t_kimura

It has certainly been an interesting year in the markets. With inflation running at forty-year highs, the purchasing power of our wealth has been rapidly declining and the weakness in the markets means that we have much less wealth to spend. Thus, many people may be looking for ways to preserve their purchasing power and possibly generate income at the same time. One potential option to achieve both of these goals is to invest in real estate. This is because real estate shares many of the same qualities as other things that rise in price in an inflationary environment as well as can be rented out to generate an income. One of the best ways to invest in real estate may be by purchasing shares of a closed-end fund that specializes in the sector. This is because these funds provide easy access to a professionally-managed portfolio of assets that can usually deliver a higher yield than any of the underlying assets. In this article, we will discuss the Cohen & Steers Quality Income Realty Fund (NYSE:RQI), which is one such option available in the market. I have discussed this fund before but more than a year has passed since that time so obviously, a great many things have changed. This article will therefore focus specifically on those changes as well as provide an updated analysis of the fund’s finances. So, let us investigate and see if this fund could be a good addition to your portfolio today.

About The Fund

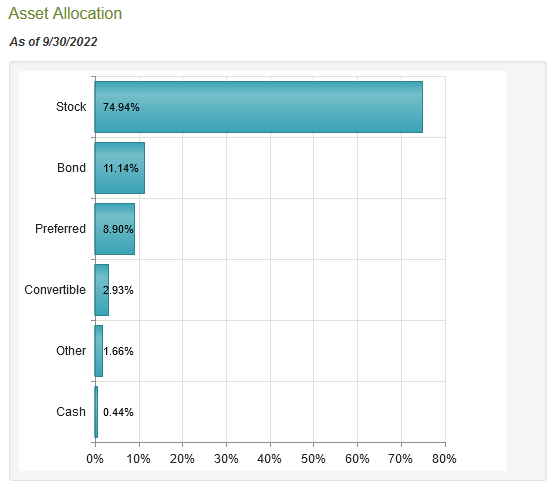

According to the fund’s webpage, the Cohen & Steers Quality Income Realty Fund has the stated objective of providing investors with a high level of current income. This is what we would expect given the name of the fund, although it would be nice to see the fund also showing interest in capital gains in order to protect the purchasing power of our wealth. However, an investor could always reinvest some of the income in order to achieve that same purpose. After all, if the fund’s distributions are reinvested then the income received from it should grow over time. As the name of the fund implies, it aims to achieve its objective by investing in a portfolio of real estate securities. Interestingly, the fund does not state specifically what type of securities these are so the portfolio might include both common equity and fixed-income securities. Currently, the fund is mostly weighted toward common equity though as 74.94% of the portfolio is invested in these securities:

CEF Connect

The fact that this fund can include both common equity and fixed-income securities works quite well for our overall thesis here. This is because common stock should appreciate as the value of real estate increases, which is exactly what we should expect in an inflationary environment. That should provide some protection against the loss of purchasing power that we would otherwise suffer. Meanwhile, the bonds and preferred stock provide some stability and, in the case of the preferred stock, greater income potential than we would obtain with the common equity. Thus, the presence of these securities in the fund’s portfolio should increase its income potential compared to a portfolio of all-common stock. The still sizable allocation to common stock should still allow the fund to provide sufficient protection against the loss of purchasing power that accompanies inflation so overall the fund works pretty well with what we are attempting to accomplish here.

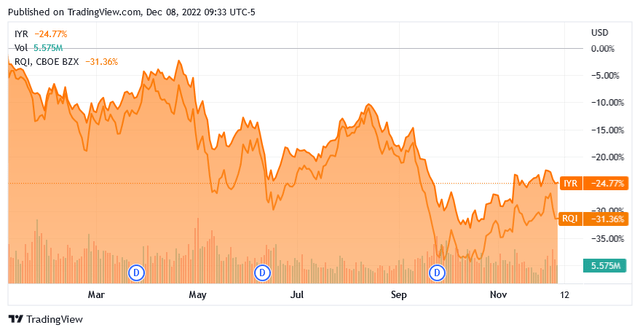

There will naturally be some readers that point out that the real estate sector has not been performing very well this year. Indeed, the U.S. Real Estate Index (IYR) is down 24.77% year-to-date. This fund has certainly not done much better as it is down 31.36% over the same period:

