Rangsarit Chaiyakun/iStock via Getty Images

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) is about to report its Q2 earnings results that should help its stock to gain more traction after weeks of declines. Due to the ongoing supply chain disruptions, we continue to witness major port congestions that continue to keep the shipping rates above the pre-pandemic levels. Thanks to this, a large part of container shipping companies reported stellar Q2 earnings results in recent weeks, and ZIM is expected to do the same thing on Wednesday when its own report comes out.

Considering that the company already trades at a significant bargain with a price-to-sales ratio of less than 1x, a possible successful earnings report could push the shares significantly higher, especially if the management once again increases its full-year guidance, as it has already done so earlier this year. As we all await the Q2 numbers to come out, this article will highlight all the major developments that happened to the shipping industry in recent months in order to build a bullish thesis in regards to ZIM.

ZIM Integrated: A Tech-Savvy Shipping Enterprise Worth Looking At

Initially founded prior to the end of WW2, ZIM specializes in container shipping services around the globe. The company relies on a chartered-in capacity strategy, which gives it flexibility in planning its operations as it can adjust its available capacity to meet the demand without capital-heavy investments. While the company operates a total of 137 vessels, it owns only a significant minority of those vessels, as the majority of them are chartered from charter owners and later used for container shipping services.

After years of struggling to recover from the Great Recession, only in the last few years did the company begin a successful turnaround that lasts to this day. As of now, ~45% of its volume goes through the Trans-Pacific route, while the rest is going through Intra-Asia, Atlantic, and other sea corridors. Overall, ZIM has around 475 000 TEUs of operating capacity, out of which around 415 000 TEUs are already on the order book.

One of the biggest advantages of ZIM is that it heavily relies on big data and business intelligence to increase its overall efficiency. Just recently, the company has increased its investment into the developer of a disruptive scanning technology Sodoyo and at the same time made a $5.5 million investment in another startup Hoopo to improve the optimization of its container fleet.

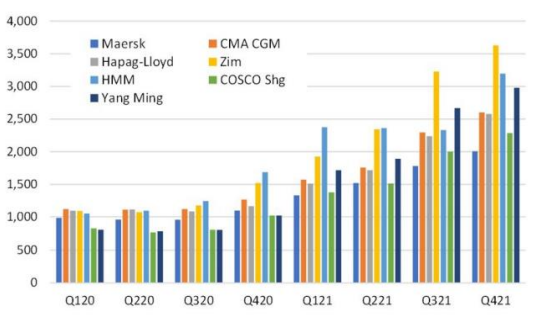

By being a tech-savvy enterprise, ZIM has been able to make its operations more efficient, which helped it to greatly increase its average revenue per TEU in the last couple of years and start earning more per TEU than its competitors in the last few quarters.

The Average Revenue Per TEU By Quarter 2020-2021 (ZIM)

In Q1, the company didn’t disappoint shareholders as well and reported stellar earnings results. Its revenue during the period increased by 113.8% Y/Y to $3.72 billion, while its adjusted EBITDA was up 209% Y/Y to $2.53 billion. Its net income during the period has also increased by 190% Y/Y and stood at $1.7 billion. What’s also important to note is that the carried volume increased only by 5% Y/Y to 859k TEU, but ZIM was able to report a significant improvement in financials thanks to the rise in shipping rates that helped it to have an average freight rate per TEU of $3848, up 100% Y/Y.

Q2 Numbers Should Lift ZIM Stock Higher

There are several reasons to be optimistic about ZIM’s upcoming Q2 earnings report. First of all, the rapid revival of trade after the initial months of the pandemic lead to the supply chain disruptions, which last to this day and have been behind the recent growth of the shipping industry due to high demand and tight supply on the market. Even now, port congestion is still an issue, as in late July there were reports of a record backlog of vessels waiting to enter American ports. What’s also important to mention is that in its Q1 presentation, ZIM noted that these issues may extend into 2023, making it possible for the company to continue to benefit from the current situation.

