and lower production. This will mark the sixth consecutive year of higher costs, with an accelerated rate of change for unit costs since 2020. However, 2022 should mark peak costs for the company, with all-in sustaining costs likely to dip closer to $1,100/oz in FY2023 and near $1,050/oz in FY2024, benefiting from what should be some moderation in energy prices and the benefit of much less diesel usage.

The other opportunity worth noting is the potential to connect Sukari to the grid (25 kilometers away), which is currently being explored, furthering cost savings.

So, while all-in sustaining costs are expected to come in $120/oz above the industry average in FY2022 ($1,390/oz vs. $1,270/oz), Centamin’s costs should decline below $1,125/oz in FY2023. In contrast, the industry average is likely to remain above $1,250/oz. Based on my estimates for FY2024, I would not expect much improvement in industry-wide all-in sustaining costs, given that the average producer isn’t able to invest heavily in cost-savings initiatives. However, Centamin will benefit from higher production and grades, pushing costs below $1,100/oz.

Finally, and not yet confirmed, Centamin could add a sub $900/oz AISC operation and shed its single-asset producer status if it green-lights the Doropo Project for construction. Assuming this asset heads into production in FY2026, Centamin’s annual production would hit record levels (650,000+ ounces), its costs would dip closer to $1,000/oz on a consolidated basis, and it would likely receive a re-rating. The reason is that it would finally benefit from the higher multiples that multi-asset producers receive (1 or more operating mines). To summarize, while Centamin may be a high-cost producer today, it will be a low-cost producer relative to the industry average in the future, meaning investors should ignore the elevated H1 cost profile.

Valuation & Technical Picture

Based on ~1.16 billion shares outstanding and a share price of US$1.09, Centamin currently trades at a market cap of ~$1,264 million and an enterprise value of $1.09 billion. This might appear to be an expensive valuation for a company with a 50% profit-sharing agreement with the Egyptian Mineral Resources Authority [EMRA], effectively making it a ~240,000-ounce producer, given that it receives 50% of the profit from the ~500,000-ounce Sukari Gold Mine (FY2025 estimates). That said, the company also has a high-grade gold project in the wings in the Ivory Coast.

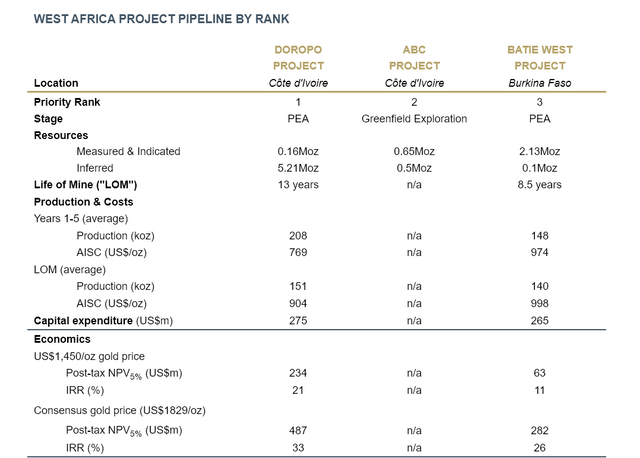

Centamin should be able to build the Doropo Project (Cote D’Ivoire) for less than $320 million even after factoring in inflationary pressures. This project is expected to produce 208,000 ounces on average in its first five years at all-in sustaining costs below $800/oz. This is a phenomenal cost profile, giving it a similar cost profile to Fortuna’s (FSM) Seguela Project but at a 40% higher production profile. Even at what I would argue to be a conservative gold price assumption for the 2025-2037 period ($1,800/oz), the After-Tax NPV (5%) on this project comes in at ~$450 million (adjusted for some cost inflation).

Given that Cote D’Ivoire is not the most attractive jurisdiction, I believe applying a 0.80x NPV (5%) multiple for the project is best to assess the real fair value in the market (West African producers trade at lower multiples). Still, even at this multiple, the fair value for the project comes in at $360 million or US$0.31 per share. It’s also worth noting that Centamin has two other projects in West Africa with a combined resource of ~3.4 million ounces, which I think it’s fair to assign a value of $97 million, or $35.000 per measured & indicated ounce. This places a fair value on its African portfolio of US$0.39 per share.