The biggest reason for these declines is rising interest rates. As of the time of writing, the federal funds rate is 3.78%, up from 0.08% at the start of the year. This has made mortgages much more expensive. As of the time of writing, the best rate that I can find on a thirty-year fixed-rate mortgage is 7.05%, up from about 3% at the start of the year. Most people look directly at the cost of the mortgage payment when evaluating offers to purchase a house so the higher rates mean that people cannot afford to carry as large of a loan. Thus, they begin reducing their offers when purchasing a property. This does not change the fact that real estate prices tend to move up faster than inflation over the long term and so does not defeat the overall thesis.

The fact that the Cohen & Steers fund underperformed the real estate index year-to-date may be discouraging to some, although when you consider the fact that the closed-end fund pays out a much higher yield, it balances out the difference somewhat. It is important to keep in mind though that the assets of the two funds are also somewhat different. In particular, the index fund does not include fixed-income securities, which will account for some of the performance difference. In addition to this, the closed-end fund uses leverage as a way to amplify its returns, which we will discuss later. Another potential reason might be that the Cohen & Steers Quality Income Realty Fund has a 38.00% annual turnover, which is not particularly high for an equity closed-end fund but it still creates a drag on the portfolio’s performance. This is because trading stocks or other assets costs money, which is billed to the shareholders. Thus, management has to deliver a return that is sufficient to cover these added costs as well as satisfy the investors. This is very difficult to achieve consistently and probably accounts for a bit of the performance difference that we see here.

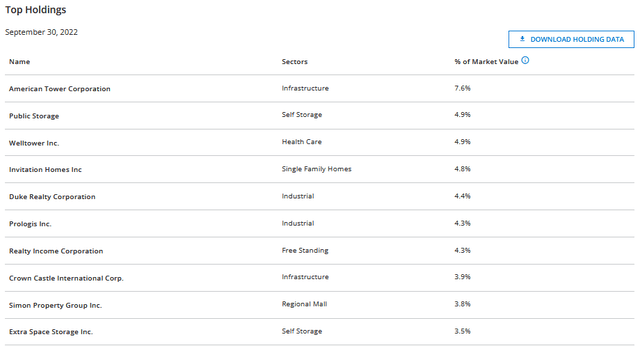

The largest positions in the fund will likely be familiar to anyone that follows the real estate sector. Here they are:

