Uwe Krejci

Company Introduction

Shimano Inc. (OTCPK:SHMDF/OTCPK:SMNNY) develops, produces, and distributes bicycle components, fishing tackles, and rowing equipment. For the Fiscal Year 2021, the bicycle components segment accounted for around 80% of revenue (EBIT-Margin 28.2%) while the fishing and rowing segments accounted for the remaining 20% (EBIT-Margin 22.5%).

According to an article from Reuters, Analysts estimate that Shimano holds around 70% market share in mid- to high-end bicycle key components, making it the undisputed market leader in this space. Shimano does not sell directly to bike customers, but to bike manufacturers that use Shimano components on their bicycles.

The company is headquartered in Sakai, Japan, and led by members of the founding family, Yozo Shimano (Chairman and CEO) and Taizo Shimano (President).

This article will focus on the bike components business, since it accounts for over 80% of revenues and more than 85% of operating profit. I will mainly use ¥ numbers from original filings and add the SMNYY ADR equivalents (10 ADR equal one share) for per share and valuation purposes.

Thesis Overview

My overall thesis is that there are a number of reasons (business quality and valuation wise) making Shimano a compelling investment opportunity at the current price. I will discuss these reasons one by one in this article:

- Shimano is the market leader in a growing market (bicycle components),

- The global trend to urbanization (denser city areas) will lead to fewer people feeling the need to own a car and instead opt to public transportation or a (electric) bicycle,

- The balance sheet is probably one of the strongest I have ever seen,

- As the post pandemic boost in sales is estimated to fade in the upcoming months/years, the stock lost 29% of its value YTD on a local currency basis while the financials and guidance for FY2022 are still strong,

- The strength of the USD and the simultaneous weakness of the YEN make for a favorable time for US investors to initiate a position.

As a conclusion, I am rating Shimano a buy at the current price of ¥22,690 (ADR: $15.42).

Bicycle components market

The global bicycle components market reached a valuation of $13.5 billion in 2021 and is projected to reach a valuation of $28.3 billion in 2032 (CAGR 6.9%). The bicycle components market is estimated to be around 20-25% of the overall bicycle market.

Main market drivers will be the growing popularity of bicycles as an alternative transportation tool (especially in densely populated areas), representing a healthy and fit lifestyle, and decarbonization efforts of governments around the world. According to the European Cyclists’ Federation, there are almost 300 tax-incentive and purchase-premium schemes for cycling across Europe offered by national, regional and local authorities. I will further elaborate on the importance of this later in this article.

Bicycle chain market

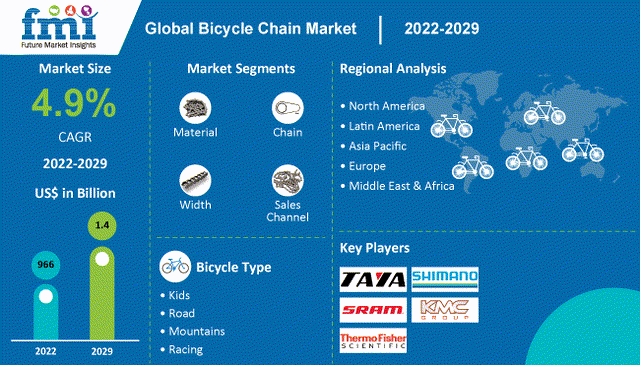

As shown in chart 1, the market for bicycle chains as a submarket of the overall components market is expected to grow from $996 million in 2022 to $1.4 billion in 2029 (CAGR 4.9%).

Chart 1: Future Market Insights – Bicycle chains Market Outlook – 2022-2029

Chains are one of the types of components in Shimano’s product portfolio.

Assuming that the overall components market will grow at around 6.9% while some submarkets Shimano is operating in may only grow at around 5% like the chain submarket, I assume the total addressable market (TAM) for Shimano growing around 6% per year.

Taking into account Shimano’s market share of 70% in the mid- to high-end bicycle key components market (Shimano’s overall market share in the bike components market is estimated at around 50%) I doubt that there is much room to grow market share. On the other hand, I think Shimano will be able to maintain the current market share as they have been able to prove in the past 100 years of the company’s history.

