miketanct

Hoo-hoo-hoo, go on, take the money and run.

Go on, take the money and run.

Hoo-hoo-hoo, go on, take the money and run.

Go on, take the money and run.

– Steve Miller

Merger arbitrage

It has been a great year for merger arbitrage so far, with two major issues confronting prospective opportunities. First, regulators have been hyper aggressive. That is mostly bad for shareholders. But it can occasionally be good. For example, Adobe (ADBE) shareholders could sidestep the miserable Figma deal if antitrust authorities block it.

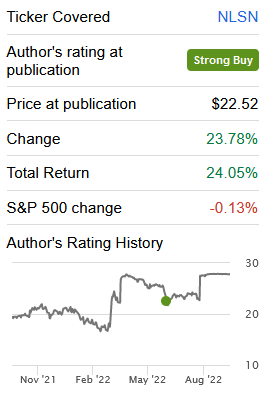

Secondly, the weak credit markets have wreaked havoc on deal financing. But this, too, has an upside for certain deals. Spreads that are wider than they otherwise would be due to shareholder opposition are likely to tighten if macro conditions further weaken. Nielsen (NLSN) was a terrific opportunity to capture a more than 20% return in a down market when shareholders acquiesced to a contentious takeover.

SA

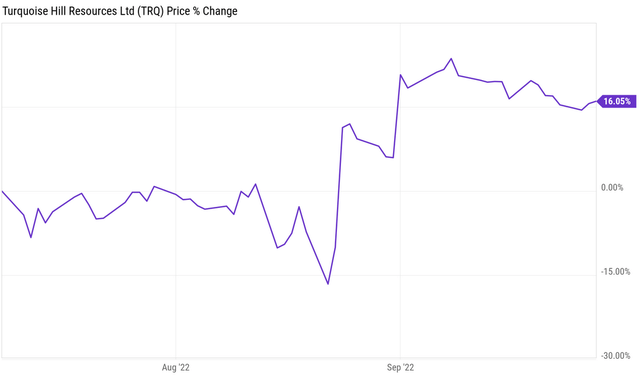

Turquoise Hill (TRQ) was also depressed due to shareholder opposition which remains to this day despite a bump in their offer price.

A third unresolved example of this category is Atlas (ATCO). The bidders offered $14.45, shareholders asked for $16.50 and they split the difference with a final $15.50 offer. What is interesting about these dynamics is that shareholder courage crumbles as the equity and credit markets crumble. So the lower the markets, the more likely it is that you capture these spreads. Today’s addition to that basket: Avalara (NYSE:AVLR).

Who?

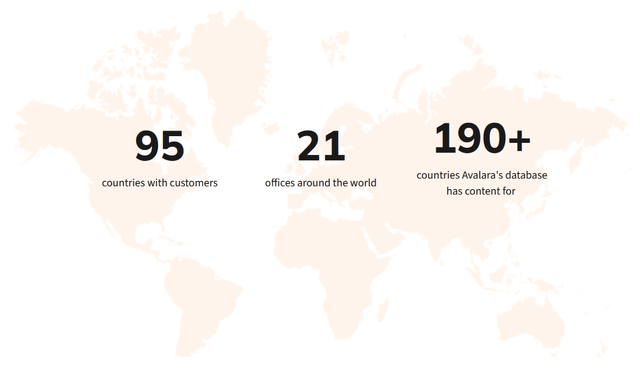

Avalara is a cloud-based transaction tax compliance company.

Their US middle market position is dominant and growing. Their biggest growth opportunities are in enterprise and abroad. Their offerings save customers money and help them avoid liability. Broke states hunt down sales tax shirkers aggressively and Avalara helps clients stay out of trouble.

What?

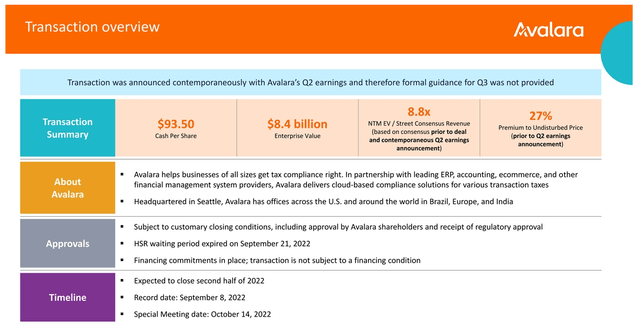

Vista is in the process of trying to buy Avalara for $93.50 per share in cash. The deal has already secured the one required regulatory approval, HSR, and awaits the remaining hurdle – getting the target’s shareholder vote.

When?

The deal was announced last month and will probably close next month. AVLR shareholders vote at 9 AM on Friday October 14, 2022. If they approve it, the deal will be able to close by the middle of the subsequent week.

Where?

The company is headquartered in Seattle with offices, customers, and data in countries around the globe.

Why?

The $1.49 net spread offers a 28% IRR if the deal closes in mid-October.