On top of that, even as China reopens, we’re unlikely to see the overcapacity of vessels in the market due to new tough environmental shipping regulations that will come into effect on January 1 and create additional hurdles for the owners of relatively old vessels. To hedge itself against the downside of new rules, ZIM has been actively chartering more LNG-fueled container ships and in the next two years, it expects 1/3 of its operated fleet to be LNG-fueled. Thanks to this, ZIM should be able to minimize the possible impacts of those regulations.

We should also remember that even though freight rates have been on a decline since the beginning of the year, they’re still significantly high today when compared to previous historical periods. The composite index shows that a spot rate for the 40ft container is around $6430, while in 2019 before the pandemic it was below $2000. This shows that the shipping companies are able to continue to generate exceptionally great returns even after the latest decline when compared to the pre-pandemic periods.

Spot Freight Rates By Major Route (Drewry)

In addition to those tailwinds, another reason why there’s a high chance that ZIM will report great numbers tomorrow is the fact that most of its competitors already reported exceptional Q2 results. Earlier this month, Matson (MATX) reported strong earnings by showing a double-digit revenue growth rate and noting that there was a strong demand from China after the reopening. In addition, Maersk also didn’t disappoint its investors, as it increased its FY22 EBITDA forecast for the year by an additional $7 billion to $37 billion after reporting record earnings for Q2. On top of that, the South Korean HMM recently revealed that its net profit in the first half of the year increased by 1560% Y/Y, while German’s Hapag-Lloyd is now on track to become more profitable than Volkswagen (OTCPK:VWAGY) after reporting its own results. Those results clearly show that the shipping industry continues to benefit from the current supply chain disruptions and that’s why ZIM shouldn’t disappoint its investors tomorrow as well.

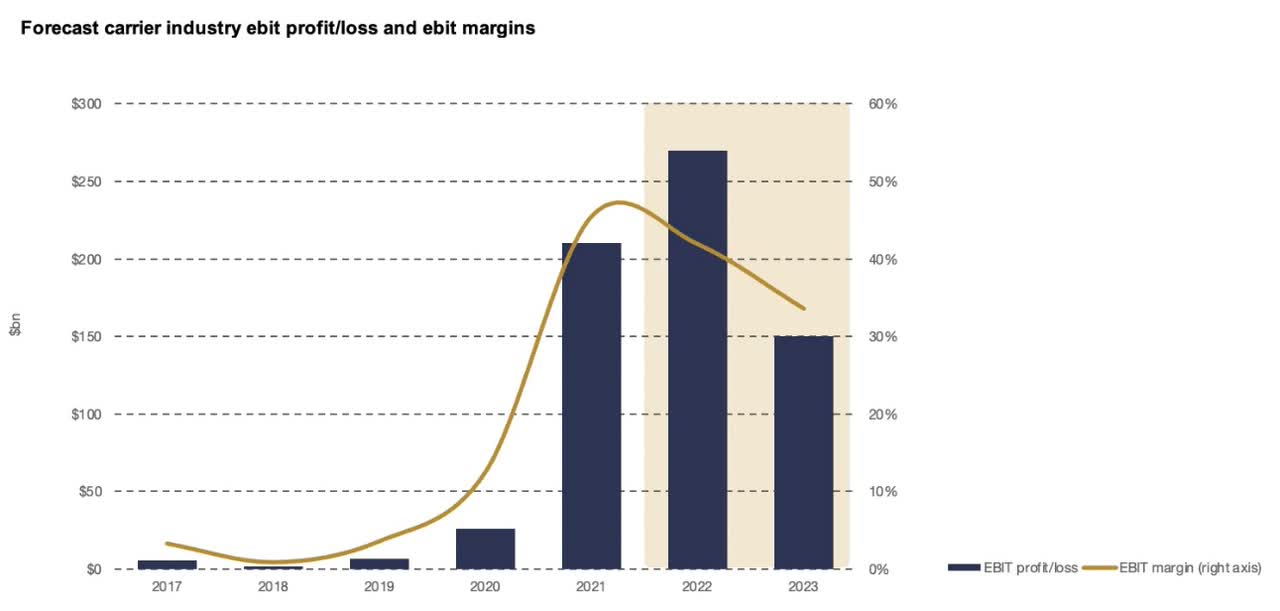

What’s also important to note is that even if we experience a further decline in spot rates in the following quarters, shipping companies are still more than likely to continue to generate record profits in comparison to the pre-pandemic times beyond 2022.

