pupunkkop

This article is part of a series that provide an ongoing analysis of the changes made to Baupost Group’s 13F stock portfolio on a quarterly basis. It is based on Klarman’s regulatory 13F Form filed on 11/14/2022. Please visit our Tracking Seth Klarman’s Baupost Group Holdings article for an idea on how his holdings have progressed over the years and our previous update for the fund’s moves during Q2 2022.

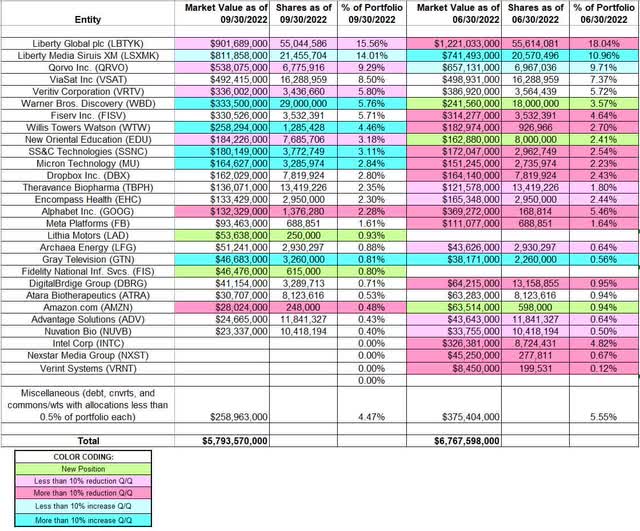

Baupost Group’s 13F portfolio value decreased ~14% from $6.77B to $5.79B this quarter. The total number of 13F securities decreased from 52 to 45. The portfolio is heavily concentrated with Liberty Global, Liberty Media Sirius XM, Qorvo, ViaSat, and Veritiv Corporation together accounting for ~53% of the 13F holdings.

Since inception (1982), Baupost Group’s 13F portfolio has accounted for between 2.4% to 15% of the Assets Under Management (AUM). The current allocation is at the high-end of that range. The rest of the AUM is diversified among cash, debt, real estate, and hedges. On average, the fund has held ~25% cash over the last decade. Seth Klarman’s distinct investment style is elaborated in his 1991 book “Margin of Safety: Risk-averse value investing strategies for the thoughtful investor”. The book is out-of-print and copies sell for a huge premium.

Note: They own ~32% of Garrett Motion (GTX) and ~14% of Just Eat Takeaway (GRUB). GTX emerged from Chapter 11 bankruptcy last May. The bulk of the ownership is through a series A preferred share offering.

New Stakes:

Lithia Motors (LAD) and Fidelity National Information Services (FIS): LAD is a small 0.93% of the portfolio stake established this quarter at prices between ~$215 and ~$296 and the stock currently trades at ~$225. The 0.80% FIS position was purchased at prices between ~$76 and ~$105 and it is now well below that range at $65.19.

Stake Disposals:

Intel Corp. (INTC): INTC is a 4.82% of the portfolio stake established in Q4 2020 at prices between ~$44 and ~$55. Q1 2021 saw a ~28% stake increase at prices between ~$50 and ~$66. Last five quarters had seen a ~63% selling at prices between ~$36 and ~$68. That was followed with the elimination this quarter at prices between ~$26 and ~$41. The stock currently trades at $29.82. They realized losses.

Nexstar Media Group (NXST): NXST stake was established in Q4 2018 at prices between $71 and $88. Q2 & Q3 2019 saw a ~80% stake increase at prices between $90 and $120. Last three quarters had seen a ~35% selling at prices between ~$144 and ~$190. This quarter saw the disposal at prices between ~$163 and ~$202. The stock is now at ~$173.

Verint Systems (VRNT): The original VRNT position was built in Q3 2020 at prices between ~$42 and ~$51. Q1 2021 saw a ~20% stake increase at prices between ~$33.50 and ~$52. That was followed with a ~15% increase Q3 2021 at prices between ~$42 and ~$46. There was a ~40% selling in Q1 2022 at prices between ~$48 and ~$54. The position was almost eliminated last quarter at prices between ~$40 and ~$56. The stock is now at $38.72. The remainder stake was sold during the quarter.

Stake Increases:

Liberty SiriusXM Group (LSXMK): The ~14% LSXMK stake was primarily built in Q3 2020 at prices between $32 and $37. Q4 2020 saw a ~14% stake increase. Last four quarters had seen the position doubled at prices between ~$35 and ~$56. The stock currently trades at $42.85. This quarter saw a minor ~4% further increase.

