Md Saiful Islam Khan/iStock via Getty Images

If you need something from somebody always give that person a way to hand it to you. ― Sue Monk Kidd

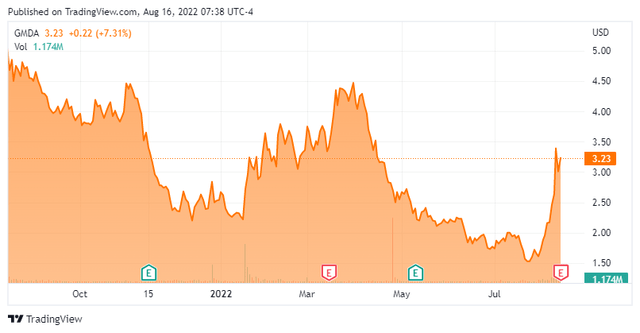

Today, we put Gamida Cell Ltd. (NASDAQ:GMDA) in the spotlight for the first time since we posted an article on it back in early November of last year. The FDA recently agreed to look at its marketing application for its stem cell therapy under and an accelerated review basis, meaning a decision is likely in the first quarter of next year. Therefore, it seems a good time to peak back in on this small developmental concern. An analysis follows below.

Company Overview:

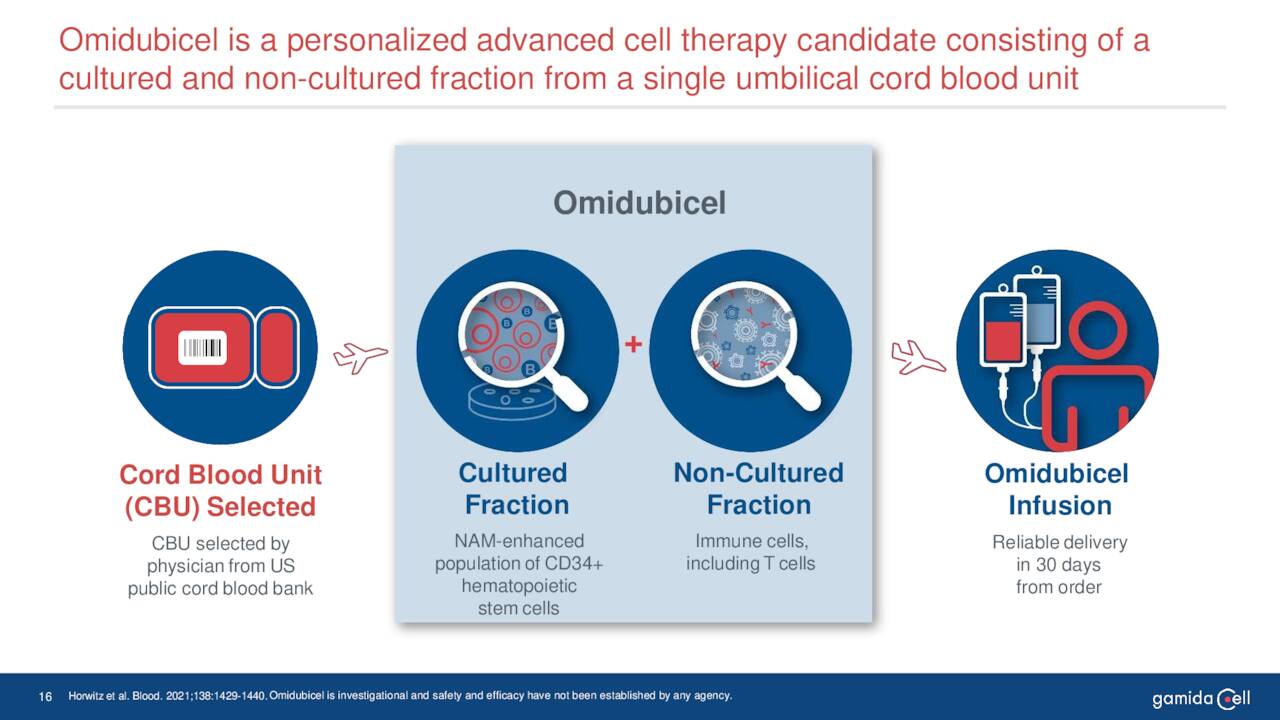

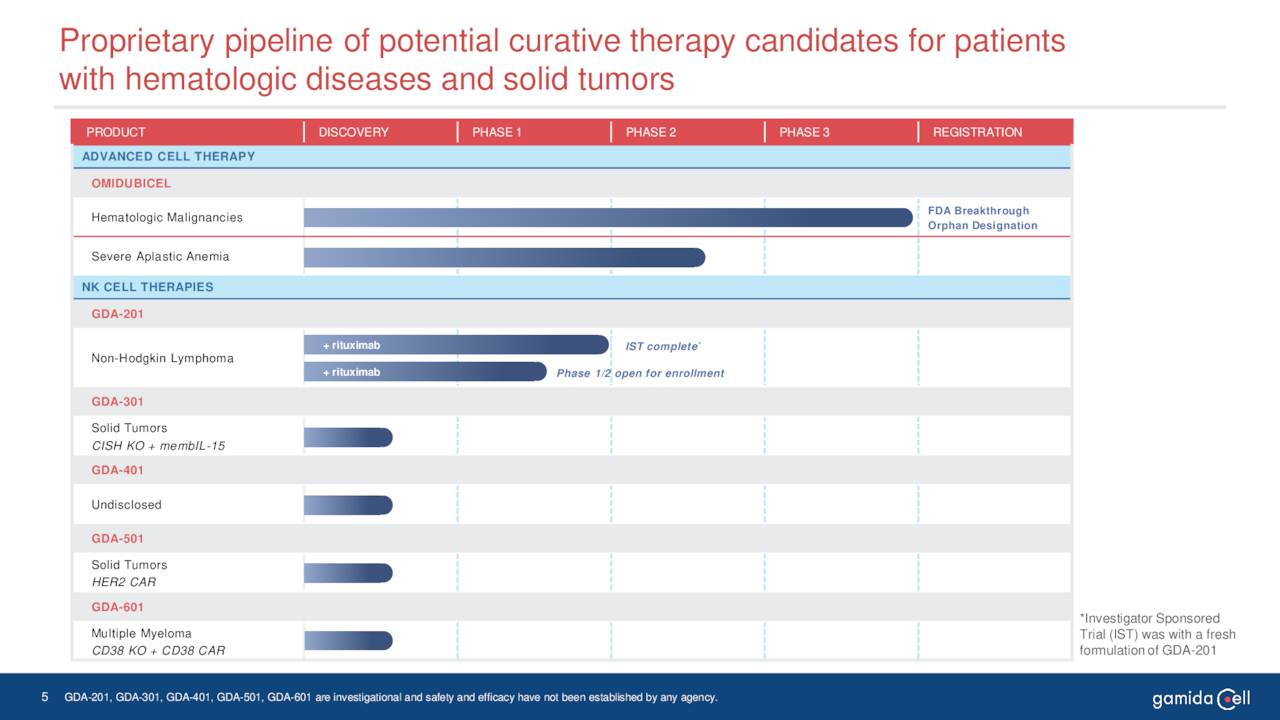

Gamida Cell Ltd. is based in Jerusalem. The company is focused on developing cell therapies to cure blood cancers and serious hematologic diseases. Gamida’s biologic candidates are developed using its proprietary developmental platform ‘NAM Platform Technology’ that allows the company to expand multiple cell types – including stem cells and natural killer or NK cells – while maintaining their original phenotype and potency.

