adamkaz/iStock via Getty Images

Because of rising interest rates that are being used to combat inflation, as well as a decline in consumer spending capabilities that are heavily related to broader economic conditions, pretty much everything related to the home building market is considered scary territory as far as investors are concerned. Truly, there is some pain being experienced in this market. But even so, one company that is holding up fairly well is a firm called Tri Pointe Homes (NYSE:TPH). In the near term, if data is any indication, this regionally focused home builder is likely to experience some pain on its top and bottom lines. Even though that is the case though, for investors who are focused on the long haul, it’s exactly this pain that may make the company a worthy prospect to consider at this time.

Pain is building and building is painful

Back in June of this year, I wrote an article that took a rather bullish stance on Tri Pointe Homes. In that article, I talked about how good a job the company had done over the prior few years to grow its top and bottom lines. Even at that time, deliveries, backlog, and the pricing that it charges for its services, were all coming in fairly strong. To top it all off, shares were trading at attractive levels that made me think as though long-term upside could be rather material. Because of that, I ended up rating the company a ‘buy’ to reflect my view that shares should outperform the broader market moving forward. Fast forward to today, and that call has not gone exactly as planned. While the S&P 500 is down roughly 1%, shares of Tri Pointe Homes have declined 9.8%.

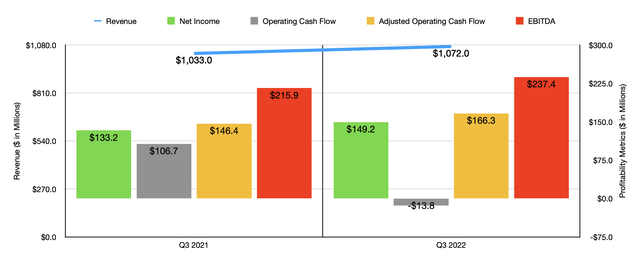

If you look at the company based solely on its revenue, profitability, and cash flows, you would be perplexed as to why share price performance has not remained at least in line with the broader market. To see what I mean, we need only look at the third quarter of 2022. During that quarter, sales came in at $1.07 billion. That represents a modest increase over the $1.03 billion the company generated the same time last year. In addition to seeing sales rise, profitability also improved. Net income of $149.2 million beat out the $133.2 million reported one year earlier. Yes, it is true that operating cash flow worsened year over year, dropping from $106.7 million to negative $13.8 million. But if we adjust for changes in working capital, it would have risen from $146.4 million to $166.3 million, while EBITDA for the business expanded from $215.9 million to $237.4 million.

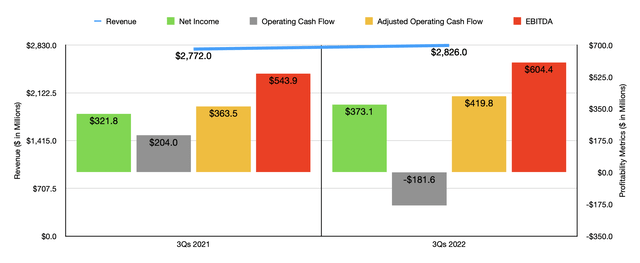

The data for the third quarter was not the only positive data for the company. For the first nine months of 2022 as a whole, sales came in strong at $2.83 billion. That represents an increase of 1.9% over the $2.77 billion the company generated the same time last year. Just as was the case in the third quarter alone, profits and cash flows followed revenue higher. Net income increased from $321.8 million last year to $373.1 million this year. Once again, operating cash flow fell, falling from $204 million to negative $181.6 million. But on an adjusted basis, it increased from $363.5 million to $419.8 million, while EBITDA grew from $543.9 million to $604.4 million.

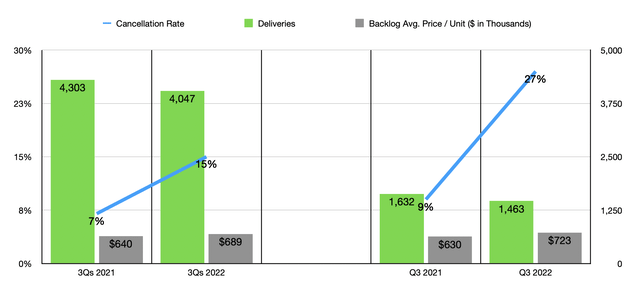

We don’t really know what to expect when it comes to the future for a lot of different companies. But when it comes to home-building firms, we do have some additional insight that is of tremendous value. This is because they typically provide a great deal of data regarding backlog, including pricing, unit count, and more. These figures are often leading indicators that show what kind of potential the company has in the near term. And that is where the concerns that investors happen to be. Take the third quarter again. During that time, the number of homes delivered by the company totaled 1,463. That’s actually down from the 1,632 the company reported the same time one year earlier. It’s only because the average price of a property delivered during this time increased significantly, climbing from $630,000 last year to $723,000 this year, that revenue managed to increase year over year for the firm.