Warner Bros. Discovery (WBD): The large 5.76% of the portfolio stake in WBD was established last quarter at prices between ~$13 and ~$26. This quarter saw a ~60% increase at prices between ~$11.30 and ~$17.50. The stock is now below their purchase price ranges at $10.80.

Willis Towers Watson (WTW): WTW is a 4.46% of the portfolio stake established in Q1 2021 at prices between ~$200 and ~$235. The two quarters through Q3 2021 saw a ~60% selling at prices between ~$202 and ~$270 while next quarter there was a ~25% stake increase at prices between ~$226 and ~$249. There was a similar reduction last quarter at prices between ~$191 and ~$243. This quarter saw a ~40% increase at prices between ~$192 and ~$221. The stock currently trades at ~$239.

SS&C Technologies (SSNC): SSNC is a 3.11% position built in Q3 2020 at prices between ~$56 and ~$65. The two quarters through Q1 2021 had seen a ~25% stake increase at prices between ~$63 and ~$71. There was a ~22% selling last quarter at prices between ~$55 and ~$79. This quarter saw a similar increase at prices between ~$48 and ~$63. It is now at $51.40.

Micron Technology (MU): MU is a 2.84% of the portfolio position purchased in Q3 2020 at prices between $42.50 and $52.65 and the stock currently trades at ~$59. Q2 2021 saw a one-third increase at prices between ~$77 and ~$96 while in Q4 2021 there was a ~55% selling at prices between ~$66 and ~$96. There was ~12% trimming last quarter while this quarter saw a ~20% increase at prices between ~$49 and ~$65.

Gray Television (GTN): The very small 0.81% GTN stake saw a ~75% increase last quarter at prices between ~$17 and ~$22. That was followed with a ~45% increase this quarter at prices between ~$16.25 and ~$20.75. The stock currently trades at $10.76.

Stake Decreases:

Liberty Global (LBTYK) (LBTYA): LBTYK is currently the largest position at ~16% of the portfolio. It was established in Q3 2018 at prices between $25 and $28.50 and increased by ~120% next quarter at prices between $19.50 and $27.50. There was another ~27% stake increase in Q1 2019 at prices between $19.80 and $25.80. Since then, the activity had been minor. There was a ~10% reduction last quarter at prices between ~$22 and ~$26. The stock currently trades at $20.36. This quarter saw marginal trimming.

Qorvo Inc. (QRVO): QRVO is a large (top three) 9.29% portfolio stake established in Q1 2017 at prices between $53 and $69 and increased by ~25% the following quarter at prices between $63 and $79. There was another ~22% stake increase in Q4 2017 at prices between $65 and $81. 2019 had seen a ~75% selling at prices between $60 and $118. Q4 2020 saw an about turn: ~50% stake increase at prices between ~$125 and ~$170. That was followed with a ~18% further increase next quarter. The two quarters through Q1 2022 had seen another ~31% stake increase at prices between ~$119 and ~$178. The stock is now at ~$97. Last two quarters have seen only minor adjustments.

Note: They have a ~6.2% ownership stake in the business.

Veritiv Corporation (VRTV): VRTV is a 5.80% of the 13F portfolio position established in Q3 2014 at prices between $32.50 and $50.50. Q4 2017 saw a ~20% stake increase at prices between $22.50 and $32.50. The stock currently trades at ~$129. There was a ~4% trimming this quarter.

Note: Klarman’s ownership interest in VRTV is ~25%.

Amazon.com (AMZN) and New Oriental Education (EDU): AMZN is a 0.48% of the portfolio purchased last quarter at prices between ~$102 and ~$168 and the stock currently trades at ~$93. There was ~60% selling this quarter at prices between ~$106 and ~$145. EDU is a 3.18% of the portfolio position purchased last quarter at prices between ~$9.75 and ~$23.50. The stock is now at ~$26. There was a minor ~4% trimming this quarter.

Alphabet Inc. (GOOG) (GOOGL): The 2.28% GOOG stake was purchased in Q1 2020 at prices between ~$53 and ~$76. Last three quarters of 2020 had seen a ~75% selling at prices between ~$55 and ~$92. There was a ~265% stake increase in Q1 2021 at prices between ~$86 and ~$105. Q4 2021 saw a ~22% trimming at prices between ~$133 and ~$151 while next quarter there was a ~7% increase. The zig-zag trading pattern continued last quarter: ~30% reduction at prices between ~$106 and ~$144. That was followed with another ~60% selling this quarter at prices between ~$96 and ~$123. The stock is now at ~$97.

