JHVEPhoto

This is one of the ongoing large-cap merger arbitrage cases where the spread has recently widened. The only remaining hurdle here is regulatory approval.

US TV station operator Tegna (NYSE:TGNA) is getting acquired by a consortium of private equity buyers. The buyer group is led by Standard General (SG) and includes Apollo Global Management and peer Cox Media (which is majority-owned by Apollo). The consideration is $24 per TGNA share plus a ticking fee that increases the consideration the later the merger closes. Further calculations assume a 10-month closing timeline leading to a total consideration of $24.5/share – a 13% spread at current prices. That said, a transaction close in 15 months would materially add to the consideration resulting in 25.88/share or 19% upside.

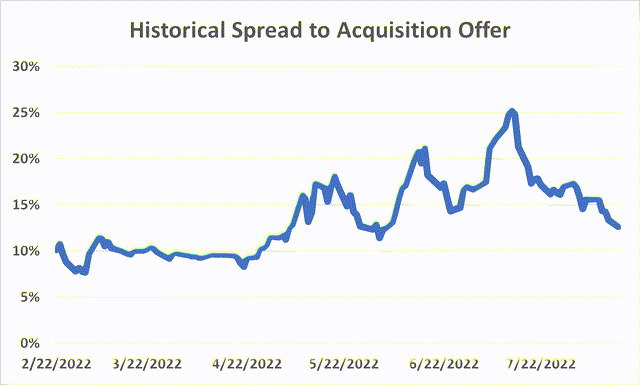

The spread used to stand at 10% post-announcement but widened as the merger received backlash from labor unions, public-interest groups and one competing broadcaster. The groups filed petitions arguing that the transaction would give the combined TGNA-Cox Media a large US broadcasting market share (coverage of 39% of US households). Other concerns include potential staff layoffs, lower local news coverage and higher retransmission fees which could lead to higher consumer prices. Moreover, the critics suggested that the merger would give Apollo control over post-transaction TGNA.

Since the opposition, the FCC issued a request for more information and later extended the deadline for labor unions and public interest groups to expand/add to their complaints. Regulatory investigation has now been ongoing for close to 4 months. Generally, the FCC follows a 180-day decision timeline benchmark. Other industry transactions have followed a similar timeline. While an informal guideline, this suggests that a decision is likely in the coming months. TGNA and the buyer consortium also expect the merger to close in H2’22. At the current spread, such a timeline would translate to a 37% annualized return.

Regulatory risks remain and merger approval is by no means guaranteed. That said, the merger seems to address all of the opposition’s concerns:

-

Market shares/overlap. TGNA and Cox Media currently only have an overlap in four markets in Texas where SG will divest its TV stations to Cox Media. Moreover, the combined TNGA-Cox Media would be within the limits of FCC’s ownership rules which do not allow any TV station group’s ownership to exceed 39% of US households. After the transaction, TGNA’s coverage is expected to reach 28.5% while Cox Media’s would stand at 10.4%, implying a total coverage of just below the FCC’s limit.

-

Re-negotiation of retransmission fees. Transfer of licenses from TGNA to SG implies a re-negotiation process with cable TV providers, however, this should not be a point of concern for the FCC. Historically, the FCC has reportedly not interfered in private retransmission agreement negotiation processes and have not positioned potential fee increases as harming the public interest. Further, retransmission consent agreements are already a regular process that takes place every three years unless a broadcast station instead chooses to require the provider to carry its signals. Currently, TGNA already has retransmission agreements with “almost all” cable providers. It is possible that TGNA could renegotiate higher retranslation fees. That said, cable TV providers are facing significant competitive pressure from online providers, suggesting that the cable providers are unlikely to transfer cost increases to consumers. Nielsen’s data shows that streaming has expanded its TV viewing market share from 26% to 34% in just one year as of Jul’22. Given the fact that the cable and broadcast markets are contracting, significant price increases for end-consumers seem unlikely. Speaking about the possible coordination with Apollo/Cox Media, SG has stated that there will not be joint negotiations nor shared information on retransmission fees.

-

Labor and local news coverage. The merger is unlikely to lead to staff reductions and lower local news coverage. While it is true that TGNA employs more workers per station (97 as of 2021) than the largest peers Nexstar (63) and Gray Television (50), TGNA generally operates in larger markets which require more workers. To illustrate this – TGNA owns TV station licenses in 51 markets compared to 124 for Gray but has a higher coverage at 29% of US households versus 23% for Gray. SG has also reiterated that they will not perform any staff reductions. Moreover, Standard Media (SG’s media subsidiary) has actually increased newsroom staffing by 28% in four stations that it has acquired since 2021. Meanwhile, SG’s management seems to have a decent track-record in expanding local news coverage. SG’s local news coverage initiatives have received industry recognition – for example, in 2015 Media General’s TV stations received 22 prestigious regional journalism awards.

-

Apollo’s influence. As part of the transaction, Apollo will acquire TGNA’s preferred shares which will not have any voting rights. Moreover, preferred equity funding amounts to a reported $925m (this includes other preferred equity investors besides Apollo) – only 11% of the transaction’s total enterprise value of $8.4bn. What this means is that Apollo will not have attributable influence at the post-merger company, if any, and both TGNA and Apollo will remain separate entities.