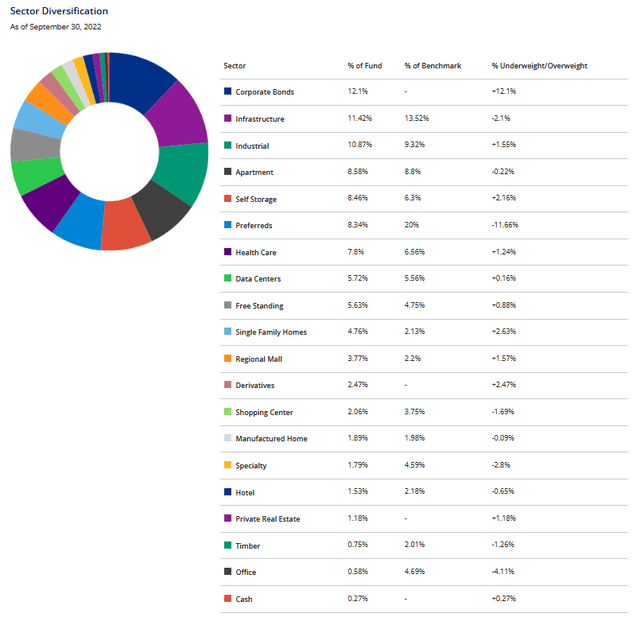

Despite the fund having a fairly low turnover, we do see a large number of changes over the past year here. These include the removal of Healthpeak Properties (PEAK), Equinix (EQIX), Ventas (VTR), VICI Properties (VICI), and Weyerhaeuser (WY) from the fund’s largest positions. The new additions to the list are Invitation Homes (INVH), Welltower (WELL), Prologis (PLD), Realty Income (O), and Extra Space Storage (EXR). A few of these changes are not particularly surprising, such as the removal of Equinix when data center real estate investment trusts got very overvalued during the peak of the pandemic and the remote working trends. We do still see companies from a variety of different real estate sectors here. For example, American Tower Corporation (AMT) and Crown Castle International (CCI) own cellular phone towers that they rent out to telecommunications companies, Simon Property Group (SPG) owns numerous premier shopping malls across the country, and Invitation Homes rents houses to individual families. This diversity of real estate types extends across the fund’s entire portfolio:

This is nice from a diversification perspective as each of these sectors has different fundamentals. For example, a shopping center is far more exposed to consumer spending than a healthcare property. After all, people will cut back on discretionary spending when money gets tight. We are already seeing this today simply from the sheer number of people that are taking on second jobs to support themselves. When people reduce their discretionary spending, merchants that operate in shopping malls have more difficulty paying their rent and may ultimately go under. This, of course, reduces the revenue of the shopping mall operator. A healthcare property does not have this problem since people will generally seek out healthcare services whenever they need it regardless of their financial condition. Thus, the real estate investment trusts that own these properties will likely hold up better in a recession. However, they will not do as well during a strong economy since people do not generally seek out healthcare services when they do not need them. The fact that the fund is invested in all different types of real estate thus provides its investors with exposure to the fundamentals of each and thus the best of all worlds.

Real Estate As A Store Of Wealth

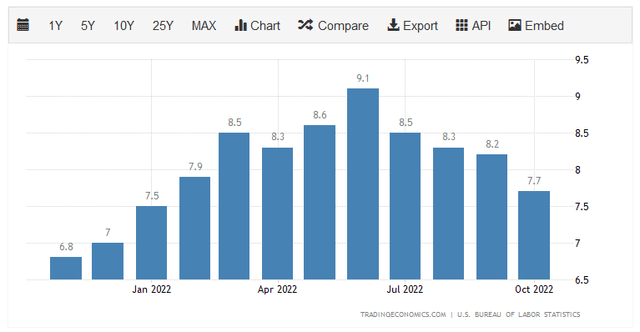

As stated a few times throughout this article, real estate can act as a way to protect your wealth against inflation and the loss of purchasing power that accompanies it. This is something that is quite important today considering that the inflation rate in the United States has been at a forty-year high all year:

TradingEconomics/Data from BLS

Although inflation has slowed down a bit from its peak in June, the most recent CPI report still shows a month-over-month inflation rate of 0.4%, which works out to 5% annualized. That is well above the normal level and as it is concentrated in the necessary categories of food and energy, we cannot really avoid the impact that it has on our ability to purchase things simply by cutting back on discretionary spending. Thus, we need a way to protect ourselves against this loss of purchasing power.

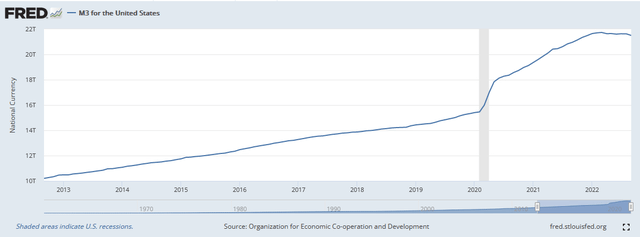

In order to understand how real estate can protect against inflation, it is important to understand the root causes of inflation. Economists usually consider inflation to be a natural occurrence but this is not exactly correct. In fact, inflation is the result of the money supply growing more rapidly than the production of goods and services in the economy. This has been the case in the United States over the past decade. We can see this by comparing the M3 money supply, which is the most comprehensive measure of the supply of money in an economy, to the gross domestic product over the period. This chart shows the M3 money supply over the past ten years:

Federal Reserve Bank of St. Louis

As we can see here, the M3 money supply has gone from $10.2008 trillion in September 2012 to $21.5034 trillion today. This is a 110.80% increase over the period. We can also clearly see that the growth rate was relatively steady over most of the period but then accelerated rapidly beginning in 2020. This growth was caused primarily by the increase in federal spending in response to the COVID-19 pandemic, which was financed by the Federal Reserve essentially creating money out of thin air. I discussed this in many previous articles. This is the root cause of the inflation that we are seeing today.

