pabst_ell

Note:

I have covered Transocean (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

This week, leading offshore driller Transocean suffered a major setback, with shares down almost 20% from Monday’s closing price.

While peers Noble Corporation (NE) and Valaris (VAL) remain within striking distance of 52-week highs, Transocean has underperformed peers by a wide margin, likely due to the company’s most recent debt management measures announced after Tuesday’s close.

In aggregate, a subsidiary of the company issued $300 million in new 4.625% Senior Guaranteed Exchangeable Bonds due 2029 (“the New Bonds”). Approximately $111.9 million of the new bonds were issued in exchange for an aggregate $116.3 million in shorter-dated maturities. In addition, an estimated $11.7 million of the proceeds will be used to repurchase an additional $13.8 million in existing, shorter-dated notes.

The New Bonds will be exchangeable into new common shares at a 22.5% premium to the volume weighted average price of Transocean shares over the 10-trading day period following Tuesday’s announcement.

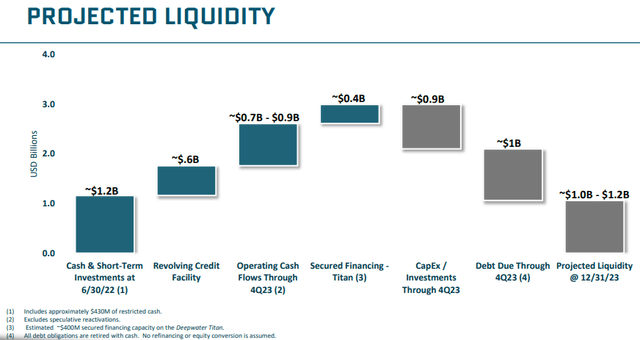

Transocean expects the transactions to provide an incremental $175 million in much-needed liquidity as the company is dealing with a double-whammy of elevated near-term capex and debt obligations:

Company Presentation

Please note that the liquidity projection above includes an anticipated $400 million secured debt issuance against the newbuild drillship Deepwater Titan’s long-term contract with Chevron (CVX) which is scheduled to commence in Q2/2023.

While Transocean recently managed to extend its currently undrawn secured revolving credit facility (“the RCF”) by two years to June 2025, the terms look plain ugly:

- an immediate 40%+ reduction in borrowing capacity to $773.5 million which will be further reduced to $600.3 million after June 22, 2023 as Barclays (BCS) and Nordea Bank declined to extend their commitments beyond the original maturity date

- the RCF remains subject to a $500 million minimum liquidity requirement

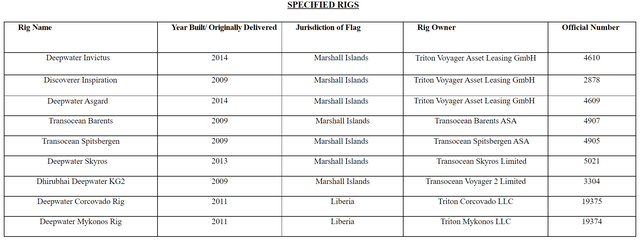

- the company was required to add the drillships Deepwater Corcovado and Deepwater Mykonos to an already outsized collateral package

Credit Agreement

Please note that none of the rigs included in the collateral package will be available for secured debt issuances going forward.

In the company’s most recent 10-Q, Transocean warned of the requirement to raise at least $330 million in additional liquidity over the next 12 months to avoid a default under the RCF (emphasis added by author):

The Secured Credit Facility contains covenants that, among other things, requires that we maintain minimum liquidity of $500 million. In order to remain in compliance with the requirement and to avoid a default under our Secured Credit Facility, we must obtain additional liquidity of at least $330 million within the 12-month period following the issuance of the financial statements included in this report, which we plan to obtain through a secured financing for Deepwater Titan. A failure by us to avoid such a default would eliminate our access to incremental borrowing under the Secured Credit Facility and, since we expect to access borrowings under the Secured Credit Facility, give our lenders the right to declare such borrowings immediately due and payable. Although not assured, we believe it is probable that we will be able to obtain such secured financing for Deepwater Titan in the required timeframe.

