Lobro78

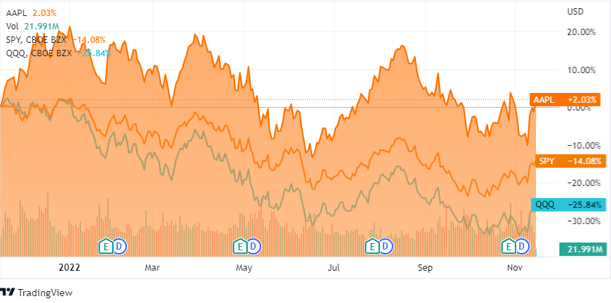

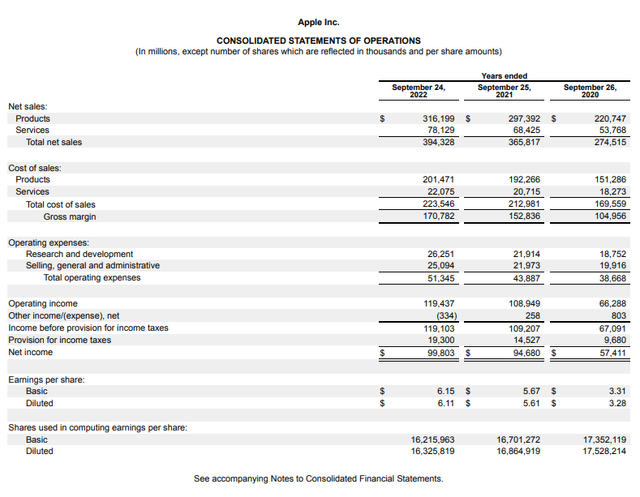

I have read a lot of opinions discussing how Apple’s (NASDAQ:AAPL) downward resilience trends in the market are unjustified, that AAPL has a China problem, and that there is more pain in AAPL’s future. Over the previous year, shares of AAPL are up 2.1%, while the SPDR S&P 500 Trust (SPY) is down -14.03%, while the Invesco QQQ ETF (QQQ) has declined by -25.83%. No matter what the bear thesis has been, AAPL continues to defy any obstacle and just reported the most profitable fiscal year of any company. Shares of AAPL make up 7.11% of SPY, and one of the main reasons SPY has been lifted out of bear market territory is AAPL. My opinion is that AAPL is the greatest brand, has the largest consumer following, and is the most shareholder-friendly company in the market, and these opinions are backed up by AAPL generating $99.8 billion of net income in FS 2022 while returning $715.2 billion of capital back to shareholders over the past decade. Shares of AAPL aren’t overvalued and are currently priced under the average price per share (PPS) that AAPL repurchased them for throughout Q4. If you’re a long-term investor, I believe AAPL is always an attractive stock, no matter if it’s trading at $130 or $160.

Seeking Alpha

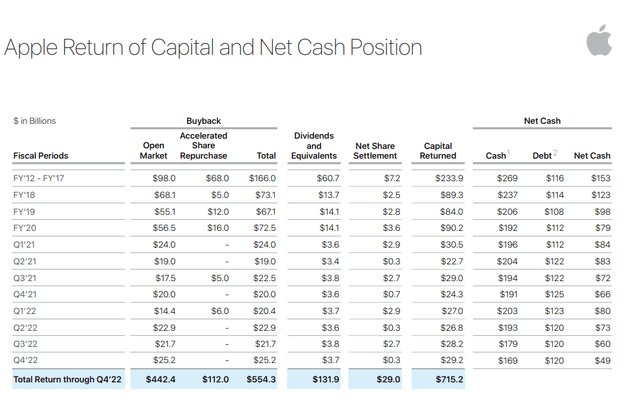

No company has come close to matching the amount of capital Apple has returned to its shareholders over the past decade.

I believe it would be hard to refute my opinion that AAPL is the most shareholder-friendly company in the market, as no company comes close to matching the amount of capital AAPL returns to its shareholders. Over the past decade, AAPL has returned $715.2 billion of capital to its shareholders. AAPL has repurchased $554.3 billion worth of its own shares, as $442.4 was on the open market, and $112 billion came from its accelerated share repurchase program. AAPL has also paid $131.9 billion in dividends over the past decade, providing shareholders with 9 consecutive years of dividend increases, bringing its annual dividend from $0.36 to $0.92 per share.