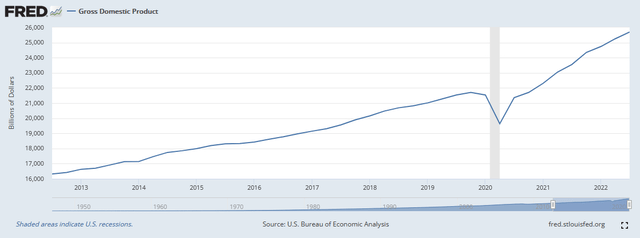

This increase in the nation’s money supply was substantially greater than the growth in the economy’s production of goods and services over the same period. This can be quite clearly seen by looking at the gross domestic product over the same time period. Here it is:

Federal Reserve Bank of St. Louis

As clearly shown, the U.S. gross domestic product went from $16.31954 trillion in the third quarter of 2012 to $25.69896 trillion today. This is only a 57.47% increase over the time period. Thus, the supply of money grew at nearly double the rate of actual economic production. This resulted in a greater amount of money being available to purchase each unit of economic output and thus drove up prices due to the law of supply and demand.

Real estate shares many of the same qualities as other items that see their prices increase during inflationary periods. In particular, there is only a limited supply of land as we cannot actually create any more of it. It also requires actual human or mechanical effort to improve real estate. Buildings do not magically appear just because someone pushes a button on a computer as money can. Thus, an increasing money supply should result in rising real estate prices. Admittedly, that growth will be muted for a while since we are beginning to see the money supply contract in response to the rising interest rates but that does not change the overall thesis that real estate should hold its value better than currency or other assets.

Leverage

As mentioned earlier, closed-end funds are able to use certain strategies that boost their yield beyond that of the underlying assets. One of the strategies that are employed by the Cohen & Steers Quality Income Realty Fund is the use of leverage. Basically, the fund is borrowing money and using that borrowed money to purchase common stock and fixed-income securities issued by real estate investment trusts. As long as the return that the fund receives from these securities is higher than the interest rate that it needs to pay for the borrowed funds, this strategy works pretty well to increase the yield of the portfolio. As the fund is able to borrow money at institutional rates, which are lower than retail rates, this will usually be the case.

However, the use of leverage is a double-edged sword since leverage boosts both gains and losses. This could explain some of the fund’s performance difference compared to the index since we see that the fund’s swings downward were generally larger than those of the index. As a result of this, we do want to ensure that the fund is not employing too much leverage since that would expose us to too much risk. I do not usually like to see a fund’s leverage above a third as a percentage of assets for this reason. The Cohen & Steers Quality Income Realty Fund fulfills this requirement as it has a leverage ratio of 29.04% of its assets as of the time of writing. Thus, the fund does appear to be striking a reasonable balance between risk and return here.

