Steven White

A Quick Take On Traeger

Traeger (NYSE:COOK) went public in July 2021, raising approximately $424 million in gross proceeds from an IPO that was priced at $18.00 per share.

The firm designs and sells wood pellet outdoor grills for consumer use.

Given the slowing U.S. economy and the time it will take for management’s belated cost-cutting actions to manifest in its financial results, my outlook is on Hold for COOK in the near term.

Traeger Overview

Salt Lake City, Utah-based Traeger was founded to develop a family of fine wood pellet grills for consumer use, along with digital controls, and cooking products.

Management is headed by Chief Executive Officer, Jeremy Andrus, who has been with the firm since January 2014 and was previously President and CEO of Skullcandy.

The company’s primary offerings include:

-

Wood pellet grills

-

Digital content

-

Consumables

-

Cooking control

The firm pursues an omnichannel approach, selling through retailers such as Ace Hardware, The Home Depot, Wayfair and Williams Sonoma as well as direct-to-consumer through the firm’s website and mobile app.

Traeger’s Market & Competition

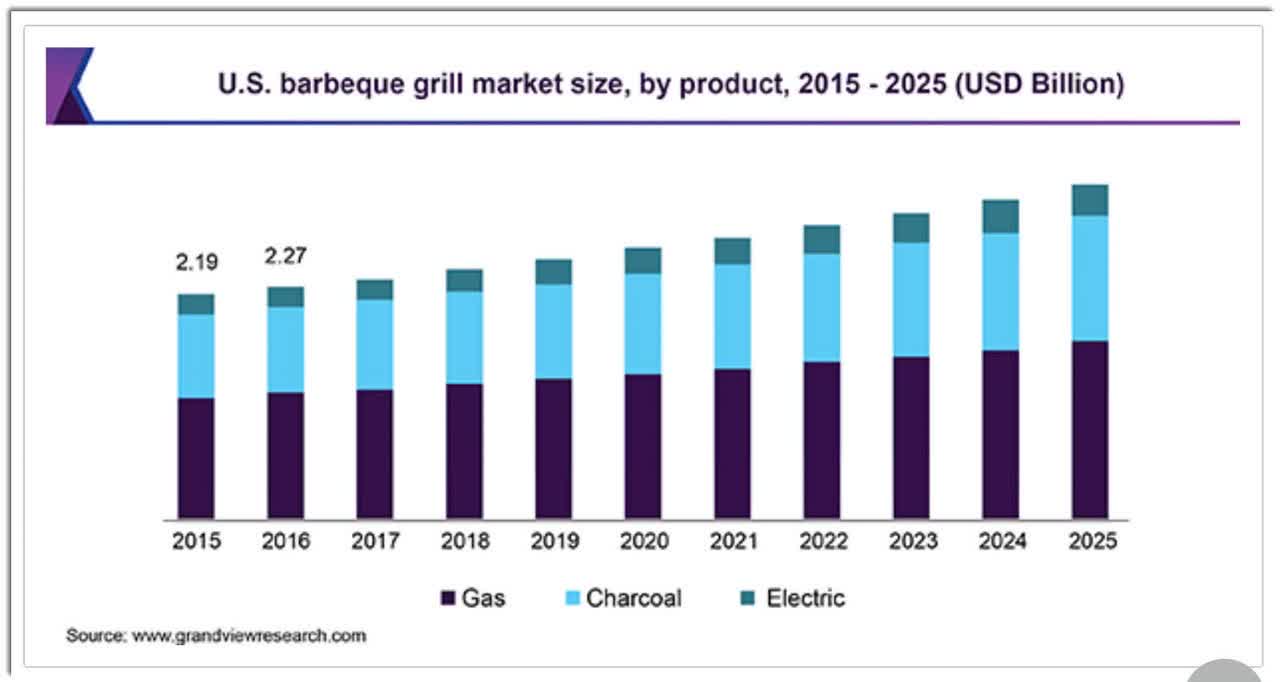

According to a 2019 market research report by Grand View Research, the global market for barbeque grills was an estimated $4.8 billion in 2018 and is forecast to reach $7 billion by 2025.

This represents a forecast CAGR of 4.5% from 2019 to 2025.