West African Portfolio (Company News Release)

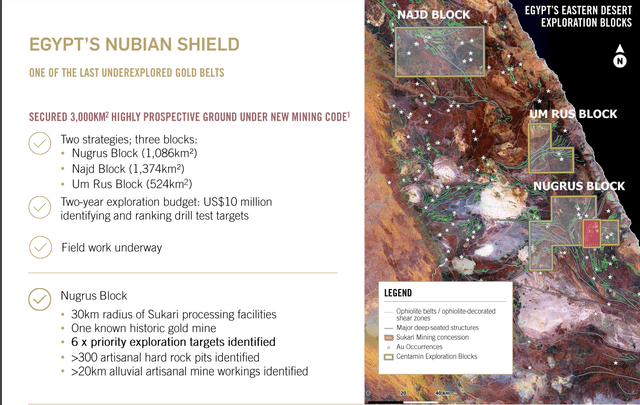

After subtracting this from Centamin’s enterprise value of $1.09 billion, investors are getting 50% of Sukari and ~3,000 square kilometers of prospective land in Egypt for $633 million. This is a very reasonable valuation considering that the Nugrus Block (1,086 square kilometers) is within trucking distance of Sukari and has over 20 kilometers of alluvial artisanal mine workings have been identified.

In addition, Sukari Underground looks better and better each quarter with new drill results that have been released and with the potential for higher throughput/improved grades like what we’re seeing in Horus Deeps (54 meters at 15 grams per tonne) and Bast, this could be a much larger contributor to Sukari’s production profile.

Centamin – Exploration Upside (Company Presentation)

To summarize, while Centamin might appear expensive if one looks solely at Sukari and only looks at it during its transition phase, I think this is the wrong way to look at the company. This is because it places zero value on its West African portfolio, which any African junior would kill for (three multi-million ounce projects at 1.1+ grams per tonne gold, oxide component at Doropo), and doesn’t give any upside to the underground opportunity at Sukari. Therefore, I think Centamin is misunderstood, and while there are better opportunities out there, this is a name worth watching as it still sits 65% off its highs with an improving investment thesis.

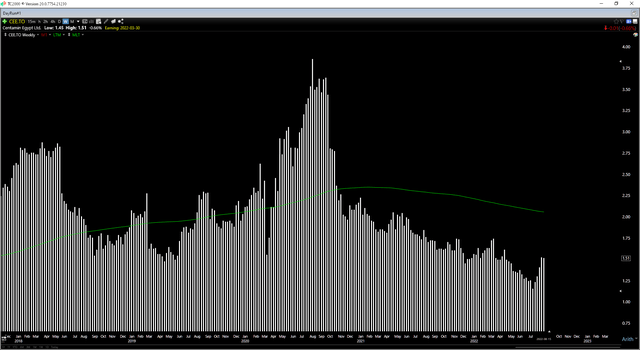

Centamin – Weekly Chart (TC2000.com)

Summary

Centamin may not be the cheapest miner out there and certainly not the lowest cost based on its FY2022/FY2023 guidance. That said, it’s quite clear that operations are turning around after the unfortunate incident in 2020, and it’s becoming more clear that Centamin’s true potential in Egypt might be 500,000+ ounces per annum, with further upside in the latter portion of this decade if new discoveries are made on its Eastern Desert exploration blocks. After adding in the potential with Doropo, I see Centamin as undervalued at current levels.

Centamin Gold Pour (Company Presentation)

That said, the stock has seen a nice run since late July, up more than 30% from its lows. This doesn’t mean that the stock must pull back sharply, but when it comes to turnaround stories, I prefer to buy on sharp pullbacks, not chase rallies. Hence, while I think the Centamin story is improving, I would only become interested in the stock on a pullback below US$0.96 per share. If the stock can find support in this area, it would leave a higher low on the chart, and this might suggest that the stock has finally put in a bottom after a violent ~2-year bear market (70%+ correction).

Be the first to comment