Distribution Analysis

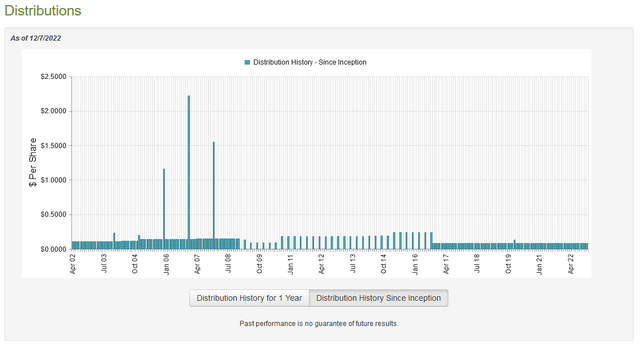

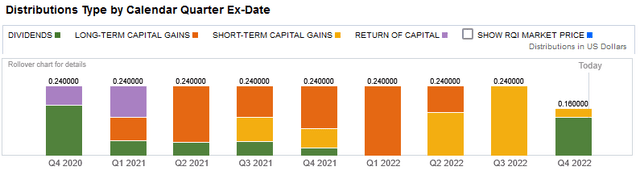

One of the major reasons that investors purchase shares of real estate investment trusts is because of the high yields that these companies tend to have. After all, these entities operate by renting out their properties to other people and then using the rent payments to cover expenses and provide a payment to the investors. In fact, tax rules require that these companies pay out the majority of their profit to investors every year. As the Cohen & Steers Quality Income Realty Fund invests in a leveraged portfolio of these assets to provide a current income to its investors, we can assume that the fund will pay out a high yield itself. This is indeed the case as the fund currently pays a monthly distribution of $0.08 per share ($0.96 per share annually), which gives it a 7.72% yield at the current price. The fund has been remarkably consistent with this distribution in recent years as the fund has maintained it since 2017:

This sort of consistency is something that will likely appeal to those investors that are seeking a secure source of income that can be used to pay bills or finance other expenses. Another thing that will be generally well-liked is the fact that these distributions are almost entirely comprised of dividend and capital gains income. There have been relatively few return of capital distributions over the past two years:

The reason why this may be appealing is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. However, capital gains are not necessarily sustainable either, as it has been very difficult to earn capital gains so far this year, particularly in real estate. As such, we do still want to examine the fund’s finances to make sure that everything is in order and that it does not need to cut the distribution anytime soon.

Fortunately, we do have a relatively recent document to consult for our analysis. The fund’s most recent financial report corresponds to the six-month period ending June 30, 2022. As such, it will include quite a bit of data from the first half of the year, which was a period of volatility in the real estate sector incited by the Federal Reserve beginning monetary tightening in March. During the six-month period, the fund received a total of $29,057,463 in dividends and another $5,746,532 in interest from the assets in its portfolio. When we combine this with a small amount of income from other sources, we get a total of $35,192,963 coming into the fund. The fund paid its expenses out of this amount, leaving it with $15,021,415 available for investors. This was nowhere close to enough to cover the $64,458,196 that the fund actually paid out in distributions during the period.

As we can see above though, all of the fund’s distributions during the first half of this year were classified as capital gains. However, the fund failed to generate much in the way of capital gains during this period. The fund did achieve net realized gains of $68,138,189 during the period but this was offset by $568,304,375 net unrealized gains. Overall, the fund’s assets under management declined by $548,919,815 in six months after accounting for all inflows and outflows. On the surface, it appears that the fund failed to cover its distributions. However, its net realized gains alone were sufficient to cover the distributions, let alone the added contribution from the net investment income. Overall, the distribution is probably reasonably safe as long as the fund’s assets do not continue to decline too much. This is because the lower the fund’s assets, the harder it will be for management to make the capital gains that are needed to maintain the distribution. This is something that we will want to keep an eye on.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Cohen & Steers Quality Income Realty Fund, the usual way to value it is by looking at a metric known as the net asset value. The net asset value of a fund is the total current value of all of the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are purchasing the fund’s assets for less than they are actually worth. That is fortunately the case with this fund today. As of December 7, 2022 (the most recent date for which data is currently available), the Cohen & Steers Quality Income Realty Fund had a net asset value of $12.92 per share but the shares actually trade for $12.74 per share. This gives the shares a 1.39% discount to net asset value at the current price. This is relatively in line with the 1.28% discount that the shares have traded at on average over the past thirty days and it is overall a reasonable price to pay for the fund. The fund certainly appears to be offering a reasonable proposition to investors at today’s price.

Conclusion

In conclusion, the Cohen & Steers Quality Income Realty Fund appears to be offering investors a reasonably good proposition here. While it is true that real estate values might drop a bit more in the near term as the Federal Reserve continues tightening, real estate should serve as a good store of value over the long term. This fund offers investors a very well-diversified portfolio of these assets combined with a high yield that is fully covered, at least for now. The biggest concern is that continued losses will drag down the portfolio’s value to a size in which it becomes difficult for management to achieve sufficient capital gains but for now everything seems fine. The price is also quite reasonable so it might make sense to buy today.

Be the first to comment