omersukrugoksu

Earnings of Union Bankshares, Inc. (NASDAQ:UNB) will most probably surge next year on the back of conducive labor markets in Vermont and New Hampshire. Further, the recent improvement in the deposit mix will boost margin expansion in the coming quarters. Overall, I’m expecting Union Bankshares to report earnings of $2.81 per share for 2022 and $3.08 per share for 2023. Compared to my last report on the company, I’ve raised my earnings estimates for both years as I’ve revised upwards my loan and margin estimates. The December 2023 target price suggests a moderate upside from the current market price. Further, Union Bankshares is offering a high dividend yield. Based on the total expected return, I’m maintaining a buy rating on Union Bankshares.

Improvement in Deposit Mix to Further Boost the Margin

Union Bankshares’ net interest margin expanded by 12 basis points in the third quarter after growing by 11 basis points in the second quarter of 2022. This is quite an achievement given that the loan book is heavy on residential real estate loans, which mostly carry fixed rates. Residential real estate loans made up around 35% of total loans at the end of September 2022, according to details given in the 10-Q filing. These loans will make the overall earning assets slow to reprice.

On the other hand, the deposit book is quite quick to reprice, because of the large balance of adjustable-rate deposits, namely interest-bearing checking, savings, and money market accounts. These deposits altogether made up 60.4% of total deposits at the end of September.

Union Bankshares has significantly improved its deposit mix so far this year. Non-interest-bearing deposits have surged to 28.2% of total deposits by the end of September from 24.2% at the end of December 2021. Further, adjustable-rate deposits have declined from 66.1% at the end of December 2021 to 60.4% at the end of September 2022. Due to this improvement, the deposit beta (rate sensitivity) will most probably be lower in the coming quarters compared to the deposit beta earlier this year.

Considering these factors, I’m expecting the margin to grow by 13 basis points in the last quarter of 2022 and 10 basis points in 2023. Compared to my last report on Union Bankshares, I’ve raised my margin estimates because of the improvement in the deposit mix. Further, my interest rate outlook is now more hawkish than before.

Enviable Job Markets to Support Loan Growth

Union Bankshares’ loan growth has been much higher this year than in previous years. The portfolio grew by 19% in the first nine months of the year, or 26% annualized, which beat my expectations.

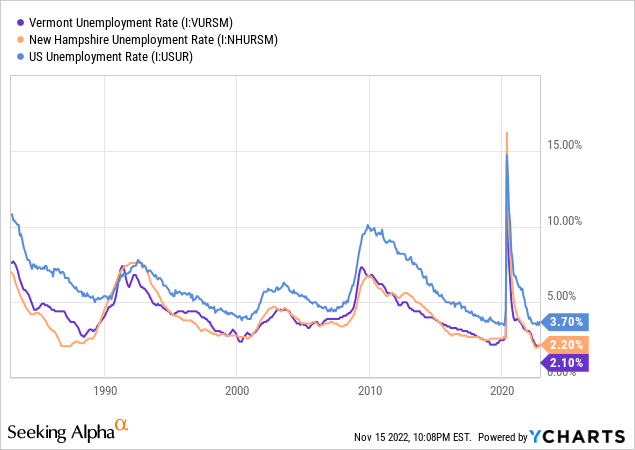

Union Bankshares operates in states of Vermont and New Hampshire, which have some of the best job markets in the country. As shown below, the unemployment rates are much below the national average.