The main drivers for this expected growth are a rising trend of cookouts on weekends and holidays as well as younger demographics driving growth.

Also, below is a chart showing the recent historical and projected future growth trajectory of the U.S. grill market:

U.S Grill Market (Grand View Research)

Major competitive or other industry participants include:

-

Weber

-

Kingsford

-

Dansons

-

Blackstone

-

Others

Traeger’s Recent Financial Performance

-

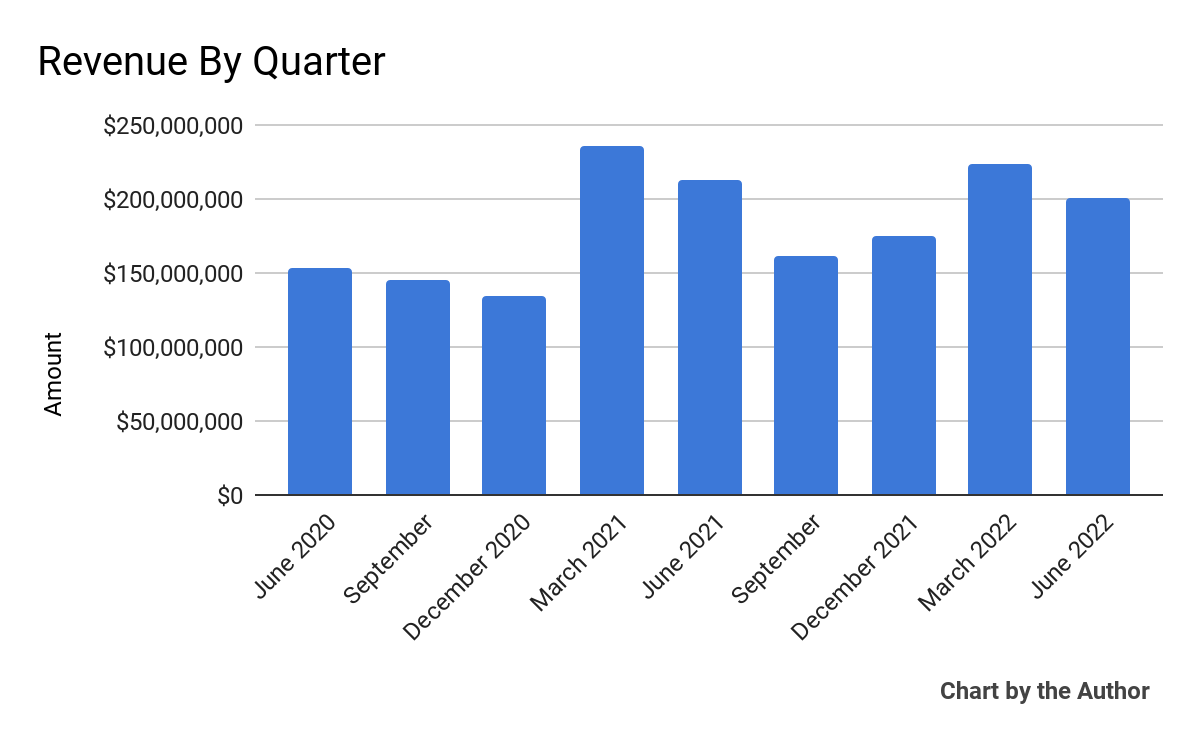

Total revenue by quarter has produced uneven results, as the chart shows below:

9 Quarter Total Revenue (Seeking Alpha)

-

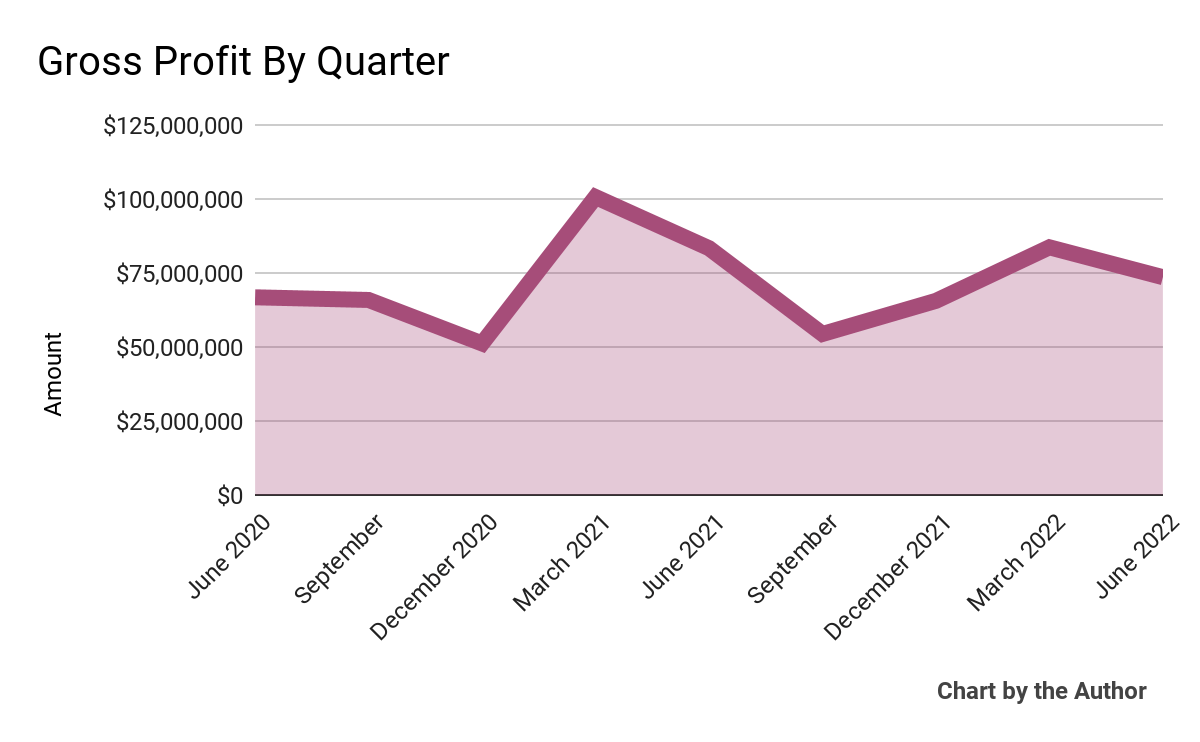

Gross profit by quarter has also fluctuated:

9 Quarter Gross Profit (Seeking Alpha)

-

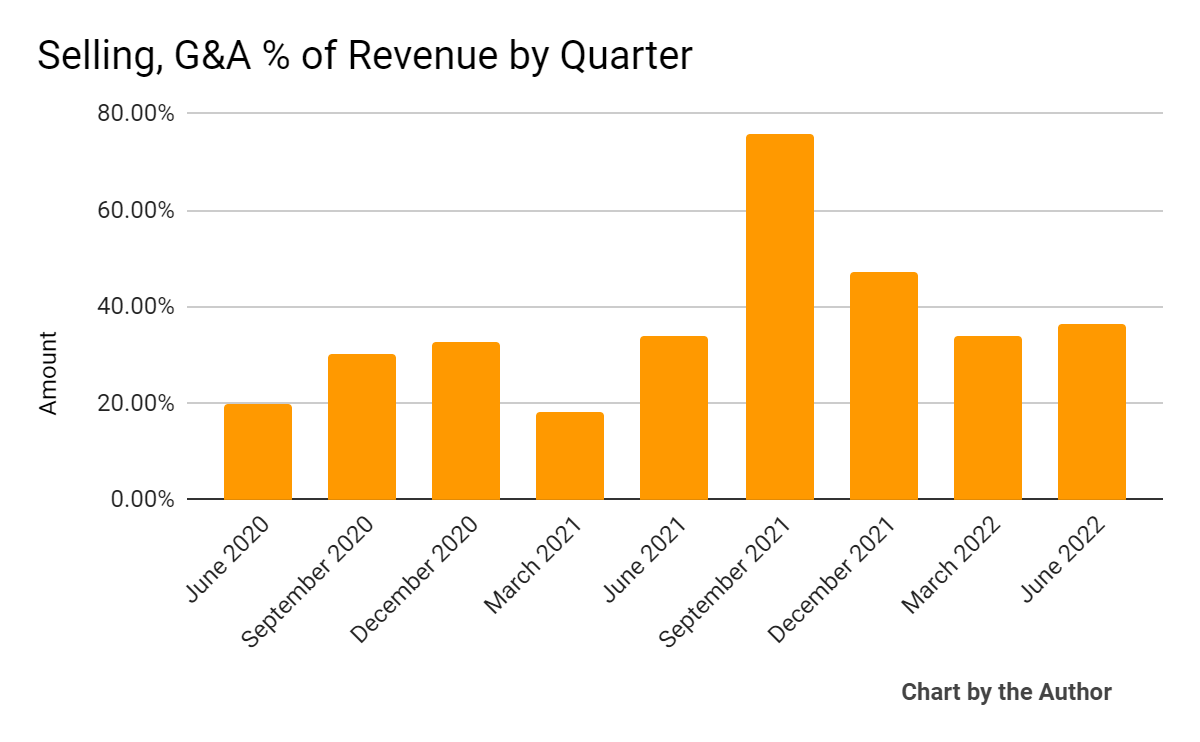

Selling, G&A expenses as a percentage of total revenue by quarter have trended higher as revenue has fluctuated:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

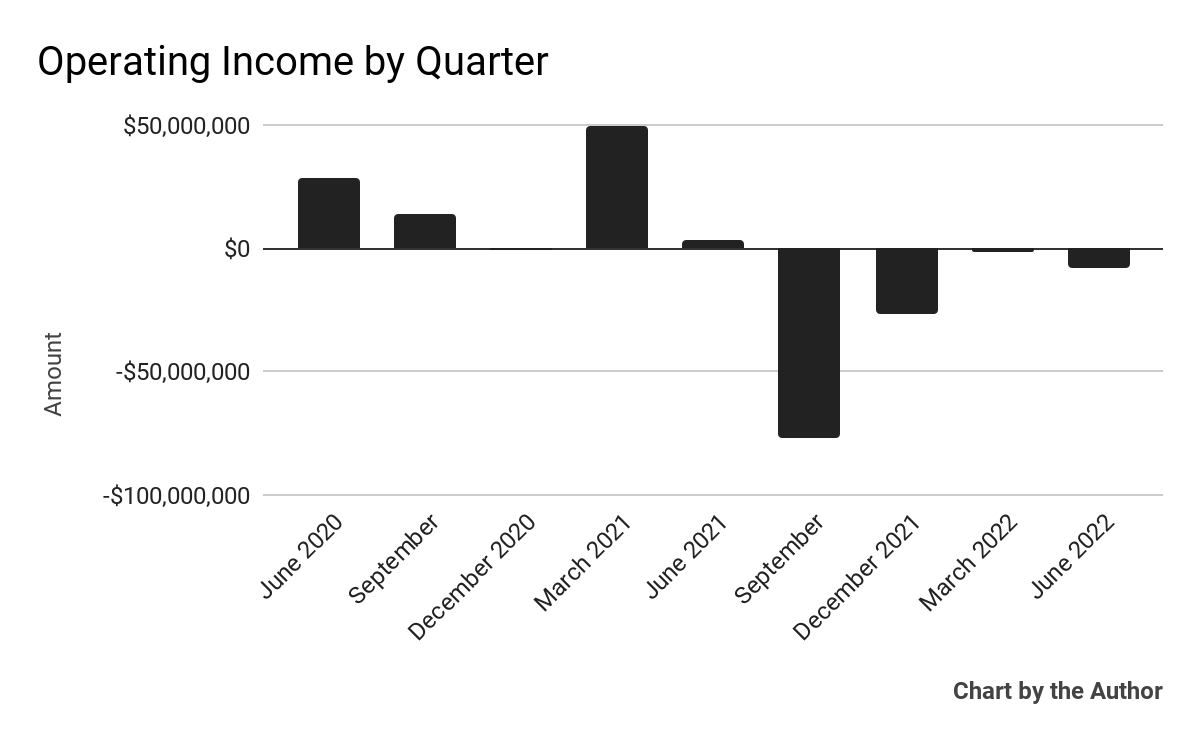

Operating income by quarter has remained negative in the last four quarters:

9 Quarter Operating Income (Seeking Alpha)

-

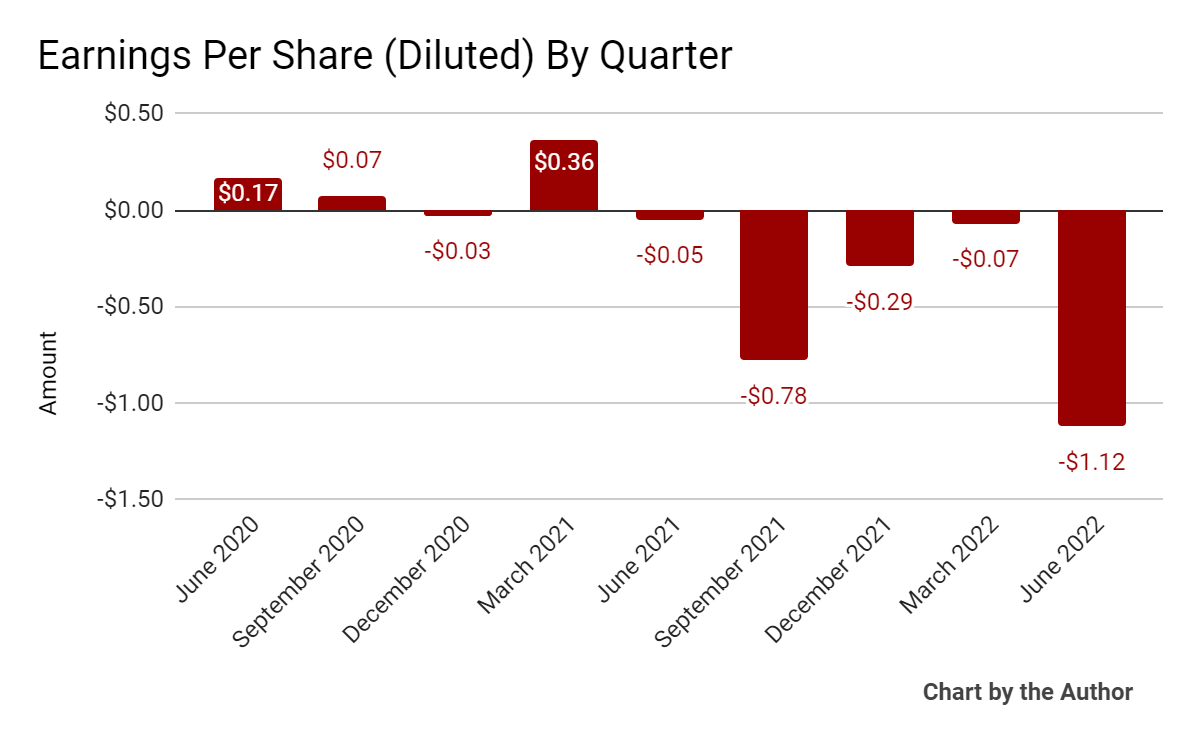

Earnings per share (Diluted) have worsened significantly into negative territory recently:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

