Justin Sullivan

Meta Platforms (NASDAQ:META) submitted its earnings scorecard for the third-quarter yesterday… and it sent shares of the social media company cratering. Meta Platforms’ shares dropped a massive 20% after regular trading which indicates how disappointed investors were with the company’s results. Meta Platforms reported its second sequential decline in revenue growth due to a broad decline in the global advertising market in the third-quarter. Additionally, Meta Platforms submitted a very weak revenue forecast for the fourth-quarter, indicating that the company doesn’t see a recovery in the advertising market in the near future!

Bad: Meta Platforms’ disappoints… big time!

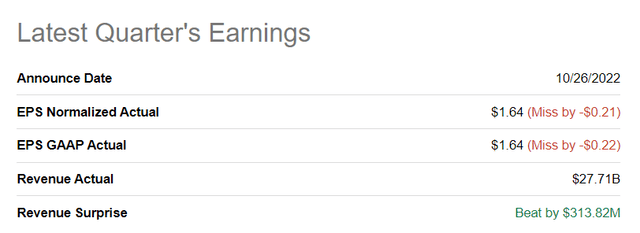

Meta Platforms reported revenues of $27.7B for the third-quarter which was better than the consensus which called for $27.4B in revenues. Regarding earnings, however, Meta Platforms did much worse than expected, reporting EPS of $1.64 compared to a prediction of $1.85.

Seeking Alpha: META Q3’22 Earnings Results

Meta Platforms’ third-quarter earnings sheet was terrible and worse than Alphabet’s (GOOG) earnings report. Google, while still having material exposure to advertising, compensated for slowing ad revenue growth with a strong performance in the Cloud business.

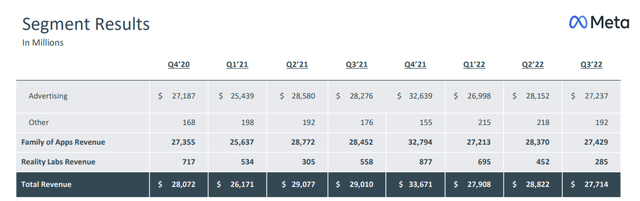

Meta Platforms generated $27.7B in total revenues in the third-quarter, showing a decline of 4.5% year over year. In the second-quarter, Meta Platforms’ top line declined 1.0% year over year due to a broad down-turn in the advertising market that also affected companies like Snap (SNAP) and Google. Meta Platforms’ Q3’22 was therefore the second consecutive quarter of declining year over year top line growth. The social media company continued to generate the majority of its revenues from advertising, however: the share of advertising revenues as a percent of total revenues was 98% in the third-quarter.

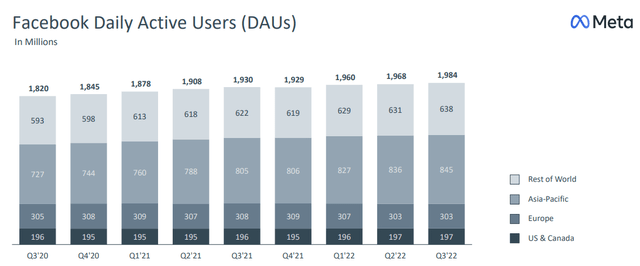

The only good news was that Meta Platforms’ daily active users continued to increase in Q3’22. The social media company ended the September quarter with 1.98B daily active users, showing a sequential increase of 16M. Daily active users in Europe and the US/Canada regions remained unchanged in Q3’22 and all of Meta Platforms’ user gains came from other regions in the world, especially the Asia-Pacific region.

