Andrii Yalanskyi

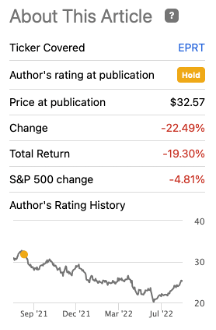

A quick look back at my previous September 8, 2021, article on Essential Properties Realty Trust, Inc. (NYSE:EPRT), my second article on Seeking Alpha. I gave a hold rating at the time, stating that the company has strong prospects, but the stock was valued more expensive than the 5-year average. Since the publication of my article, the stock has fallen 19% (including pre-tax dividends). My article clearly indicated the peak.

Return Essential Properties (Seeking Alpha)

Currently, the stock is valued more cheaply and management raised expectations for 2022: management expects 2022 AFFO per share to be between $1.52 and $1.54.

What I especially like about Essential Properties are the concepts of the tenants. Look at the concept of Chicken ‘n Pickle, which could easily become the next McDonald’s (MCD) in size. It’s a great concept.

Essential Properties is growing rapidly and exceeding analyst expectations. The stock is valued cheaply, and a strong stock return can be expected. The stock is a strong buy.

Expanding Portfolio Diversification

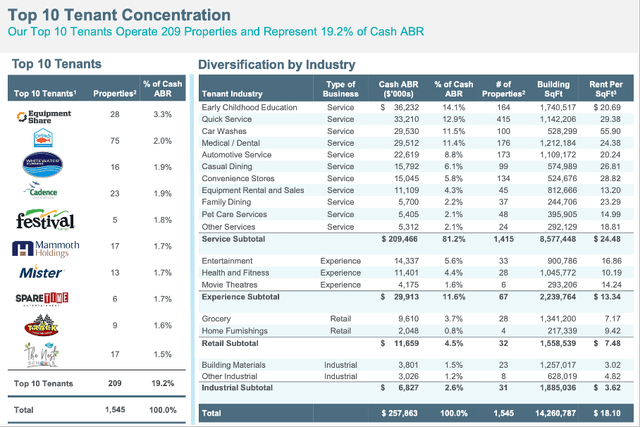

Essential Properties is a real estate investment trust (“REIT”) whose portfolio consists of 1,561 freestanding net lease properties. The company primarily rents out its freestanding properties to service-oriented and experiential tenants in the United States. The company’s tenants are well-diversified by industry. More than 80% of the cash annualized base rent (“ABR”) consists of service-oriented tenants. Just over 10% of ABR’s cash comes from rent from the more volatile experience industry. A small portion of cash ABR is received from tenants in the retail and industrial sectors. Service-oriented tenants provide services that customers need, there is always demand, even during recessions.

The table below shows the diversification by industry and tenants. But keep in mind that the presentation is from the first quarter of 2022.

1Q 2022 presentation (Essential Properties Investor Relations)

Since my last September 2021 article, Essential Properties has invested less in service-oriented customers (81.2% vs. 84.5% last year), but significantly more in retail (4.6% vs. 2.8% last year). A portion of the retail sector consists of grocery stores (3.7% of the cash ABR). Essential Properties receive more rent from tenants in the industrial sector compared to last year (2.6% compared to 1.9% last year). The sector diversification from tenants is currently greater than last year, and this will pose a lower downside risk in times of recession.

Second Quarter Results Were Strong

The results of the second quarter are strong. Revenue grew 25% year-over-year to $71.4 million, and same-store rents grew 1.9%. Adjusted Funds From Operations (“AFFO”) grew 12% to $0.38 per share. The company is growing strongly.

The average rental term is 13.8 years and 4.3% of the ABR expires until 2026. The weighted average rental coverage ratio is even higher than when I first published my article, standing at 4 compared to 3.2 in September 2021.

Management raised its expectations and now expects 2022 to approach AFFO in the $1.52 to $1.54 range. This equates to a growth of 13.4% to 14.9% compared to 2021. AFFO is growing steadily, from 2019 to 2021 the AFFO grew on average 35.5% per year. The company has been able to achieve this rapid growth by issuing shares. AFFO grew on average by 8.4% over the same period.

|

Year |

AFFO |

AFFO per share |

|

2019 |

$86M |

$1.14 |

|

2020 |

$107M |

$1.11 |

|

2021 |

$158M |

$1.34 |

|

2022 1Q |

$48.9M |

$0.38 |

|

2022 2Q |

$50.6M |

$0.38 (23% increase) |

Repay Amounts Outstanding On Its Revolving Credit Facility

Recently, Essential Properties offered investors the opportunity to purchase an additional 7.6M shares at a public offering price of $23 per share. And underwriters granted a 30-day option to buy up to 1.14M additional shares. The net proceeds will total $201 million. This will be used for the repayment of outstanding amounts on the revolving credit facility and for general corporate purchases.