Urbanization

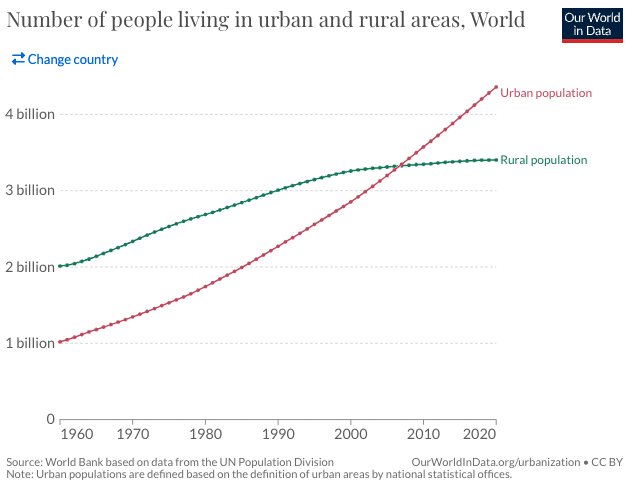

The UN estimates that since 2007 more people in the world live in urban than in rural areas. In 2017, the percentage of world population living in urban areas already increased to 55%. As chart 2 shows, this trend shows no signs of slowing down.

Chart 2: ourworldindata.org

It is estimated that by 2050 two-thirds of the world population (7 billion people by that time) will live in urban areas.

This trend should be a secular tailwind for Shimano for two reasons. Firstly, the middle point of interest in people’s lives (family, friends, work) shifts to a denser area. This, combined with shortage of parking place and the annoyance over urban traffic, should lead people to overthink the need of owning a car in the city.

For sure, there will still be occasions when owning a car will prove beneficial, but the question is if these actually justify the costs coming along with it. Of course this won’t be true for everyone, since the car is still seen as a symbol of status and there will still be people who depend on it, be it for work or for grocery shopping for a bigger family. However, the overall trend should develop to fewer reasons of owning a car and looking for alternatives.

One of these alternatives is simply owning a bicycle for covering the shorter distances in the city. The evolution of the E-bike is also playing a crucial role here. Nobody wants to ride the bike to work or a meeting with friends and arrive even the tiniest bit of sweaty. The E-bike makes bicycling effortless so that anyone can cover even midrange distances without any problems.

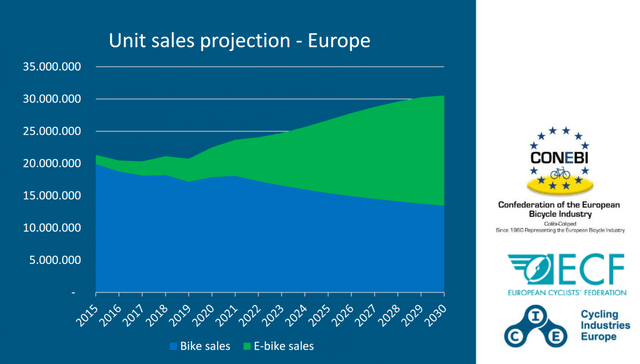

Chart 3 shows the projected unit sales of Bike and E-bike sales in Europe according to the European Cyclists’ Federation (ECF). Note that Europe is Shimano’s biggest market (around 42% of revenue).

Chart 3: European Cyclists’ Federation

The ECF projects that the pandemic has caused a spark in bicycle purchases, completely reshaping the growth curve of the market. It is expected that Europeans will buy an extra 10 million bikes per year by 2030, an increase of 47% compared to sales in 2019. The fact that the estimates are based on a per-year basis leaves me to assume that the recent surge in revenue for Shimano is actually not a pandemic outlier as one may think, but rather the new normal.