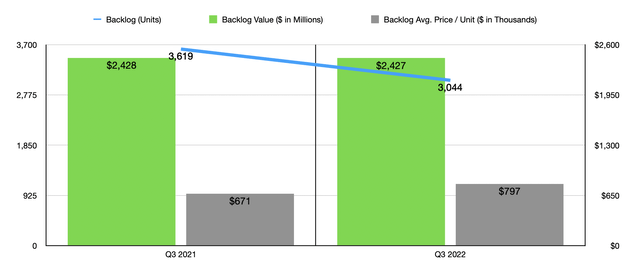

This weakness when it comes to deliveries was not just a blip on the radar. It’s part of an unsettling trend for the company. Consider total backlog. As of the end of the latest quarter, the company had 3,044 units in its backlog. This is down from the 3,619 units the company reported the same time last year. In addition to the number of deliveries reducing backlog, the company also saw its cancellation rate spike to 27% in the third quarter. That’s triple the 9% reported the same time last year. To make matters worse, that picture seems to be getting progressively worse. For the first nine months of 2021, the cancellation rate was only 7%. And for the first nine months of this year, it came in at 15%. The only positive in this data is that the average price of the homes in backlog remains robust, climbing from $671,000 in the third quarter of last year to $797,000 the same time this year. It’s also worth mentioning that the number of lots that the company has to build on also decreased, dropping from 41,675 last year to 37,269 this year. If the picture does not worsen materially from here, profits and cash flows can remain robust. After all, the total contract value of its backlog is $2.43 billion. That’s essentially even with what the company reported the same time last year. But with interest rates continuing to increase, it’s highly improbable that the bleeding will stop.

After seeing these numbers, I can understand why some investors might become bearish about the company. Certainly, in the short term, the enterprise could experience a great deal of pain. It’s not unthinkable that shares might fall further in response to that. In the long term though, the housing market is destined to grow further. In addition to the population of the US continuing to climb, it’s also true that, according to the most recent estimates available, there is a housing shortage of roughly 3.8 million units across the nation. On top of this, shares of the company look rather cheap today.

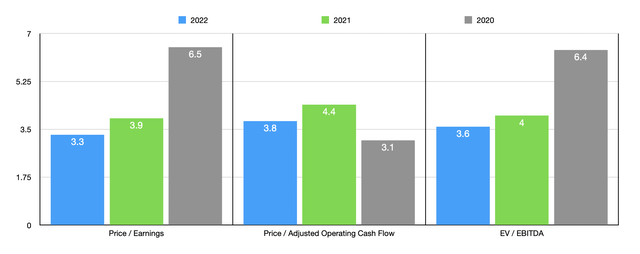

If we annualize results experienced so far for 2022, we would get net income of $544.1 million, adjusted operating cash flow of $484.5 million, and EBITDA totaling $754 million. As you can see in the chart above, this gives us some rather low trading multiples for the company. At the same time, however, this weakness the business is experiencing should result in bottom line performance worsening before it gets better. But even in the event that the company were to revert back to 2020 levels, shares would still look quite cheap on an absolute basis. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 2.8 to a high of 8.2. In this case, only one of the five companies was cheaper than our prospect. Using the price to operating cash flow approach, the range was from 9.6 to 117.6. In this scenario, Tri Pointe Homes was the cheapest of the group. And finally, using the EV to EBITDA approach, the range was from 3.6 to 7, with two of the five companies tying with our target as the cheapest.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Tri Pointe Homes | 3.3 | 3.8 | 3.6 |

| LGI Homes (LGIH) | 5.7 | 117.6 | 7.0 |

| Cavco Industries (CVCO) | 8.2 | 9.6 | 5.6 |

| Century Communities (CCS) | 2.8 | 25.7 | 3.6 |

| M.D.C. Holdings (MDC) | 3.6 | 10.4 | 3.6 |

| Dream Finders Homes (DFH) | 4.2 | 26.4 | 5.8 |

Takeaway

From what I see today, I understand why investors might be bearish in the near-term. For those who don’t have at least a five-year investment horizon, a good idea might be to wait this out. At the same time though, shares look incredibly cheap and I see no reason why, in the long term, we wouldn’t see some nice upside for shareholders. This should be especially true if current housing market conditions result in the housing shortage growing even more severe. Due to these factors, I still rate the enterprise a ‘buy’ at this time.

Be the first to comment