Looking at AAPL’s balance sheet, it’s repurchased 36.85% of its common stock over the past decade, bringing its shares outstanding to 15.91 billion from 25.19 billion. This is important for two reasons. First, with every share that AAPL repurchases, it increases the amount of equity each remaining share represents while entitling each share to a larger portion of AAPL’s profits. The second reason why this is important is that it instantly increases AAPL’s earnings per share (EPS) provided that AAPL produces the same level of earnings from operations as the prior year. As AAPL repurchases shares, it could have a flat year on its income statement across the board and still see its future EPS increase due to its earnings being divided among a smaller share count. This also provides a large boost to EPS in years where AAPL is growing its revenue base and earnings from operations as its profit base expands while being distributed among a smaller share count. Walmart (WMT) currently has a market cap of $387 billion, and The Home Depot (HD) has a market cap of $322.41 billion. When you look at the numbers, AAPL has returned the equivalent of WMT and HD’s market caps to its shareholders in a decade.

AAPL ended its 2022 fiscal year with $169 billion of cash and marketable securities on its balance sheet. Luca Maestri reinforced AAPL’s stance of getting to a cash-neutral point on the Q4 earnings call. He explained that AAPL repaid $2.8 billion in maturing debt and decreased commercial paper by $1 billion while issuing $5.5 billion of new debt, leaving them with a net cash position of $49 billion. In addition to AAP: having a net cash position of $49 billion, they just generated $111 billion of FCF in 2022. AAPL continues to be in a position where it can allocate an immense amount of capital toward Capex, while investing in growth projects and continuing to return large amounts of capital back to its shareholders.

In Q4 of 2022, AAPL repurchased 160 million shares on the open market at the cost of $25.2 billion. This is the equivalent of an average share price of $157.5. Over the past decade, regardless if shares were at an all-time high or declining, APPL was buying. Why wouldn’t you want to be a shareholder of a company that continues to increase your equity position and the amount of EPS represented in your shares? Based on AAPL’s net cash position and the level of FCF it produces, I don’t see the buybacks disappearing anytime soon, and AAPL is likely to continue repurchasing shares no matter what valuation Mr. Market puts on them. Currently, you can purchase shares of AAPL several dollars cheaper than AAPL’s average repurchase price in Q4 of 2022.

Is Apple dead money, or can it reach new highs in the next bull market cycle?

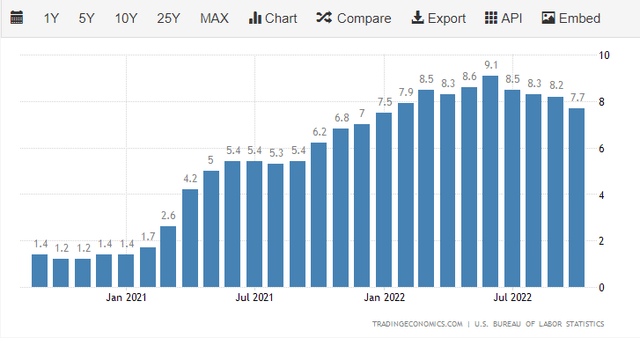

I don’t have a crystal ball, but I believe AAPL is more likely to reach new highs and provide capital appreciation for its shareholders rather than being dead money in the future. AAPL’s fiscal year runs from 10/1 – 9/30, as they do not report on a calendar year. Something that isn’t discussed much is what AAPL accomplished in the largest inflationary environment we have seen in decades. The average monthly rate of inflation during AAPL’s 2021 fiscal year was 3.35%. This more than doubled throughout the 2022 fiscal year to 7.91%, with inflation peaking at 9.1% in the month of June 2022. What’s astonishing is that even with the average monthly rate of inflation more than doubling, AAPL wasn’t impacted and, on many levels, excelled.