Caveat

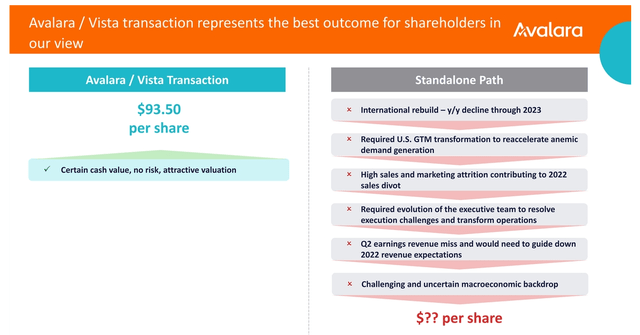

Some shareholders actively oppose the deal and could vote it down. Companies arguing for shareholders to vote in favor of cash deals are put in the funny situation of talking their share price and its prospects down. To that end, management is trying to convince shareholders that they better sell now. Their international business needs a rebuild that will take years. They expect international growth to decline until at least 2024. Growth will be down and volatility will be up as they rebuild their US go-to-market operations. Management questions… management. Or in corporate jargon, Avalara faces the challenge of:

Required evolution of the executive team to resolve execution challenges ahead.

Or in English,

We suck.

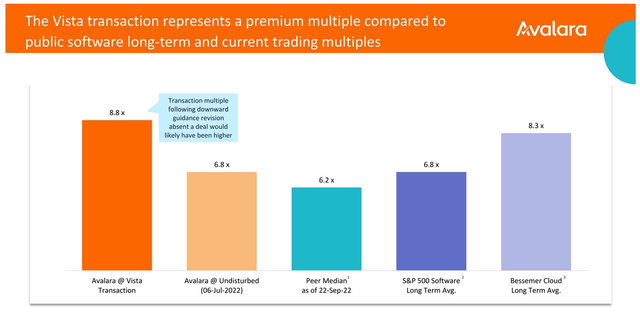

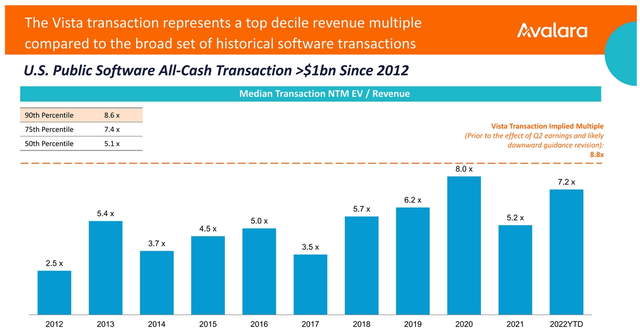

Absent a sale, macroeconomic headwinds and high interest rates would hurt the stock price for a long time to come. Their Q2 stunk. Other companies with similarly stinky quarters were down an average of about 25% after their announcements. Comparable companies generally are down 20% since the sale was announced in August. The deal looks like a 27% premium, but management points out that it would be an 82% premium if the stock was not impacted by the deal and was able to rip down 30% after their earnings were announced. Their business has degraded and they lack better options. Strategic buyers didn’t want them. They started with eight potential buyers, but seven ran for the hills when they got a closer look.

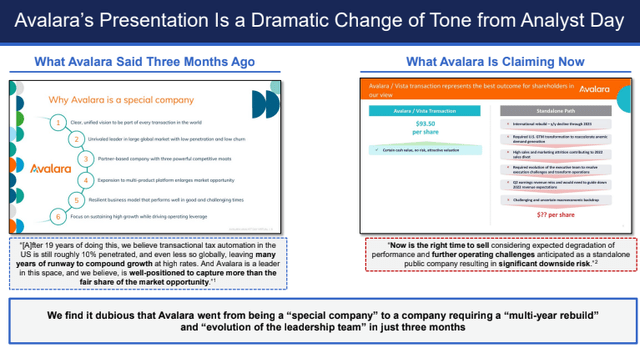

Shareholder activist Altair disagrees. They think the timing was bad, process was flawed, and price was low. They accurately point out that management is bashing their prospects to close the deal while they had recently sounded far more cheery at their analyst day. Everything Altair accuses management of is true. But if fellow shareholders follow them in voting down the deal, it is also true that the stock price will get crushed. I’m a skeptic, but no martyr and can afford less principle than a few months ago in rosier times. I like Altair’s convincing and almost funny comparison of “What Avalara Said Three Months ago” next to “What Avalara Is Claiming Now”.

Yet I find myself reaching for an alternative explanation: that things have gotten much, much worse over those three months.

Conclusion

This is a good return for a deal with no regulatory risk and little financing risk. Shareholders are probably better off voting for it. But they could win either way: by capturing the deal premium or if Altair is right to vote it down. Shareholders can only lose by voting it down with the view that it is worth more, having the buyer fail to bump the offer, and then changing their (cumulative) minds and dumping their shares for less than they turned down in the open market. It is quite possible that this is a time horizon arbitrage in which a yes vote is right short-term and a no vote is right long-term. My sense is that bear markets lead to shorter-term thinking on average and that most holders will want to take the money and run. We’ll know by this time next month.

TL; DR

- Buy AVLR,

- Take the money, and

- Run.

Be the first to comment