The second reason that urbanization should be a tailwind for Shimano is the fact that overall bike sales are expected to shift towards E-bikes. In my opinion, one of the reasons for this is what I stated above, that the E-bike makes covering midrange distances effortless for everyone. The tax-incentives and purchase-premiums I already mentioned earlier are another reason. In a push for decarbonization, governments in Shimano’s biggest market Europe are supporting the shift towards cycling through direct subsidies for a variety of bike-types or through tax-incentives through employer benefits for granting a bike as part of the salary of the employee.

For example, in Germany, the employer can lease a bike and give it to the employee as a tax-free part of the salary. Another option is that the employee asks the employer to lease a bike for him. The leasing fee is deducted from his gross salary on a tax and social security contributions-free basis (taxes and social security costs in Germany are around 50% of gross salary), basically leaving the employee with a bike lease at a discount of 50% to a regular lease price.

The shift towards E-bikes should be a major tailwind for Shimano for two reasons. Firstly, average selling prices of e-bikes are way higher than those of conventional bikes. This is partly because of the cost of the battery. Another reason is simply that buyers are willing to pay premium prices, especially if they get a purchase-premium or a tax-incentive, leaving them to pay basically pay 50% of the regular price. This may open up opportunities for Shimano to increase margins. This is not the important point, however.

The most important point is that people tend to drive way more distance with an e-bike than with a regular bike. As a preparation for this article, I listened to a podcast with the CEO of Paul Lange & Co. OHG, Bernhard Lange. Paul Lange & Co. OHG is a major bicycle retailer based in Germany and Shimano’s largest customer. Mr. Lange mentioned that the e-bike driver drives around eight times the distance of a conventional bike driver. He also mentioned that the e-bike is often the replacement of the only car or, in cases where a family owned two cars and decided to reduce this to only one, of the second car.

The more distance the bike covers, the earlier the owner has to replace parts because of the wear and tear. This should shorten the lifecycle of bike components, not because of quality but because of the increase in usage, ultimately leading to increasing demand for Shimano’s products.

Balance Sheet

As of 09-30-2022, Shimano reported ¥434,425 million of cash and time deposits, ¥899 million of short-term loans and ¥1 million of long-term loans for a net cash position of ¥433,525 million. With 90,629,127 shares outstanding at the end of September, this results in ¥4,784 (ADR: $3.25) of net cash per share. The share price at the time of this writing stands at ¥22,690 (ADR: $15.42). The net cash position already covers 21% of the share price/market capitalization.

This is not that unusual for a Japanese company, and as an investor, we should not expect this cash pile being distributed through special dividends or share repurchases anytime soon. Shimano does pay a regular dividend of ¥235 (ADR: $0.16) for an annual yield of a bit over 1%, and they actually did some share repurchases in FY2021 (around 0.8% of the market cap), but the prior years they did no share repurchases at all.

What the strong balance sheet does is give quite some downside protection and the ability to weather any storm that may come in the future.

Financials

To get a better understanding of the underlying earnings, I try to adjust them to factor out any kind of currency related fluctuations. To achieve this I will use the reported Income before income taxes (EBT), adjust these for the non-operating income effect of foreign exchange gains/losses and apply a 23% tax rate as seems to be the standard for Japanese companies.

This results in the following numbers (in ¥ million):

| FY | 2019 | 2020 | 2021 | TTM |

| EBT | 71,393 | 84,820 | 153,728 | 187,729 |

| f(x) adjustment | 2,463 | 2,372 | -3,386 | -19,023 |

| 23% Tax-rate | -16,987 | -20,054 | -34,579 | -38,802 |

| Net Income | 56,869 | 67,138 | 115,763 | 129,904 |

We can already see the significant effect of the YEN depreciation for the trailing twelve months (TTM).

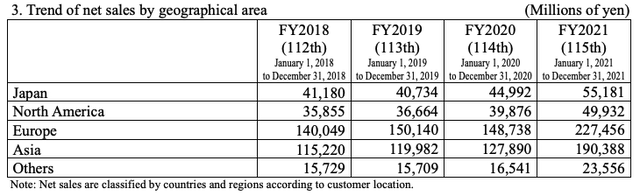

As already mentioned, Europe is Shimano’s largest market (41.6% of sales) which is why my focus in this article lies on the European bike market. The second-largest market is Asia (34.8%), followed by Japan (10.1%) and North America (9.1%). Chart 4 shows the development of revenues per region over the past few years.