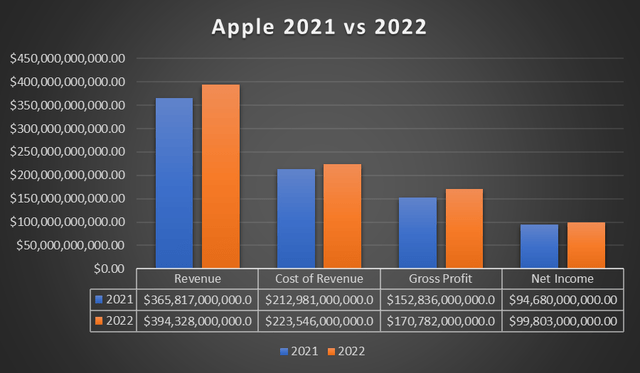

While inflation impacted many companies, consumers spent a record amount on AAPL products in 2022, and when the year commenced, AAPL proved its impervious to not only economic pressures but inflationary environments. In 2022, AAPL’s revenue increased by 7.79% YoY as it generated an additional $28.51 billion. This was more than enough to defend its margins as its cost of revenue increased by 4.96% or by $10.57 billion. AAPL’s cost of revenue margin actually declined in 2022 by -1.53% to 56.59%, while others felt the full brunt of inflation on their costs. AAPL’s gross profit increased by 11.74% YoY to $179.78 billion and gained 1.53% on its gross profit margin as it came in at 43.31%. When it was all set and done, AAPL generated a 5.41% net income increase YoY to $99.8 billion and its bottom line profit margin only declined by -0.57% to 25.31%.

Investors allocate capital toward companies that they believe will generate a positive return on investment over a period of time. The real question is, can AAPL continue to replicate its past performance and deliver additional capital appreciation going forward? Nobody can say yes with 100% certainty. Based on the data, I believe AAPL can continue growing its revenue, maintain or improve its margins, and increase its EPS which should drive its share price higher.

AAPL’s revenue in Q4 was a Q4 record of $90.1 billion, up 8% year-over-year despite over 600 basis points of negative foreign exchange impacts. AAPL’s product revenue in Q4 increased by $71 billion YoY. Services set a Q4 record at $19.2 billion, which is a 5% increase YoY, and now has over 900 million paid subscribers. AAPL recently released its iPhone 14 lineup, and its new iPads just landed in stores. AAPL also delivered new MacBook Air and Pro models over the summer while introducing the Apple Watch Series 8. Luka was cautious when discussing Q1 2023 and didn’t provide projections on the earnings call. He steadied the market for the possibility of decelerating revenue QoQ due to an increase in increasing impacts to FX, Services being impacted by the macroenvironment, and Mac seeing FX headwinds. He has been cautious in the past, and I believe there are more than enough fresh products for AAPL to see QoQ growth in Q1 of 2023.

Even if AAPL sees a flat year in revenue, its annual EPS is expected to increase by $0.14 to $6.25 YoY. 2022 indicated that AAPL could improve its margins as inflation increased as its cost of revenue declined on a percentage basis. If inflation continues to decline in 2023, AAPL’s cost of revenue margin could continue declining, leaving more room for the bottom line to expand, in addition to seeing general and administrative costs decline on a percentage basis as well.

AAPL is also going to continue buying back shares at an aggressive rate, and this will artificially increase its EPS. At the close of 2022, AAPL had 15.91 billion shares outstanding after allocating $90.2 billion toward buybacks. Based on AAPL’s shares on the latest filing date, if they were to replicate 2022’s earnings from operations of $99.8 billion, they would generate $6.27 of EPS which is a YoY increase of $0.16 or 2,68%. Hypothetically, if AAPL allocates $80 billion in 2023 toward buybacks and its average price per share is $160, AAPL would reduce its share count by 500 million shares or -3.14%. $80 billion of buybacks would be worth an additional $0.21 in EPS as $99.8 billion of earnings from operations would be allocated across 500 million fewer shares, increasing 2023’s EPS to $6.48 per share, a YoY increase of 6.01%. This is if AAPL’s financials come in flat in 2023 and allocate less toward buybacks. AAPL is in a position where it could see a slight decline in earnings from operations and still produce YoY growth in earnings due to its buybacks or continue its YoY earnings from operations growth and blow out the 2023 consensus estimates for EPS. Either way, I see AAPL as a long-term buy, as it will continue to buy back shares, and its pricing power has proven it can defend in addition to improving margins throughout tough economic environments.

Steven Fiorillo, Seeking Alpha

Conclusion

Shares of AAPL are still -17.86% off their 52-week highs, even after reporting tremendous results in 2022, where AAPL generated $99.8 billion of net income and $111 billion of FCF. Instead of sparking a rally, shares of AAPL declined more than -10% after its 2022 fiscal year earnings were announced over the next several days. AAPL is the most profitable company in the market today and allocates more capital back to shareholders in the form of buybacks and dividends than any other company. AAPL will continue working toward its goal of a net zero cash position, and to achieve this goal, AAPL needs to utilize $49 billion in net cash remaining on its balance sheet, in addition to all future FCF generated from its continuing business operations. I believe AAPL is a buy no matter where we are in the economic cycle, and AAPL is a stock that should just be owned and not sold. I think 2023 will work out well for AAPL, as they buy back shares and deliver additional EPS to shareholders, which I believe will cause shares to appreciate toward their all-time highs.

Be the first to comment