June Company Presentation

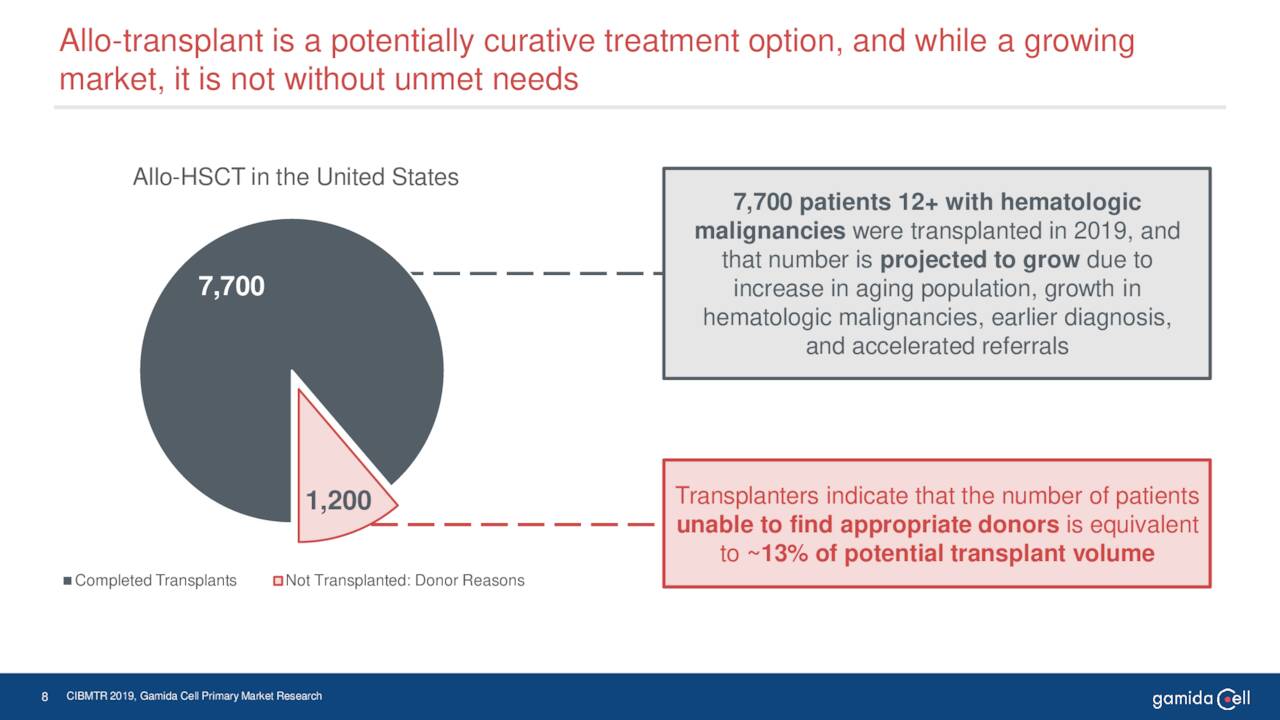

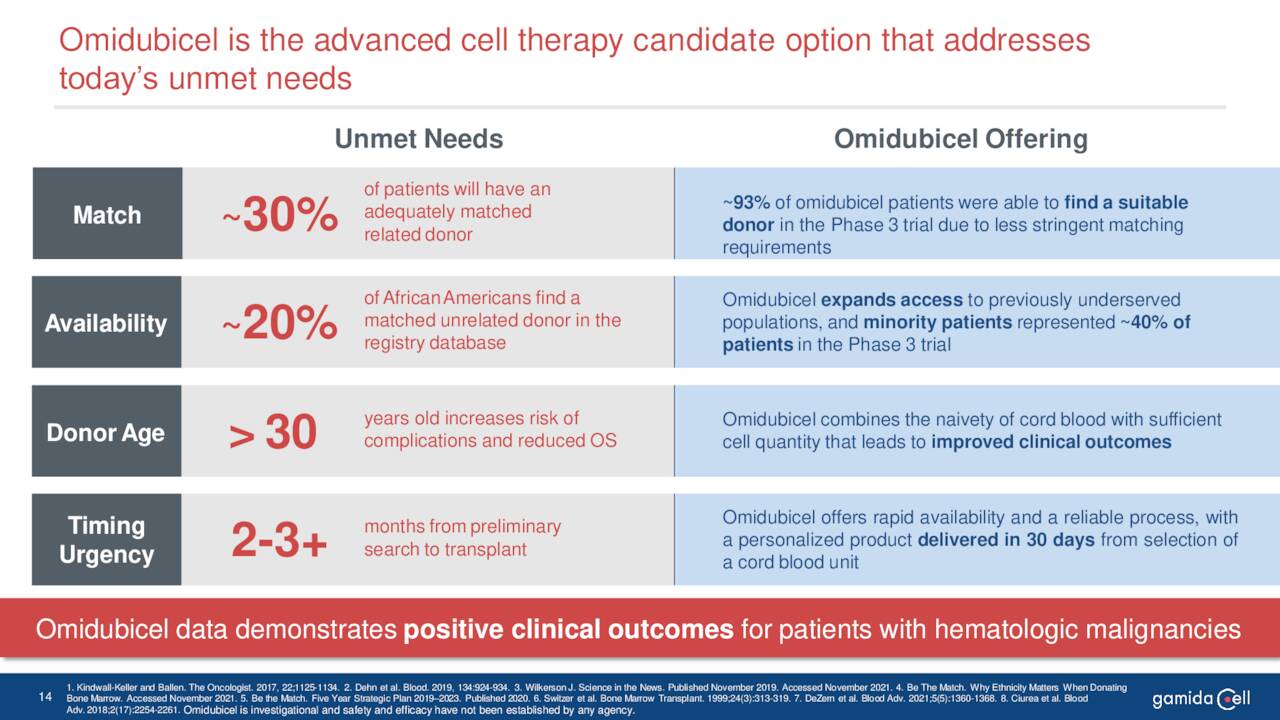

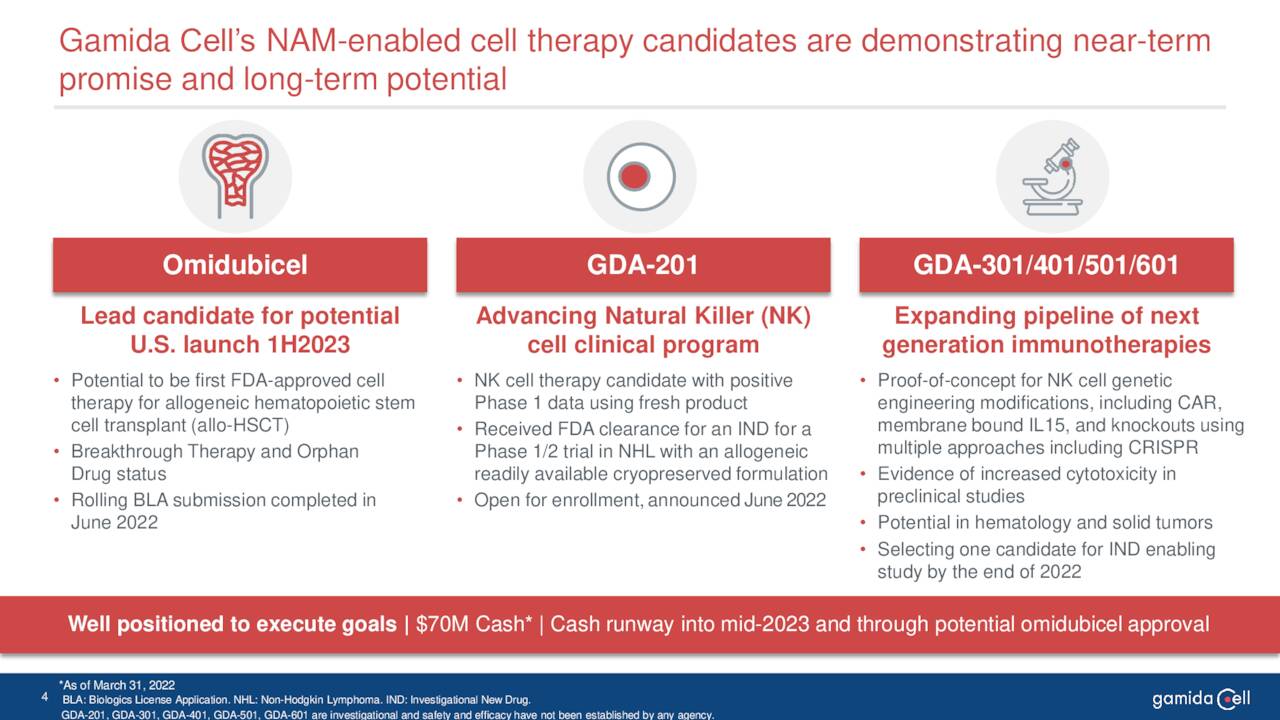

Gamida’s key asset is omidubicel. Omidubicel is an advanced cell therapy under development as a potential life-saving allogeneic hematopoietic stem cell (bone marrow) transplant solution for patients with hematologic malignancies. This biologic has completed Phase III clinical trial in patients with high-risk hematologic malignancies and now is pending FDA approval for this indication

June Company Presentation

Omidubicel has both Orphan Drug and Breakthrough Therapy status for this affliction.