Chart 4: Shimano Investor Relations – 115th General Meeting Document

Now the elephant in the room is the question “Is this surge in revenue and income sustainable or will demand and earnings normalize/decline?”. At first thought, my guess was that there is no way this is sustainable and that most likely at least half of the growth in earnings from 2020 to current numbers should fade going forward. After some digging, I will bring two arguments to the table that are favoring this level of earnings being sustainable.

Firstly, as I mentioned earlier the European Cyclists’ Federation expects an extra 10 million sold bikes per year by 2030 and as can be seen in chart 3 there is no expectation of bike sales dropping for a few years in the near future. Secondly, inventories did rise hand in hand with revenue. So the surge in earnings is not an effect of depleting inventories that will reverse in the coming years. I came across an article from Reuters that, in my opinion, gave great insight into what is happening with inventories and supply of Shimano bike components. The article states that while Shimano has been running factories at full capacity since the pandemic, they refused to significantly boost capacity, resulting in shortages of bike components. This fits the picture of the huge net cash pile on Shimano’s balance sheet. Rather than boosting capacity in an extraordinary environment, risking ending up with normalizing demand and new factories not running on full capacity, Shimano’s management takes a longer, more sustainable view with opting to only use already existing capacity.

The market obviously disagrees with the current level of earnings being sustainable, sending shares down YTD by around 29% on a local currency basis and 44% on a USD basis.

Currency effect

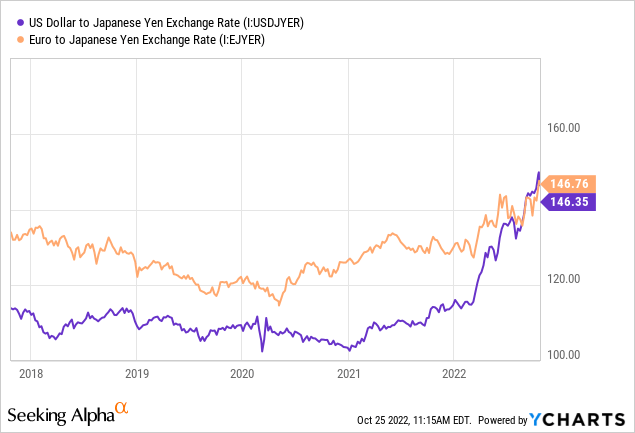

Another potential tailwind for USD or even EUR investors may be the current weakness of the Japanese YEN, in the case of the USD paired with a simultaneous strength. Chart 5 shows the 5-year exchange rate for the USD and the EUR to the YEN.

Chart 5: EUR/USD to YEN Exchange Rate past 5 years

Now I have to admit that by no means I am considering myself a currency expert, but the fact that the USD becomes more attractive with the Federal Reserve raising rates, pushing treasury rates higher, while the Bank of Japan is just doing nothing (while even the European central bank started raising rates), is something I do understand. In the case of a reversal of the exchange rates to the mean, there is a possibility for upside from the currency side, beside potential upside from actual business performance.

For any further interest, here are two articles from fellow SA contributors regarding this topic.

The Yen: A Perfect Storm And An Opportunity

Finally Bullish Catalysts For The Japanese Yen

Valuation

To value the business, I will use the adjusted earnings I outlined in the Financials part to exclude any sort of currency related gains/losses. To make it more simple, I will just use the operating income (which excludes exchange rate gains/losses) and apply a 23% tax-rate. Since Shimano actually earns interest from the net cash position, this does make sense in this case and is actually rather conservative since I exclude this non-operating income.

In the most recent 3rd quarter report, Shimano guides for FY2022 operating income of ¥163,500 million, resulting in a 4th quarter guidance of ¥36,924 million. The 4th quarter guidance is actually a YoY decrease from ¥41,314 million for a YoY decline of around 10%. To be conservative, I will assume this 10% drop in operating income for full FY2023 for an operating income of ¥147,150 million and start the valuation from this point.