Meta Platforms: Daily Active User Trend

Ugly: Meta Platforms’ free cash flow trend

A painful down-turn in the advertising market and heavy investments into the so far unprofitable metaverse have resulted in a serious (and unexpected) contraction of Meta Platforms’ free cash flow in the third-quarter. The company’s free cash flow amounted to just $173M in Q3’22, dropping 98.1% year over year. The free cash flow margin calculated to just 0.6%, down from 32.9% in the year-earlier period. In my work “Meta Platforms Q3 Earnings Preview: Watch These 2 Key Metrics” I indicated that a decline in free cash flows (margins) would be a reason for me to change my opinion on the social media company. For that reason, I am changing my recommendation from Strong Buy to Hold.

|

in mil $ |

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

Q3’22 |

Y/Y Growth |

|

Revenues |

$29,010 |

$33,671 |

$27,908 |

$28,822 |

$27,714 |

-4.5% |

|

Operating Cash Flow |

$14,091 |

$18,104 |

$14,076 |

$12,197 |

$9,691 |

-31.2% |

|

Purchases of Property/Equipment |

($4,313) |

($5,370) |

($5,315) |

($7,528) |

($9,355) |

116.9% |

|

Payments on Finance Leases |

($231) |

($172) |

($233) |

($219) |

($163) |

-29.4% |

|

Free Cash Flow |

$9,547 |

$12,562 |

$8,528 |

$4,450 |

$173 |

-98.2% |

|

Free Cash Flow Margin |

32.9% |

37.3% |

30.6% |

15.4% |

0.6% |

-98.1% |

(Source: Author)

A disaster: Meta Platforms’ outlook for Q4’22

The implication of Meta Platforms’ guidance for the fourth-quarter is that the ad market is expected to decelerate further. The social media company expects to generate between $30.0B and $32.5B in revenues between October and December which implies an up to 10.9% year over year decline in the firm’s revenue base… which would then also be the third straight top line decline in FY 2022. Meta Platforms expects a 7% top line headwind from the strong USD that is plaguing international companies right now, but the guidance is a disaster nevertheless: the advertising market is expected to go into a prolonged slump and there is very little that Meta Platforms can do about it now.

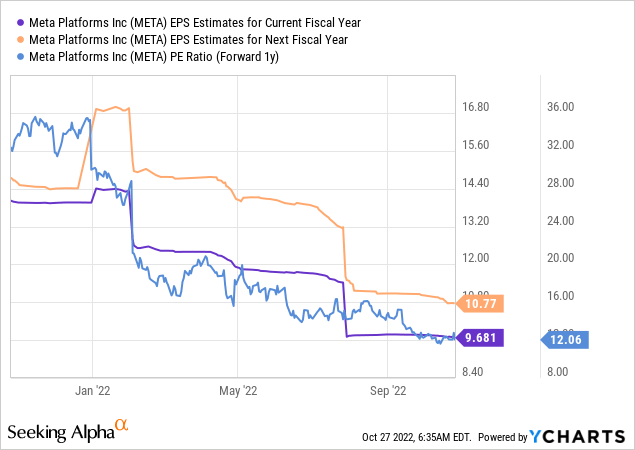

Estimate risk and valuation

META plunged 20% after earnings were reported and analysts are set to revise their estimates to the down-side. Such revisions are likely going to be drastic and pose a risk to stock going forward. Earnings estimates have already started to drop before earnings, but now things are really going to get worse. Meta Platforms’ EPS for FY 2022 is expected to decline about 30% year over year, according to estimates provided by Seeking Alpha. Based off of the current earnings expectation of $10.77 for FY 2023, shares of Meta Platforms are valued at a P-E ratio of 12.1 X. With earnings estimates now set to fall, however, this P-E ratio is poised to increase, possibly materially.

Risks with Meta

The big risk for Meta Platforms is that the advertising market goes into a deeper and prolonged slump, thereby limiting prospects for top line and earnings growth. If the advertising slowdown goes from bad to worse, Meta Platforms is likely to see an even lower valuation factor and might have to accept much lower free cash flow going forward. TikTok also remains a serious competitor that threatens to further undermine Meta Platforms’ position with advertisers.

Final thoughts

The 20% price drop outside regular trading yesterday indicates that investors have lost confidence in Meta Platforms’ near term growth potential. While Meta Platforms is clearly seeing a growth slowdown in the advertising market and the company is challenged by popular social media apps like TikTok, the massive decline in free cash flow is especially concerning. The guidance for Q4’22 was a complete disaster for Meta Platforms and it will be very hard for the company to convince investors to buy the stock in the foreseeable future. While I still like Meta Platforms and believe that free cash flow can rebound, the stock will likely continue to face significant headwinds in the foreseeable future!

Be the first to comment