Forecast Carrier Industry EBIT Profit/Loss And EBIT Margins (Drewry)

Back in May, ZIM has already increased its full-year guidance and now expects its adjusted EBITDA to be between $7.8 billion and $8.2 billion, while its adjusted EBIT is expected to be between $6.3 billion and $6.7 billion. Considering the successful results of its peers, ZIM has all the chances not only to meet those full-year targets but also to increase them as well.

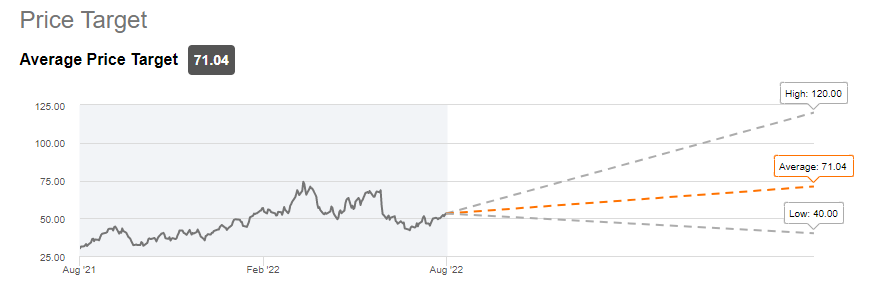

What’s also important to note is that ZIM trades at a forward P/E of 1x, while its price-to-sales ratio is less than 1x. Considering those multiples, we could conclude that the company’s stock is a bargain at the current levels. On top of that, ZIM also pays a hefty dividend, as its TTM dividend yield is ~44%, which makes its stock an even more attractive investment. In addition, the current consensus price target for ZIM’s stock is $71.04 per share, which represents a nearly 40% upside from the current levels and signals that the stock has more room for growth going forward.

ZIM’s Consensus Price Target (Seeking Alpha)

Risks

One of the biggest downsides of ZIM is that it operates in a cyclical industry, which already reached its peak a few months ago and is currently on a downward slope. The good thing is that as we’ve seen the company is likely to continue to generate great returns in comparison to the pre-pandemic levels beyond 2022, but there’s a risk that several headwinds could disrupt the current forecasts and negatively affect the share price in the following quarters.

First of all, despite the better CPI numbers, we could still see the Fed acting more aggressively when it comes to increasing interest rates to tackle inflation, which could lead to a worse than expected decline in economic activity. This will undoubtedly have a negative effect on the whole shipping industry.

In addition, China is also not growing as fast as expected and is unlikely to meet the official GDP growth rate target of 5.5% this year, the lowest target in decades. Its latest industrial output growth already came weaker than expected and considering the fact that the country decided to stick with a zero-Covid-19 policy, there’s always a risk that new lockdowns will be implemented, which will hurt the growth of the global economy.

In addition to the weak economic growth of China, there’s a risk that if Russia cuts gas supplies to Europe at the time when the EU’s oil sanctions against Russia are implemented at the end of this year, we’ll once again see an increase in energy prices, which could create an additional hurdle for the global economy.

Last but not least, there’s also a risk that the new regulations won’t be as effective as expected, which could lead to a greater capacity on the market that will likely pressure the freight rates even more.

The Bottom Line

Despite all the risks, ZIM is a decent long play at the current price. The company is significantly undervalued and will continue to benefit from the higher freight rates, which are significantly above the pre-pandemic levels, in the following quarters. On top of that, ZIM continues to pay hefty dividends. Considering the results of its peers in recent weeks, its own Q2 earnings report shouldn’t disappoint its shareholders as well.

Be the first to comment