As I outlined earlier, I expect Shimano to grow around 6% per year, in line with the market, for the foreseeable future. Under the assumption of operating income of ¥147,150 for FY2023, Shimano’s ROCE would come in at around 45%. So to achieve 6% growth per year with a ROCE of 45% implies that Shimano needs to reinvest around 13% of earnings back into the business, leaving 87% of net income as free-cash-flow (FCF). This matches with the average cash-conversion of around 85% over the past few years. So FCF for FY2023 should be around ¥98,500 million ((¥147,150 million operating income – 23% taxes) x 87% cash-conversion).

As of the 3rd quarter report, there are 90,629,127 shares outstanding at a current price of ¥22,690 (ADR: $15.42) per share for a total valuation of ¥2.056 trillion ($13.975 billion). After deducting the net cash position of ¥433,525 million, we would need to pay ¥1.623 trillion ($11.029 billion) to buy the whole company. Comparing this with the estimated FCF of ¥98,500 million ($669 million) for FY 2023 gets me to an estimated FCF-yield of around 6% at the current price.

Disregarding multiple compression or expansion, Shimano should be able to deliver 6% (growth) plus 6% (FCF-yield) for a total return of 12% per year.

DCF-valuation

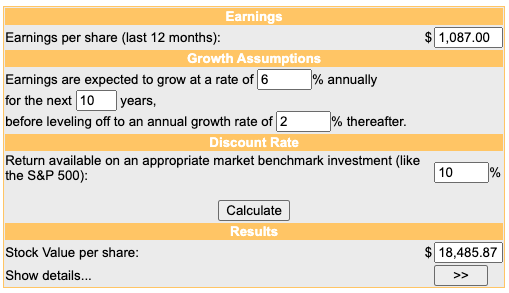

To evaluate possible effects of multiple compression or expansion, I will use a DCF-valuation as a supplement. Dividing the estimated FCF for FY2023 by the current shares outstanding results in FCF per share of around ¥1,087 (ADR: $0.74). I assume the 6% growth rate in line with the market for the next 10 years and a 2% terminal growth rate. With a discount rate of 10% I get a fair value per share of ¥18,486 (ADR: $12.56), as can be seen in chart 6.

Chart 6: DCF – moneychimp.com

After deducting the net cash per share of ¥4,784 (ADR: $3.25) from the current price of ¥22,690 (ADR: $15.42), the actual price to pay for the operating business stands at ¥17,906 (ADR: $12.17), indicating that Shimano is currently a bit undervalued.

Risks

In my opinion, there are two major risks for my thesis, potential market share losses and a much bigger drop in earnings in the near future as a normalizing effect after the pandemic.

Shimano’s major competitors in the market are SRAM LLC and Campagnolo. Since Shimano’s market share of 70% in the mid to higher end bike-components market is already really high, there is, in my opinion, a higher chance of Shimano losing rather than gaining market share. The problem is that the above-mentioned competitors are private companies so that it is not easy to get numbers to compare revenue growth to Shimano. For now, I will trust in Shimano’s ability to deliver great products and protect their market share like they did in the past. However, this is a risk investors need to watch out for.

Regarding the risk of a bigger drop in earnings, I already laid out my thoughts and the reasons for those in this article. However, I am relying on official estimates for the overall bike and bike-components market, so a much larger drop can’t be ruled out. This would result in Shimano being actually a bit overvalued at the current price, since the FCF-basis for FY2023 used in the DCF-valuation would need to be adjusted to the downside.

Conclusion

Summing it up, I think that Shimano can deliver 12% returns per year (6% growth and 6% FCF-yield) going forward, disregarding multiple compression or expansion. The supplemental DCF-valuation leaves me to assume that Shimano might be a bit undervalued at the current price of ¥22,690 (ADR: $15.42). The current weakness of the Japanese YEN and strength of the USD might act as an additional tailwind regarding price appreciation for USD investors in case of a reversion to the mean for the exchange-rate.

I am rating Shimano a buy at the current price.

Be the first to comment