Cheesecake

popovaphoto/iStock via Getty Images

Overview

The Cheesecake Factory (NASDAQ:CAKE) is a well-known consumer brand and restaurant operator. Having visited their restaurants several times throughout my life, including recently, I saw fit to look into this business – invest in what you know, as they say. For the record, I also enjoyed the cheesecake.

Founded 50 years back as a bakery in Beverly Hills, CAKE has grown into a billion-dollar company and national brand. It generates revenue in two ways: operating (full menu) restaurants and selling cheesecakes direct to consumers. This makes it a somewhat different enterprise than a standard restaurant operator, but still subject to the same commodity cost inputs.

CAKE is an interesting canary in the goldmine for the current consumer environment. What makes it interesting is the very fact that it is a casual establishment; its ability to raise prices is constrained by its market segment. The same would go for its direct order cheesecakes; while well-regarded, it would be difficult to call these a luxury good. Thus, ongoing inflation is very much a concern for this company and others like it; in economics, we would say that this firm has limited ‘pricing power’.

Limited pricing power means that the company’s room to maneuver in the current inflationary context is exactly that – limited. While a luxury brand would have plenty of pricing power, CAKE must hew closer to its costs. Its customers are price sensitive, unlike those for a luxury good. The latest quarter, and overall trendline, makes clear the stresses that they are working through.

Earnings & Fundamentals

CAKE earnings for Q3 2022 have come in below analyst expectations on both revenue and earnings. The company lost 3 cents per share instead of earning 30 cents per share, and generated $15M less revenue than expected. Per-restaurant sales grew 1.1%, also below the 2.8% expected by Wall Street.

This is unsurprising in the current consumer environment. In times of economic distress, eating out tends to be one of the first things to go for an average consumer. Additionally, executives made clear that the firm’s cost structure continues to be affected by inflation, with the CFO stating that ‘we continue to face higher inflationary headwinds than we had anticipated.’

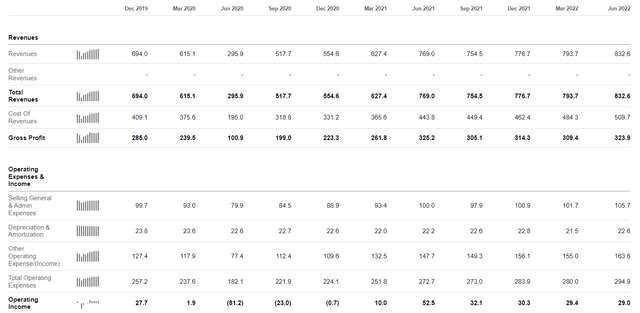

Looking at the trendline on a quarter-to-quarter basis, we see that the company has been facing increased G&A expenses as well as operating expenses overall:

SeekingAlpha.com Financials CAKE 11.2.2022

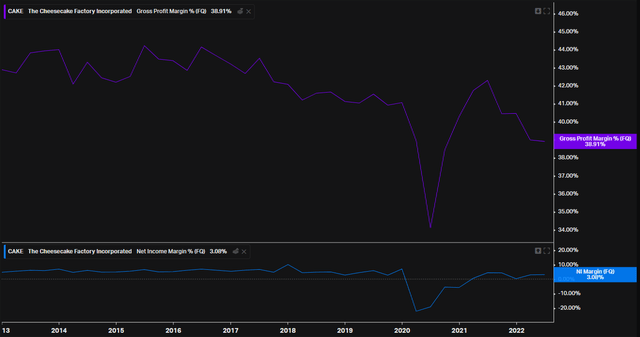

Worth noting is the more quantitatively significant uptick since the beginning of 2020/the pandemic era. The continuation of this in the most recent quarter is a cause for concern. Looking at the company’s gross profit and net profit margin percentages, we see that the company has been in new territory since the pandemic and its concomitant inflationary environment:

Koyfin.com Financials CAKE 11.2.2022

The net profit percentage took a nosedive in 2020 and has appeared more volatile since. The company has had to raise prices in order to keep up the same margin.

Higher prices impact revenues while increasing unit profits, as per standard economic theory. CAKE experienced a quarter-over-quarter revenue decline in its latest quarter, but this happened previously in Q3 2021:

SeekingAlpha.com Financials CAKE 11.2.2022

As such, I am hesitant to read too far into it. This level of revenue is completely within statistical norms for the firm, and doesn’t give us new information. Two quarters of this, however, would be novel from a financial reporting perspective – and a bad sign indeed.

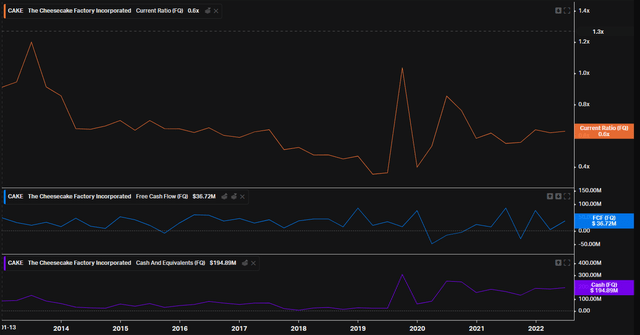

Additionally, the company has a healthy cash position and is managing its debt well:

Koyfin.com Financials CAKE 11.2.2022

As seen above, it was able to stabilize its debt exposure after entering the pandemic era while also generating FCF and keeping cash on hand.

Conclusion

Synthesizing all of this information, The Cheesecake Factory is a consumer brand that has weathered the storm fairly well. Yet, it is not a luxury brand – and it has continued to increase prices. As economics tells us, this could push it into a stagnant revenue regime.

This is made more urgent by the continuing inflationary environment that it faces. I see this stock centering around the company’s product and pricing power. If its brand is truly differentiated, and it can keep increasing prices, then it will be fine. However, it is more likely that the company’s ongoing room to maneuver in this regard will continue to be limited – which would lead to lower margins and/or declining revenues.

The company is stuck between this set of choices – between a rock and a hard place, if you will. If you’re a true believer, I think it could be worth sitting on this one, but in general, I don’t think one should open a position if they do not have one. This stock is a referendum on the degree of differentiation that CAKE truly has – as that determines its pricing power and its ability to pass costs along to consumers. I would be cautious, rating this a HOLD overall.

Be the first to comment