As of June 30, 2022, the revolving credit facility offers a maximum principal amount (including accordion feature to increase maximum availability) of up to $600 million. Currently, $218 million is being drawn from the revolving credit facility. The decrease in the amount outstanding in the revolving credit facility will benefit the company as it reduces the interest payable, and this is especially beneficial during the current rising interest rates.

One drawback is that it will dilute shares. As of June 30, 2022, there are 132.7 million shares outstanding, so it will dilute the shares by 6.6%. That is a lot. I expect management made a thoughtful decision and the revolving credit facility rate was much higher than 6.6% to offset the stock dilution.

Dividends And Stock Valuation

In my previous article I showed a table of expected dividend payments for the coming years. 10 analysts expected the dividend per share for 2021 to be $0.99. For 2021, Essential Properties paid more dividend than analysts had predicted ($1 dividend per share). The dividend grew TTM by no less than 8.3%.

Dividend expectations for the coming years have been revised upwards by analysts:

|

Analyst Forecast |

Source: |

Seeking Alpha as of August 15, 2022 |

||

|

Year |

# estimates |

Dividend per share |

||

|

2022 |

10 |

$ 1.07 |

||

|

2023 |

10 |

$ 1.13 |

||

|

2024 |

7 |

$ 1.15 |

||

In my article, I explained that I preferred to value the stock based on the average dividend yield of recent years. The ratio P/FFO reflects the current valuation, and discounted cash flow analysis gives the valuation into the distant future. My stock valuation is somewhere in between, because the distant future is uncertain. But it also has its limitations, the average dividend yield of recent years has been taken while interest rates are now being raised sharply. Higher interest rates affect the share price because investors demand more dividend yields in times of higher interest rates.

The average dividend yield from 2018 to 2021 is 3.8%. The share price for the coming years is calculated in the table below:

|

Analyst Forecast |

Source: |

Seeking Alpha as of August 15, 2022 |

||

|

Year |

# estimates |

Dividend per share |

Expected Share Price (own calculation) |

|

|

2022 |

10 |

$ 1.07 |

$28.2 |

|

|

2023 |

10 |

$ 1.13 |

$29.7 |

|

|

2024 |

7 |

$ 1.15 |

$30.3 |

|

According to this method, the stock is currently undervalued at $25.30. If the shares are purchased and held until the end of 2024, this will yield an average annual pre-tax return of 11.7%.

Risks

There are a few points that I would point out as risky in this strong REIT business, these are: 1) negative GDP growth; 2) inflation and interest rate hikes; and 3) debt maturities.

1) The United States is currently experiencing 2 quarters of negative GDP growth, some speak of a recession. However, Essential Properties is very positive on tenant credit metrics which show a rosy picture over the course of this year. The coverage ratios are all-time high and they experience no cracks or anticipate that the tenants will do very well. Still, this worries me, especially the prospects of the high-risk experience-oriented tenants. A bright spot: Cash ABR consists of only about 11% of experience-oriented tenants.

2) Essential Properties is a triple-net lease play, property taxes, insurance and maintenance are passed on to the tenant. Essential Properties will not suffer much from the high inflation. But high inflation is offset by introducing interest rate hikes. Investors would rather choose safe government bonds than a risky REIT in times of high interest rates. Investors are demanding a higher dividend yield to offset the risk, resulting in share prices falling. With a dividend yield of 4.10% and a recent inflation rate of 8.52%, this poses a risk. Fortunately, the dividend grows every year and inflation can still fall this year.

3) An unsecured term loan of $200M with maturity 2024 is open. Essential Properties will have to refinance it at a higher interest rate and this will impact operating profit.

Conclusion

Essential Properties Realty Trust is a fast-growing REIT that has primarily service-oriented and experience-oriented tenants. Company’s tenants are well diversified in both industries.

The recent figures for the second quarter are strong. Revenue grew 25% YoY and AFFO grew 12%. The average lease term is 13.8 years and only 4.3% of cash ABR will expire in 2026. Tenants are doing well: average rental coverage ratio is 4 compared to 3.2 last year. Management is raising its expectations for this year and expects AFFO to grow between 13.4% and 14.9% YoY.

Based on the average dividend yield of recent years, the stock is attractively valued. From the analysis, I expect an annual pre-tax return of 11.7%.

However, I see some risks. 1) Essential Properties do not expect any difficulties despite the negative GDP growth in the United States. Essential Properties see a strong improvement in the financial situation of its tenants. But I think the negative GDP growth poses a risk to the growth of the company. 2) In times of high inflation and rising interest rates, investors are more likely to invest in safe government bonds and demand a higher dividend yield for equities, causing stock prices to fall. This is detrimental to both the share price and the growth of Essential Properties as it issues shares to purchase properties. 3) The $200 million unsecured term loan due 2024 will need to be refinanced at a higher interest rate, impacting operating income.

Despite the risks I see, I’m giving this stock a strong buy. There are risks, but there is no indication that the risks become material. Essential Properties is growing strongly, has good prospects and the stock is valued cheaply.

Be the first to comment