Unfortunately, the Deepwater Titan contract won’t commence before Q2/2023 which would make it difficult for Transocean to place secured debt in a timely manner. In the past, it has taken the company at least six months from formal contract commencement to close on the respective secured debt financing.

Given this issue, I wasn’t exactly surprised by the company entering into a new, $435 million Equity Distribution Agreement with Morgan Stanley (MS) last month, as Transocean simply can’t risk a potential default under the RCF.

Please note that between June 14, 2021 and June 30, 2022 the company already sold 80.9 million shares under a previous Equity Distribution Agreement for net proceeds of $364 million.

With the exchange price determination period still ongoing and a good chunk of the $300 million in New Exchangeable Bonds potentially being subject to holders employing convertible arbitrage strategies, I would expect short sales to be responsible for most of this week’s share price declines. Selling pressure might continue until the exchange price has been determined and arbitrageurs have fully established their hedges.

That said, some investors were likely flabbergasted by the surprise debt transaction and particularly the obvious requirement to issue a sizeable amount of warrant sweeteners to get the deal done (emphasis added by author):

As a result of the transactions contemplated by the exchange and purchase agreements and after giving effect to the expected use of proceeds described above, Transocean will have outstanding $300.0 million aggregate principal amount of New Exchangeable Bonds and Warrants to purchase an aggregate number of Transocean shares equal to approximately 25.4% of the aggregate number of shares underlying the New Exchangeable Bonds.

In addition, news of the semi-submersible rig Paul B. Loyd having suffered a “vital” equipment failure certainly didn’t help sentiment.

While there’s nothing to celebrate in the surprise issuance of equity-linked securities in combination with warrant sweeteners, Tuesday’s transaction will hopefully result in somewhat reduced dilution under the above-discussed $435 million Equity Distribution Agreement as Transocean will now only need to raise another $155 million to remain in compliance with the onerous $500 million minimum liquidity requirement governing the RCF.

Taking a deeper look into the details of Tuesday’s transactions, the company actually managed to exchange $73 million of its 2023 0.5 exchangeable bonds into New Bonds due 2029 which reduces the additional liquidity requirement to a manageable $82 million.

With day rates for high-specification drillships at multi-year highs and further increases likely ahead, I would advise speculative investors to stay calm and use potential, additional weakness to scale into the shares or add to existing positions.

Last week, BTIG analyst Gregory Lewis upgraded the company’s shares to “Buy” from “Neutral” with a price target of $8 based on recent, “impressive” contact announcements and expectations for the industry recovery to continue:

We are in the early innings of the ongoing offshore rig upcycle, which should provide strong cash flows and refinancing opportunities for RIG to improve its balance sheet”

Bottom Line

Admittedly, Transocean isn’t my number one pick among offshore drillers as the company’s ongoing debt and liquidity issues are likely to result in further, near-term dilution for common shareholders.

In addition, there are still questions regarding the level of investment required to put some of the company’s cold-stacked, high-specification assets back to work and the fate of four purpose-built semi-submersible rigs currently chartered to Equinor (EQNR) after the Norwegian oil giant recently notified Transocean of its surprise decision to return the first of the so-called “CAT-D” rigs to the company ahead of schedule later this year.

Meanwhile, competitors like Noble Corporation, Valaris and Diamond Offshore (DO) continue to enjoy the benefits of having emerged from chapter 11 with sufficient liquidity and very low debt levels, while Transocean’s incorporation in Switzerland likely prevented the company from going this avenue.

That said, with the industry recovery unlikely to abate anytime soon, I would expect the rising tide to literally lift all drillships and Transocean to resolve its current issues in due time.

Starting in 2024, the company should benefit from substantially reduced capex requirements and further increased day rate levels, which should finally result in the company generating substantial amounts of free cash flow.

Given the above-discussed issues, only the most speculative investors should consider an investment in Transocean at this time.

Personally, I prefer to stay with my short-term investment approach and used the most recent weakness to establish another trading position in the company’s shares.

Be the first to comment