June Company Presentation

The compound could greatly improve outcomes for this rare affliction as it significantly improves the matching rate between donor and recipient.

June Company Presentation

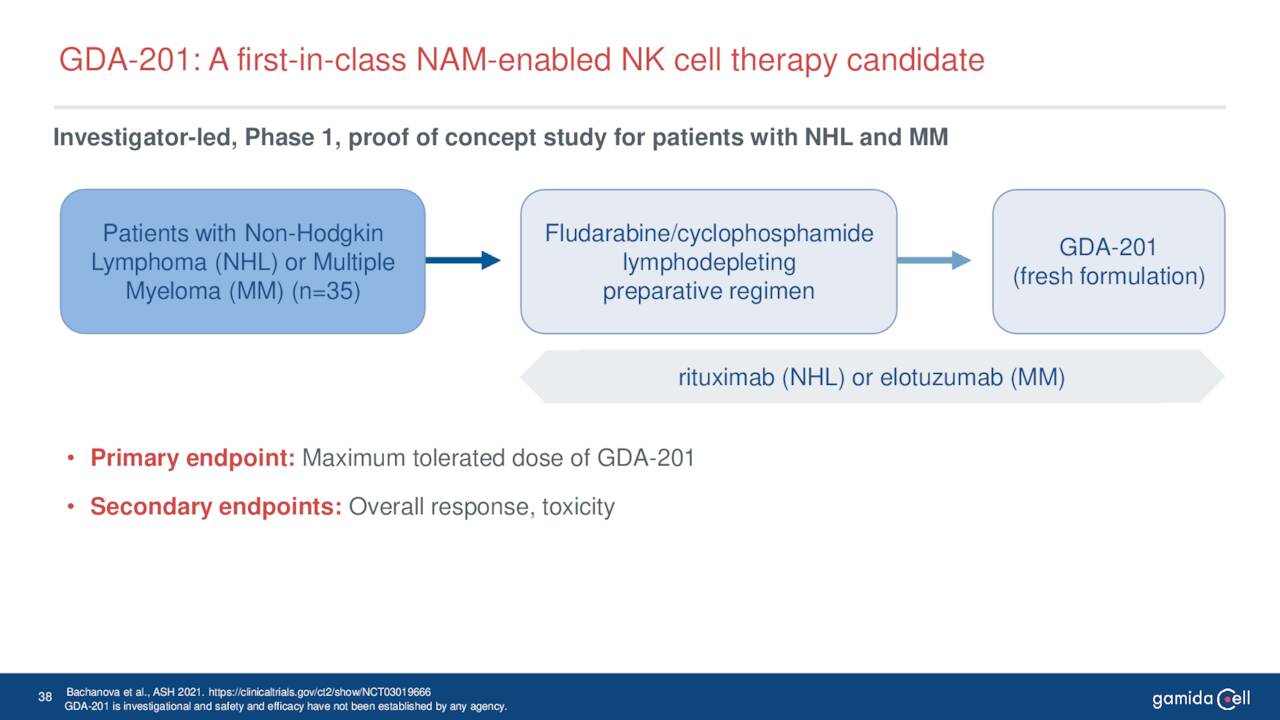

This biologic candidate is also in Phase I/II clinical trials for patients with severe aplastic anemia. Also in Phase I/II clinical studies is GDA-201, a natural killer cell-based cancer immunotherapy. It is being evaluated for the treatment of relapsed or refractory non-Hodgkin lymphoma and multiple myeloma. The company recently dosed the first patient in this study.