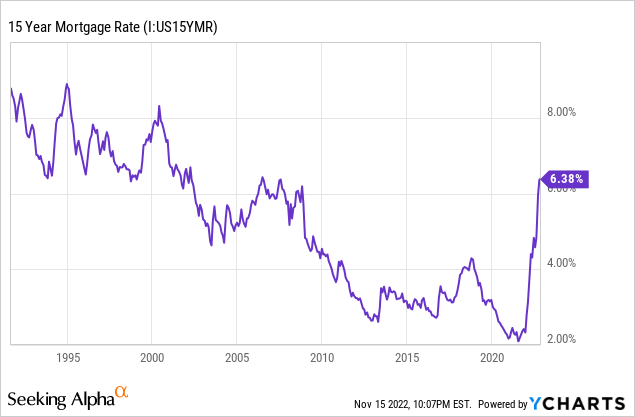

As a result of the strong job markets, economic activity will likely remain elevated, which will support commercial loan growth. However, the environment is less conducive for residential real estate loans. Borrowing costs and home prices are important factors that drive residential mortgage demand. Both factors currently bode ill for loan growth. Mortgage rates are at a decade high, as shown below.

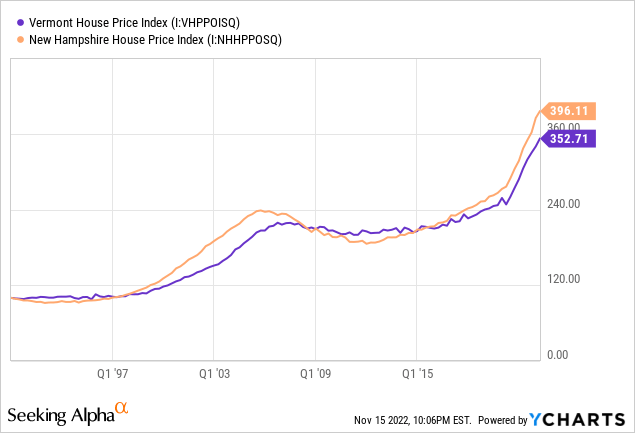

Further, house price indices in both states are showing a steep uptrend in recent quarters, as shown below.

Considering these factors, I’m expecting the loan portfolio to grow by 2% in the last quarter of 2022, leading to full-year loan growth of 21.8%. For 2023, I’m expecting the portfolio to grow by 8%. Compared to my last report on the company, I haven’t changed my growth estimates for the loan portfolio. However, my updated balance estimates for the loan book are much higher than before because of the third quarter’s surprisingly good performance.

Meanwhile, I’m expecting deposits to grow somewhat in line with loans. However, the equity book value will likely continue to decline due to accumulated mark-to-market losses on the large available-for-sale securities portfolio. Equity book value has already dipped by 41% in the first nine months of 2022 as rising interest rates reduced the market value of available-for-sale securities, thereby resulting in unrealized losses. These losses bypassed the income statement and flowed into the equity book value account through other comprehensive income, as per relevant accounting standards. Further book value attrition is likely as I’m expecting a 75 basis points hike in the Fed funds rate till the middle of 2023.

The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net Loans | 638 | 665 | 763 | 779 | 950 | 1,028 |

| Growth of Net Loans | 9.6% | 4.3% | 14.7% | 2.2% | 21.8% | 8.2% |

| Other Earning Assets | 74 | 148 | 269 | 357 | 293 | 299 |

| Deposits | 707 | 744 | 994 | 1,095 | 1,220 | 1,321 |

| Borrowings and Sub-Debt | 28 | 47 | 7 | 16 | 42 | 43 |

| Common equity | 64 | 72 | 81 | 84 | 42 | 39 |

| Book Value Per Share ($) | 14.4 | 16.1 | 18.0 | 18.7 | 9.2 | 8.6 |

| Tangible BVPS ($) | 13.9 | 15.6 | 18.0 | 18.7 | 9.2 | 8.6 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) | ||||||

Expecting Earnings to Rise by 10% Next Year

The anticipated loan growth and margin expansion discussed above will drive earnings through the end of 2023. Meanwhile, the provisioning for expected loan losses will likely remain near the historical average. I’m expecting the net provision expense to make up 0.07% of total loans in 2023, which is the same as the average from 2017 to 2019.