Kept Steady:

Viasat (VSAT): VSAT is a large (top five) position at 8.50% of the portfolio. Klarman first purchased VSAT in 2008 at much lower prices and his overall cost-basis is in the high-teens. In July 2020, Baupost participated in ViaSat’s 4.47M share private placement by acquiring ~2.56M shares at ~$39 per share. The stock currently trades at ~$34.

Note: Baupost controls ~22% of the business.

Fiserv Inc. (FISV): FISV is a 5.71% of the portfolio position purchased in Q4 2021 at prices between ~$96 and ~$111. There was a ~30% stake increase in Q1 2022 at prices between ~$93 and ~$110 while last quarter there was a ~11% trimming. The stock is now at ~$101.

Dropbox Inc. (DBX): DBX is a 2.80% of the portfolio position established in Q3 2021 at prices between ~$28 and ~$32.50 and the stock currently trades well below that range at $22.35. Q1 2022 saw a ~30% stake increase while last quarter there was a similar reduction.

Theravance Biopharma (TBPH): TBPH is a 2.35% of the portfolio position established in Q2 2014 as a result of the spinoff of TBPH from Theravance (now Innoviva). The spinoff terms called for Theravance shareholders to receive 1 share of TBPH for every 3.5 shares of Theravance held. The two quarters through Q3 2021 saw a ~50% stake increase at prices between ~$7 and ~$22.50. The stock is now at $10.61. There was marginal trimming in the last two quarters.

Encompass Health (EHC): The 2.30% stake in EHC was primarily built during Q1 2022 at prices between ~$60 and ~$70. The stock is now below that range at $56.72. There was marginal trimming last quarter.

Meta Platforms (META) previously Facebook: META is a 1.61% of the portfolio position established in Q1 2020 at prices between $146 and $223. The next two quarters had seen a ~70% selling at prices between ~$154 and ~$304. There was a ~175% stake increase over the three quarters through Q3 2021 at prices between ~$245 and ~$355 while next quarter there was a ~36% reduction at prices between ~$307 and ~$348. That was followed with a ~30% selling last quarter at prices between ~$156 and ~$234. The stock is now at ~$111.

Archaea Energy (LFG): The small 0.88% of the portfolio LFG stake was purchased in Q3 2021 at prices between ~$14.50 and ~$20 and it is now at $25.86. Last two quarters had seen a ~18% selling at prices between ~$15.50 and ~$23.

Note: Baupost controls ~5.5% of Archaea Energy.

DigitalBridge (DBRG) previously Colony Capital: The 0.71% stake in DigitalBridge came about as a result of the three-way merger of Colony Capital, Northstar Asset Management Group, and Northstar Realty Finance that closed in January 2017. Baupost held stakes in all three of these stocks and those got converted into CLNY shares. Roughly half the position was sold in Q2 2020 at prices between ~$5.70 and $12.40. Q1 2022 saw another ~20% selling at prices between ~$26.40 and ~$33. That was followed with another ~30% reduction last quarter at prices between ~$18 and ~$30. Their overall cost-basis is ~$50 per share. DBRG currently trades at $14.54.

Note: the prices quoted above are adjusted for the one-for-four reverse stock split in August.

Atara Biotherapeutics (ATRA): ATRA is a 0.53% of the portfolio stake established in Q4 2014 at around $19 per share. The original position was almost doubled next quarter at prices between $18 and $42.90. Recent activity follows: Q3 2019 saw a ~20% stake increase at prices between $12 and $20. Q2 2020 also saw a similar increase at prices between $7.50 and $14.93. The two quarters through Q1 2021 had seen a combined ~15% trimming. The stock currently trades at $4.21.

Note: Klarman controls ~8.5% of the business.

Advantage Solutions (ADV): The 0.43% ADV stake was established in Q4 2020 at prices between $8.75 and $13.35. The stock currently trades at $2.39. Last two quarters had seen minor selling.

Nuvation Bio (NUVB): NUVB is a 0.40% of the portfolio stake established in Q1 2021 following their de-SPAC transaction that closed last February. The stock currently trades at $1.82. There was a ~20% stake increase in Q1 2022 at prices between ~$4.50 and ~$8.83. Last quarter saw marginal trimming.

The spreadsheet below highlights changes to Klarman’s 13F stock holdings in Q3 2022:

Seth Klarman – Baupost Group’s Q3 2022 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Baupost Group’s 13F filings for Q2 2022 and Q3 2022.

Be the first to comment