June Company Presentation

The company has some earlier stage drug candidates that will not be germane to this analysis. The stock currently trades just north of three bucks a share and has an approximate market capitalization of $195 million.

June Company Presentation

FDA Approval Pending:

At the beginning of August, the company’s its Biologics License Application or BLA for omidubicel was accepted for filing from the FDA with priority review status. This means a review of six months, instead of the average ten months. A decision date is scheduled for late January. The FDA will also act upon this BLA without an Advisory Committee, which I see as encouraging.

Analyst Commentary & Balance Sheet:

The analyst community is currently very enthusiastic about the prospects for Gamida Cell. So far this month, five analyst firms including Piper Sandler and Needham have reissued Buy ratings on the stock. Price targets proffered range from $8 to $22 a share. Here is H.C. Wainwright’s analyst on what is behind the firm’s Street high $22 price target.

Our $22 PT is derived by using a 14% weighted-average cost of capital for Gamida Cell shares to discount free cash flows from annual sales of omidubicel and GDA-201, dividing them by our projected number of shares for each year to account for the effects of share dilution, and then factoring in a 1% terminal growth rate and 85% clinical program probability of success.

Approximately one out of 16 shares is currently held short in GMDA. The company ended the second quarter of this year with $55 million in cash and marketable securities. Leadership believes funding is in place for all operating activities through mid-2023. This does not include needs for the commercialization of omidubicel. Therefore the company is very likely to raise additional capital sometime on the near term horizon.

Verdict:

June Company Presentation

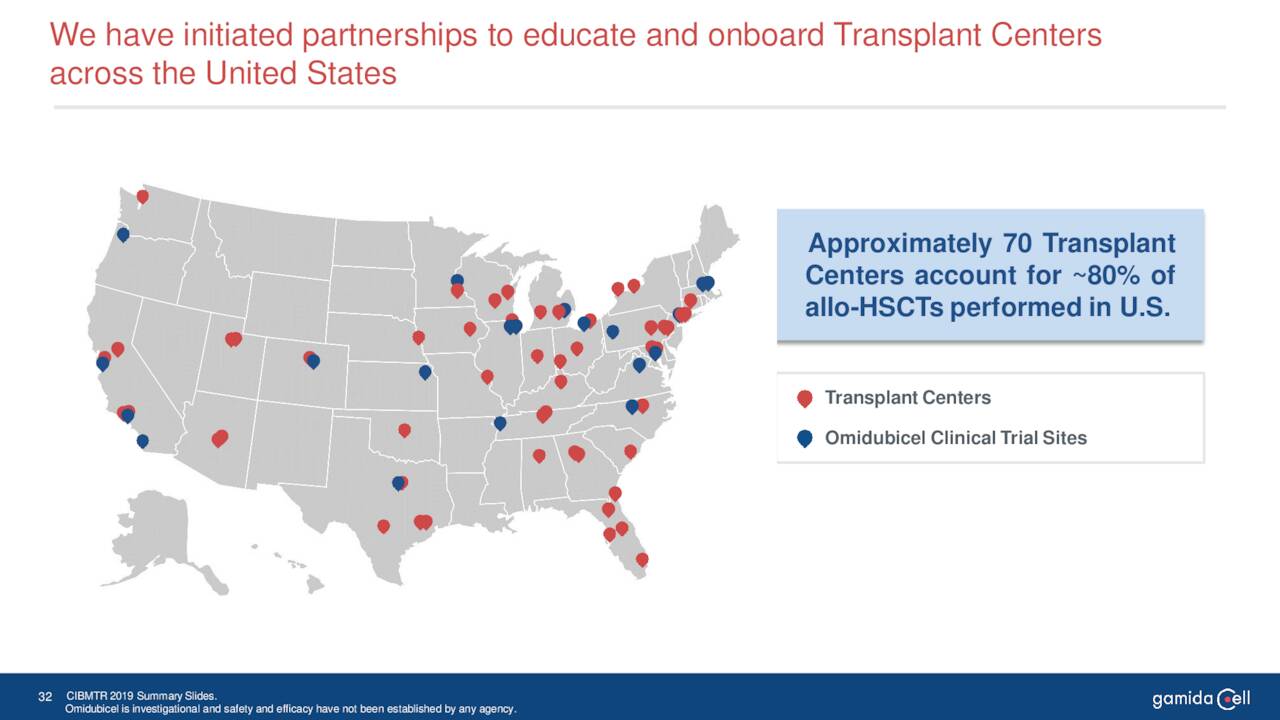

The rollout of omidubicel to treat hematologic malignancies, provided FDA approval is garnered, is relatively straight forward as approximately 80% of the population for this rare affliction get treatment at some 70 transplant centers in the United States. Gamida is already deeply engaged with many of these centers.