Overall, I’m expecting Union Bankshares to report earnings of $2.81 per share for 2022, down 4% year-over-year. For 2023, I’m expecting earnings to grow by 10% to $3.08 per share. The following table shows my income statement estimates

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net interest income | 29 | 30 | 32 | 36 | 40 | 48 |

| Provision for loan losses | 0.5 | 0.8 | 2.2 | – | 0.2 | 0.7 |

| Non-interest income | 9 | 10 | 16 | 13 | 9 | 8 |

| Non-interest expense | 29 | 27 | 30 | 33 | 34 | 39 |

| Net income – Common Sh. | 7 | 11 | 13 | 13 | 13 | 14 |

| EPS – Diluted ($) | 1.58 | 2.38 | 2.85 | 2.92 | 2.81 | 3.08 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

In my last report on Union Bankshares, I estimated earnings of $2.59 per share for 2022 and $2.84 per share for 2023. I’ve raised my earnings estimates for both years as I’ve increased my loan and margin estimates.

My estimates are based on certain macroeconomic assumptions that may not come to pass. Therefore, actual earnings can differ materially from my estimates.

Dividend Appears Secure

Union Bankshares has a long-standing tradition of increasing its dividend every year. Given the earnings outlook, I’m expecting the company to increase its dividend by $0.01 per share to $0.36 per share in the first quarter of 2023. This dividend estimate suggests a high dividend yield of 5.9%. The dividend appears secure because of the following two reasons.

- The dividend and earnings estimates suggest a payoff ratio of 47% for 2023, which is below the last five-year average of 56%. Union Bankshares has borne a payout ratio as high as 76% in 2018. Therefore, a 47% ratio for 2023 should not be a problem.

- The capital is currently at an adequate level as required by relevant regulations. Union Bankshares reported a total capital-to-risk-weighted-asset ratio of 13.69%, which is far higher than the minimum regulatory requirement of 8.00%. Therefore, there is little threat of dividend cuts from regulatory requirements.

Maintaining a Buy Rating

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Union Bankshares. The stock has traded at an average P/TB ratio of 1.80 in the past, as shown below.

| FY19 | FY20 | FY21 | Average | |||

| T. Book Value per Share ($) | 15.6 | 18.0 | 18.7 | |||

| Average Market Price ($) | 37.4 | 23.7 | 31.6 | |||

| Historical P/TB | 2.40x | 1.32x | 1.69x | 1.80x | ||

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $8.6 gives a target price of $15.6 for the end of 2023. This price target implies a 35.9% downside from the November 15 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.60x | 1.70x | 1.80x | 1.90x | 2.00x |

| TBVPS – Dec 2023 ($) | 8.6 | 8.6 | 8.6 | 8.6 | 8.6 |

| Target Price ($) | 13.9 | 14.7 | 15.6 | 16.4 | 17.3 |

| Market Price ($) | 24.3 | 24.3 | 24.3 | 24.3 | 24.3 |

| Upside/(Downside) | (43.0)% | (39.4)% | (35.9)% | (32.3)% | (28.8)% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 11.6x in the past, as shown below.

| FY19 | FY20 | FY21 | Average | |||

| Earnings per Share ($) | 2.38 | 2.85 | 2.92 | |||

| Average Market Price ($) | 37.4 | 23.7 | 31.6 | |||

| Historical P/E | 15.7x | 8.3x | 10.8x | 11.6x | ||

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $3.08 gives a target price of $35.8 for the end of 2023. This price target implies a 47.1% upside from the November 15 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 9.6x | 10.6x | 11.6x | 12.6x | 13.6x |

| EPS 2023 ($) | 3.08 | 3.08 | 3.08 | 3.08 | 3.08 |

| Target Price ($) | 29.6 | 32.7 | 35.8 | 38.8 | 41.9 |

| Market Price ($) | 24.3 | 24.3 | 24.3 | 24.3 | 24.3 |

| Upside/(Downside) | 21.8% | 34.5% | 47.1% | 59.8% | 72.5% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $25.7, which implies a 5.6% upside from the current market price. Adding the forward dividend yield gives a total expected return of 11.4%. Hence, I’m maintaining a buy rating on Union Bankshares.

Be the first to comment