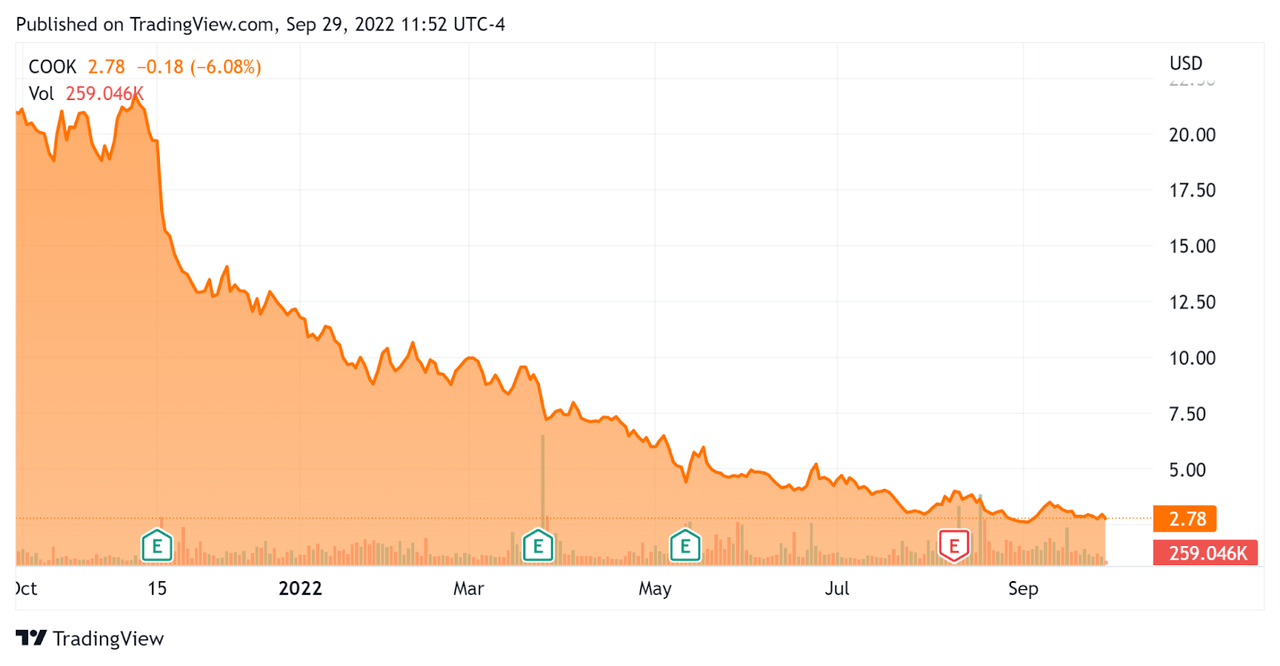

In the past 12 months, COOK’s stock price has fallen 86.8% vs. the U.S. S&P 500 Index’s drop of around 16.2%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Traeger

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

0.69 |

|

Revenue Growth Rate |

4.6% |

|

Net Income Margin |

-34.6% |

|

GAAP EBITDA % |

-7.8% |

|

Market Capitalization |

$326,330,000 |

|

Enterprise Value |

$800,840,000 |

|

Operating Cash Flow |

-$74,670,000 |

|

Earnings Per Share (Fully Diluted) |

-$2.26 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Weber (WEBR); shown below is a comparison of their primary valuation metrics:

|

Metric |

Weber |

Traeger |

Variance |

|

Enterprise Value/Sales |

0.85 |

0.69 |

-18.8% |

|

Revenue Growth Rate |

-11.6% |

4.6% |

–% |

|

Net Income Margin |

-5.0% |

-34.6% |

-587.3% |

|

Operating Cash Flow |

-$263,200,000 |

-$74,670,000 |

-71.6% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On Traeger

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the negative impacts of a reduction in consumer sentiment and spending on durables.

Additionally, the company’s retailer partners have had to keep abnormally high inventory levels to compensate for supply chain challenges. Retailers are now stuck with too much inventory as the economy enters a sharp slowdown or contraction, so management has been forced to reduce growth guidance.

Also, the firm began to implement a ‘broader cost reduction and streamlining plan in late July,’ but those actions will not show up in its financial results until the back half of 2022.

Management has also scaled back production volumes as the company works through existing inventory.

As to its financial results, total revenue dropped 6% year-over-year due to weakness in its grill segment.

Gross profit dropped while SG&A expenses rose as a percentage of total revenue, leading to loss per share of $1.12 for the quarter.

For the balance sheet, the firm finished the quarter with cash and equivalents of $14 million and $392 million in long-term debt.

Over the trailing twelve months, free cash used amounted to $95.4 million.

Looking ahead, management reduced full year revenue guidance to $650 million at the midpoint of the range.

Notably, the market is valuing Traeger at a lower EV/Revenue multiple than Weber.

The primary risk to the company’s outlook is an economic slowdown in the U.S. and other primary markets due to rising interest rate policies and post-pandemic changes in consumer spending habits.

While COOK appears to be a victim of its recent success during the pandemic, management’s inability to react quickly to the change in consumer activity has led the company into a painful reckoning, as it reduces headcount, suspends new initiatives and closes its Mexico factory.

Given the slowing U.S. economy and the time it will take for management’s belated cost-cutting actions to manifest in its financial results, my outlook on COOK is Neutral.

Be the first to comment