June Company Presentation

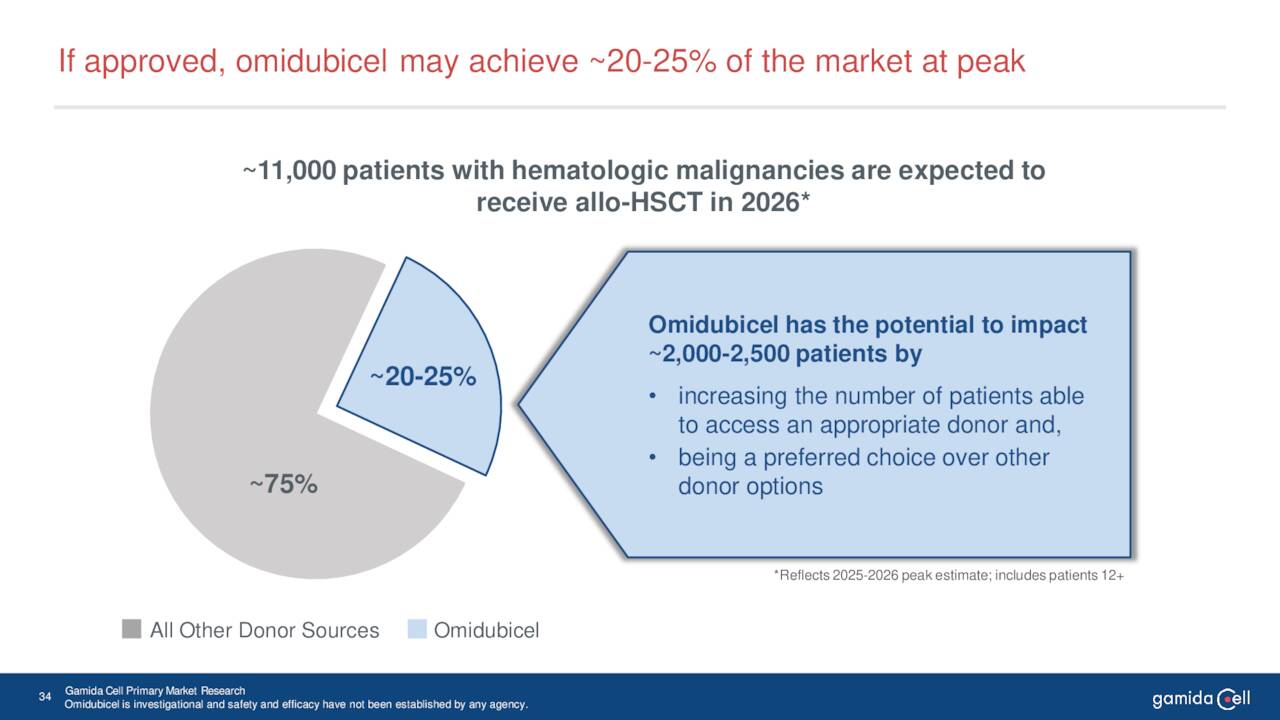

Leadership believes omidubicel can eventually garner 20% to 25% market share in this space. FDA approval does seem likely in January, and the stock may very well run up into that approval date. My guess is that Gamida initiates a secondary offering to raise additional funding to commercialize omidubicel soon thereafter. Overall, the risk/reward profile on Gamida seems attractive. Options are available against this equity which enables a simple covered call strategy around Gamida. This is how I have been maintaining my small position in this interesting but high beta small cap concern.

To be most effective, flattery is always best applied with a trowel. ― Alan Bradley

Be the first to comment