Moreover, a review of other large industry transactions shows that the FCC is rather lenient in approving broadcaster mergers as long as they are within the ownership cap threshold and proposed divestitures are appropriate. The regulator previously approved several acquisitions involving two large peers – Nexstar and Gray Television – which significantly expanded their broadcasting presence. Meanwhile, the current transaction does not involve any consolidation and will actually decrease the number of TV stations that post-merger TGNA will operate. DOJ approval is likely for the same reasons – in the past 3 years, the regulator apparently approved all six broadcasting station group mergers for which it had filed antitrust lawsuits after divestitures were agreed upon.

Importantly, since 2020 TGNA has received numerous acquisition offers from other interested parties, including several broadcasting industry peers. Most recent bid in Sep’21 came in from Allen Media Group at $23/share. This suggests that in case of a deal-break, the company could attract the interest of strategic buyers.

Broadcasting Market

While Nexstar is the clear leader in the US broadcasting industry, the rest of the pack fares similarly – nine other companies operate TV stations that cover more than 20% of US households. Tegna is currently the second-largest broadcaster by revenues and the third largest by household coverage. Cox Media and Standard Media are both small industry players – Cox Media is only the 15th largest company by TV station coverage while Standard Media operates just 4 TV stations.

Selected data of broadcasters as of 2021:

|

Industry Rank by Revenue |

Company |

Markets |

TV Stations |

Broadcasting Revenue ($bn) |

Coverage |

Coverage with UHF Discount |

|

1 |

Nexstar |

116 |

199 |

4.5 |

68% |

39% |

|

2 |

Tegna |

51 |

64 |

3.0 |

39% |

30% |

|

3 |

Sinclair |

86 |

185 |

2.8 |

45% |

24% |

|

4 |

Gray Television |

113 |

180 |

2.3 |

36% |

25% |

|

5 |

Fox |

18 |

29 |

2.5 |

39% |

26% |

|

11 |

Cox Media |

10 |

33 |

– |

9% |

4% |

|

– |

Standard Media |

4 |

4 |

– |

– |

– |

Source: Company filings and press releases.

Note: Household coverage figures in this write-up refer to how the FCC calculates it – the regulator applies the so-called UHF discount. In short, it discounts the coverage of UHF (ultra high frequency as opposed to very high frequency) stations by half. It dates back to the 1980s when UHF stations were inferior to VHF stations. Removal of the UHF discount has been an object of FCC’s discussions since 2017 but no changes have been made so far.

Other Industry Acquisitions

-

Nexstar acquired Tribune for $7.2bn in 2019. The transaction created the largest broadcaster in the US (197 stations at the time) with the combined coverage touching the FCC’s 39% threshold. The merger faced DOJ’s opposition but eventually divestitures of 21 stations did the trick. FCC approved the transaction in 210 days.

-

E. W. Scripps acquired ION Media for $2.7bn in 2021. The combined company had a reach of 39% after divestiture of 23 of ION stations.

-

Gray Television bought Meredith for $2.8bn in 2021. The transaction made Gray the second-largest TV station group with a combined 25% coverage. No divestitures were required and FCC approved the merger in 6 months.

-

Gray Television acquired Raycom for $3.6bn in 2019. Reportedly, the DOJ filed an antitrust lawsuit to block the merger, however, divestitures eventually helped to resolve regulatory issues. FCC’s approval came after 5 months.

The only industry acquisition that was rejected by the FCC was the Sinclair-Tribune merger back in 2018. The combined company would have exceeded the national television ownership limit by 6.5%. To resolve this, Sinclair proposed to divest several of its stations. However, the divestitures were to be done to entities controlled by its chairman – this pushed the FCC to block the deal.

Other Bidders

Since 2020, TGNA has attracted the interest of numerous industry bidders (note: the timeline does not include SG’s proposals made throughout the time period):

-

In Feb’20, an offer from an undisclosed company valuing the company at $20/share.

-

In Mar’20, TGNA received another three bids all valuing the company at $20/share. One offer came from Apollo, another from Allen Media and the last one from a consortium consisting of a private investment firm and a broadcasting industry participant. Two offers were withdrawn due to COVID-19 while the others were rejected by the company.

-

In Oct’20, Apollo made a proposal at $16/share. The Board rejected the bid. Apollo later revised the offer to the $16.50-18/share range. Both sides did not reach an agreement.

-

In Dec’20, an offer from an undisclosed company to acquire TGNA’s assets in 14 markets for $2.8bn-$2.9bn.

-

In Feb’21, another offer from Allen Media who valued the company at $20/share.

-

In Sep’21, Allen Media made another bid at $23/share.

Conclusion

At the current price, TGNA offers a compelling merger arbitrage opportunity with a potential ~37% annualized return. The merger effectively addresses most important concerns voiced by labor unions and public interest groups. Moreover, interest from other bidders in the previous years suggests that the downside could potentially be limited.

Great News

Our new premium marketplace service is on its way to launch on September 15! The marketplace will feature only our highest-conviction special situation investment ideas backed by high-quality/original research. More details are coming shortly so stay tuned!

Be the first to comment