MarianVejcik/iStock via Getty Images

Published on the Value Lab 11/14/22

The iShares MSCI Brazil ETF (NYSEARCA:EWZ) is a pretty good representation of the Brazilian markets. With the recent Lula win, it’s reasonable to start considering how the direction of the markets and this ETF might change. Lula will inject spending into the economy and there are industries that will benefit. The BRL may suffer on lacking budgetary prudence, and some stocks may see specific risks, but there should also be some positives coming from a Keynesian economic expansion. The direction is mixed, but not necessarily ambiguously negative. We think the recent declines reflect quite reasonably the uncertainty. It’s a hold.

EWZ Breakdown

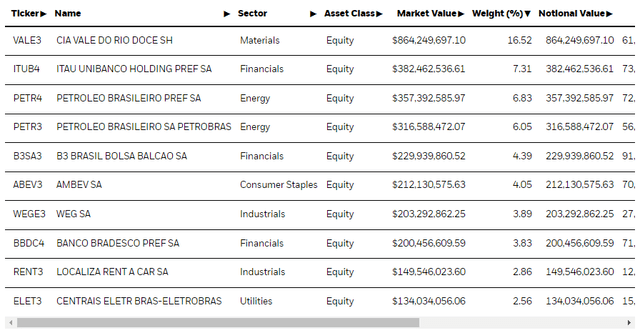

Let’s start first with some of the top holdings.

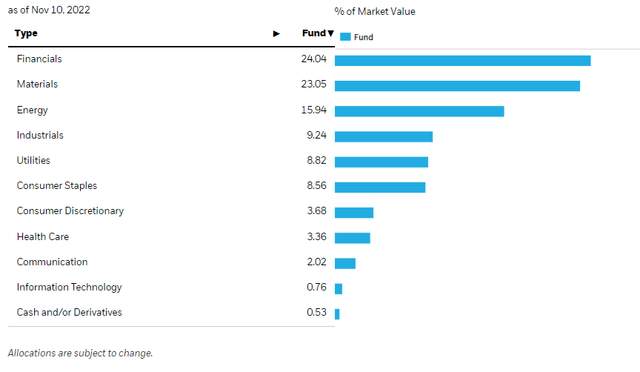

Not much has changed with this ETF. Vale (VALE) is still prominent with a 17% weighting, then there are plenty of financial exposures as well as a 13% exposure through preferred and common stock to Petrobras (PBR). These elements and sectoral exposures set the tone of the EWZ.

Starting with the financial exposures, they should be quite well positioned in some respects to the current environment. Spending plans should increase loan volumes in the economy. How the spending is done though will affect things. The BRL at any rate will likely see some declines, and this will affect financials which are BRL-denominated. BRL declines will be poor if financial concerns around budgetary prudence overcome the benefits of higher returns on bonds if bonds are sold. Spending should raise interest rates. Selling bonds should increase Brazilian yields, and this should help NIMs for the financial sector. Higher yields may hurt loan volumes in some sectors but not all. If rates are made to fall while spending rises, this would be quite bad for the financials on the other hand, with BRL declines coming with lower rates. Again, depending on the fiscal and monetary plans, financials could be variably affected.

Talking about Vale, steel and, consequently, iron ore demand is determined on the global stage. China is huge in this regard and defines the market. China is in an economic rut that is self-inflicted, and politics may stop them from getting out of the COVID-zero mania in good time. Brazilian spending may help infrastructure and steel demand, but whether it moves the needle globally, or whether particularly nice sales agreements can be determined with local buyers, is something that is still uncertain. General global economic declines are likely going to be a problem for steel and iron ore demand. The cycle has very much turned here already and could stay bad for a year.

Petrobras has the issue that part of the Lula campaign is around a renewable push. Petrobras is controlled by the government and this means that there could be a lot of poor-economics CAPEX going into renewables where legacy energy capacity is more profitable. Not an ideal situation. While the government controls Petrobras, a windfall tax is less effective and likely, but that is a risk as well. On the other hand, Petrobras is very cheap and provides yield. Upside remains in energy and for that EWZ benefits.

Bottom Line

The market has demonstrated some displeasure with the EWZ since Lula’s win.

This is reasonable. Brazilian finances and economic policy are still unclear, and how it will fare interacting with disruptive geopolitical forces creates uncertainty that warrants a discount.

The yield of the ETF is slightly inflated by the dividend yield from Petrobras, which is coming with a special dividend in the coming months, but the yield from the EWZ is strong, and the PE remains low at 5.84x driven by low multiples for materials stocks including Vale and for PBR. There is a margin of safety in the compressed multiple, and the energy exposures remain positive in the current environment in our view, but the direction of the ETF is uncertain as Brazil’s prospects and leverage towards financials in the ETF are marred by uncertainty. We think this ETF is a hold.

Be the first to comment